Gold Rallies As The Fed Hints At Rate Hike Pause: Is NOW The Time To Buy Gold?

Bank bailouts in late March (including the $300 billion printed by the U.S. Treasury), a weakening U.S. dollar and a drop in Treasury yields are sending gold prices higher.

Bank bailouts in late March (including the $300 billion printed by the U.S. Treasury), a weakening U.S. dollar and a drop in Treasury yields are sending gold prices higher. This is a trend that is not unique to the United States. Gold has been increasing in value globally and is up 9% since the beginning of 2023.

In 2022, demand for physical gold hit a 10 year high and is remaining very strong in 2023. Its daily trading volume increased by 25% in March alone when compared to February trading. When compared to the same time in 2022, this is a 39% increase.

Besides a growing inflow of cash into precious metals, Gold ETFs are reporting a sharp increase in investments. This is the case for European gold ETFs as well as North American. In March alone, global gold ETFs recorded net inflows of 32 tons, an increase of approximately $1.9 billion.

Such a dramatic increase in demand for gold is mainly due to investors not being as active in the stock market - as the result of its poor performance - as well as a considerable uncertainty around the banking industry and whether the worst is…behind us or yet to come.

In addition to the above, there’s the looming adoption of central bank digital currencies (CBDCs). The majority of us realize that the U.S. dollar may not be as safe as we once thought. Naturally, de-centralized crypto, precious metals and other tangible assets are in high demand. Over the long term, with higher inflation becoming the new norm, gold is expected to hit record levels despite its forecasted volatility in the short term.

There’s an interesting opinion I came across:

“The best way to keep physical Gold and Silver out of the hands of the masses is allowing it to go much higher in price, thereby making the physical metals too expensive for the majority of people to buy. Perhaps that is what is happening now.”

“Pullback or Not, Record Highs Ahead in Gold”, SprottMoney, April 13 2023

Many are questioning whether now is a good time to buy gold as it has traditionally been a hedge against inflation: its value rises as economy weakens. A Fed policy pivot could result in higher inflation becoming embedded in the economy for years, which will result in an environment that favors higher gold prices. If the Fed doesn’t reverse its course - they won’t cut rates but it is likely that there will be a pause -gold prices may shift downward.

With that in mind, here are a couple of things for you to consider when deciding what may be the right course of action.

Firstly, there is no guaranty that gold will continue to increase in price ( i.e.without major volatility) even during a recession.

