This Week's Recap: Citi Announces Layoffs, OPEC+ Considers Cuts Amid Declining Oil Prices

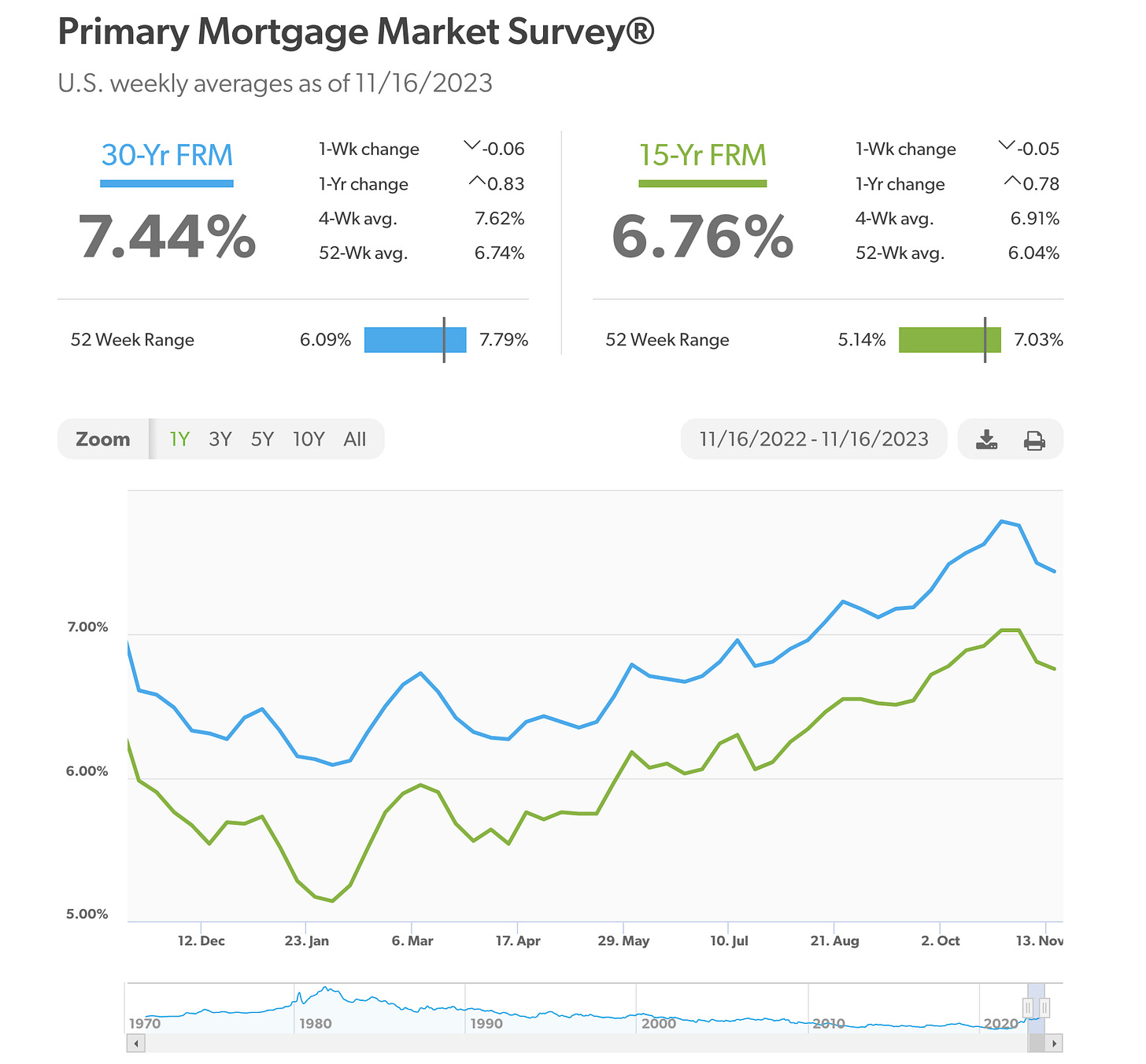

According to the Freddie Mac Primary Mortgage Survey, mortgage rates trended down for the third straight week.

30-year fixed-rate mortgages averaged 7.44% as of Nov. 16, while 15-year fixed-rate mortgages averaged 6.76%:

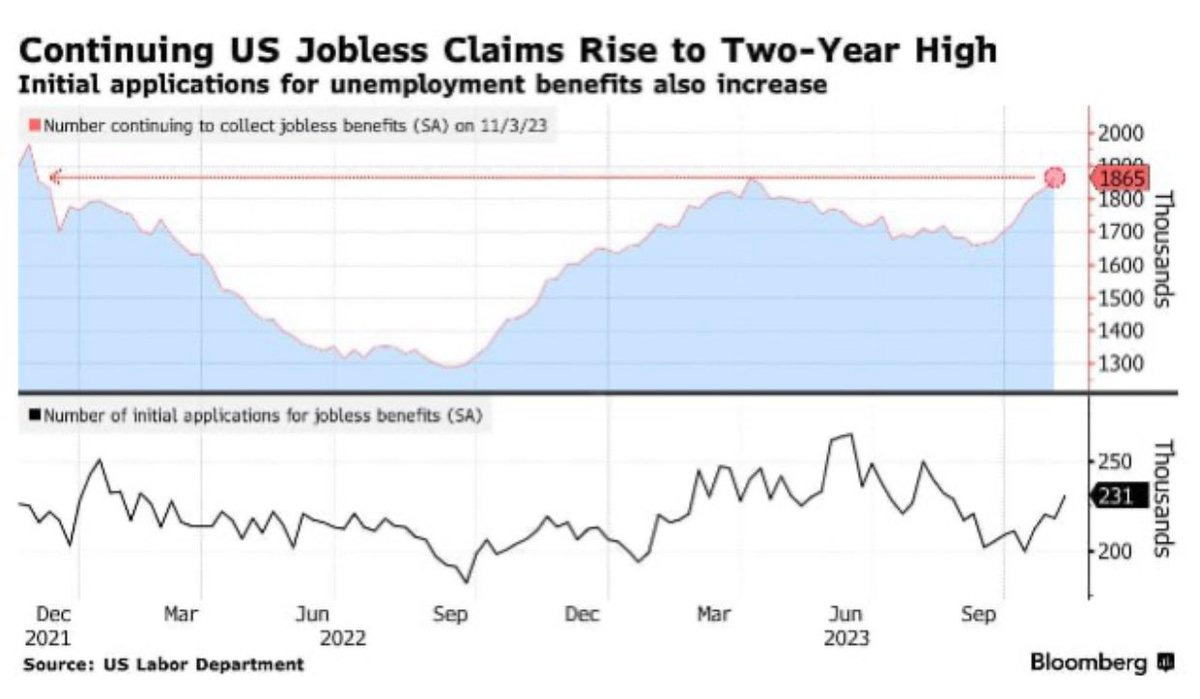

U.S. jobless claims at 3-month highs, confirming economic slowdown:

U.S. October Industrial Production fell 0.6% vs. September reading vs. 0.3% expectation. The higher than expected drop is driven by a 10% decline in the output of motor vehicles and parts as the result of strikes at major automakers.

U.S housing start just hit a 3-month high. Housing starts climbed 1.9% month over month in October to 1.4 million.

Late Thursday, President Biden signed the temporary funding bill. The new funding ensures that the federal government will operate for at least two more months.

The newly signed legislation provides funding for transportation, military construction, veterans' benefits, housing, urban development, agriculture, the Food and Drug Administration, and energy and water programs through January 19, 2024. The rest of the government (including the DoD) will be funded through February 2, 2024.

Amid oil prices declining, OPEC+ is considering an additional 1 million oil production cut.

WTI Crude is trading at $75.40 per barrel this Friday:

In a recently released audit opinion, independent auditors state that Pentagon, once again, has failed its annual financial audit. Auditors gave the Department of Defense a “disclaimer opinion” which means that auditors were not provided with all of the documentation they had requested and needed to complete their audit procedures. An unqualified, or “clean,” opinion is the highest possible rating and a qualified opinion is an acceptable rating. Both mean that auditors were given enough information to make a complete judgment. However, a disclaimer opinion is typically regarded as a red flag in the industry.

The energy regulator issued a report with a warning of possible blackouts this winter:

As consumer demand is unpredictable and growing household debt signals that consumers’ purchasing power might be questionable, major retailers start their Black Friday deals early. According to an analysis of U.S. retailers from GlobalData, the depth of discounts and the total amount of items that were on sale during October were much higher than the last four years.

Online sales grew nearly 6% to $76.8 billion compared to last year.

On Friday, Citigroup announced it would begin multiple rounds of layoffs, starting next Monday, due to “massive restructuring” efforts.

Have a great weekend!

Stay connected:

https://rumble.com/c/LenaPetrova

https://www.youtube.com/@lenapetrova

https://twitter.com/_lenapetrova

Thank you Lena. Have an excellent weekend.

Good morning Lena , (Sat 11/18/23 ) Some times it's thought's little things that tells you a lot.

Head line's this morning " Russia Transitioning to GAS heating in the country side-- Europe is moving to log fireplaces in the city " I mentioned my early comment Russia's gas reserves are the largest in the world not counting what Russia will discover in the Artic which is 50 % of the artic ocean out to about 200 miles from land on their international legal economic outer shelf. so why is Russian Transitioning to to Gas heating well they have much more gas than oil ,so they can use gas domestical and sell more oil international .I think in the future Russia will be able to provide China with all the energy resource China requires ,Gas ,oil , and Uranium not that China should cut itself of from other

suppliers but it can reduces it's amounts from others.

As for Europe it's moving to a third world countries ,Europe does not have natural resource to speak of and it has lost it's cheap energy From Russia ,lost it's completive edge.