PM Modi Peace Role, Harris' Tax Hikes & Trade Wars

Weekly Recap as of August 31, 2024

▪️U.S. federal debt continues to surge, rising $64 billion in 24 hours this week, to a new record of $35.272 trillion:

How soon will it hit $36 trillion? Likely before 2025 at the rate it’s been going.

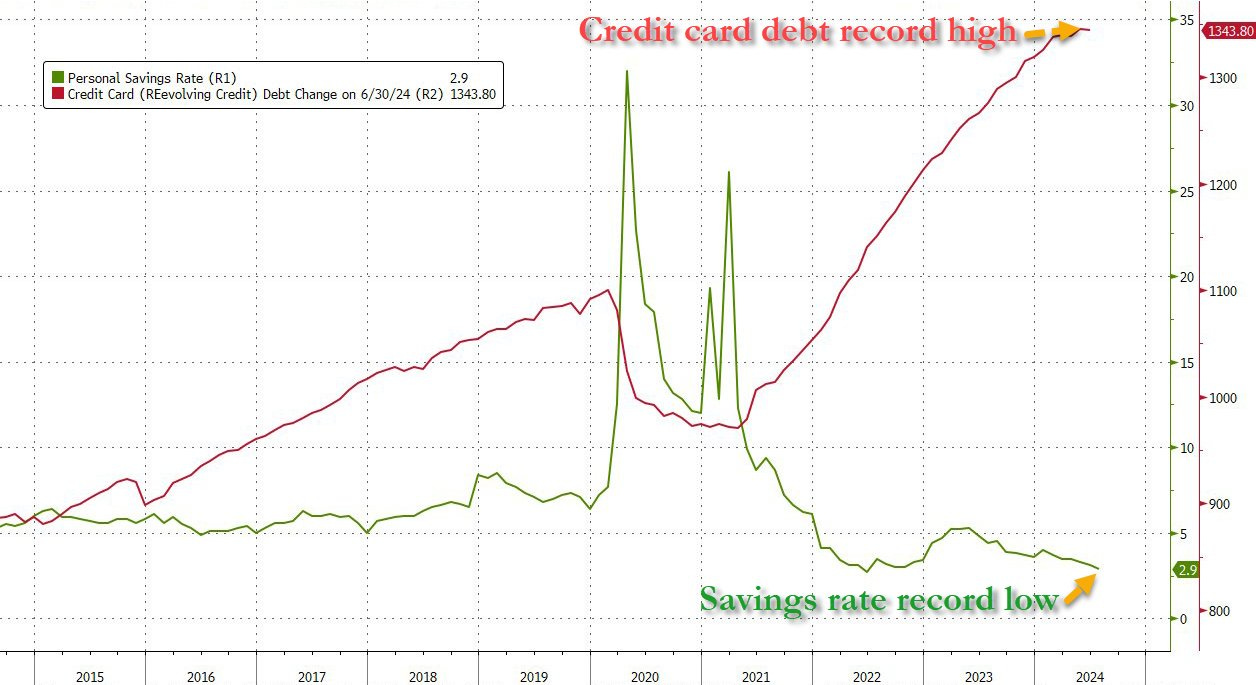

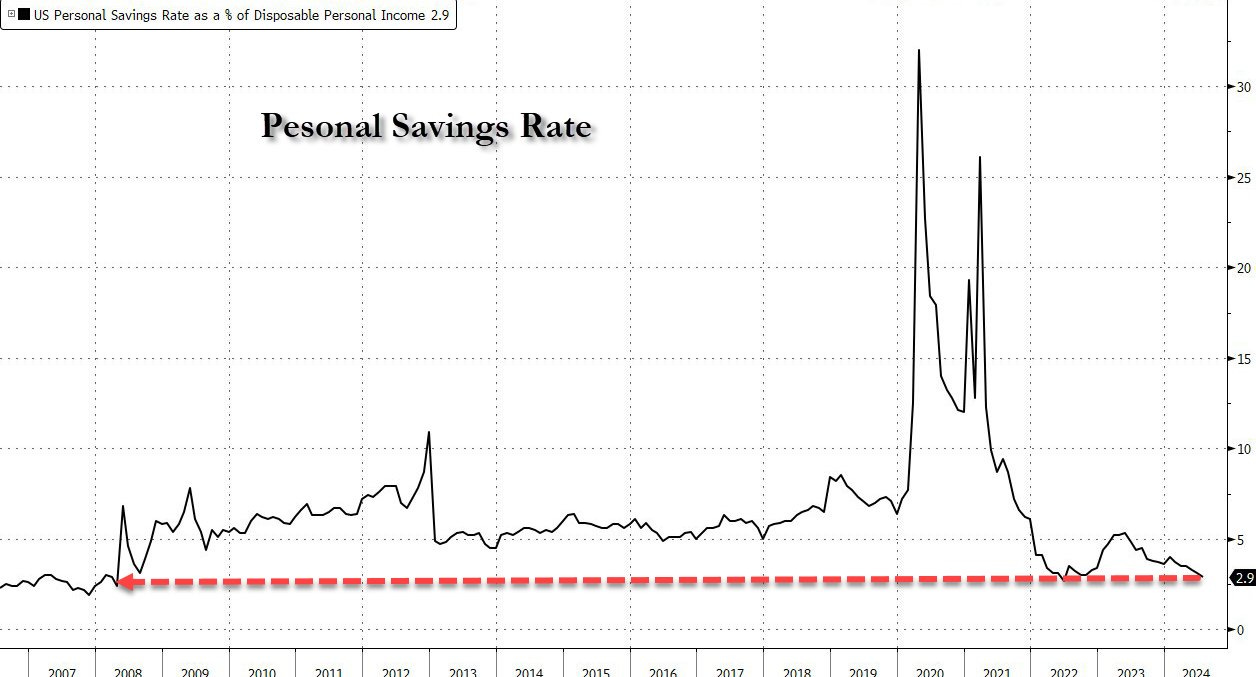

▪️Consumer savings rate is now at a record low, while credit card debt has reached record high.

"US households have blown through their pandemic savings. In fact, compared to the pre-pandemic trend, households have now drawn down some $2.4 trillion in excess savings, compared to just $2.2 trillion in excess savings accumulated during the covid years." (Rabobank)

Personal Savings Rate dropped to 2.9%, down from 3.1% and lowest since Covid pandemic.

▪️Kamala Harris’ economic advisor Bharat Rama indicated that the VP supports taxes on unrealized gains (aka money you don't actually own).

In the CNBC interview, Rama appears to misunderstand the basic difference between property taxes and taxes on unrealized gains.

VP Harris supports nearly $5 trillion dollars in new tax increases and elimination of preferential tax treatment on a variety of economic activities, including oil, coal and gas extraction (thus, higher taxes would push prices up for related products, transportation, etc.) If this proposal is ever enacted, it will drive capital out and US markets will decline, resulting in much lower tax revenue than she may be hoping for.

I recently shared a video with the details and my perspective on proposed tax law changes:

New Tax Hikes: $5 Trillion Tax Increases Include Unrealized Gains Tax & Other Hikes to Know About:

Watch on: YouTube | Rumble | Locals | Patreon

Additionally, I covered Kamala Harris’ price controls proposal earlier this week:

