Planned Real Estate Meltdown

The End Hedge Fund Control of American Homes Act Cures the Symptoms, Not the Disease

In a recent video I discussed the bill, the End Hedge Fund Control of American Homes Act, introduced in the U.S. Senate that seeks to force hedge funds to sell single-family home portfolios. My argument in the video was focused on the impact that the proposal, if signed into law, would have on existing homeowners as well as those tenants who are renting from corporate landlords. I chose to deliberately omit the discussion of whether hedge funds are “good” or “bad”, as well as their undeniable role in the housing affordability crisis, as it is beyond the scope of the new bill itself.

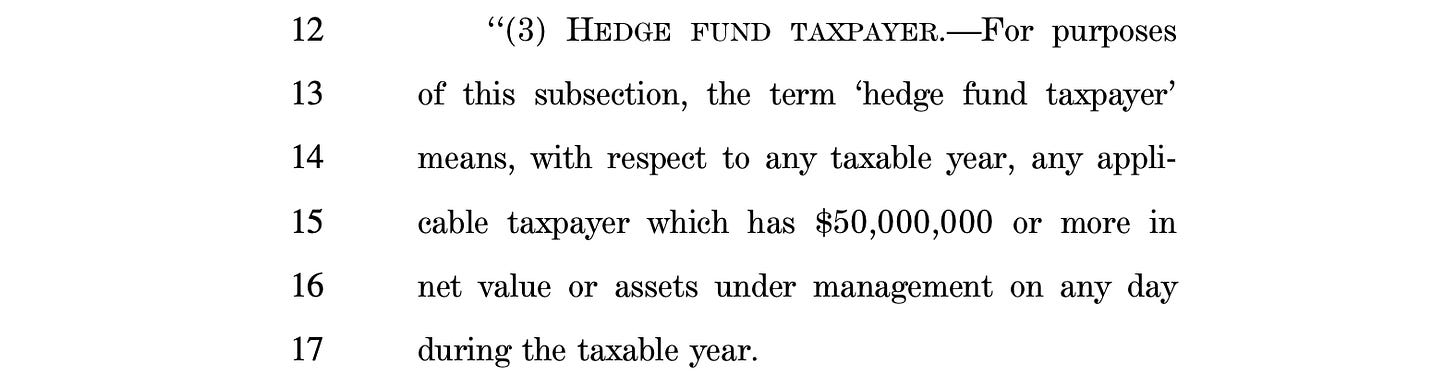

The language of the bill is vague when it comes to the definition of a “large” investor, and would technically include REITs, real estate investment trusts.

