GDP Declines, New "Yellen Moment", Funding Endless Wars and Blinken's Voyage to China

A selection of key events for the week ending April 28, 2024

Hello, Everyone!

I’m starting to really love Substack, it has so much potential! After the TikTok ban (although I’ve never used the app or even downloaded it on my phone), we really have to question “who’s next?”. It’s a matter of time.

Besides weekly updates, I plan on starting several periodic “series” such as opinion posts, quick (possibly daily or bi-weekly) updates, videos, maybe even a podcast… I hope you find all of these new things interesting!

Now let’s take a look at the highlights of the week…

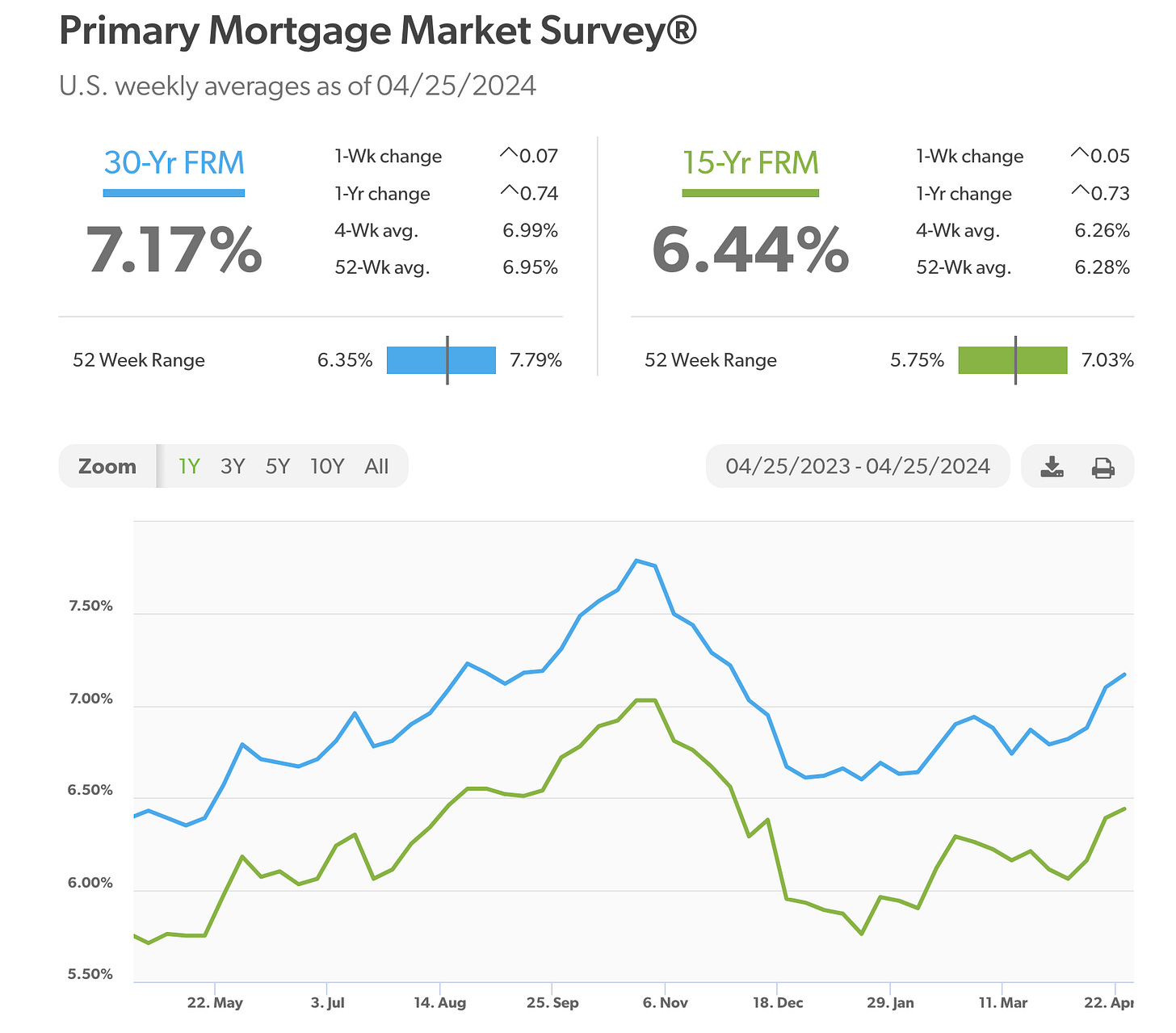

Mortgage rates continue to rise:

The 30-year rate averaged 7.17 % vs. 7.10% last week.

