US Interest Burden Hits 28 Year High, BRICS+ Summit Agenda, US Oil Extraction Hits New High

Weekly Recap for the Week of October 20, 2024

Hello, All! Let’s quickly catch up on anything you may have missed this week!

🌏 Fmr President Donald Trump announced he would impose a 100% tariff on countries that seek to de-dollarize.

While the states seek economic sovereignty and diversification away from the U.S. dollar to mitigate the risk of being sanctioned or otherwise coerced, imposing tariffs is a clear way to accelerate de-dollarization.

🌏 BRICS+ Gains Momentum as the European Union Loses Steam

With so many countries growing increasingly frustrated with the demands made by the E.U., it’s only reasonable to expect that the appeal of joining the economic association led by the Global South will continue to increase.

Despite the fact that new memberships in BRICS+ have been put on pause, the President of Russia Vladimir Putin clarified that the bloc plans to discuss its expansion during the Annual Summit in Kazan next week.

🌏 BRICS+ Pay Card Is Successfully Tested During the Business Forum in Moscow, October 17-18 2024

During the conference , every attendee had the opportunity to test the new BRICS Pay card. It could be used in stores with special BRICS Pay markings. To activate the money, one needs to register in the system and scan the QR code of the card. To pay, one needed to scan the QR code from the screen of the employee's phone in the cafe or store from the payment system.

In my recent video, I showed the BRICS Pay demo video and shared further details:

Connect with Lena: YouTube | Rumble | Locals | Patreon | X | Telegram

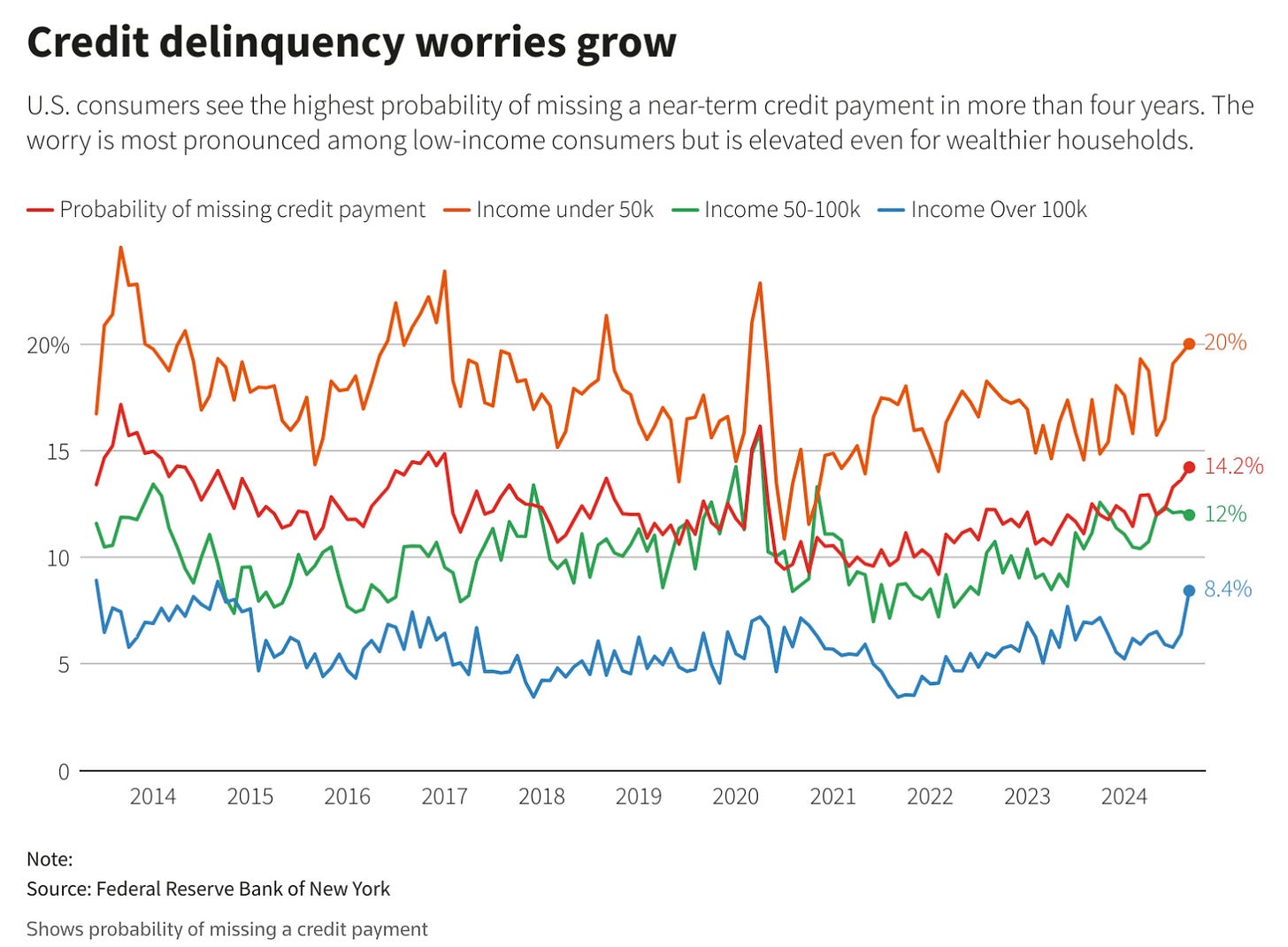

🌏 U.S. consumers now see a 14.2% chance of missing a minimum debt payment over the next 3 months, the highest reading since 2020

The highest chance of delinquency, at 20.0%, was seen among those who earn less than $50,000.

Delinquency probabilities for Americans making over $100,000 rose to 8.4%, the highest reading since September 2014.

🌏 The market is now pricing in a 35% chance of a recession in the US within the next 12 months.

The U.S. yield curve is pricing a 28% chance of an economic downturn, while the next 12-month Fed interest rate policy expectations imply an 84% probability of a recession.