US Dollar Has Lost 86% Of Its Value And Continues To Lose Its Global Hegemony To Chinese Yuan

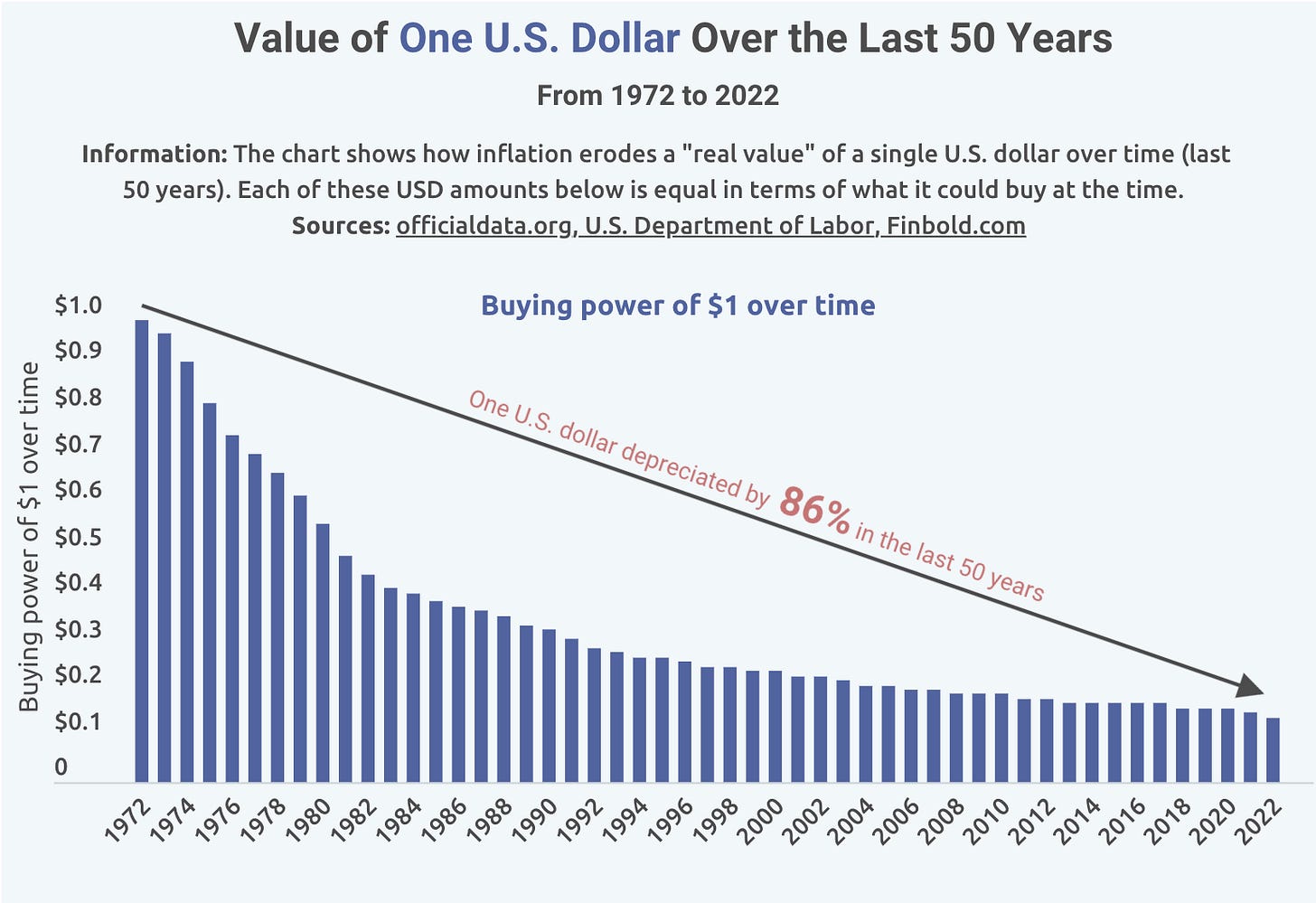

The value of the US dollar has dropped by 86% in the last 50 years. It is becoming increasingly clear that the future of the USD is in danger. Does the Chinese Yuan have any potential to dethrone it?

Countries that have close trade relations with China have been methodically increasing their central bank reserves held in the Chinese Yuan. It’s a common known fact that the value of the US dollar has been slipping but will it be dethroned by the Yuan, or any other currency?

There’s been a significant shift in the global position of the US dollar due to the well known economic and political events. Some experts go so far as to say that the days of its global hegemony are slowing coming to an end. We cannot avoid it due to a variety of reasons, including the country’s trillion-dollar debt, the dollar’s diminishing share in global money supply, and the Feds’ policies that have become a catalyst in the downward path that the United States economy has been on.

First, let’s focus on the context. What does it take for a currency to gain the global reserve status?

There is no official process of achieving it. It happens over time as the result of wise economic, political and financial decisions. Global reserve currency requires the issuing country to be perceived as both economically secure and socially stable.

There have been six global reserve currencies in history. The first country to enjoy such popularity of its national currency was Portugal in the 14th century. Spain, a strong political and maritime power of the 15th century, was the second country in history to enjoy financial hegemony. Later on, the currencies issued by the Netherlands and France dominated world markets during the 17th and the 18th centuries. The Pound Sterling issued by the British Empire was the longest lasting global reserve currency. It played a significant role well until the end of the First World War. As the United States’ economy grew stronger and surpassed that of the Great Britain after the end of the World War 2, the United States dollar emerged as the next global reserve currency. It marked the beginning of the new global financial system.

The United States dollar has been the world's primary reserve currency for 70 plus years. Under the Bretton Woods system, the dollar was pegged to gold and most other currencies were pegged to the dollar. It goes without saying that this type of an arrangement served as the catalyst for the United States to gain its super power status on the global arena. When the gold standard was removed, the dollar maintained its strong position partially due to the fact that oil has been historically traded in US dollars. However, the future of the United States dollar is becoming increasingly questionable as the United Arab Emirates and Qatar are moving towards accepting the Chinese Yuan in exchange for oil shipments.

The status of the global reserve currency comes with many privileges. It gives the United States government an immense level of control over the financial system, including the authority to sanction its adversaries. Further, it allows the government to borrow in its own currency. This is extremely advantageous because there are no additional costs typically associated with foreign exchange rates. Additionally, private and publicly traded American companies benefit from this system as it allows them to do business in dollars without having to pay the costs of converting it into another currency.

Partially, the gradual decline of the United States dollar has been the result of multiple foreign governments deciding to find safer, more stable alternatives. This is caused by geopolitical tensions and weakening of the US economy. In 2022 when the Federal Reserve started to raise interest rates, the dollar’s value increased as the result of foreign investors perceiving the United States to be a safe economic space. However, in 2023 we witnessed a reversal of the trend: the value of the American currency is declining as inflation persists and employment numbers remain strong. If anything, 2023 brought more issues to light that remained previously unseen.

An equally important factor that will affect the value of the United States dollar is the outcome of the war in Ukraine. If it ends in a way that serves the interests of the West, the value of Euro may increase - if it does, it’ll push the value of the US dollar further down.

The dollar’s declining value is seen as an opportunity for China to convince foreign banks to hold Chinese Yuan in reserve. While the Chinese Yuan is unlikely to gain parity with the U.S. dollar in the near future, there are three main factors that appear to be in focus. In 2022, China made a major step towards strengthening its national currency by partnering with five nations in the region - Indonesia, Malaysia, Hong Kong, Singapore, and Chile. Additionally, the Chinese Yuan is being traded directly between China and two other countries: Australia and Japan. This means that both countries do not need the U.S. dollars to trade with their biggest partner, China. The second factor to consider is the increasingly comfortable partnership between China and Russia. The Chinese Yuan has effectively become a reserve currency in the Russian Federation. Russia holds approximately 20% of its central bank reserves denominated in the Yuan. As China continues to develop its established and potential partnerships around the world, it is safe to say that its currency will continue to benefit. We know that China facilitated the United Arab Emirates and Iran to re-start their relationship. The third reason that could help the Chinese Yuan effectively become an alternative global reserve currency is e-yuan, China’s central bank digital currency. It has the potential to challenge the dollar, and, without a doubt, it will.

So what we might see is as the U.S .dollar continues to decline and the world becomes increasingly “multi polar”? The Yuan has a strong potential to be an appealing alternative to the current global reserve currency. A study recently done by economists point to the fact that the Yuan’s current position is similar to that of the U.S. dollar in the 1950s. This effectively indicates that the Chinese Yuan is expected to increasingly gain value. If this is correct, we may be just a few decades before the Yuan gains parity with the United States dollar.

It goes without saying that the path to becoming the next global reserve currency is not an easy one and there are many obstacles. In order for the Yuan to gain parity or to surpass the U.S. dollar in value, there would have to be an improved and an increased degree of transparency on behalf of the Chinese government. The lack of transparency may become the biggest drawback against the Yuan.

As you can see there’s a lot standing in the way to displace the US dollar as the global reserve currency but the process has certainly started.