Week In Review: Key Numbers and Events For The Week Ending October 13, 2023

Numbers:

September CPI came in slightly higher than expected: 3.7% vs 3.6% expectation. The two biggest drivers of the increase were shelter and gasoline costs.

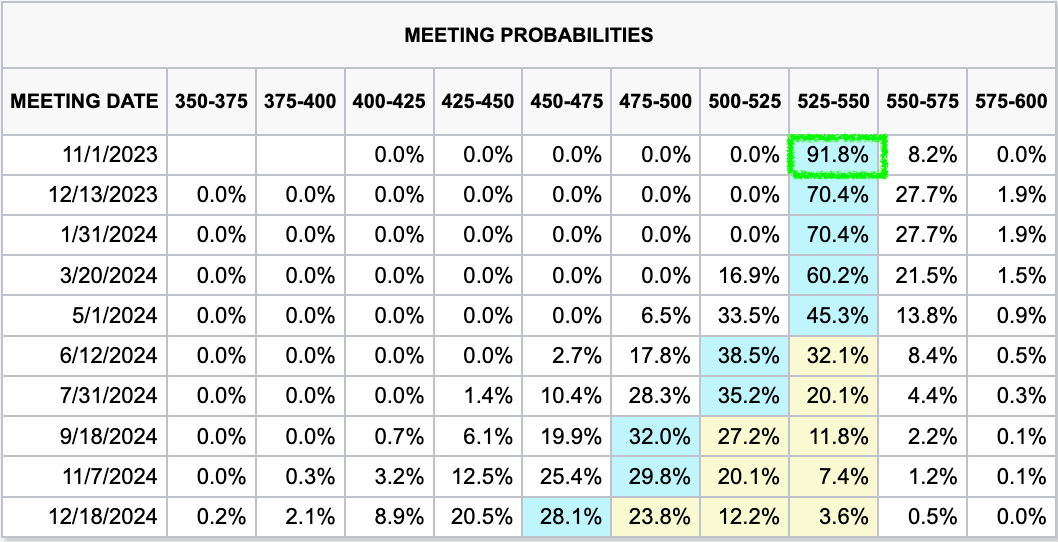

Given the latest CPI data, the probability of the Federal Reserve keeping interest rates unchanged in November stands at 91.8%, up from 79.9% a week ago:

