Week In Review: Bond Market Meltdown, U.S. Oil Reserve Is Empty As The Government Adds $500B Of New Debt In 14 Days

Key Events For The Week Ending October 6, 2023

Happy Friday!

Numbers:

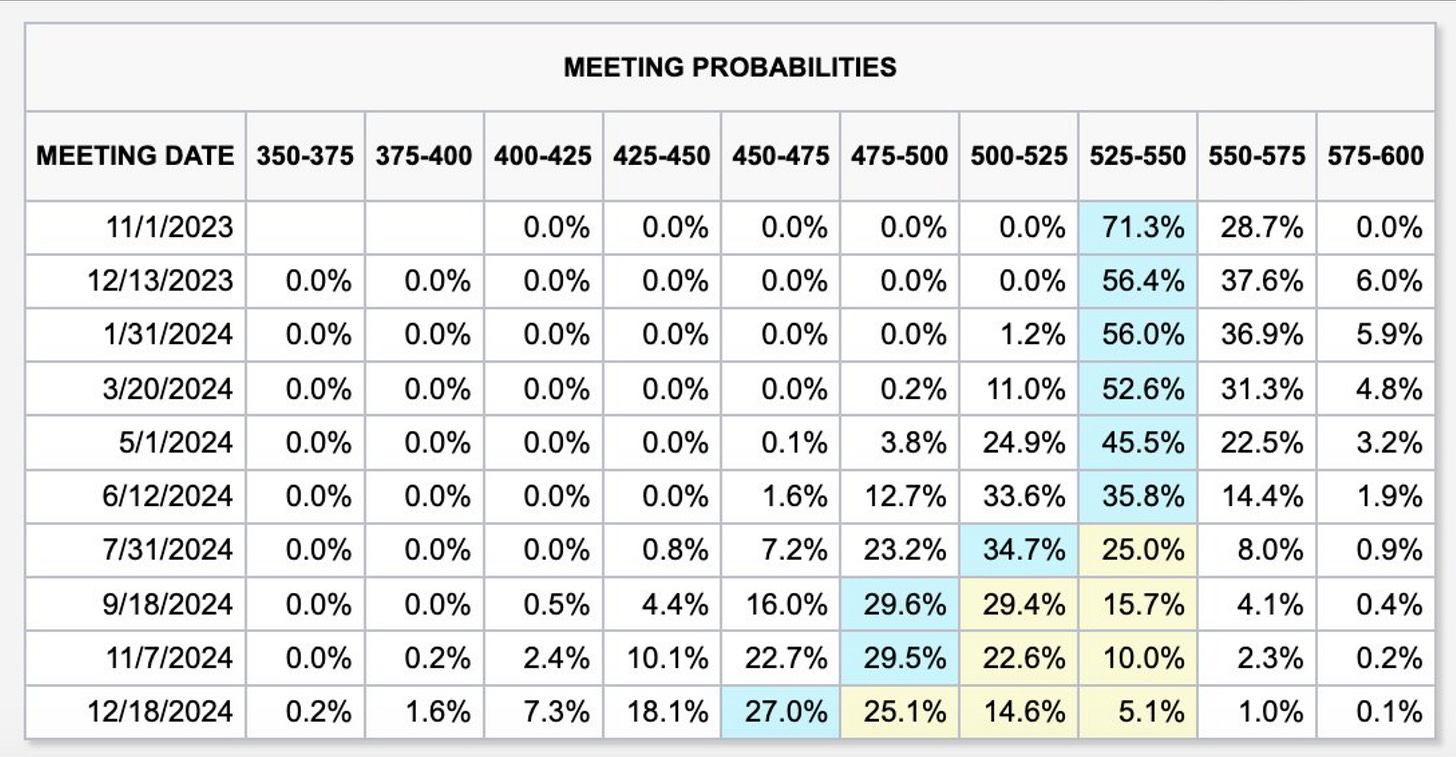

The U.S. economy added 336,000 jobs in September above expectations of 170,000. The unemployment rate was unchanged at 3.8 percent, indicating the labor market remains very strong. The Fed's fight against inflation is far from over. It is becoming increasingly likely that the central bank will raise the rate one more time before the year end. Rates are expected to remain high until mid or late 2024.

Odds of a rate increase rose to 44% after September jobs report:

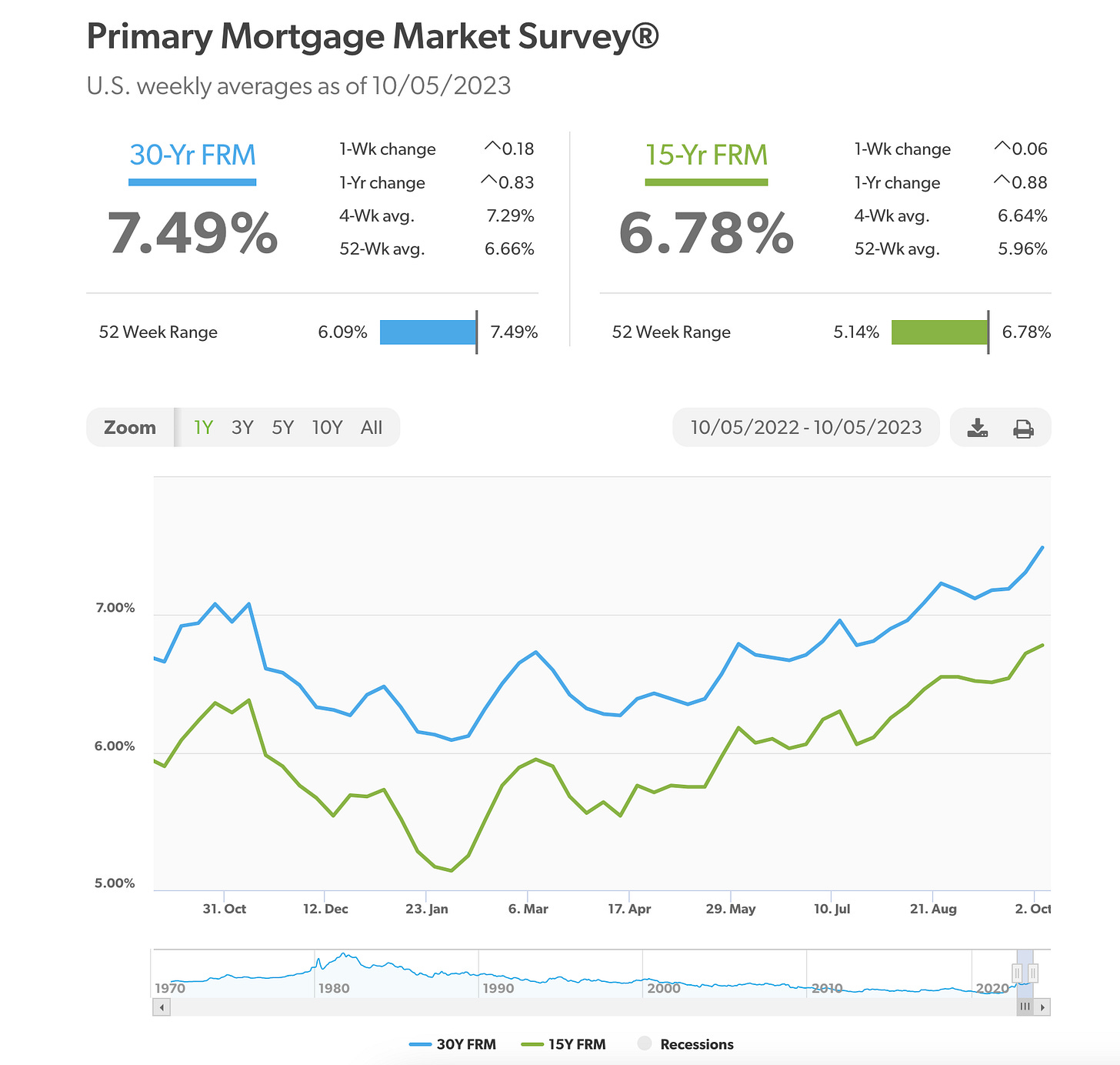

Mortgage demand hit its lowest levels since 1995. The average interest rate on 30-year mortgage is 7.49%. As the Federal Reserve plans to keep interest rates elevated and if the number of homes for sale does not increase significantly, we are likely to see housing affordability worsen.

