Economic War With China, U.S. Borrows to Pay Interest on Debt, BRICS News

Weekly Recap For The Week Ending July 13, 2024

US Deficit Reaches $1.27 Trillion in Fiscal Year-to-Date

The U.S. government is now borrowing to pay interest expense on its surging national debt, which stands at $34.9 trillion as of today. Interest payments on government borrowing drive the deficit.

According to the latest Treasury report, the deficit in June reached $66 billion. Moreover, interest on public debt in June hit $140 billion and totaled $868 billion in the first nine months of the current fiscal year — 33% higher than in the same period last year.

Additionally, annualized interest payments on U.S. federal debt just reached record $1.14 trillion. Even during the financial crisis of 2008, annual interest costs were approx. 60% lower.

Meanwhile, Federal Reserve Chair Jerome Powell says the economy is “balanced”.

US consumers' sentiment falls to an eight-months low, at the worst point since 2022.

The consumer sentiment index showing Americans' financial situation dropped 26 points, the 2nd worst since 2012. Most recently, consumer sentiment decreased for the 3rd straight month, to its lowest since November 2023.

Odds of a Fed rate cut in September 2024 surged to 90%.

According to the official data, June 2024 was the first month-over-month decrease in inflation since May 2020. Inflation is now at a 12-month low.

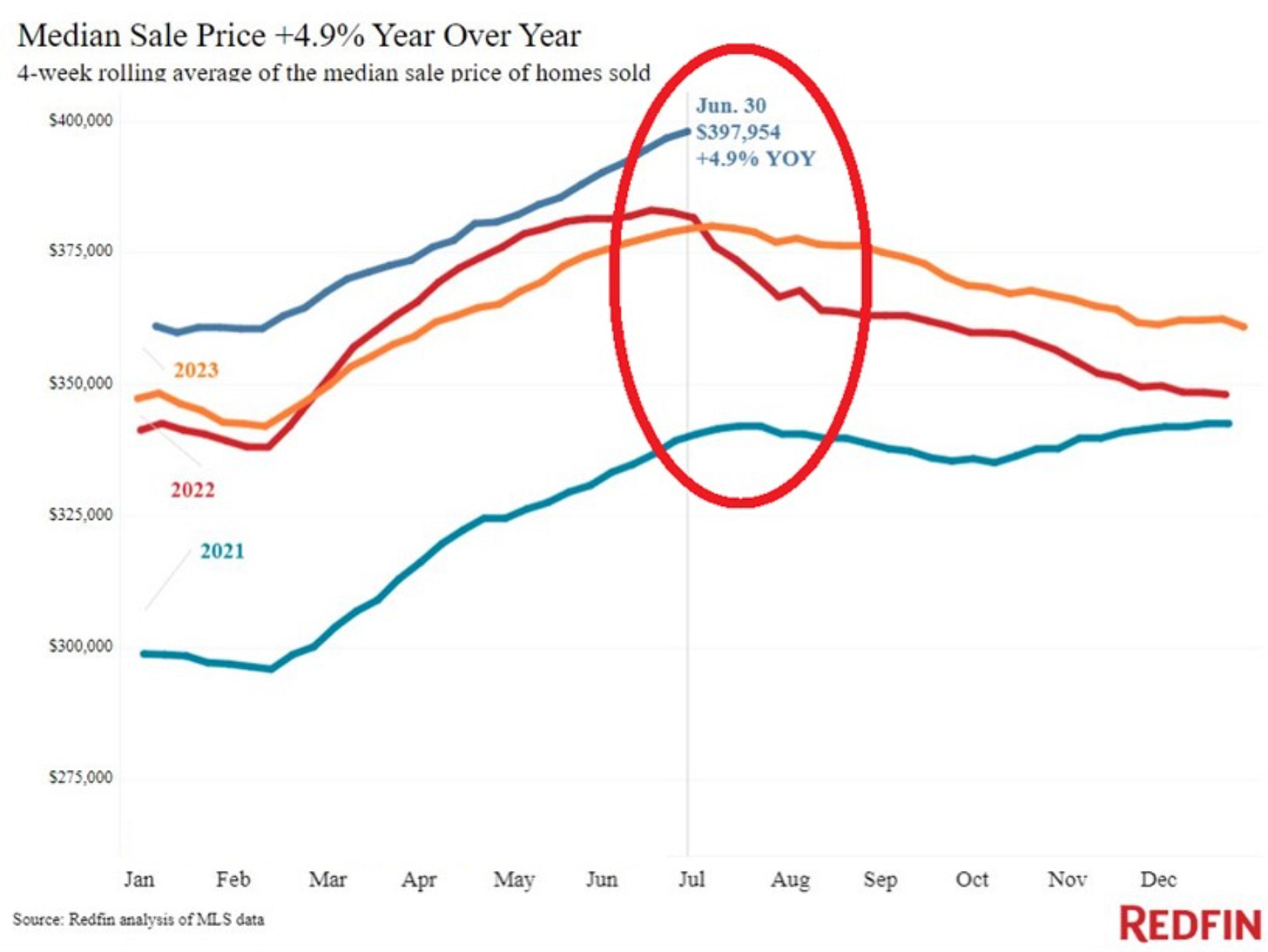

Despite official data indicating that inflation is cooling, US house prices have risen in a straight line in Q2 2024.

According to Redfin, the median sales price hit a record high of $397,954 in June, a 4.9% year-over-year increase and a 17% increase since 2021.

Saudi Arabia warned G7 against stealing $300 billion in Russian sovereign assets.

In a private warning, the Saudis reportedly said that they would sell their European bonds, starting with those issued by the French Treasury, if the US/ EU coalition move forward with the plan:

U.S. economy is far worse than the official data shows, with political turmoil and external geopolitical factors contributing to the decline of the “empire”.

I had a fascinating conversation with Professor Richard D. Wolff.

In Part 1, we discuss the rapid decline in the U.S. economy and reasons for a looming banking crisis. Professor Wolff points to the Fed's plan to prepare for an economic crisis while misrepresenting the data to the public. Professor Wolff concludes that even though it is clear that the United States will face a severe banking crisis and bank consolidations, the "plan" is to let it collapse in hopes of another government bailout.

In Part 2, we discuss why foreign countries are selling US debt, how this will impact the US dollar, the rapid decline in the economy as well as the risk of a hyperinflation. Additionally, Professor Wolff focuses on the role of the rising China and the BRICS nations in the global economy.

As European countries are actively militarizing, refusing to negotiate and acting against their own best interests to provoke a full scale war, returning to competent diplomacy, neutrality and peace must become the priority.

In a great conversation I had this week with Dr. Pascal Lottaz, we discussed the role of neutrality in international relations (it is very often misunderstood!), Hungarian PM Viktor Orban's peace mission to Russia, China and Ukraine, NATO Summit and its possible expansion into Asia as well as the militarization in Scandinavia and its implications in case of a "worst case scenario"

Thank you for reading and listening to my podcast episodes! If you enjoy my work, please consider upgrading to a paid subscription.

Let the economic war begin: with the increased focus on China following NATO summit that concluded on July 11, the U.S. officials are leading discussions with the EU to seize Chinese assets in Europe.

NATO officials are discussing taking action.