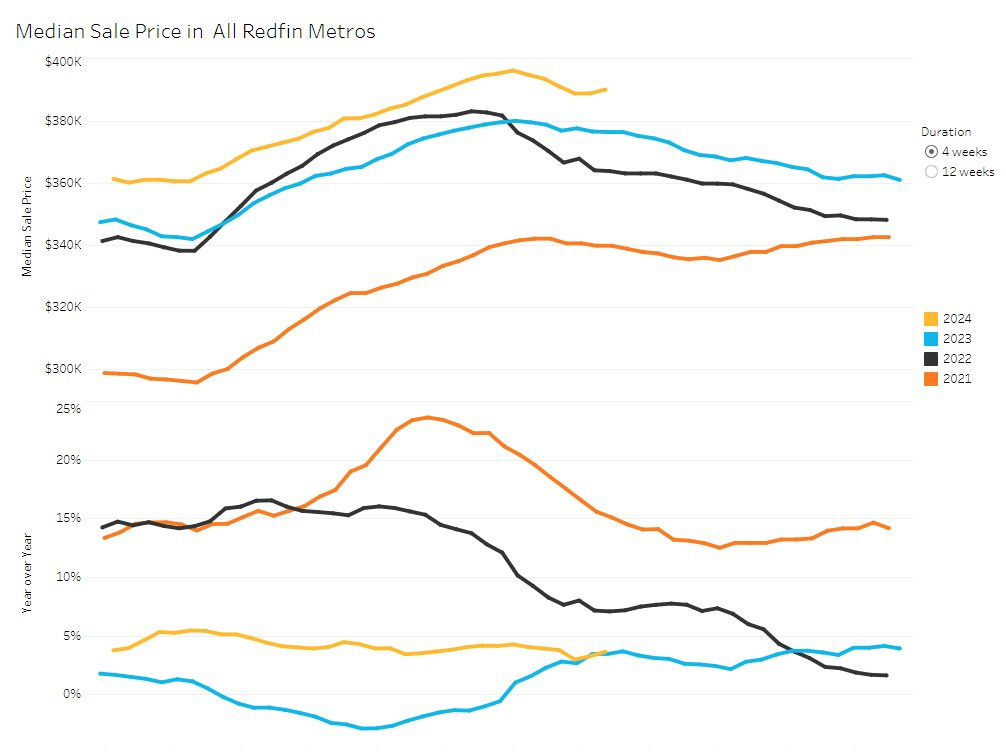

▪️ U.S. housing market continues to slow down.

Listings with price drops is at the highest level in 4 years, while the days on the market is at the highest level in at least 4 years:

Median home price is inching closer to $400K, as construction prices increased once again in July due to higher materials/ labor costs:

Thank you for reading! If you find my work helpful, please consider upgrading to a paid subscription or supporting me via Locals & Patreon.

▪️Goldman Sachs to Lay Off Over 1,300 Workers.

Between 3-4% of Goldman’s global workforce is expected to be culled by the fall, impacting between 1,300 - 1,800 people. Reportedly, it comes as part of its annual review to remove low performers. The layoffs will span various divisions, affecting different teams to varying degrees.

▪️Saudi Arabia - China Ties Are Expected to Strengthen Crude Oil Trade in Yuan.

China, the largest oil importer, and Saudi Arabia continue discussions on denominating oil purchases in renminbi which, according to S&P Global, has led to expectations that China’s massive purchases from the Saudi kingdom will boost demand for the Yuan in oil trade.

China’s trade with the Gulf region has more than tripled over the past two decades. As Saudi Arabia is pursuing a foreign policy that will allow it to balance its existing strong relations with the West (primarily the US), it now eyes continued development of economic ties with China - a win-win for both states.

Watch on: YouTube | Rumble | Patreon | Locals

▪️ Government Orders Fuel $52 Billion Revenue for Top Defense Contractors in the United States.

Top US defense contractors set to rake in record cash after orders soar.

The world’s largest aerospace and defense companies are set to rake in record levels of cash over the next three years as they benefit from a surge in government orders for new weapons amid rising geopolitical tensions.

The leading 15 defense contractors are forecast to log free cash flow of $52 billion in 2026, according to analysis by Vertical Research Partners for the Financial Times, almost double their combined cash flow at the end of 2021.

Watch on: YouTube | Rumble | Patreon | Locals

▪️ Zelensky wants India to stop trading crude oil, sever ties with Russia instead of pursuing a “balancing act”.

On Friday, August 30, Volodymir Zelensky made a bald demand following PM Narendra Modi’s visit to Kiev last week.