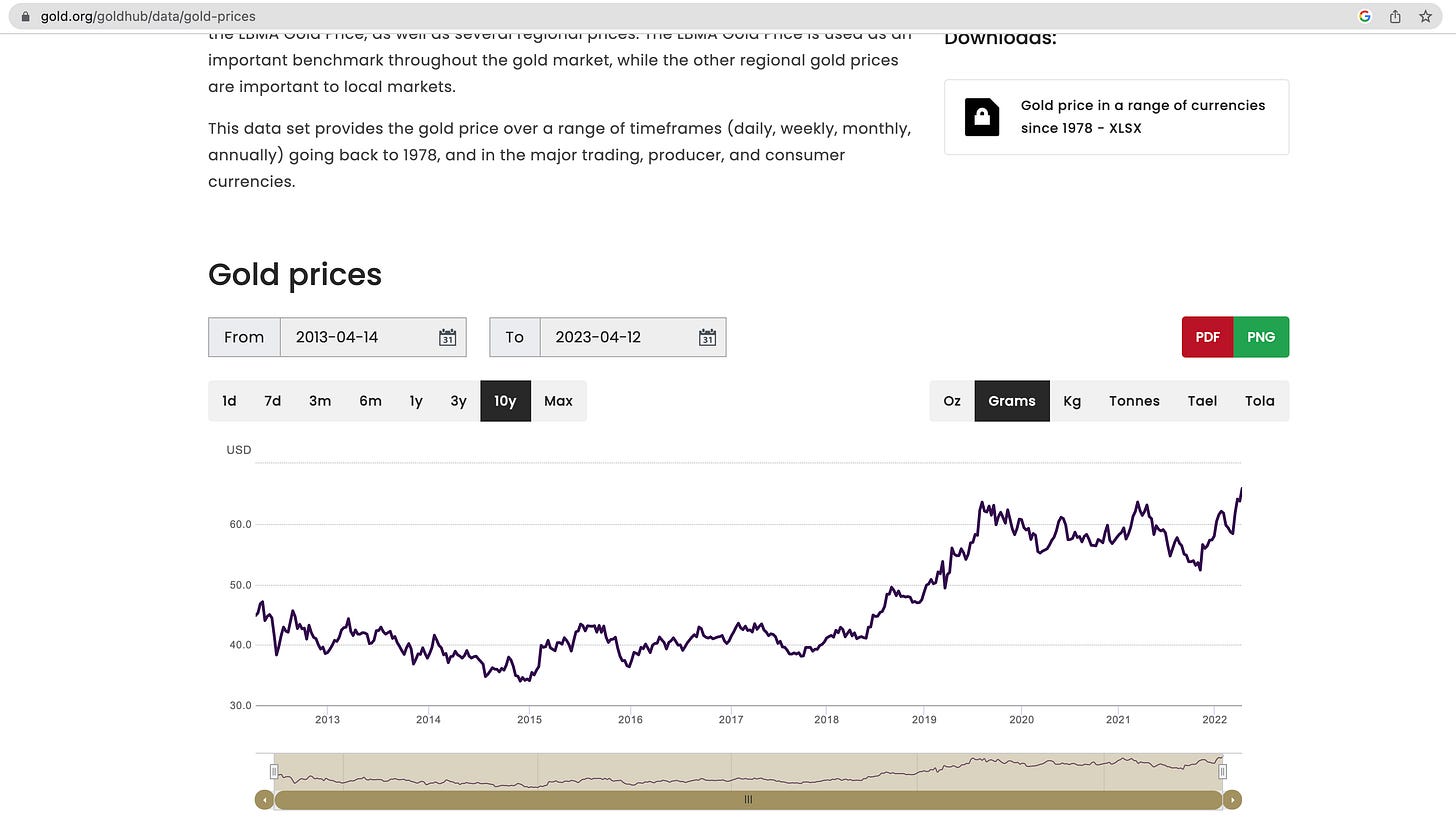

If we look at the historical gold prices above, until early 2019 gold prices has been relatively consistent. In 2019, its demand increased and the price followed suit. Since the start of the pandemic gold has become a relatively volatile asset that is extremely impacted by geopolitics and interest rate hikes and the market.

What does this mean for someone who may be thinking to purchase gold for the first time in their lives? This essentially means that the sentiment we are hearing - that gold is the asset to pour your savings into in our current economy - should be taken with a grain of salt. Gold is the store of value but it doesn’t produce constant income i.e. it doesn’t pay interest and, given that prices are high at the moment, it has quite a bit to lose. Only a smaller portion of your overall assets should be in gold. If this is your first time buying gold, it may be wise to buy the dip and to invest at most 5-15% of your available cash.

This brings us to my next point. Market analysts are seeing red flags in gold investment activities. According to Michael McDonald, an author, former Senior VP of Investments at Morgan Stanley, option activity indicates caution:

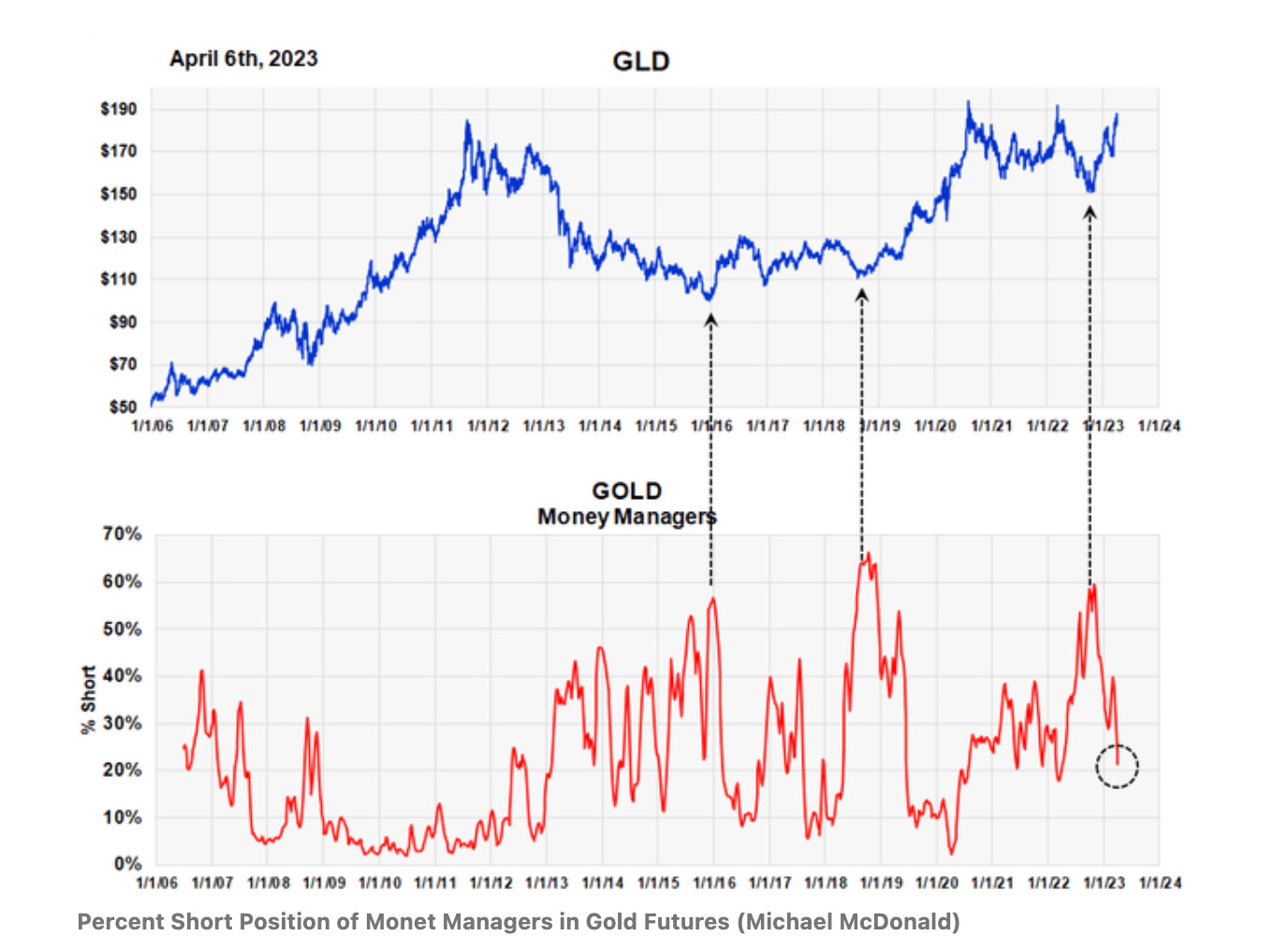

He explains that large institutional investors are reducing their short positions in gold. The increase of these short positions is what signaled a bullish outlook in the latter half of 2022. Now the trend is reversing. The current number is shown with a black circle below:

The analysis concludes that it is important to be cautious now even though long term gold outlook is extremely positive. It’s the short term outlook that is concerning as there may be a pull back (which is precisely the time to buy for those who are ready to invest).

The Federal Reserve is planning on yet another 25 basis point rate increase at its next meeting on May 3rd. The Fed might pause after that which would impact the price of precious metals.

If the Federal Reserve pauses but inflation remains elevated it will essentially be a green light for precious metals. Goldman recently emphasized that gold is the best hedge against financial risk and raised its 12 month price target for gold to $2,050 per ounce.

There is a strong argument to be made that the latest, March 2023, CPI data shows signs of cooling inflation which means that the Federal Reserve now may have what it needs to take a pause. But will it? The rate of inflation is worse than any of these reports suggest. In fact, we are seeing forecasts of “persistent” inflation i.e. it’s not going anywhere and it may even result in a stagflation.

To sum up the above, expectations for Fed rates and gold prices move in opposite directions.

If the Fed pauses and inflation persists or even increases, it will drive the price of gold up. If the Fed continues with interest rate hikes, the price of gold will react negatively and decline. When the price drops, that’s when it might be a smart move to consider adding gold to your investments since its long term outlook is definitely a promising one.

The FED reputation and core inflation (5.6%) - they are raising one or two more times - .025%

Thank you for all the research and work. I appreciate you being transparent about the source of your information. I know it takes a lot more effort, and it makes a monumental difference. I do not always agree with your analysis and/or position, but I do respect your work ethic and transparency greatly. Thank for all you do, and exposing yourself to the negative sides of the Internet. Positive thoughts for you and those close to you.