U.S. Consumers Scale Back On Groceries, EU-China Tariff Talks, Ukraine's Splurge on American LNG

WEEKLY RECAP: Saturday, June 22 2024

Good afternoon, All!

Since there are so many events going on (and even during the weekend, too!), weekly recap posts will go live on Saturdays. Hopefully you will welcome the change. The past week was a busy one and the following week appears to be even more interesting.

Let’s recap:

United States:

In the first 8 months of fiscal 2024 (starts in October), the US deficit hit a record $1.2 trillion.

In other words, deficit grew by $4.9 billion per day. Deficit spending as a percentage of GDP has exceeded World War 2 levels:

Meanwhile, U.S. Treasury Secretary Janet Yellen said that US debt load is in a "reasonable place" if it remains at current levels relative to GDP (which is highly unlikely given that the economy is slowing).

Scott Wren, Wells Fargo's senior global market strategist, shared that the outlook for the market is "not as good as it looks" with the underlying labor market weakness slowly but surely hurting at the economy:

“In our view, the underlying labor market is weakening, which directly affects consumer spending and is one of the keys to our forward outlook for the economy and financial markets”

Not surprisingly, jobless claims hit a 9-month high, recording an unexpected increase of 13K to 242K in mid-June.

U.S. consumer credit reached $5.05 trillion.

Credit card debt was at an all time high, $1.34 trillion while delinquency rates of 90+ days past due increased by 6.9%, and now the highest since 2001.

U.S. consumers are scaling back on groceries.

Americans on average spent 3.1% less on food at home in 2023 than in 2022, according to Wilson Sinclair, an economist at the US Department of Agriculture. Checkout terminals at US stores scanned 248 bn items in the past 12 months, down 3 bn from the prior year and 20 bn fewer than the year leading up to June 2020, according to NielsenIQ data.

The declines have put pressure on retailers and their vendors to offer discounts. Without a doubt, the decrease in demand is one of the reasons for increasing bankruptcies.

