End the Fed Bill, Xi Jinping & Putin's Message to the West & Australia's New Digital ID

A Weekly Recap as of Friday, May 17 2024

U.S. economy latest readings:

Household debt explodes to $17.7 trillion dollars as of March 31, 2024:

As households take on more debt, delinquencies are rising virtually across all loan types. The largest categories were mortgage debt (increased $190 billion to $12.44 trillion) and auto loans (rose $9 billion to $1.62 trillion):

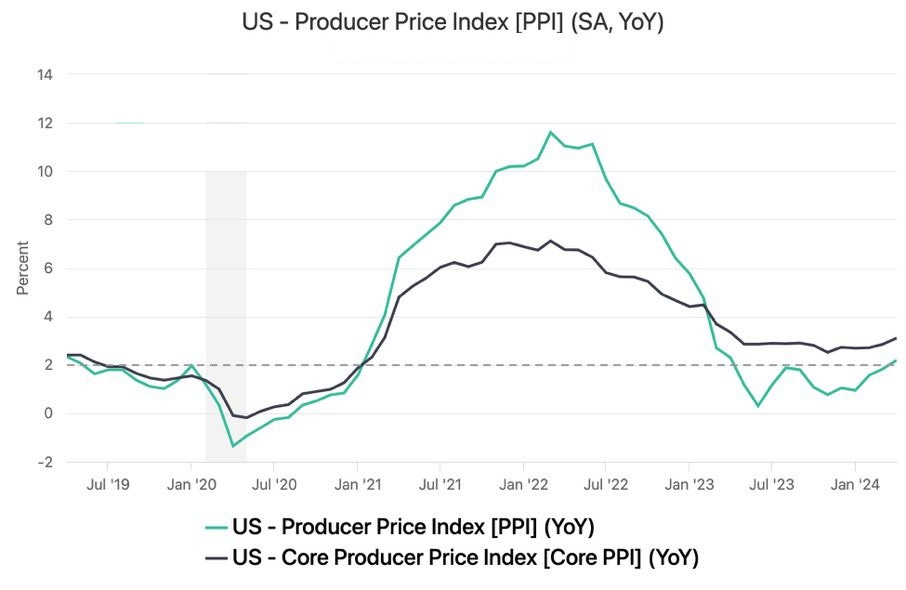

The Producer Price Index advanced 0.5% vs. 0.3% expectation, the highest PPI reading since April 2023.

You are welcome to watch the video on YouTube or Rumble for further details.

U.S. mortgage rates declined for the second consecutive week, following CPI data:

30-year fixed rate averaged 7.02% vs. 7.09% a week prior; and

15-year fixed rate closed the week at 6.28% vs. 6.38% last week

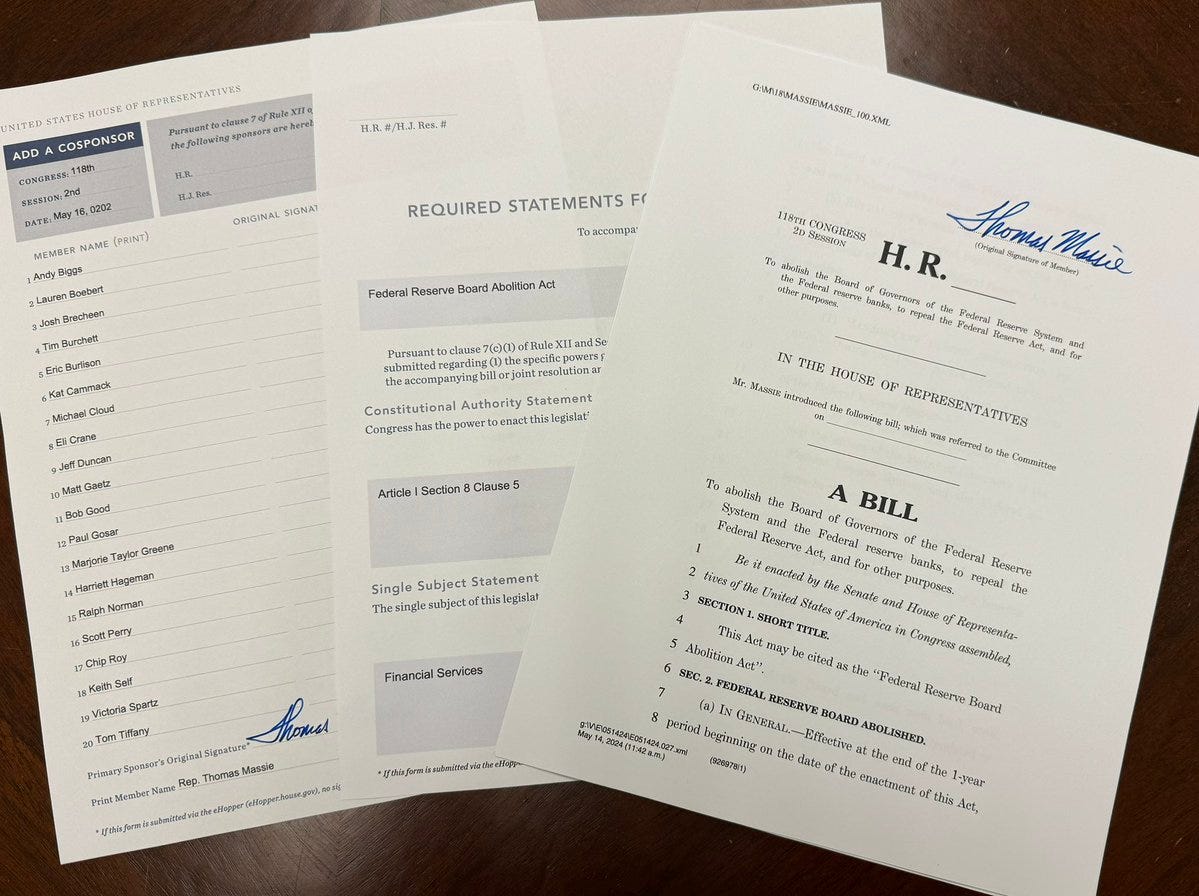

Rep. Thomas Massie (R-KY) introduced “End the Fed” bill titled Federal Reserve Board Abolition Act, HR 8421.

In his post on X, he commented that “Americans would be better off if the Federal Reserve did not exist”.

The Biden Administration announced a new round of “protectionist” actions (i.e. tariffs) against the Chinese goods. President Biden explained it as follows:

Despite the seemingly positive justification, in a recent video I argue that these tariffs will make American manufacturers less competitive, US consumers poorer and lower the GDP in the long run.

Watch the video on YouTube or Rumble.

Bidenomics at work: a new report suggests that $100,000 income no longer buys the American Dream: 50 states require more than a $100,000 annual income, according to the report, with 38 states needing more than $140,000.