Record Breaking 800 Tonnes Of Gold Purchased By Central Banks Amid Push To Diversify Reserves With Safe Haven Assets

According to World Council Survey, central bank reserves will consist of only 40-50% of USD in 5 years

Central banks have been on a gold buying spree since 2021 when the World Gold Council reported their net purchases were gaining momentum. In its latest report, the World Gold Council shared that Q3 2023 has exceeded 5-year averages by 8%. This is hardly a surprise - safe haven assets are typically sought after during uncertain times. And how much more “uncertainty” can there be when we hear about multiple wars erupting and even the possibility of a World War III!

In the beginning of December, the spot price of gold reached a record $2,114 per troy ounce. Even though it has retreated (it’s currently trading at $2,045), gold is expected to remain above $2,000 and may continue its upward trend due to the market expectations of the Federal Reserve starting a QE cycle sooner rather than later, perhaps even in January of 2024 as I discussed in detail in this video as well as the ongoing war in the Middle East.

As soon as the Federal Reserve lowers interest rates, gold will become an attractive investment option while the U.S. dollar and U.S. Treasuries will weaken.

According to the World Gold Council, central bank bullion reserves increased by 800 tonnes at the end of Q3 2023. Even though the third quarter demand was slightly weaker, the data shows that net central bank buying of 337 tonnes during the third quarter alone was “the third strongest quarter in our data series” and “demand from central banks year to date is 14% ahead of the same period last year at a record 800 tonnes.”

The biggest gold buyers have been China, Poland and Singapore. This year along, China’s holdings of gold increased by 204 tonnes; Poland purchased 100 tonnes while Singapore added 75 tonnes through the end of the third quarter.

Increasing gold reserves allows foreign nations to decrease their dependence on the dollar, as well as to mitigate the risk associated with the U.S. foreign policy. Thus, accumulating physical gold has become the top priority that’s unlikely to change in the near future.

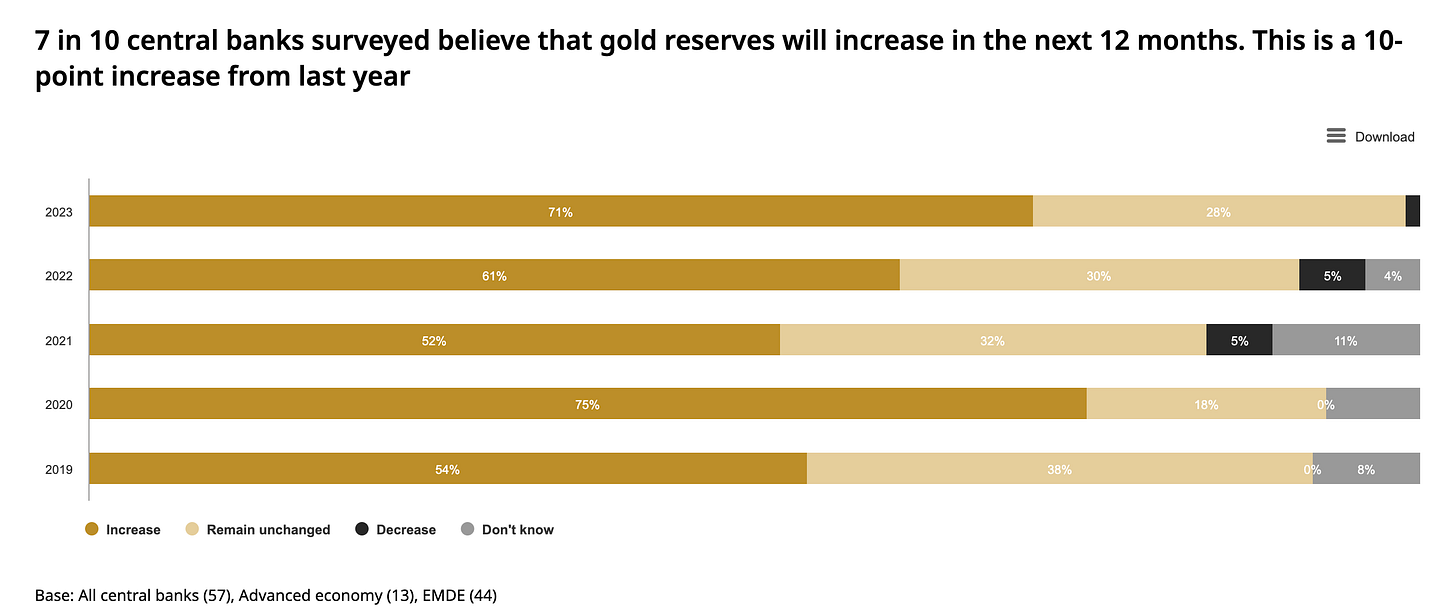

The World Gold Council expects demand for gold to remain strong in 2024 as 24% of all central banks intend to increase their gold reserves in the next 12 months, according to the survey. The main driving force behind the trend is the loss of confidence in the U.S. dollar as a safe reserve asset. Central banks point to the de-dollarization trend, indicating that the percentage of reserves denominated in U.S. dollars will decline to 40%-50%. This is not surprising as 7 in 10 central banks are planning to increase their gold reserves in the next 12 months.

As demand for gold remains strong, primarily driven by central banks and purchases of gold bars/ coins, gold mining is gaining momentum. Production has reached a new - year to date - record of 2, 700 tons.

Access to natural resources is becoming one of the hottest topics. Saudi Arabia along with other potential investors are planning to take advantage of the world’s largest undeveloped reserves of gold and copper owned by Pakistan.

I discussed further details on this topic in my recent video.

We will rue the day we criminally stole Russia's central bank reserves at the start of the Ukraine war. This was a real eye-opener to any country that had/has reserves on deposit with the Fed.

Who is selling??? If Central Banks are buying, then some entity must be selling???

Why has the price not exploded exponentially? Month after month, we have been told that "Central Banks" have been purchasing volumes equal to 1/4-1/2% of all the above ground gold. Where is the supply coming from? Or is this just a "Churn" aimed at maintaining the price?