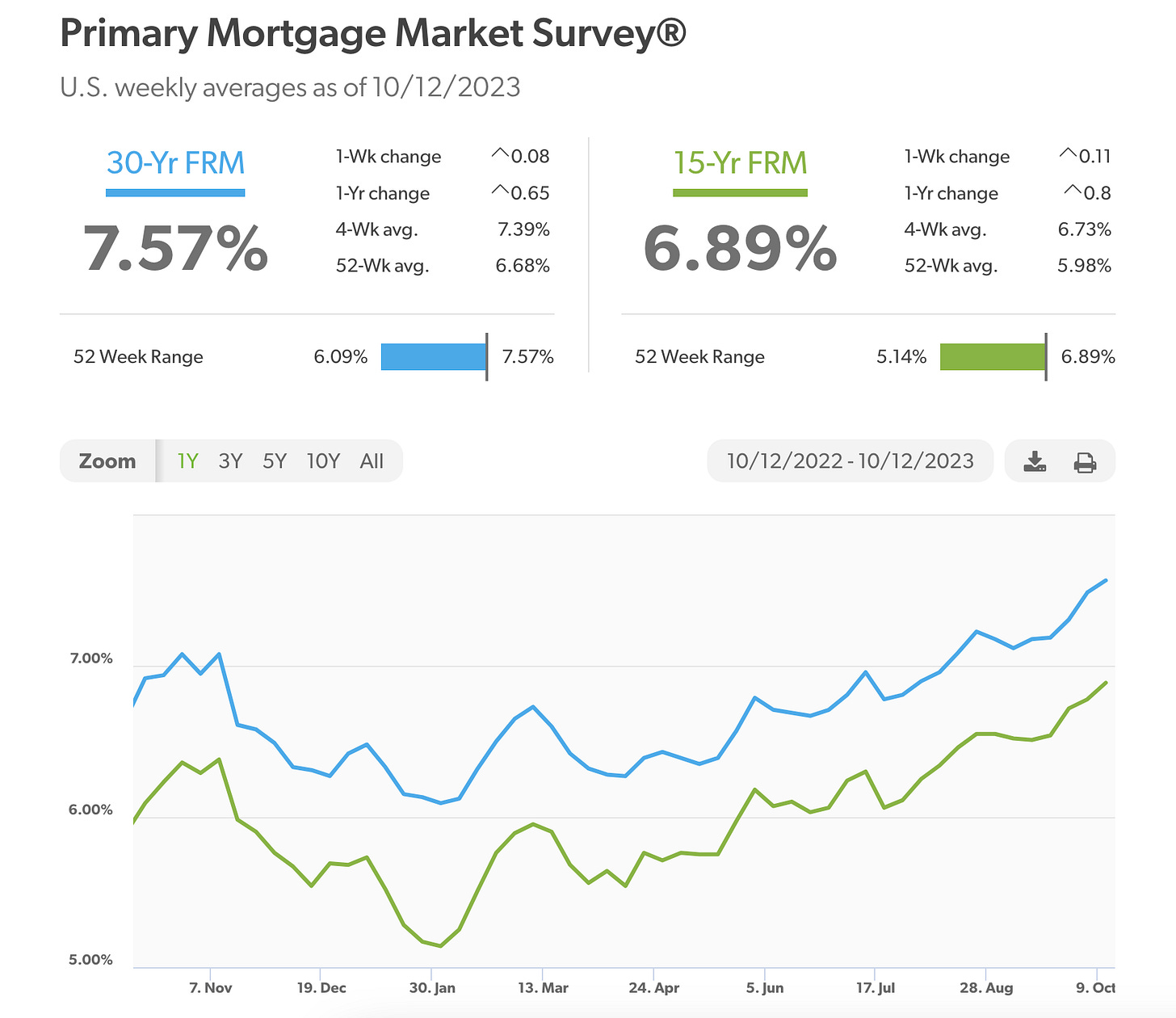

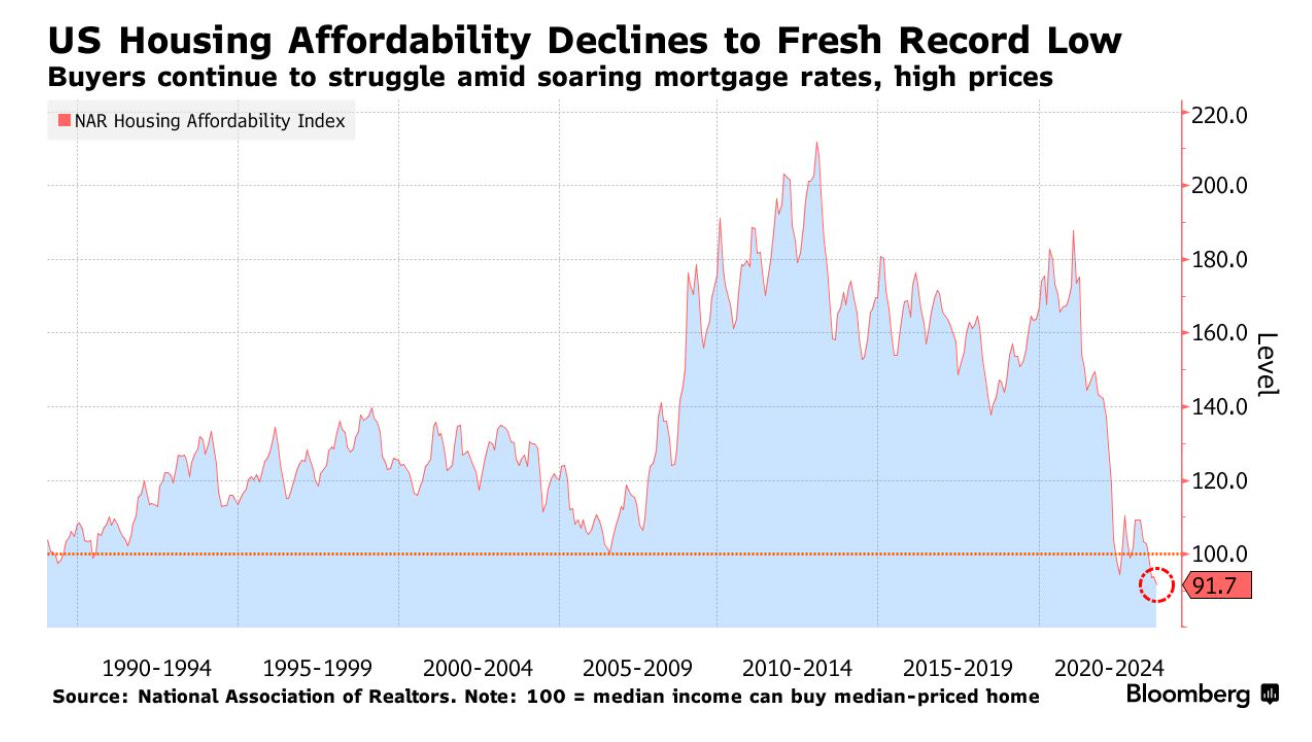

Mortgage rates rose for the fifth consecutive week.

30-year fixed rate mortgage rate increased to 7.57%; while 15-year fixed rate mortgage rose to 6.89%:

