Global Race To Secure Rare Earth Minerals Heats Up As Countries Face Growing Geopolitical Tensions

Copper, lithium, cobalt and other resources have increased in price as the result of surging demand

As the world is going through multiple transitions, the global push for green energy transition is one of the crucial areas that drives the increase in the demand for rare earth minerals. Due to shortages in many key elements, countries are racing to secure resources such as copper and lithium among other metals that are necessary for the production of EVs as well as wind and solar farms.

The head of International Monetary Fund, Kristalina Georgieva pointed out that global economies are racing to secure access to critical minerals needed for green technologies:

“If you end up not having access to them, that can be dramatically impacting your future competitiveness in a rapidly transforming world economy.”

Echoing the sentiment, Global Director of Energy and Extractive Industries, Riccardi Pulity at the World Bank commented:

“Ambitious climate action will bring significant demand for minerals”

According to the World Bank, the production of key minerals, including lithium, would need to rise by nearly 500% by 2050 to meet the growing demand for critical clean energy technologies. There may be shortages of these elements as there is an imbalance in supply and demand; in addition to producing mines facing resource exhaustion and declining resource grades.

Copper prices rose about 10% last year because the metal is crucial to renewable energy technology and the transition away from fossil fuels. Its deposits are primarily concentrated in North and South America. Among major global exporters of copper are: Chile, Russia, Congo, Japan and Australia; while the world’s top importers of the red metal are China, the United States, Germany, Italy and Taiwan. China represents over 50% of the world’s copper demand.

Lithium is often referred to as “white gold”. South America holds around 75% of the world’s known reserves, with Argentina, Chile and Bolivia representing the so-called ‘lithium triangle’ of producers. The three countries have already discussed the possibility of creating their own OPEC-style alliance that would allow them have a degree of control over the metal’s production and price.

On the European continent, the biggest proven reserves of lithium are located in the Donbas. Not too long ago a member of Germany’s government admitted that these essential reserves are one of the reasons why Europe should be invested in supplying military assistance to Ukraine as it would then have access to lithium, likely at a heavily discounted price.

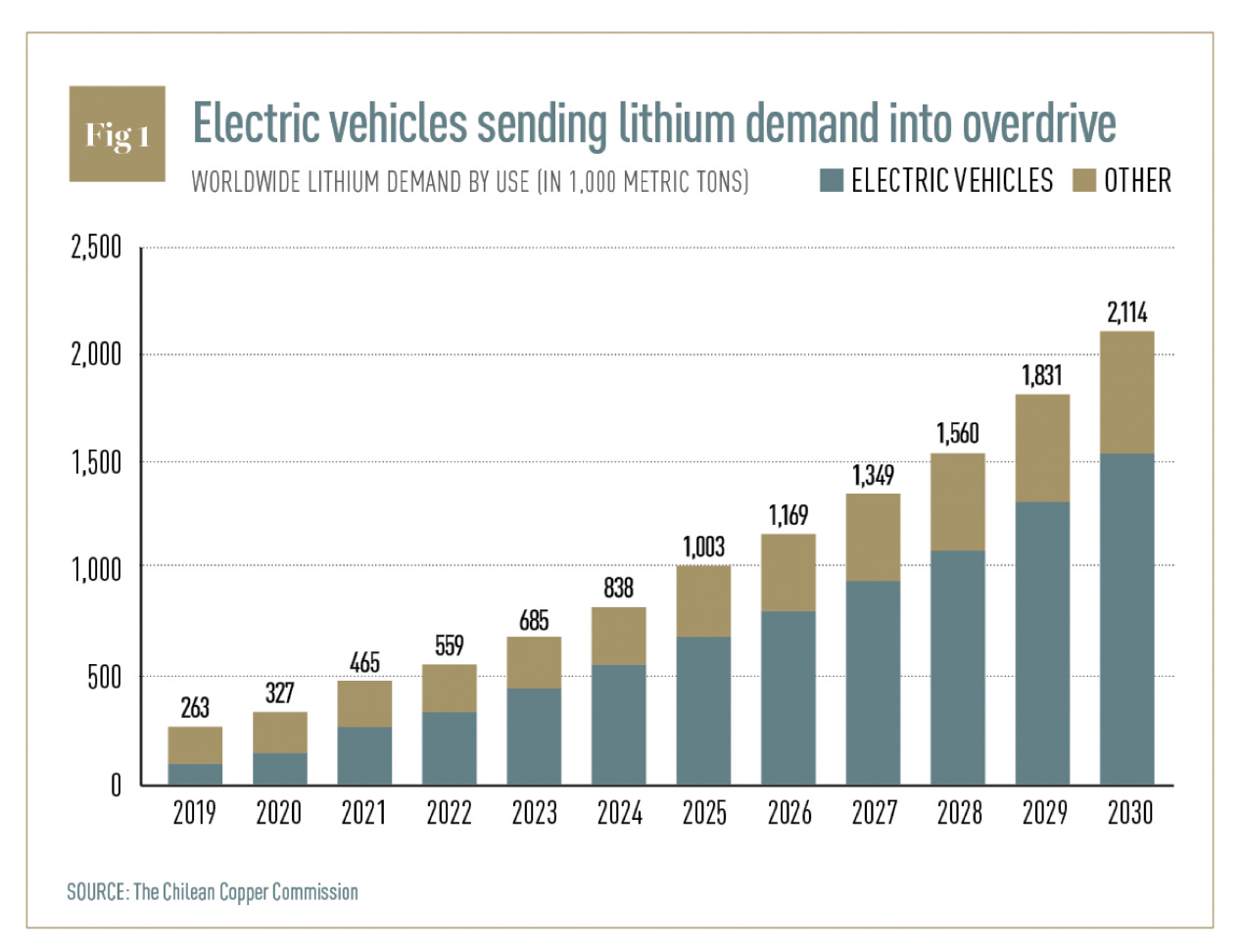

The demand for lithium is expected to reach record levels in the next decade.

As the race to secure access to key rare earth minerals heats up, it is becoming increasingly clear that developing countries with the vastest natural resources will assume increasingly important geopolitical roles. One of the newest economic alliances, the BRICS bloc, is heavily focused on developing a reliable network of resource rich countries that would trade using a basket of local currencies, thus slowly but surely increasing their self sufficiency.

For further details on this topic, you are welcome to watch the video on YouTube and Rumble.

Germany must be joking, Donetsk and Luhansk form the Donbas, in what was previously the Ukraine, but are no longer, and are now annexed and form part of the Russian Federation, and Russia has a firm grip on the region, something that will not easily change, even in a global war.

I saw an interesting statistic yesterday which coincides with this video, which confirms that 70% of all rare earth metal reserves are held within the BRICS countries, with China being the global leading refiner of rare earth metals.

Duncan Wanblad, CEO of Anglo American Corporation, a major mining company, in a statement two years ago, said that a hundred new Copper mines had to be developed, within the next five years ( from date of his statement ) delivering equivalent production to that of the existing Average Copper mine, in order to meet global needs.

To the best of my knowledge, I know of two new Copper mines under development.

The insanity of the supposed "Green Energy Revolution", being that on the one hand activists are demanding the switch to development and consumption of Copper and other rate earth minerals, for "Green Energy", but on the other hand are resisting the development of many of the new open pit mines, required to produce these minerals.

This effectively means that the left hand is preventing the right hand from achieving the transition to "Green Energy".

Your information is highly benificial to keep our vision to view beyond the horizon.