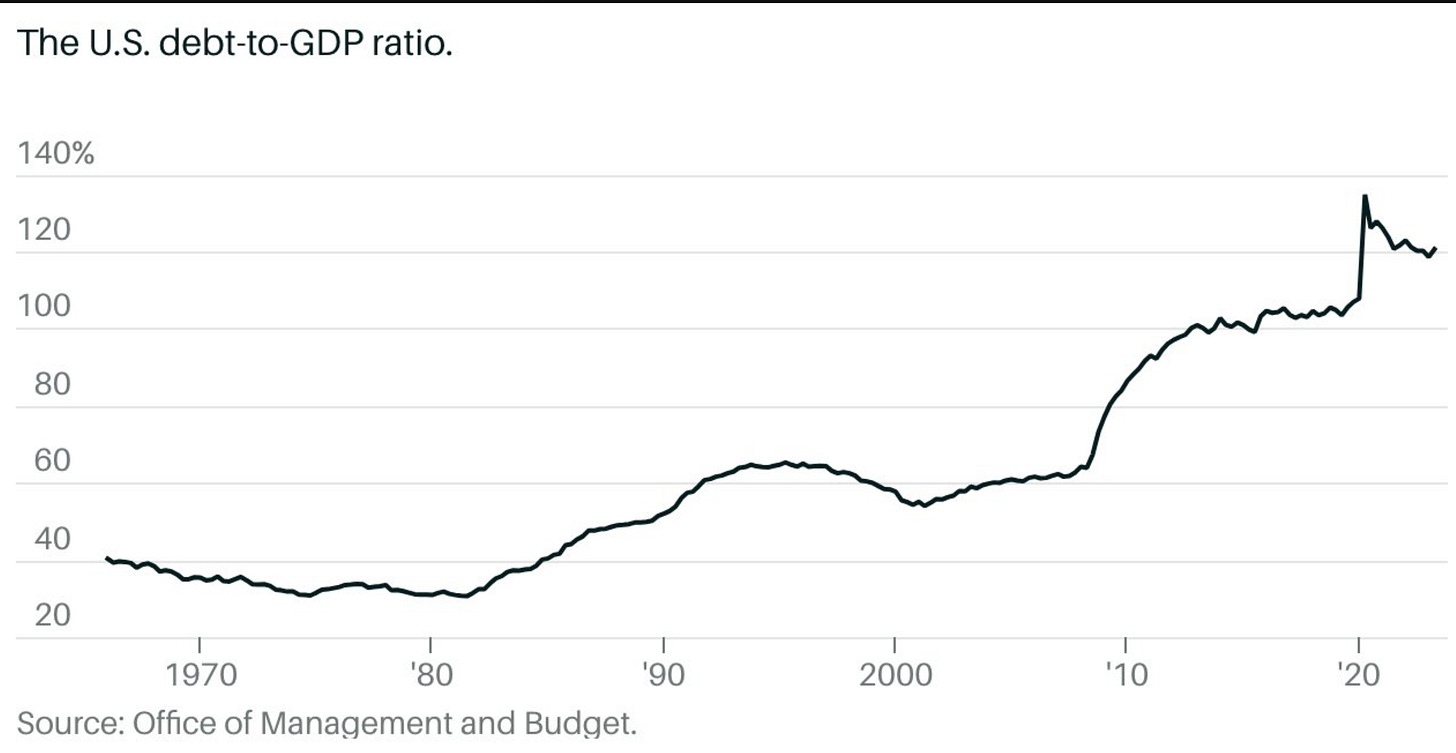

U.S. national debt continues to surge. In a span of just 2 weeks, the government added nearly $500 billion to it’s massive $33 trillion debt balance.

The yield on the 10-year U.S. Treasury note reached a 16-year high. This signals that borrowing is now more expensive; and the government will continue to issue new debt at a record pace to finance its deficit. This week I discussed how the process works and what it means for the U.S. consumers:

Events:

Exxon Mobil is planning to acquire Pioneer Natural Resources. The deal would turn Exxon into one of the main global oil producers with an output capacity of 1.2 million barrels per day.

Union strikes extended beyond the automotive industry. Kaiser Permanente’s 75,000 workers are currently on strike in California, Colorado, Washington and Oregon. The current strike is the largest walkout by health-care workers in U.S. history.

The resumption of $1.6 trillion in student loan debt is expected to result in a sharp drop in consumer discretionary spending of $9B month or $27B/quarter. It will cause a decline in GDP, leading to -0.3% economic growth in 2024. I discussed the impact in further detail in a recent video:

The U.S. Strategic Petroleum Reserve has fewer than 17 days left of crude inventory. There are no plans to refill it either.

Thank you for reading! Have a great weekend!

Stay connected:

https://rumble.com/c/LenaPetrova

https://www.youtube.com/@lenapetrova

https://twitter.com/_lenapetrova

Dear Lena ,did you known that I do not like to write and i' am a poor speller. did you ever heard it's

better to be year ahead than a Day late ,well this past week i did that ,I went on a long vacation where

the Jet stream moves from East to West.

I read many blogs and comments every Day ie should i buy gold now ,will we run out of gas ? ,well they want us to ride bicycles and later we will have wall because rubber tires are bad for the envirment

Over a half million men have been KILLED both Ukraine and Russian both are from the same families (Slavica) they don't care about Life. So least get really here, the big picture ,there is this BIG SNAKE it's being around for a very long time ,the longer it;s alive the more it has to EAT and the bigger it gets , now their are other ( R -C ) Big Snakes around, so it eats the smaller fish lately ( 70 yrs ) that are in the European Pond .,Eventionaly this big Snake only is able to eat sardines in it,s own Neiborhood

And now this Snake has to Eat it's self ,yes we are on the MENUE .

Thomas It,s time to get out of Dodge !

Hi Lena, I have a question for you that I have been seriously wondering and I was curious to hear your opinion:

I understand the importance of gold and silver in general, in terms of real wealth, hedge against inflation, wealth transfer and currency swaps; but with what's going with CBDCs, cash recalls and banks tokenizing, I am wondering if it is smart to have it in the long term to "beat the system." I heard from an episode of Stansbury Research when Lynette Zang talked about how Zimbabwe is testing a gold-backed currency, but nothing in the whitepaper says the CBDC is convertible.

https://www.youtube.com/watch?v=O6eKbBN_4WE

Of course, who wants a CBDC? But when I hear things like this, and knowing that the final transaction must be in the digital trap, then what is the real point of having all these precious metals? Does that make sense?

As a young adult myself that does not have a lot of money, still living in his Dad's house, trying to navigate this minefield, in your humble opinion, what do you think? To me, I feel like having things land, livestock, natural resources, ammo, and barterability are more important to have long term than precious metals, in order to buck the system. But, I am genuinely open to hear if that is a good or bad thought pattern?