The 15-year mortgage rate averaged 6.44%, up from last week’s 6.39 percent.

U.S. economy is weakening as inflation is rising: a massive red flag!

U.S. gross domestic product (GDP) growth declined to 1.6% (less than half of the 3.4% Q4 2023 number and the lowest point in two years) vs. +2.3 % consensus and +3.4% growth in Q4 2023.

The recent reading is about 50% below Goldman Sach's expectations.

The main drivers of the GDP “growth” were government spending (aka “military aid packages” to foreign governments) and consumer spending.

At the same time, inflation continues to rise: Q1 2024 price index grew 3.4% vs. 1.8% in the previous quarter.

US consumer spending has been outpacing income growth. The personal saving rate fell to 3.2% from 3.6% in February and 4.1% in January.

Additionally, household debt has skyrocketed to $17.3 trillion. Equifax reports the severe balance delinquency (60+ days past due) rate in January 2024 was 1.59%, which is 17 basis points higher than January 2023. Outstanding balances on bankcards increased 12.1% year-over-year to $1.02 trillion from January 2023 to January 2024.

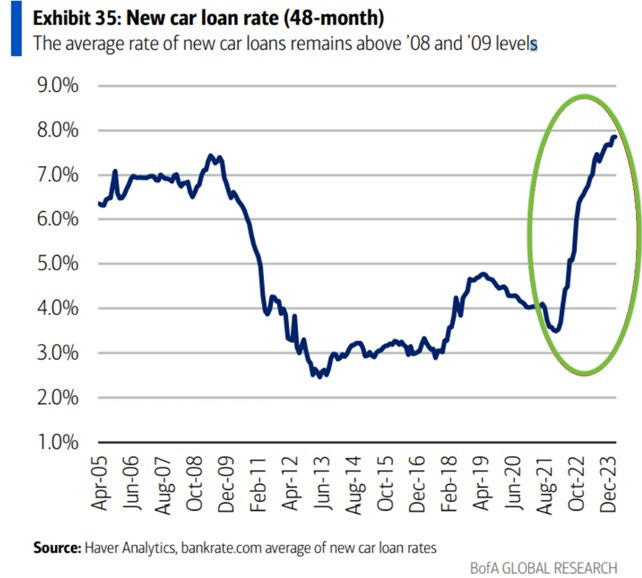

New car loan rates just jumped to their highest level in 23 years, at 8%, and now stand above 2008 highs:

A new “Yellen” moment: in an interview to Reuters, Treasury Secretary Yellen said Americans should not be worried about the decline in GDP growth because “GDP growth for the first quarter could be revised higher” (just as they do with labor market numbers, inflation, etc.) adding:

“The U.S. economy continues to perform very, very well. The headline figure was off a little bit but for reasons that are peculiar and not really indicative of underlying strength. The fundamentals here are in line with inflation continuing back down to normal levels."

That wasn’t even the best part of the interview.

Janet Yellen proceeded to share that “China exporting its way to full employment is not acceptable to the rest of the world”:

In other words, the rest of the world (read: the US) is threatened by China creating new jobs via rapidly (and aggressively) expanding its production capabilities.

The administration is proposing massive tax increases that will impact the US economy (read: everyone), not just the “high income earners”.

I shared a summary of the proposal in a recent video: YouTube | Rumble

“It’s a good day for America”.

$95 billion in military aid to Ukraine, Israel and Taiwan was approved by the US Senate and signed by the President.

The details and detailed discussion of the controversy can be found in my two recent videos:

Does the IRS use AI to access your bank account?