Conflicting Economic Data: GDP Accelerates While Consumer Savings and Income Decline

Key Numbers and Events For The Week Ending October 27th, 2023

Numbers

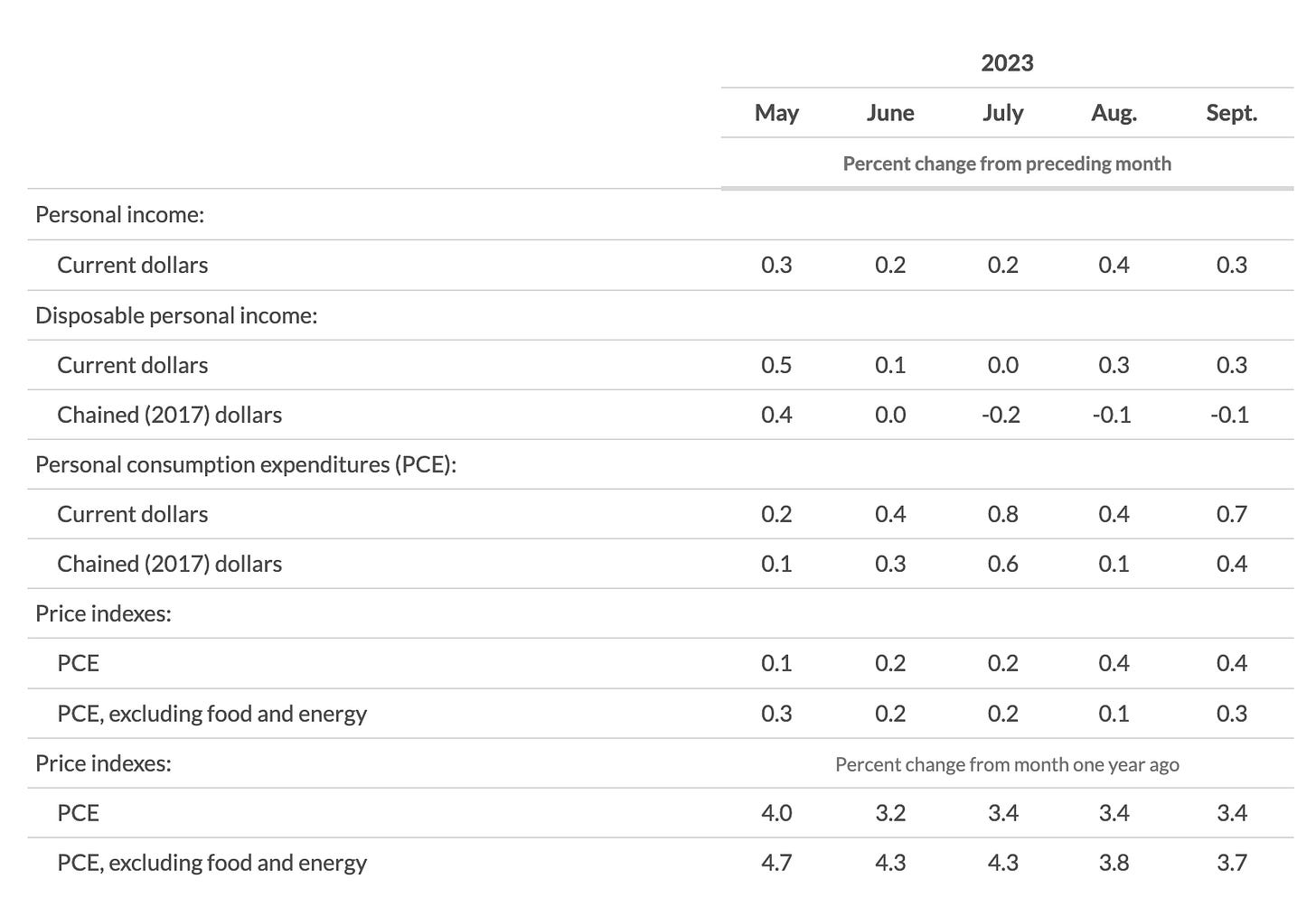

The Fed's "preferred" inflation metric, PCE inflation, falls to 3.4%, in-line with the expectations of 3.4%.

Core PCE inflation decreased to 3.7%, for the first time in 3 months.

The latest Q3 GDP data (preliminary) suggests that the U.S. economy grew at a 4.9% pace, exceeding expectations. However, the growth was fueled by consumer spending, government spending (state, local and federal), business inventories and residential fixed investment.

At the same time, consumers’ incomes and personal rate of savings declined.

I discussed the GDP data and my take on it in the video:

Now is worst time to be a homebuyer. Mortgage applications are down 50% since January 2023 and at the lowest since 1994. According to the NAR, if rates stay at 8% and home prices stay at current levels, income would need to increase by 63% in order for housing to become affordable.

