"There Will Be Bank Failures!", Says Powell. Record Job Cuts, Bitcoin Reaches $69K, Gold Hits New Record High

Key Events and News for the Week Ended March 8, 2024

Domestic Events:

U.S. economy is adding more jobs as the rate of unemployment increases.

According to the U.S. Department of Labor, U.S. nonfarm payrolls increased by 275K in February vs. an expected increase of 190K, and vs. + 229K jobs added a month prior, in January. At the same time, the unemployment rate jumped to 3.9% vs. 3.7% expected and 3.7% a month prior.

It’s worth noting that the Department of Labor has been making significant downward revisions every single month so its current data should likely be taken with a grain of salt. For example, there was a 124K downward revision in January’s payroll number; a 43K revision to December’s number.

Additionally, there are more concerning trends in employment data than one might think. For instance, there is a growing gap between native-born and foreign-born employment. Native-born employment is now 1 million below pre-pandemic level; while foreign-born employment has not just surpassed pre-pandemic trends but has grown 3.3 million above its pre-pandemic level.

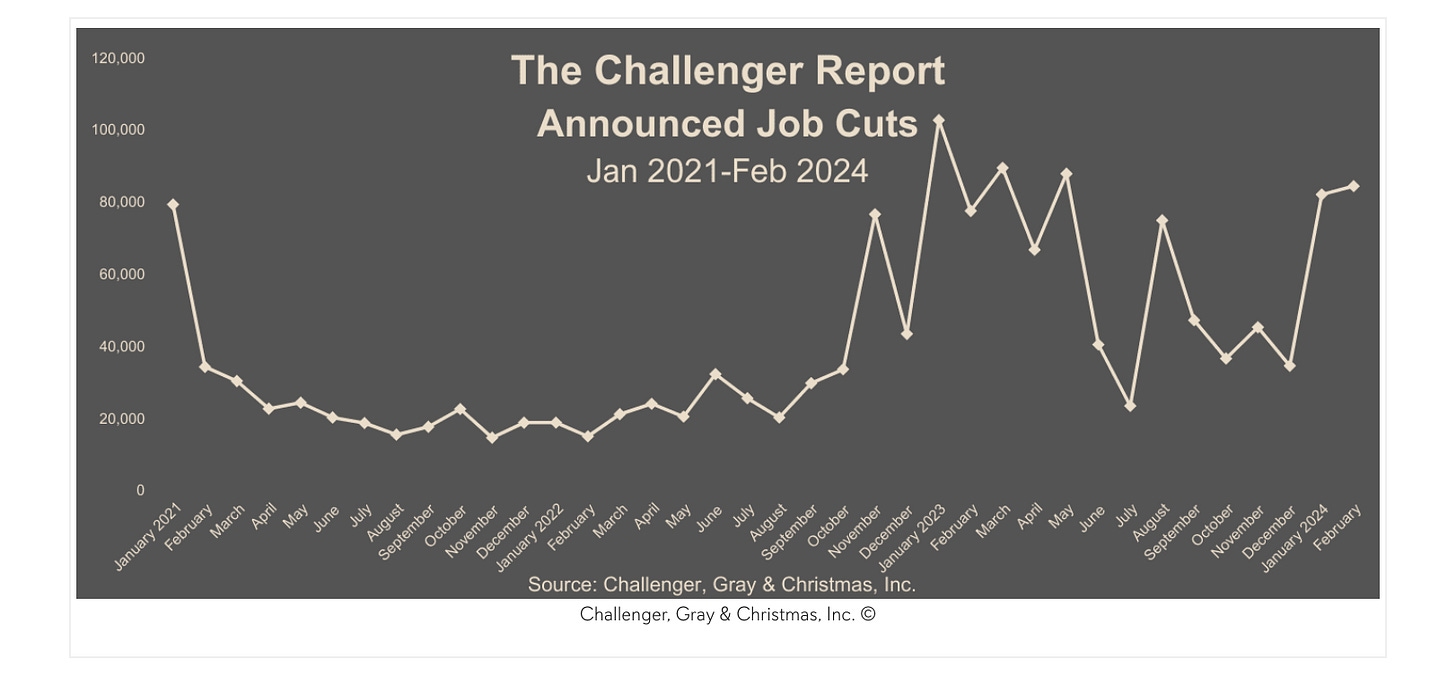

A new record number of job cuts have been announced by U.S. - based employers. February saw 84,638 job cuts, a 3% increase month over month and the highest number since 2009! Financial, technology and transportation sectors account for the biggest portion of job losses.

U.S. consumers continue taking on more and more debt, according to the Fed.

Consumer credit grew by $19.5 billion in January 2024 vs. $10.1 billion consensus. Revolving credit, which includes credit card debt, now stands at $1,327 billion. Revolving credit increased at an annual rate of 7.6%.

This week mortgage rates declined as the number of mortgage applications increased.

According to Freddie Mac, 30-year fixed-rate mortgages averaged 6.88% vs. 6.94% last week. Additionally, 15-year fixed-rate mortgages averaged 6.22%, vs. 6.26% last week.

Jerome Powell was questioned by Senator Cynthia Lummis whether the Federal Reserve prints money to fund government deficit. Although buying US Treasuries during the QE cycle is, indeed, funding the government, Powell’s answer is not too surprising:

During the Congress hearing, Powell stated that he expects bank failures among small to mid-size banks. Powell does not appear to be concerned, however, saying it’s “manageable” although he failed to quantify what that might mean.

I’ve discussed banks’ liquidity issues and commercial loan portfolio challenges in great detail in my previous videos:

Bitcoin reached $69,249 as the result of ETF cash inflows and bitcoin mining halving. Besides the obvious economic drivers, the ongoing uncertainty in politics internationally and domestically in the U.S. is encouraging investors to seek safe haven assets.

Gold hit a new all time high of approximately $2,177 on Friday, March 8th. The increase in the price of gold is the result of foreign central banks buying more and more gold as a safe haven asset. As they are buying gold, they continue to shift away from the U.S. dollar.

International Events:

Despite no media coverage, European farmer protests get progressively worse: