U.S. Economy Sinks, BRICS to Create New Grain Exchange, U.S. Admits Houthis Are Winning

Weekly recap: June 6, 2024

U.S. job growth continues to decline, while unemployment numbers rise.

U.S. nonfarm payrolls increased by 206K in June which exceeded the 190,000 median estimate. But don’t let the numbers confuse you: more than half of the increase was actually offset by downward revisions in prior months. Moreover, for nearly 12 months now, employment “gains” have been part-time jobs while the number of full-time jobs has been declining:

Mark Hamrick, senior economic analyst at Bankrate, commented on the downward job growth revisions of 111K in April and May:

“Downward revisions for the previous two months take some of the shine off the as-expected payrolls gain”.

The unemployment rate is at the highest level since November 2021: it increased to 4.1% in June, vs. 4.0% expected, from 4.0% in the previous month.

Bloomberg Economics said the labor market has passed an inflection point headed for more rapid deterioration.

Fed’s officials are still using the old playbook: Fed’s John Williams says the US economy is strong and the Fed has more work to do to bring inflation down to 2%.

According to John Williams, the New York Fed President:

“Inflation is now around 2-1/2%, so we have seen significant progress in bringing it down. But we still have a way to go to reach our 2% target on a sustained basis. We are committed to getting the job done.”

Williams further praised the strength of the US economy:

“The economy is doing remarkably well. Unemployment is low and growth is good. So I think some of market’s kind of positive strength is really based on that.”

Apparently, not everyone at the Fed got the memo that it’s “okay” to start slowly acknowledging the economic uncertainty and a looming crisis.

The U.S. economic slowdown is raising major concerns.

The labor market has become weaker than expected, with clear signs of further deterioration.

Even with the consistent downward revisions, the US job growth has been the slowest since 2020:

Companies are unable to hire as many workers as they used to:

If we put these data points in the context of the increase in corporate bankruptcies, as discussed previously, it becomes clear that it’s only reasonable to expect a severe economic downturn.

Central banks continue to purchase gold at record levels.

The Reserve Bank of India added more than 9 tons in June, the most in two years. India’s reserves are estimated at 841 tons.

Central bank buying continues to drive global demand, pushing gold prices to record levels:

Germany’s economy continues to struggle.

Germany is unable to regain its industrial capacity with May output declining further by 2.5%. Cars, machinery production and electrical equipment all saw drops of more than 5%.

High interest rates, weak demand and expensive energy cost remain considerable obstacles to Europe’s biggest economy.

Russia’s proposal to create an inter-BRICS bloc grain exchange by the end of the year will further undermine Western influence globally, since the price of grains has been historically set in the US and Europe.

The BRICS countries now make up about 30% of all arable land in the world. They jointly produce about 40% of grain crops, 50% of fish, 50% of dairy products worldwide.

Watch the full video for further details: YouTube | Rumble

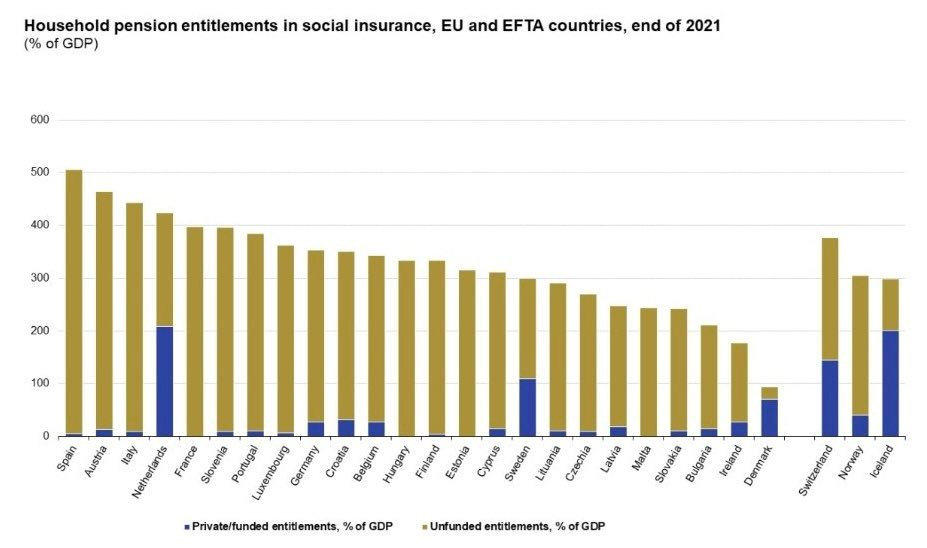

Unfunded Pensions in major European countries are at 300% to 500% of GDP:

The World Bank has upgraded Russia’s economy from an upper-middle-income country to high-income, highlighting its growth despite more than 16,000 sanctions implemented by Western countries.

The upgrade demonstrates the ineffectiveness of sanctions as well as the competence of Russia’s economists.

Watch the full video for further details: YouTube | Rumble

The United States is finally admitting that AnsarAllah, or Houthis, won.