Week In Review: Housing Market Recoups $3T in Losses; U.S. Deficit Hits $1.6 Trillion And Counting, and PayPal Issues Stablecoin

Key Events For The Week Ending August 13, 2023

Numbers:

The U.S. government spent $220.8 billion more in July than it collected in revenue, according to the latest statement issued by the Department of Treasury. The fiscal year-to-date deficit is $1.6 trillion; and it keeps growing as the cost of financing national debt is increasing exponentially.

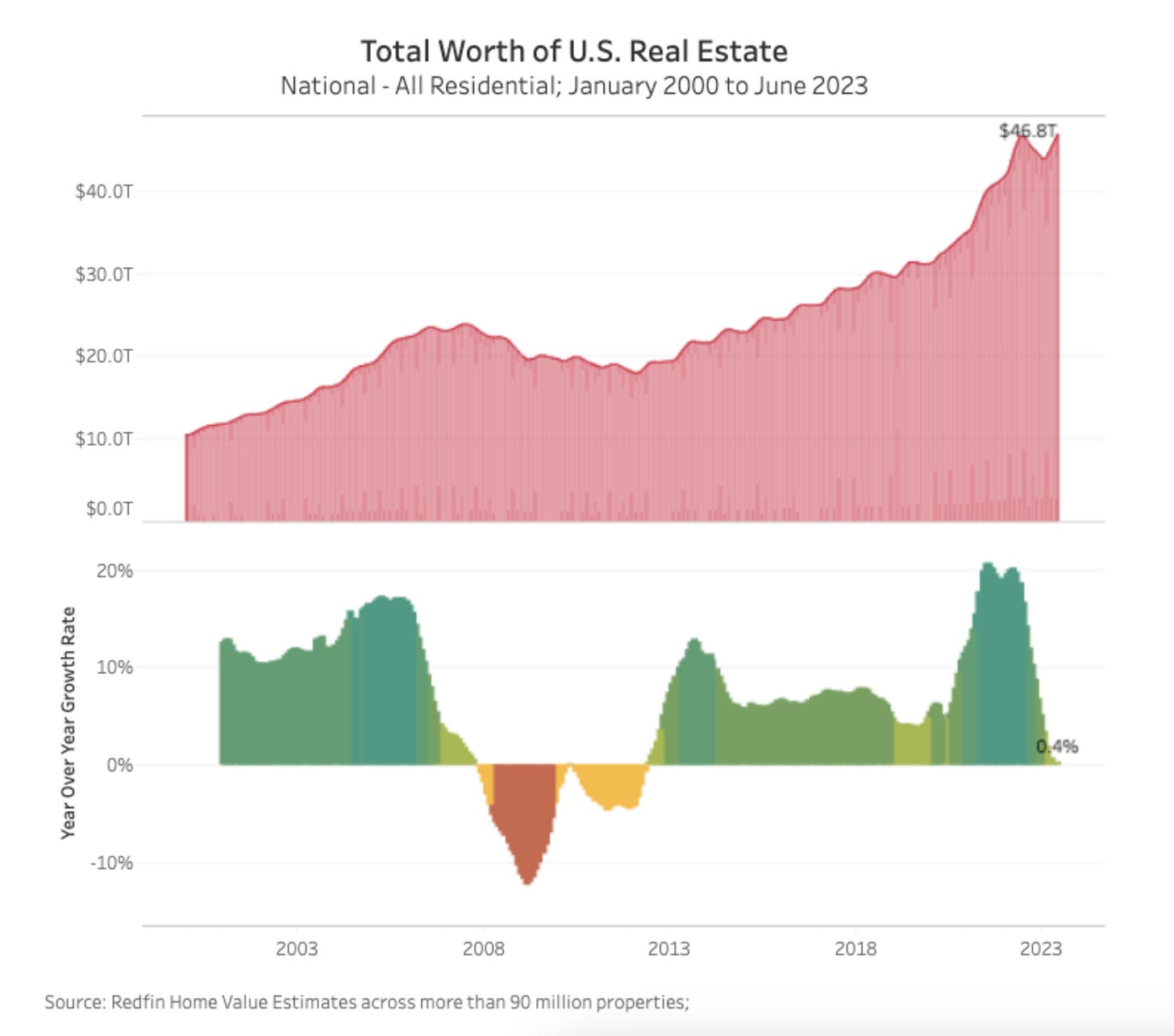

The U.S. housing market recouped its prior losses (nearly $3 trillion). The total worth of American homes hit a new record high of $47 trillion, according to the latest report by Redfin. Homes worth between $250,000 and $750,000 are gaining the most value:

The U.S. housing market is out of balance: low supply and lukewarm demand are keeping values high. Housing inventory dropped 15% year over year, indicating the biggest annual decline in nearly two years.

Mortgage rates continued to increase for the third consecutive week. With home prices remaining stable or rising, mortgage rates near 7% pose substantial affordability challenges:

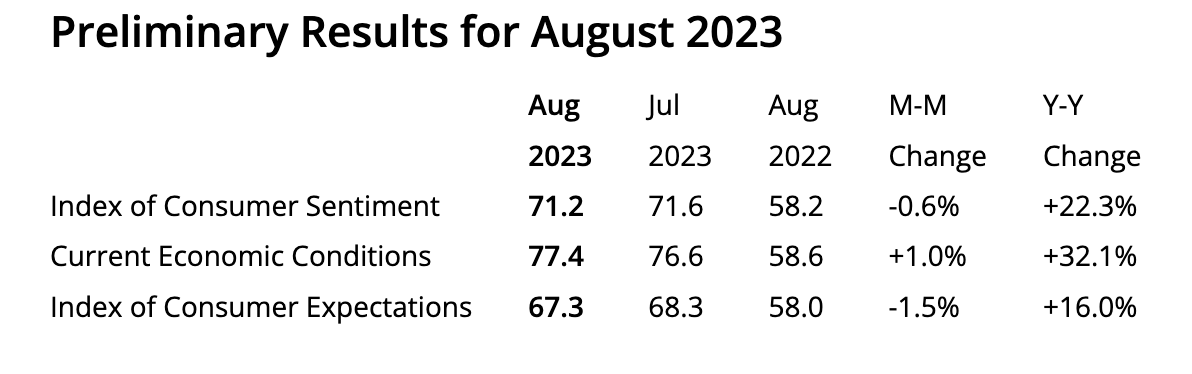

Per the University of Michigan Consumer Sentiment index, the latest reading is now 42% above the all-time historic low that was reached in mid-2022. Yet, consumers stated they do see an improvement from just three months ago.

This is somewhat of a surprising result considering that producer prices rose more than expected during the same period. According to the U.S. Department of Labor Statistics, “The index less foods, energy, and trade services moved up 0.2 percent in July, the largest increase since a 0.3-percent rise in February. For the 12 months ended in July, prices for final demand less foods, energy, and trade services advanced 2.7 percent.”

