Asia’s Economic Realignment: China, Japan and ASEAN Nations Push for De-Dollarization and Regional Sovereignty

The global majority seeks to decouple from the United States as economic coercion escalates under President Trump

The recent joint statement issued by China, Japan, South Korea, and the 10 ASEAN member states during the 28th ASEAN+3 Finance Ministers and Central Bank Governors’ Meeting on May 4th marks a pivotal shift in global economic dynamics. The statement emphasizes a collective move toward strengthening regional economic resilience and reducing reliance on Western-led financial frameworks. This development is part of a broader trend of de-dollarization, which emphasizes a growing trend among countries in the Global South to protect economic sovereignty and mitigate risks associated with reliance on Western-led financial systems.

This momentum has not arisen in isolation. It has been catalyzed by years of increasingly aggressive U.S. economic policy during recent administrations, which resorted to various forms of economic coercion - economic sanctions imposed on non-aligned actors, sweeping tariffs and trade restrictions on key global economies. Trump’s protectionist stance caused deep concern across Asia, pushing even traditionally adversarial nations like China and Japan to find common ground. These actions effectively encouraged regional cooperation as a countermeasure to what many perceive as economic coercion. During my recent interview with a BRICS expert, Dr. Yaroslav Lissovolik, who attended a BRICS meeting in Brazil this spring, he noted that President Trump’s tariffs may ultimately become a “blessing in disguise” for the BRICS+ nations as they are further incentivized to focus on prioritizing regional cooperation and South-South alignment.

The U.S. continued use of the dollar as a geopolitical tool through sanctions and restrictive trade policies has not gone unnoticed. This policy continuity has only strengthened the resolve of countries across Asia to forge alternative economic pathways. As a result, the joint statement marks not just an economic agreement but a geopolitical alignment, one that seeks to diminish dependency on Western institutions like the IMF and World Bank and sidestep the U.S.'s economic influence altogether.

One of the most striking features of the joint statement is its denunciation of “escalating trade protectionism,” a veiled reference to U.S. economic policy.

“Escalating trade protectionism weighs on global trade, leading to economic fragmentation, affecting trade, investment, and capital flows across the region.”

Instead of relying on Western-centric trade, the ASEAN nations and China, Japan, and South Korea are promoting intra-regional trade and deepening regional financial cooperation.

“We call for enhanced regional unity and cooperation as we endeavor to weather the heightened uncertainty. Our current policy priority is to reinforce long-term resilience while maintaining flexibility to address near-term challenges, including rising protectionism and volatile global financial conditions. On the fiscal front, this means rebuilding policy buffers while continuing to provide well-targeted support to sustain growth while implementing structural reforms. We will also carefully recalibrate monetary policy based on domestic conditions. We will maintain exchange rate flexibility as a buffer against external shocks.”

One major initiative in this effort is the Chiang Mai Initiative Multilateralisation (CMIM), a currency swap mechanism designed to provide liquidity support in times of financial stress without involving Western financial institutions. Will it impact U.S. dollar demand? Absolutely! This regional mechanism allows participating countries to respond to financial emergencies with local and regional resources, reducing the risk of being subject to Western political and economic pressures.

In addition, the statement outlines plans to develop local currency bond markets, which would further insulate regional economies from fluctuations in the U.S. dollar. By doing so, these countries aim to create more stable financial systems that are less exposed to external shocks and the unpredictability of U.S. fiscal and monetary policy. The creation and growth of local bond markets also symbolize a decisive break from the dollar's historic dominance in global finance.

“Given the continued uncertainty in the global financial markets, well-functioning local currency bond markets remain the cornerstone of the region’s financial stability. We celebrate the 15th anniversary of the Credit Guarantee and Investment Facility (CGIF). To date, CGIF has successfully realized 100 bonds guaranteed and sukuks issued by 64 companies across 12 economies in 9 currencies with a total cumulative notional guarantee amount of USD 4,151 million.”

Furthermore, the declaration renews the bloc’s commitment to the Regional Comprehensive Economic Partnership (RCEP), the largest trade agreement in the world by population and economic output. Notably, the United States is excluded from RCEP, a clear indication of the shifting center of economic gravity. The agreement represents a powerful regional alternative to U.S.-led trade frameworks and provides a platform for deeper economic integration across Asia.

