Fears of Supply Chains Shock, 1920s-Style Crisis, $1 Trillion in Interest Costs & EU's Economic Decline

Weekly Recap for the Week Ending September 22, 2024

Hello, All! As this busy week is winding down, let’s catch up on what you may have missed!

🌏 Fed Chair Powell Says Unemployment Is Rising Due to Illegal Immigration, 50 bp Rate Hike & Powell's Money Printer (click on the title link to watch the video)

The Fed’s decision to cut the fed fund’s rate by 50 basis points evidenced not only its “independence” from politics, but also its desperation as the labor market is showing considerable cracks. The Fed expects unemployment to rise: the latest forecast expects the rate of 4.4 percent at year-end. vs. 4.0 percent expectation at the end of Q2 2024.

The most interesting highlight of Jerome Powell’s speech was his commentary on why US unemployment is rising:

Stay connected with Lena: YouTube | Rumble | Locals | Patreon | X | Telegram

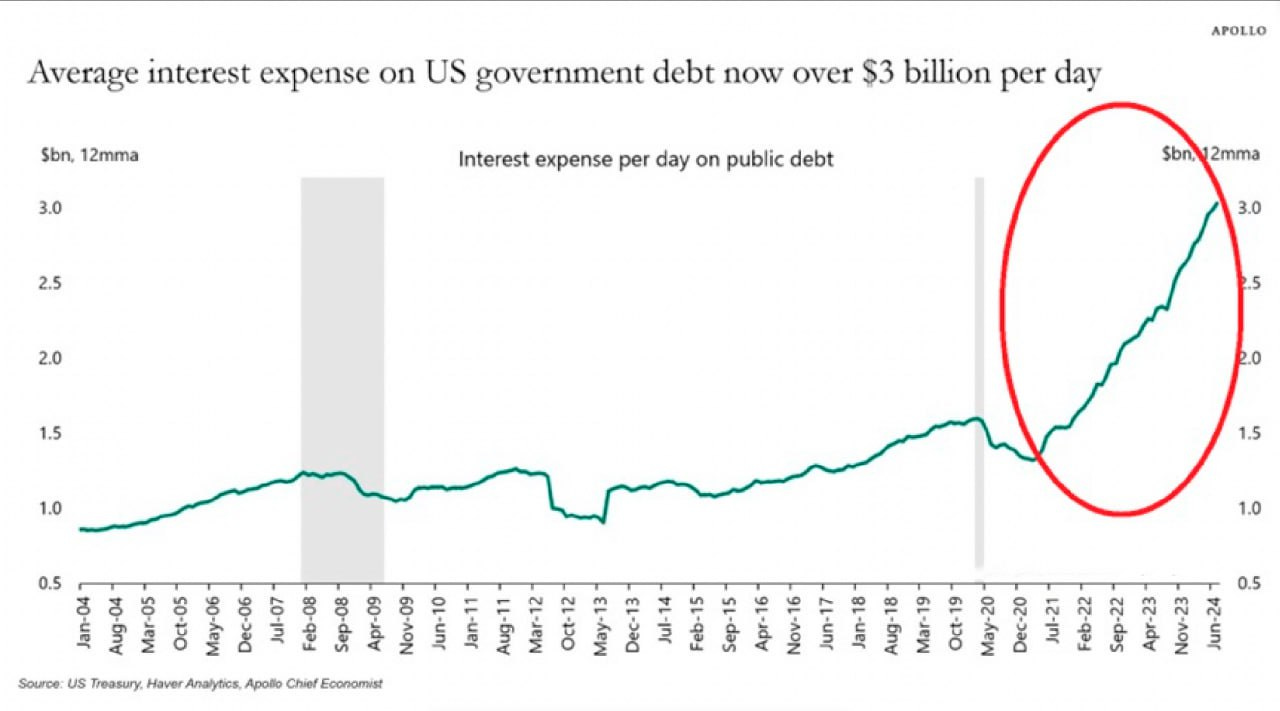

🌏 Record Breaking $1 TRILLION Spent to Pay Interest on National Debt as Deficit Soars: What Can Go Wrong? (click on the title link to watch the video)

As the government spending reaches new levels of “normal”, the deficit soars and the US officially crossed a new milestone of $1 trillion spent to cover the interest on its national debt.

Interest cost on $35.3 trillion in national debt hit $1 trillion, an increase of 30% compared to last year

Budget deficit is nearing $2 trillion, a 24% jump year over year.

The U.S. gov't is now spending $3 billion every 24 hours to service its debt

Since paying one’s creditors is always a priority, the government will soon have no option but to decrease its spending on not only “social entitlements” but also defense discretionary and non-discretionary spending in order to be in a position to cover its growing interest expense:

🌏 Germany is Officially in Crisis: The Biggest Companies Announce Closures as Germany Continues to De-industrialize (click on the title link to watch the video)

The German economy is not getting off the ground. As its forecasted growth has been downgraded once again, its once-industrial giants are forced to face consequences of their government’s failing economic policies: Volkswagen, Audi and ThyssenKrupp are joined this week by the chemical conglomerate BASF.

This week a series of protests against closures and current policies took place across Germany.

Some fear that the problems of the biggest economy in Europe are just the beginning with the decline poised to quickly spread across the EU. European producers will find it increasingly challenging to compete with companies from China, as well as other parts of the world, where access to cost-effective resources, modernized industrial infrastructure, skilled labor at a lower price point combined with favorable government regulations do not prevent businesses from operating with higher profit margins.

Thank you for your continued support!

If you enjoy my work, please consider upgrading to a paid subscription.

🌏 The Head of the European Central Bank Issues a Warning: 1920s-Style Depression, Global Fragmentation and "Major Changes Are On The Way" (click on the title link to watch the video)

This was the most concerning development of the week, in my opinion. Christine LaGarde visited the IMF in Washington DC where she gave an extensive speech, pointing out similarities between the economic downturn of the 1920s to the risks posed by the global fragmentation and geopolitical escalations of the 2020s.

LaGarde hinted at “digital transformations” and the ECB’s plans to change how “monetary policy is delivered”, indicating that a launch of a central bank digital currency is not off the table.

I discussed the key points of her speech and their interpretation in a recent video:

🌏 BRICS+ Opens to New Collaboration: Security, Cyber Crime and Growth of Eurasian Infrastructure (click on the title link to watch the video)

As BRICS+ is preparing for the annual summit in Kazan, Russia that is scheduled to take place on October 22-24, a series of important meetings among the bloc’s members are taking place. Perhaps the most symbolic one was the security conference held in St. Petersburg. Members of the extended bloc were in attendance, including a group of prospective and interested parties.

Earlier this year, the bloc agreed to expand cooperation in preventing the use of information technologies and virtual payment systems in drug trafficking. At the conference, members agreed to collaborate on a new range of security-related issues, including combating crime in information technologies, threats of terrorism and extremism, illegal weapons, cross-border crime, and illegal migration.

🌏 Attacks with Exploding Civilian Devices on Lebanon Raise Global Supply-Chain Security Concerns

Weaponizing supply vulnerabilities drives a shift in trade practices.