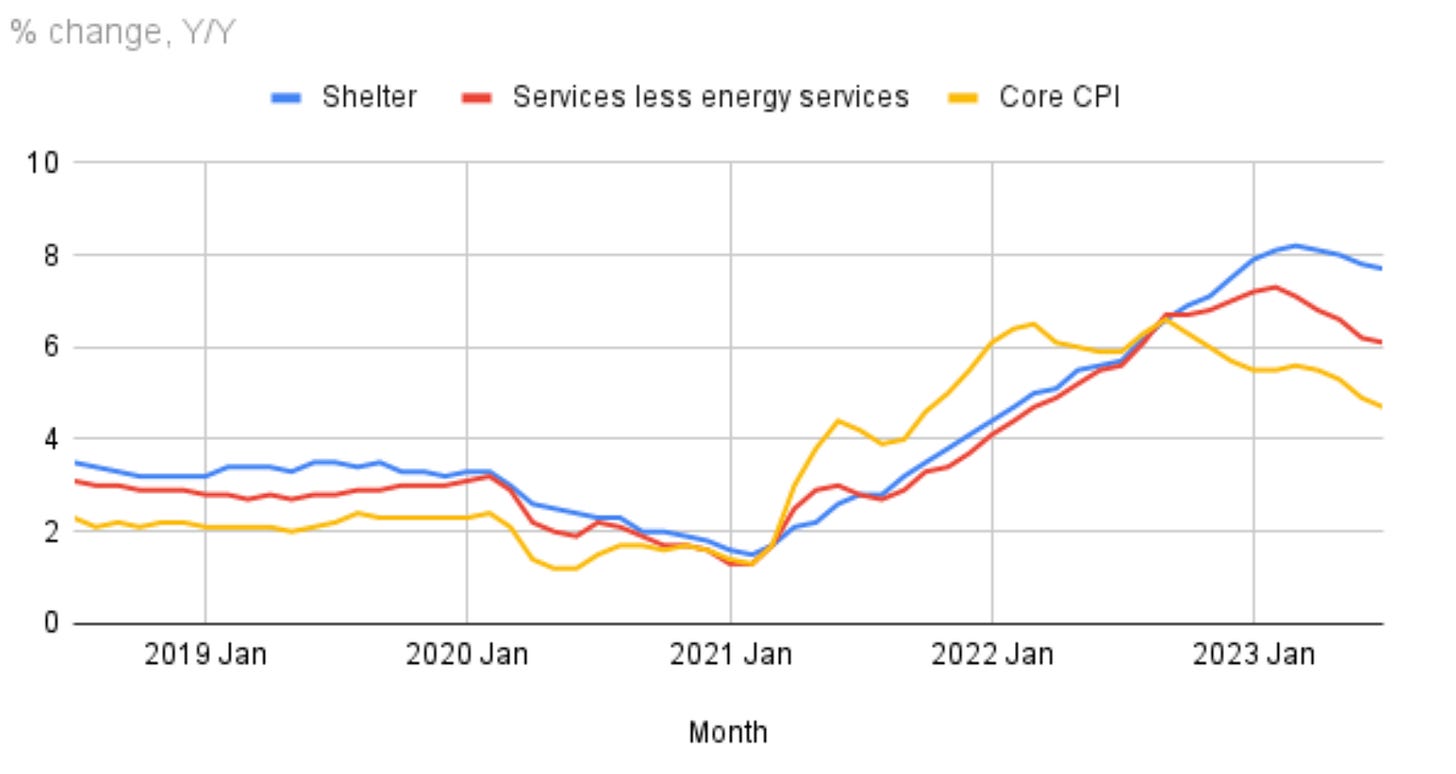

Inflation continued to rise in July at a slower pace. Shelter prices, up 7.7%, contributed the most (approximately 90%) to inflation:

San Francisco Fed President Mary Daly responded to the CPI data above, indicating that the “Fed has more work to do”; and emphasized that “the Fed is fully committed to resolutely bringing inflation back down to its 2% target.”

Events:

Following the downgrade by Fitch last week, the Treasury Department accelerated its quarterly sales of longer-term debt. The Fed’s portfolio had shrunk by nearly $1 trillion and is expected to decrease through 2025. Quantitative tightening, or, in other words, Fed’s balance sheet reduction, is occurring simultaneously with the government issuing record amounts of debt in order to finance the growing deficit (ie. the gap between low tax revenue and high government spending). Foreign investors no longer see U.S. debt as a fully safe investment; and, therefore, there is less demand for it. When and if demand continues to decline, the costs associated with borrowing will surge, resulting in financial losses and more economic instability.

PayPal launched PayPal USD, stablecoin, that it hopes would become a competitive payment alternative in the long run. The new stablecoin is pegged to the U.S. dollar and is effectively backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar highly liquid cash equivalents. While consumers are unlikely to favor the new payment option, the company believes this is a long term plan. According to PayPal:

“Over the longer term, we expect PYUSD to experience additional adoption headwinds as competition from CBDCs and yield-bearing stablecoins increases”.

Thank you for reading! Enjoy your weekend!!

There is growing noise out of Russia and China that their economies are in series trouble, far more than anything in the West. Any suggestions why we are not seeing the usual content we see if the West is experiencing issues? Difficulties in authoritarian regimes have far more drastic consequences for domestically and to their neighbors. Is this why the BRICS noise has quieted down?