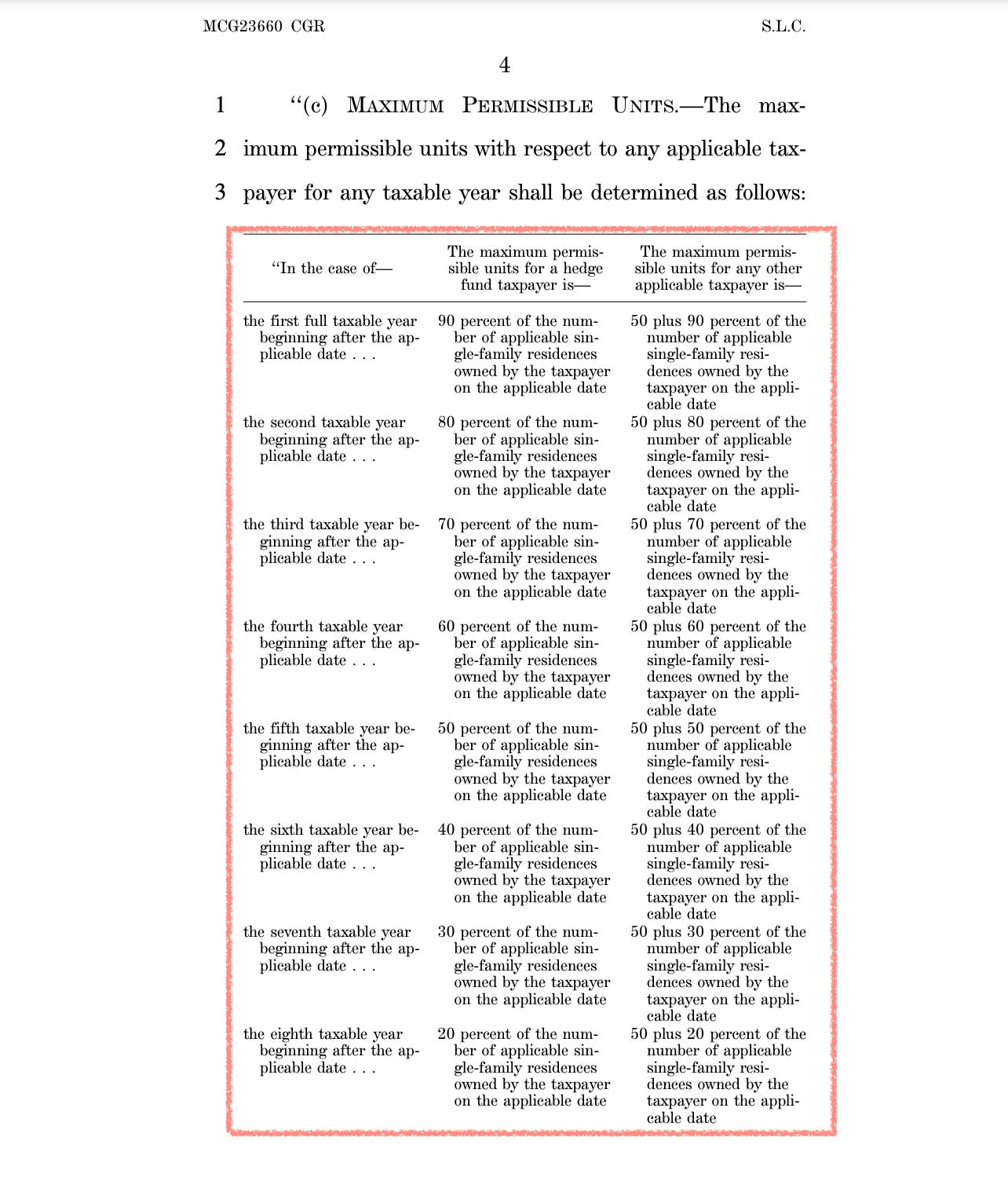

The proposed legislature aims not only to ban hedge funds from owning large portfolios of single-family homes, but also to force them to sell at least 10% of the total number of single-family homes they currently own to families per year over a 10-year period. After a 10-year full phase-out, all hedge funds will be completely banned from owning any single-family homes.

Further, the bill calls for the establishment of a "housing downpayment trust fund” that would be funded using tax receipts collected from those paying taxes. The fund would disburse funds to those taxpayers who need assistance while purchasing a home. It should be noted that qualification criteria were not discussed in the bill.

What’s the main selling point of the bill? It aims to improve housing affordability and is conveniently introduced to the U.S. Senate several weeks ahead of the 2024 election year. While large institutional investors should have never been allowed to dominate the single family housing market in the first place, it’s worth remembering that the road to hell is paved with good intentions.

The bill was introduced by Representative Adam Smith (D-Washington) and Jeff Merkley (D- Oregon), whose press release states:

“the housing should be for people, not profit centers for Wall Street. In every corner of the country, giant financial corporations are buying up housing and driving up both rents and home prices. It's time for Congress to put in place common sense guardrails that ensure all families have a fair chance to buy or rent a decent home in their community at a price they can afford.”

This is nothing but a well written, deliberate and timely attempt to appeal to voters. Where exactly were Rep.Smith and Sen. Merkley when hedge funds were outbidding every single prospective home buyer by 20% back in 2022? Why was the bill not introduced then to provide much needed relief to an average person?

While there are more questions than answers, timing is not a coincidence. This bill has many potential outcomes if it does become law.

First and foremost, the bill is likely to result in evictions over a short period of time as it clearly defines the percentage of properties to be disposed of annually. The requirement to dispose 10% annually is arbitrary and does not appear to be based on actual housing data. What happens if only 5% of leases are up that year? Would a hedge fund be penalized for not meeting the government sales quota?

Given that a residential lease is typically renewed annually, corporate landlords would not be incentivized to keep quickly depreciating properties on their books, knowing that there will be a constant periodic supply of newly listed homes for sale. While there are laws in place that protect tenants’ rights, the bill fails to address whether hedge funds would provide concessions to tenants who wish to purchase the homes they are renting. There is no assurance that these homes would be soled to individuals instead of newly formed, mid-sized corporate investment companies. The bill is silent on whether there would limitations as to who can purchase these rental properties.

The second outcome to consider is the impact on home prices. While the housing affordability index is at an all time low, flooding the market with prior rentals is hardly the answer. Existing home owners would likely be “upside down” on their mortgages, with their equity completely wiped out. Approximately 66% of Americans, or 230 million, would be affected by the housing market being saturated with single family homes. Additionally, the underlying value of collateral assets for trillions in residential real estate loans would be negatively affected. This, in turn, would impact investments, retirement accounts, etc.

While there is no easy solution to solve the housing crisis, there are far more efficient ways to limit the risk exposure. An excellent starting point would be to re-route government funding towards affordable housing, creating incentives to build cheaper starter homes, lifting tariffs off Canadian lumber and raising taxes on hedge funds’ profits off of residential real estate investments while capping monthly rent.

A housing economist, Kevin Erdmann, who happens to believe that the lack of the U.S. housing supply stems from under building for decades, has this to say about the new bill:

“As a result of the regulatory tightening after 2008, we need millions of new homes and this new bill would force builders to sell them piecemeal, a few at a time. Rents are already undermining this country’s economic fairness and capacity. I shudder to think of the potential ramifications of this travesty. If this passes, I cannot fathom a functional source of new housing that could stop the bleeding in American rent inflation.”

While the bill is highly controversial, it appears to attempt to cure the symptoms rather than the disease itself.

Seems like a typical govt approach. Take a problem and make it worse. If we’re so inclined to move our country in a socialistic direction, then at some point the govt is going to want to own the real estate, and in other areas, nationalized police, nationalized schools, nationalized medical care, etc. That provides for everthing within/controlled by the govt, nothing outside the govt, and nothing against the govt. In so many ways, it seems we’re purposely destroying the very fabric that made our country strong, and the one word in your title explains it all - regardless of topic - PLANNED. Thanks Lena. You’re always spot on - well, most of the time. Have a great day.

This looks to be, among other things, a Trojan Horse for the Housing Downpayment Trust fund. It will be a vote-buying publicity stunt, just like student loans and the subsequent forgiveness. The forced selling of houses will have the same result as a wealth tax on stock investors, i.e., a forced sale which will undermine the market and hurt even the small 401K investor.

Remove the government from housing market meddling. (See Amendment 10 in US Constitution.)

Still, it's nice to see someone wanting to do SOMETHING about corporate bullies like Black Rock.