On October 25th, the average interest rate on a 30-year mortgage rose to 8.09%, the highest reading since July 2000. Long-term mortgage rates are consistently heading towards the 8% level:

Yet, despite high interest rates and elevated home prices, new home sales increased 12.3% month-over-month in September. While there is a limited supply of re-sale homes available on the market, homebuilders are offering substantial incentives to buyers.

10 Year U.S. Treasury yields are rising at the fastest pace since the 1980s. Year to date, the yield increased nearly 25%:

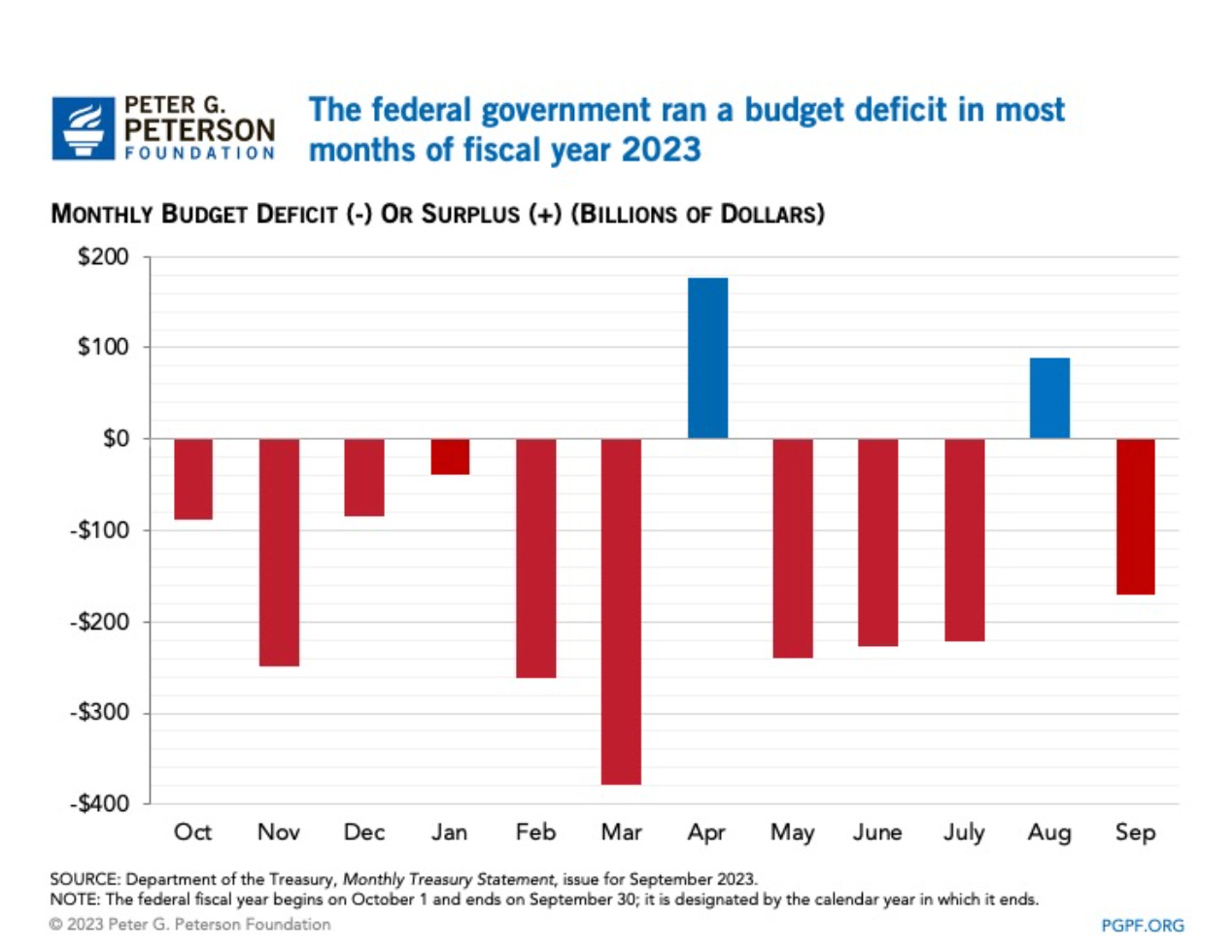

The federal government ran a deficit of $171 billion in September 2023:

Events:

On Friday, October 27th, the White House announced an initiative to provide $45 billion in federal funds to developers to help convert vacant office buildings into apartments.

As the conflict in the Middle East appears to be gaining momentum, the price of gold rose higher, reaching $2,006 per ounce:

Have a great weekend!

Stay connected:

https://rumble.com/c/LenaPetrova

https://www.youtube.com/@lenapetrova

https://twitter.com/_lenapetrova

Anyone who understands how the numbers are calculated for inflation and unemployment versus how they should be calculated - understands that the situation is far far far worse than “the numbers” show.

Great post and writing!

Lena,

Where in New England could you recommend a good resource to exchange dollars for Gold? Boston Gold.com? Want to start accumulating 1oz gold coins. Have a money market account doing nothing.

Thanks

SeaBird1