Heading for Stagflation, Missing 5.8M in Labor Market, Bernstein's Economic Genius (or: THIS is Why We Are in Trouble) & How You'll End Up Buying National Debt

Key numbers and events for the week ending Friday, May 3 2024

Happy Friday, All!

I hope you are doing well and ready for a relaxing weekend!

Let’s quickly run through the top events of the week. I hope you enjoy this week’s recap and if you have any recommendations or ideas, please feel free to leave a comment.

Following the FOMC meeting on May 1, the Federal Reserve kept interest rates unchanged at 5.25-5.50%. Due to rising inflation, Powell indicated that no rate cuts in 2024 might be on the table, although a rate hike is likely ruled out. Interestingly enough, the Fed Chair said he did not believe concerns of a looming stagflation were valid.

Despite Powell’s weak attempt to dismiss stagflation (i.e. his answer that he “sees neither “stag” nor “flation”), analysts at the Bank of America believe that a weaker jobs report may mean stagflation, adding that it would result in a sell-off in the stock market.

“The term stagflation is a portmanteau of the words stagnation and inflation:

Stagnation: Economic growth is sluggish, meaning businesses aren’t producing at full capacity, there aren’t enough jobs to keep everyone employed, and, as a result, consumers drastically reduce spending because they have less money to spend.

Inflation: The prices of goods and services keep rising, making the overall cost of living more expensive or even, for some, virtually unaffordable.” (Brittanica Money)

According to Bank of America, latest data has been “stagflationary,” and is indicative of a looming downturn.

According to the latest jobs report released on May 3, U.S. economy added fewer jobs than expected in April while the official unemployment rate increased 3.9% vs. 3.8% forecasted.

Nonfarm payrolls advanced only 175,000 versus 240,000 expected, posting the smallest gain in six months.

What was the Fed’s response? Federal Reserve Bank of Chicago President Austan Goolsbee said he’d like to see more jobs reports like this one as it gives him comfort the economy is not overheating:

“The more jobs reports you get like this where they’re solid but it’s clearly moving back into something that looks like pre-Covid, the more confident we can be that the economy is not overheating.”

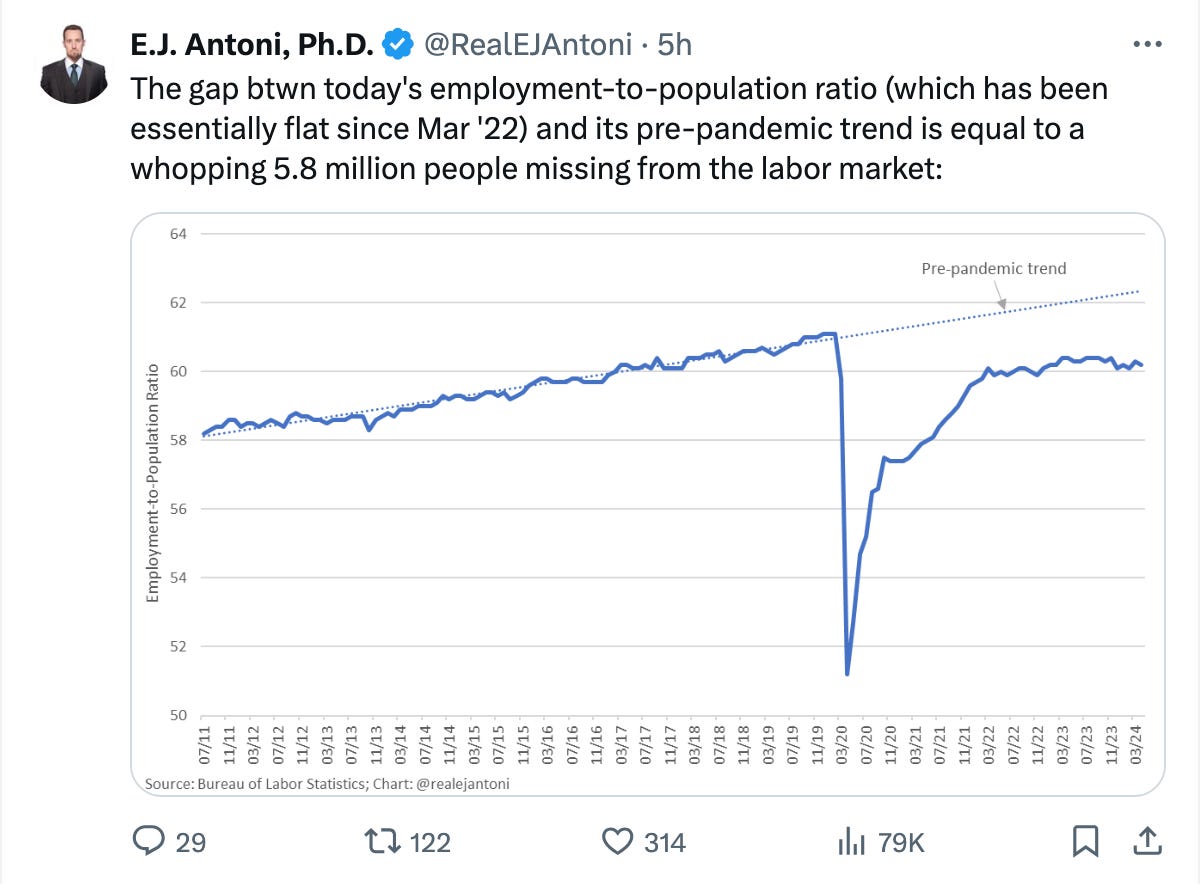

By the way, 3.9% unemployment rate wouldn’t be bad news if it was accurate. According to economist E.J. Antoni, the labor market is missing 5.8 million people (ie. the numbers are not taking into account increases in the US population since March 2022).

E.J. Antoni writes that if we account for the “missing” 5.8 millions of people, the real unemployment rate jumps to 6.5%-7.7%:

Mortgage rates have increased for the fifth week:

30-year fixed rate mortgage rate was 7.22% vs. 7.17% a week prior;

15-year fixed rate mortgage averaged 6.47% vs. 6.44% last week

This week I had the pleasure of speaking with Andy Schectman, owner and president of Miles Franklin. Andy shared his thoughts on gold prices, why central banks are stockpiling gold and selling US-denominated investments, BRICS, and CBDC.

The interview is available on YouTube and Rumble.

Recent study finds that of 4,000 US-based banks surveyed, 282 are at risk of a failure due to liquidity concerns. Community and regional banks are disproportionately impacted as they are overexposed to commercial real estate loans.

A video with further details and my commentary is available on YouTube and Rumble.

If you feel that you don’t understand how the government can print so much money, please don’t worry - even Jared Bernstein (whose background is Bachelors in Music and Doctorate in Social Welfare), the Chairman of the Council of Economic Advisors, can’t explain and is absolutely clueless, too or…