U.S. Depletes Its Strategic Oil Reserves As Saudi Arabia Cuts Oil Output To Raise Prices

Strategic Oil Reserves Are Being Sold With Proceeds Transferred To The Department Of Treasury

On Tuesday, September 5th, Saudi Arabia announced its decision to extend its voluntary production cuts of 1 million barrels per day until the end of 2023. Oil prices are back above $85 per barrel: WTI closed at $86.79 and Brent traded at $90.15. Gas prices are now 31% above the 5-year average and are rising rapidly.

This is not a surprise. With the recent OPEC oil production cuts, led by Saudi Arabia and Russia, followed by a lack of any appropriate response domestically, the American consumer has no choice but to start paying more. Expect to spend more at the pump as well as at a grocery store, since rising oil prices drive up farming and transportation costs.

Saudi Arabia announced the extension of oil production cuts in addition to 1.6 million barrel per day output cut by OPEC+ members earlier this year. OPEC+ enacted the restriction through the end of 2024. According to CNBC:

“Fellow heavyweight oil producer Russia — which leads the contingent that joins OPEC nations in the OPEC+ coalition — also pledged to voluntarily reduce exports by 500,000 barrels per day in August and by 300,000 barrels per day in September. Russian Deputy Prime Minister Alexander Novak on Tuesday said that it will extend its 300,000 barrels per day reduction of exports until the end of December 2023 and will likewise review the measure on a monthly basis, according to the Kremlin.”

