The Great Financial Illusion - Why the Stock Market Is So High While the Economy Is Collapsing

The Stock Market Isn’t the Economy — It’s a Mirror That’s Cracked

One of the most common questions I get goes something like this:

“If the economy is doing so poorly, then why is the stock market so high?”

It’s a fair question — and one that reveals a fundamental misunderstanding that’s been decades in the making. For much of modern history, people have looked to the stock market as a kind of mirror — a reflection of economic strength, productivity, and national vitality.

But today, that mirror is cracked. It’s broken.

What we’re seeing in financial markets — especially in the United States — isn’t a portrait of economic health. It’s a distortion. A mirage born of monetary excess, financial engineering, and broken market forces.

A Trillion-Dollar Illusion

Let’s start with the numbers.

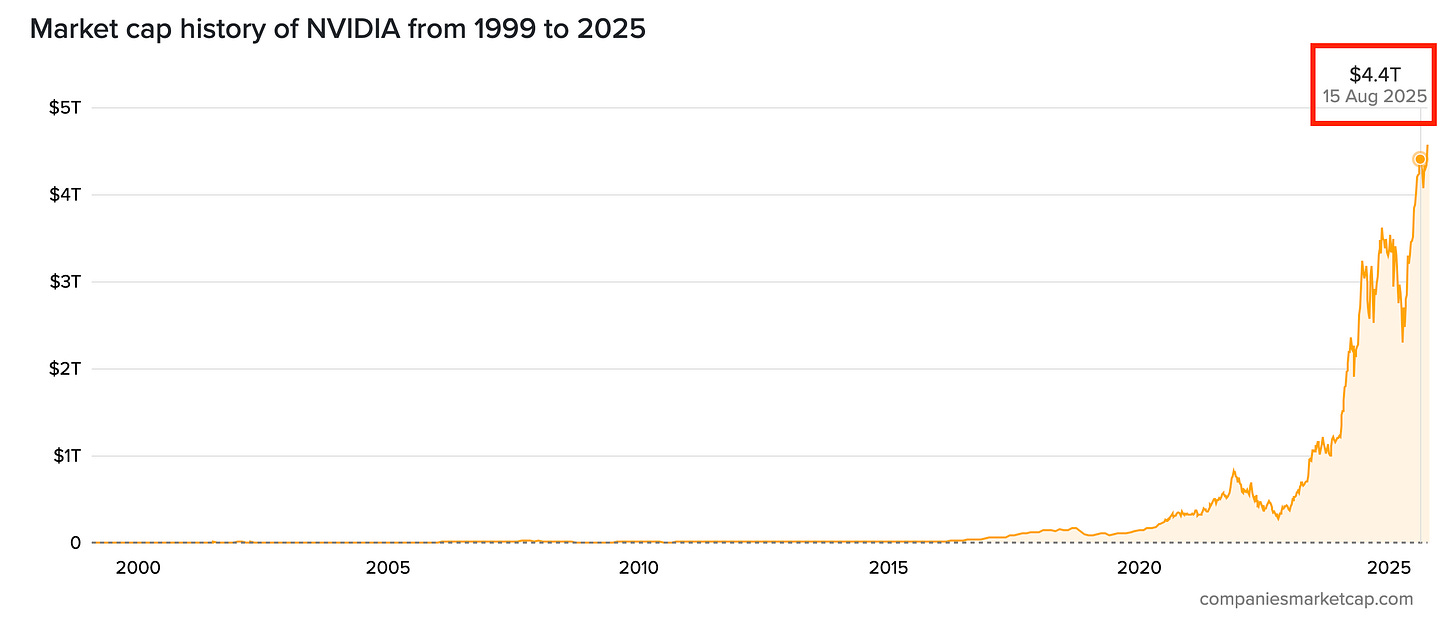

In August of this year, Nvidia — a single American chipmaker — reached a market capitalization of roughly $4.4 trillion.

That’s more than the entire GDP of Japan, larger than India’s economy, and greater than the total market value of every company listed on the Swiss Stock Exchange combined.

To put it another way, Nvidia — a company that makes computer chips — is worth more than all U.S. farmland and represents nearly one-fifth of the value of all the gold ever mined.

Nvidia doesn’t feed people. It doesn’t build homes. It doesn’t grow food or pave roads. Yes, it creates powerful, useful technology — but not something that justifies a valuation rivaling that of entire nations. This is the new absurdity of modern finance: stock valuations soaring far beyond any connection to real economic activity.

And Nvidia isn’t alone. The so-called Magnificent Seven — Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and Nvidia — together are now worth more than $19 trillion. That’s more than the combined GDPs of Germany, Japan, and India.