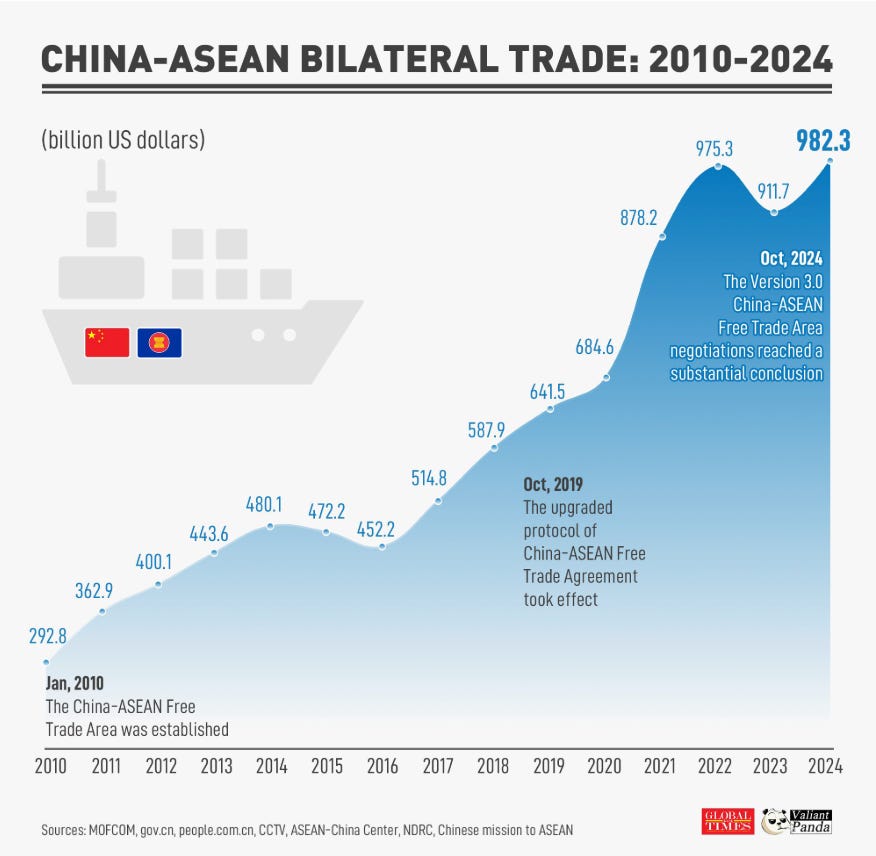

The scale of regional trade is already massive. In 2024 alone, trade between China and ASEAN reached nearly $1 trillion, underscoring the growing interdependence of Asia’s economies.

When Japan and South Korea are added to the equation, the total economic value becomes even more significant. This bloc of countries is effectively creating a self-sustaining economic ecosystem—one that is less susceptible to external interference.

This joint initiative is more than a response to U.S. policies—it is part of a strategic decoupling. These nations are proactively seeking to safeguard their economic sovereignty and build resilient systems that can endure geopolitical turbulence. It reflects the emergence of a multipolar world order, in which economic and political power is no longer concentrated solely in the West. Countries are exploring new alliances, fostering South-South cooperation, and designing regional financial architectures that support shared growth and independence.

This initiative, while rooted in economic cooperation, is deeply geopolitical in its implications. By aligning their financial and trade strategies, these countries are reshaping the global landscape. If the current trend continues, the world could witness a lasting shift toward a decentralized, multipolar economic order where Asia plays a central and independent role.

Remember to tune in to World Affairs in Context for more news, analysis, and upcoming interviews available on YouTube, Rumble, Patreon, Locals, and now Spotify.

Thank you to all my subscribers for being part of World Affairs in Context. Your support makes the newsletter happen, and your questions, ideas, and suggestions inspire it. Please consider becoming a paid subscriber, which will help contribute to the resources needed to produce more content on the platform. If you’d like to make a one-time contribution, please do so via PayPal or Buy Me a Coffee.

Good job Lena.

It's only a matter of time before it all falls down. Unfortunately, the American consumers will take the brunt of the damage to their personal households. We have scary times ahead as other regions closely aligned with the feckless Americans will go down with them. Such as the Europeans. The Austrians and Germans are starting to feel it right now.