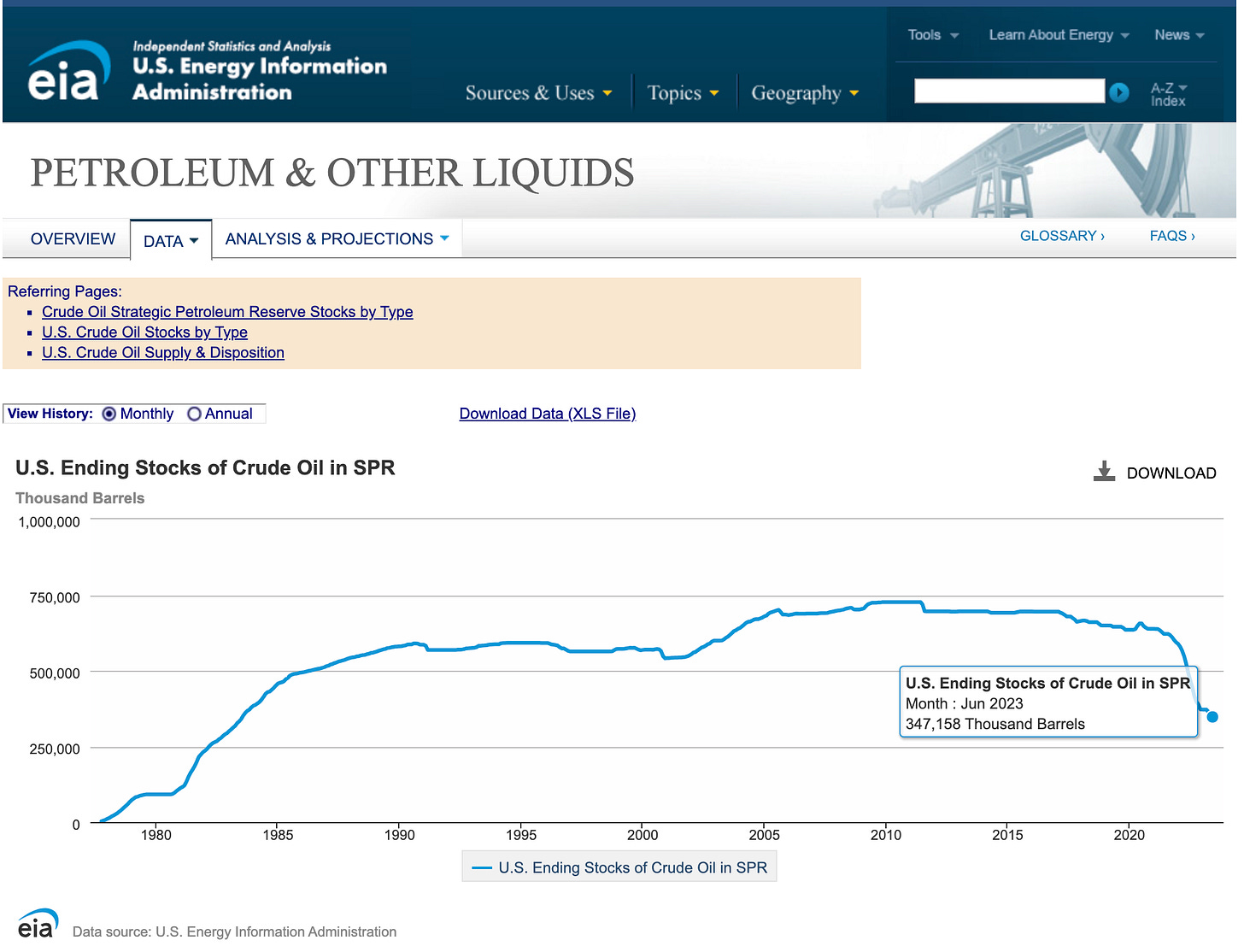

When gas prices increased several months ago, the Biden administration, unwilling to address the issue by ramping up domestic output, tapped into the U.S. Strategic Petroleum Reserve to lower gasoline prices. Using oil reserves was a temporary fix: a short term solution that failed to address the issue. As the result of multiple drawdowns, the U.S. Strategic Petroleum Reserve is now at the lowest level it’s been in four decades since 1983. Over the course of just two years, petroleum inventory decreased by 43%, falling to 347 million barrels.

It has been reported that the current administration delayed plans to restock the nation’s emergency oil reserve. In early August 2023, the Energy Department canceled a planned purchase of 6 million barrels for the strategic reserve, explaining it as a move necessary to secure a better deal.

Without replenishing the reserve, or even with its current depleted levels, we may have only two options. The first option is to focus on domestic exploration and oil production in order to replenish the reserve and to be in control of our own supply chain. In an increasingly unstable world, with growing geopolitical tensions it appears to be a reasonable course. However, it is as much reasonable as it is unlikely. The focus is on green energy; fossil fuels don’t attract major investments. The alternative is to accept that oil costs, and the well being of a U.S. consumer who is heavily dependent on the price of gasoline, will be dictated by a coalition of foreign countries.