At these levels, it’s fair to argue that the numbers stop meaning anything. The market no longer reflects reality. It reflects speculation, cheap money, and government policy that have turned global finance into an alternate universe.

How We Got Here

To understand this distortion, we have to go back — not just to 2008, but further still.

The first crack appeared in the early 1970s, when the Bretton Woods system collapsed and currencies were unanchored from gold. But the real break came after the 2008 financial crisis, when central banks unleashed extraordinary measures — quantitative easing, near-zero interest rates, and massive government debt — to keep economies afloat. These were supposed to be temporary emergency measures. They became permanent policy.

Central banks flooded the system with liquidity — trillions of dollars created with a few keystrokes — and handed it to private banks, corporations, and governments.

But that money didn’t spread evenly. It flowed first to those closest to the source: financial institutions, hedge funds, and large corporations. Economists have a name for this: the Cantillon Effect.

When new money enters the system, those who receive it first benefit before prices rise. By the time it trickles down to workers and consumers, inflation has already eroded their purchasing power.

This creates two-tiered inflation:

Asset inflation that enriches the wealthy through rising stock and property prices.

Consumer inflation makes life harder for everyone else.

The result? A widening gap between those who own assets and those who don’t. In other words, it fuels inequality.

Free Money and the Great Buyback Era

Artificially low interest rates made money nearly free to borrow. In Europe, they even went negative — banks were essentially paying companies to borrow. But instead of investing in innovation or productivity, corporations borrowed cheap money to buy back their own shares. This reduced the number of shares in circulation, driving prices higher and rewarding executives — without improving the company’s fundamentals.

It was illusory growth — a financial sleight of hand. It was not real progress. Meanwhile, central banks congratulated themselves for “stabilizing markets,” arguably unaware they were inflating the biggest asset bubble in history.

The Market as a Casino

Markets were once places of price discovery — where investors weighed earnings, risk, and competition. Today, they are casinos. The odds are set by central banks, and everyone plays because there’s no alternative. Even professionals admit this. In a recent Bank of America survey, 91% of fund managers said U.S. equities are overvalued — yet most remain fully invested. Why? Because they have to.

In a world where cash yields nothing, speculation is the only game in town. The consequences go far beyond economics.

Asset inflation is reshaping society itself. The divide between those who own assets and those who don’t is now the defining feature of our age. Home ownership is out of reach. Savings can’t keep pace. Young people often view wealth as a fantasy, as an increasing number of them remain single and continue to live with their parents.

This isn’t just a financial problem — it’s a political time bomb.

As wealth concentrates in fewer hands, trust in institutions collapses. The middle class — once the bedrock of democracy — feels squeezed and abandoned, while the elite drift further from the realities of everyday life. I wrote about the death of the American middle class in a previous post.

You are welcome to watch the video I just uploaded for further insights on this topic:

If you found this analysis valuable, consider subscribing here on Substack or Patreon. Your support helps keep this work independent — and grounded in reality. Join our subscribers-only chat here to connect with the community.

I watched your video and it follows along with what other economists are predicting. The U.S. stock market is vastly over priced and the bubble is going to break very soon. I moved all of my meager investments offshore into gold ETF's and solar energy companies. I'm thinking of maybe moving some money into the Hong Kong market to invest in Chinese manufacturing. I first need to make sure I won't get into trouble with the American government for doing that.

Meanwhile, as I research that, I rely on your reporting, among many, to keep me abreast of the financial situations in the U.S. and Europe. I do fear that the U.S. economy is going to suffer a hard fall very soon and I want to protect what I can before it all comes tumbling down.

The concentration of US capitalism in on finance rather than on production is based on the immorality of US leadership. It is a leadership directed at imperial conquest by military power and its threat. Such a goal does not require a leadership to improve the broad functioning of a society, its productivity, education, transportation, and healthcare. All it requires is a small ruling class that can control its population through propaganda and force of arms when necessary. Production of arms to defend against false enemies serves as a pump for extracting wealth from the working and professional classes. The pump runs on public debt which is paid for by the taxes from which the wealthy are relieved by the political class, their servants. The pump will run until it overheats and can no longer meet the the debt burden. That point is no longer far in the future as is shown by increasing distrust in the purchasing power of the currency or the government's ability to meet its debt obligations such as old age pensions and medical care. It is also reflected in the growing international distrust in the US currency as a reserve. The ruling class seems slow to realize the international threat, and responds only with greater use of military power and warfare. The people of the USA are no longer served by their Constitution and branches of government. Congress and the executive branch have been placed in the care of corporations in elections paid for by corporations as a result of their unlimited "free speech" according to the Supreme Court's decision in 2010 entitled, "Citizens United v. F.E.C." The betrayers of the Constitution were Justices Roberts, Kennedy, Alito, Scalia, and Thomas.