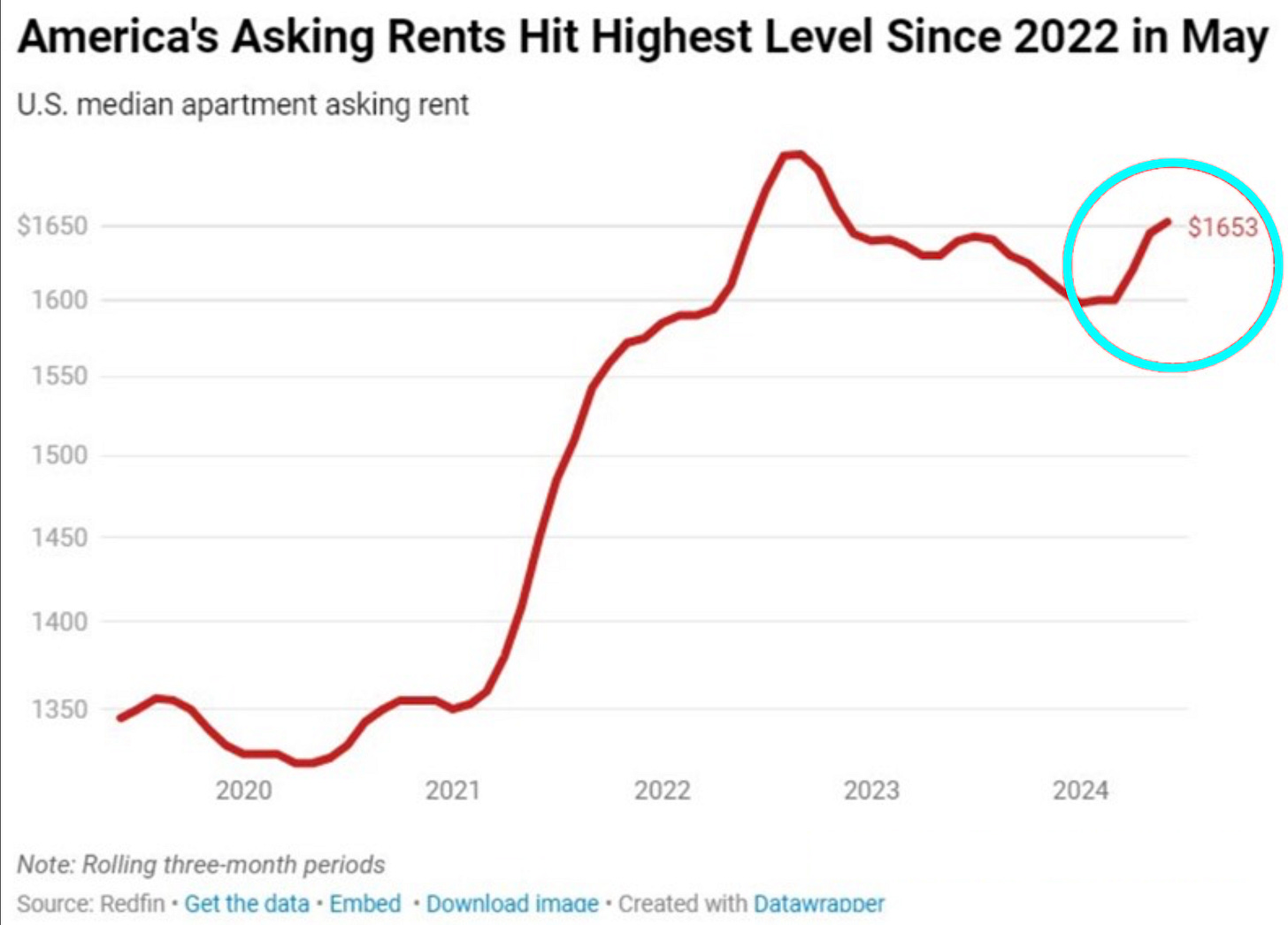

Rent is rising (along with housing costs).

US rents rose to $1,653 per month in May, reaching the highest level since October 2022. Rent prices are now just $47 below the all time high:

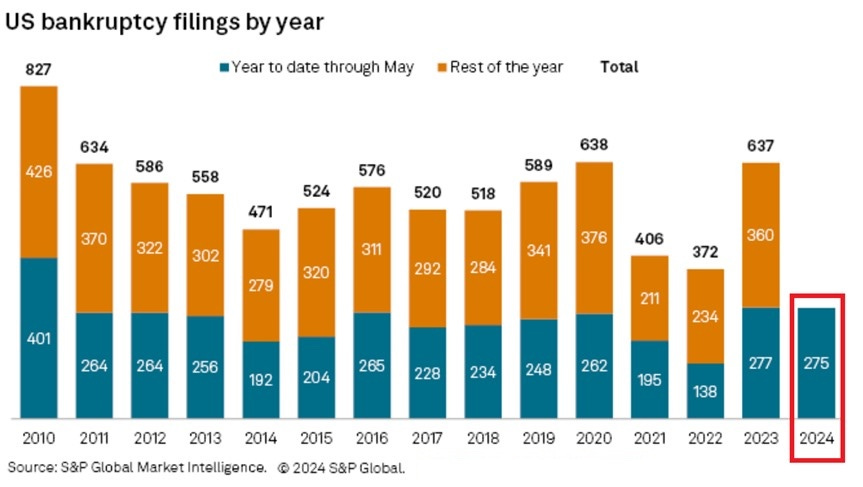

US corporate bankruptcies are on the rise.

275 companies have declared bankruptcy through May of 2024. The trend began in 2023 and continues as the economy is slowing and household debt is increasing at an unprecedented rate.

Consumer discretionary companies face the biggest risk as American consumers spend less money on items they “want” rather than “need”.

$525 Billion in unrealized bank losses push the banking industry on edge.

FDIC reports $525 billion in unrealized losses on insured banks' books. U.S. banks are not capitalized to withstand the "worst case scenario".

As a former bank auditor, in my opinion these unrecognized losses dramatically increase the probability that the federal government will have to intervene and to provide deposit insurance guarantees with the goal to stop systemic bank runs. Depositors are losing confidence in the banking system and we are probably just a couple of bank collapses away from massive bank runs.

I discussed further details in a recent video. Watch the program on Rumble or YouTube:

The World:

The New Development Bank Drives De-dollarization Efforts: Multi-currency Lending to Emerging Markets.

The New Development Bank’s first international forum is scheduled to take place in Egypt. Dilma Rousseff, the president of the New Development Bank and other senior level leaders will travel to Egypt to meet with Egypt’s President El Sisi and other political leaders. Officials from international institutions, development partners, economic experts, and think tanks are also expected to join.

The forum will introduce a new major lender - the NDB - to a new market, government organizations as well as its private sector. It will give both sides an opportunity to identify investment opportunities, indicating that the IMF and World Bank now have a strengthening competitor.

I discussed further details in a recent video. Watch the program on Rumble or YouTube:

According to the EU Central Bank President Christine Lagarde, the world risks a new “geopolitical divide” :

“a geopolitical divide between some of the developed countries led by the United States and some emerging market economies, in particular China. That is a transformation of the trading landscape that we have known, with all consequences that go with a fragmentation of trade”

Javier Milei is warming up to China.

Despite Javier Milei’s early signs of dislike for China, the President of Argentina has reconsidered his options. Reportedly, Argentina and China