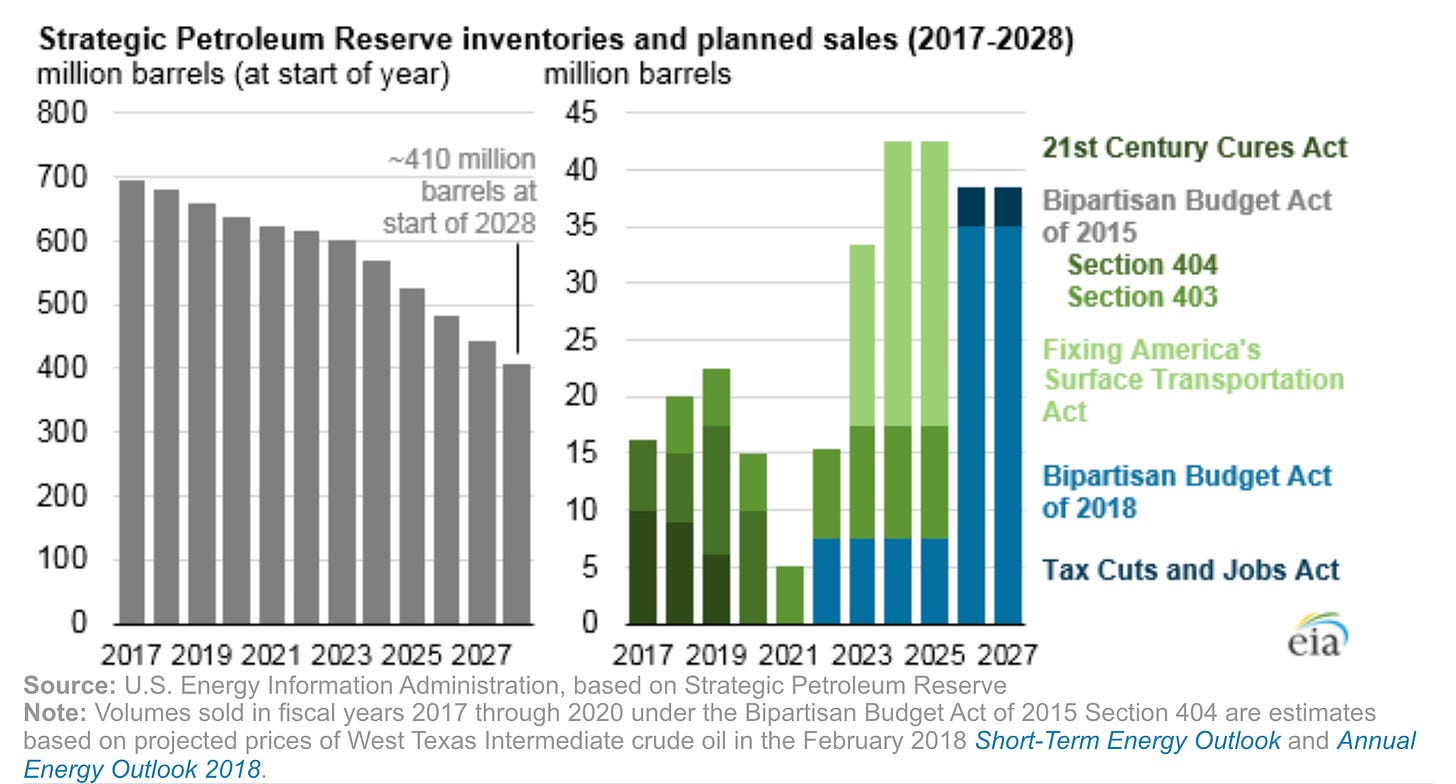

In recent years the U.S. Strategic Reserve was used to fund federal spending. According to the U.S. Energy Information Administration, legislation that allows sale of strategic crude oil reserves was enacted in 2015:

"Recent legislation has directed the sale of more than 100 million barrels of oil from the U.S. Strategic Petroleum Reserve (SPR) in U.S. government fiscal years (FY) 2022 through 2027. Based on legislated sales established in multiple acts of Congress, the SPR could decline by about 40% in the coming decade while still meeting requirements for petroleum import coverage. Assuming no other legislation over this period, the SPR could decline from 695 million barrels at the start of 2017 to about 410 million barrels at the start of 2028.”

Prior to FY 2017 sales, the SPR inventory level had remained nearly constant for several years.

Three bills enacted in 2015 and 2016 called for the sale of million of barrels in 2017 through 2025. Revenues from these sales go directly to the U.S. Department of Treasury. These bills are: The Bipartisan Budget Act (Section 404), enacted in 2015; The 21st Century Cures Act; and The Fixing America’s Surface Transportation Act, enacted in December 2015.

OPEC+ will play an increasing role in regulating global energy markets. During its latest BRICS Summit in Johannesburg, the bloc effectively formed a successful coalition with the biggest energy players: the United Arab Emirates, Saudi Arabia and Iran. With six new member states whose membership is effective January 1, 2024, the BRICS block will control 43% of global oil production.

In a nutshell, what does this mean for the United States? This significant reduction in the U.S. Strategic Petroleum Reserves is a major concern especially when oil prices are rising. Since our oil reserves are depleted, we now have extremely limited options for stabilizing the market. There are no reasonable options since alternative energy resources simply aren’t able to close the gap. As long as there is no effective approach to bring consumers’ best interest to the forefront, Americans will absorb the costs of a failed energy policy.

I read of the Saudi cutback in the news, but your article provided much more in-depth coverage.

Hi Lena ,well written article thank you ,another item is being over looked is that EV cars do not pay

taxes for their use on the highways ( state and federal taxes ) that means those fuel taxes per gal.

will have to go up ,in Washington state their is a proposal to increase the state fuel tax another sixty cents per gal. on top of the 50 cents a gal. now. World shipping requires the largest oil use which will

increase all cost to products world wide. the USA and Europe are in self destructing mode..

Thank you

Thomas