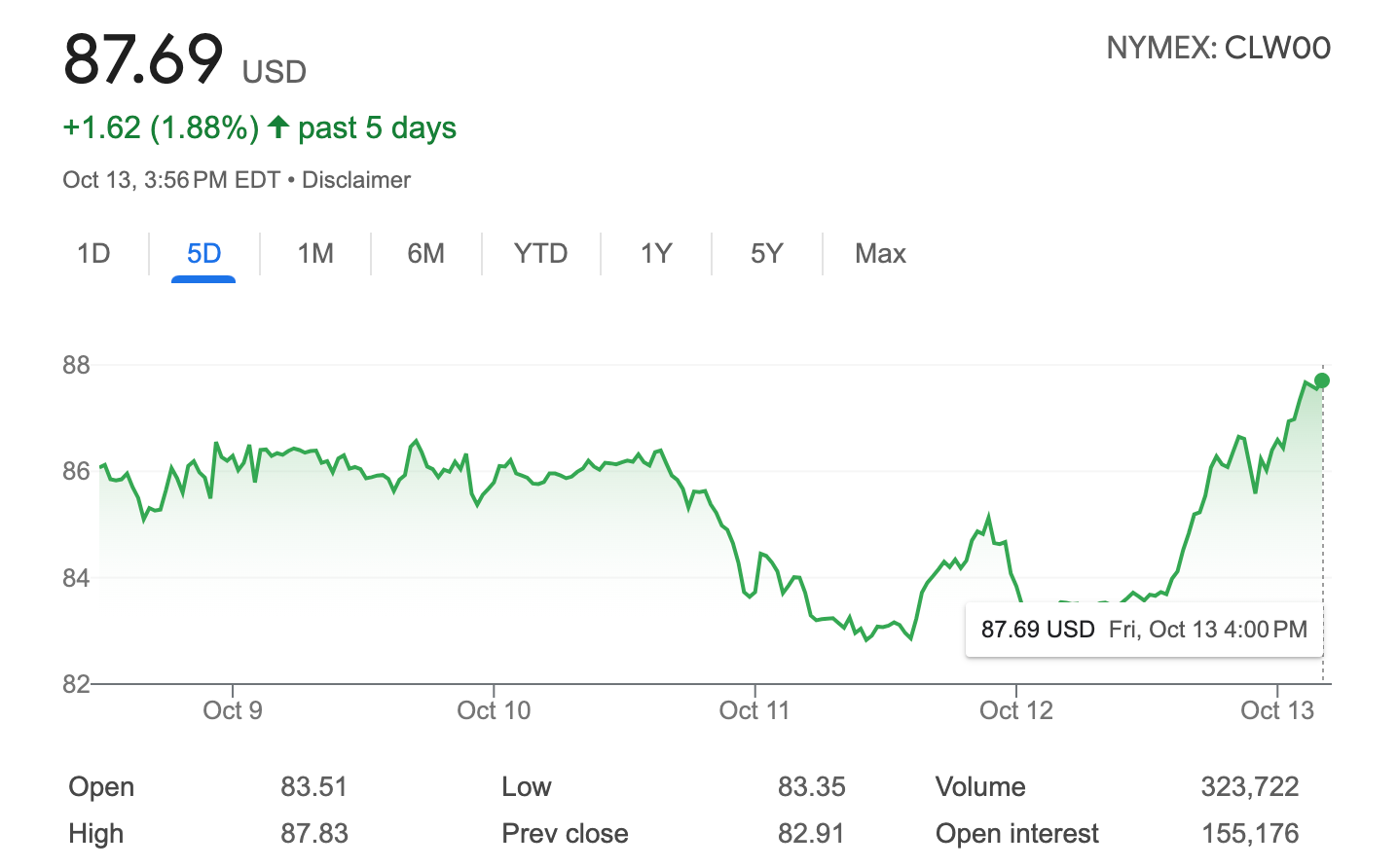

Crude oil prices are nearing $90/barrel today while the supply is facing increasing risk due to the Israel-Palestine war. The US Strategic Petroleum Reserves (SPR) stand at their lowest levels since 1983:

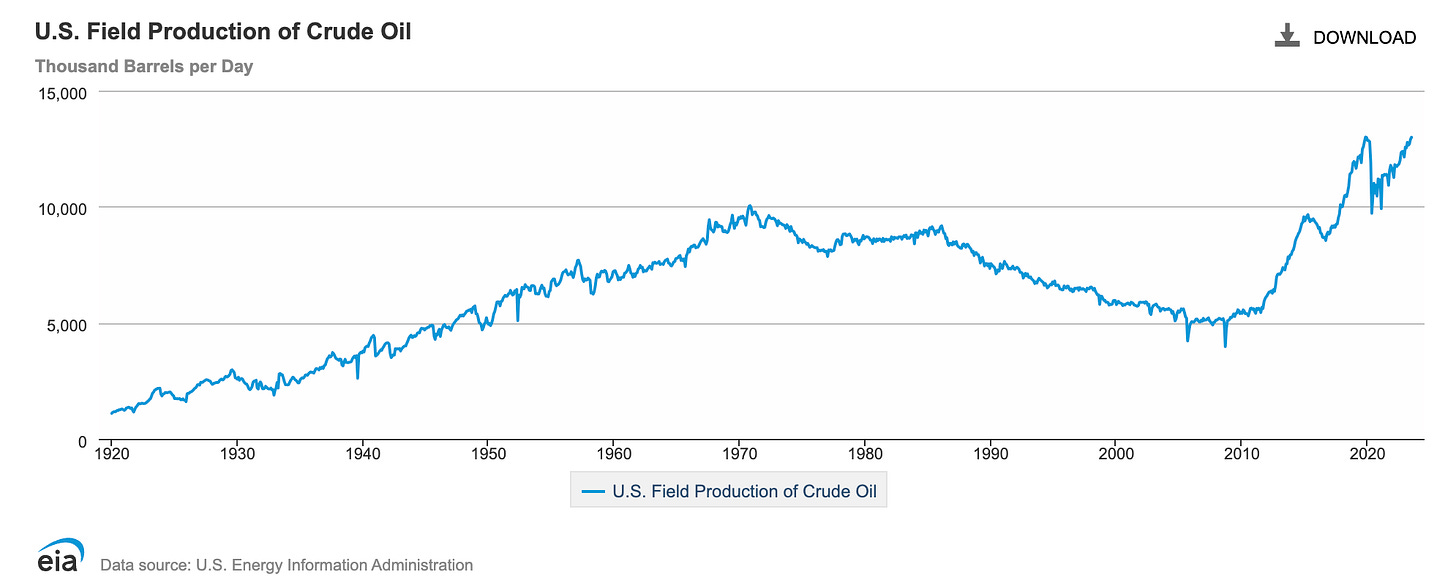

US oil production increased to pre-pandemic levels of 13.2 million barrels per day (vs. 12 million barrels per day):

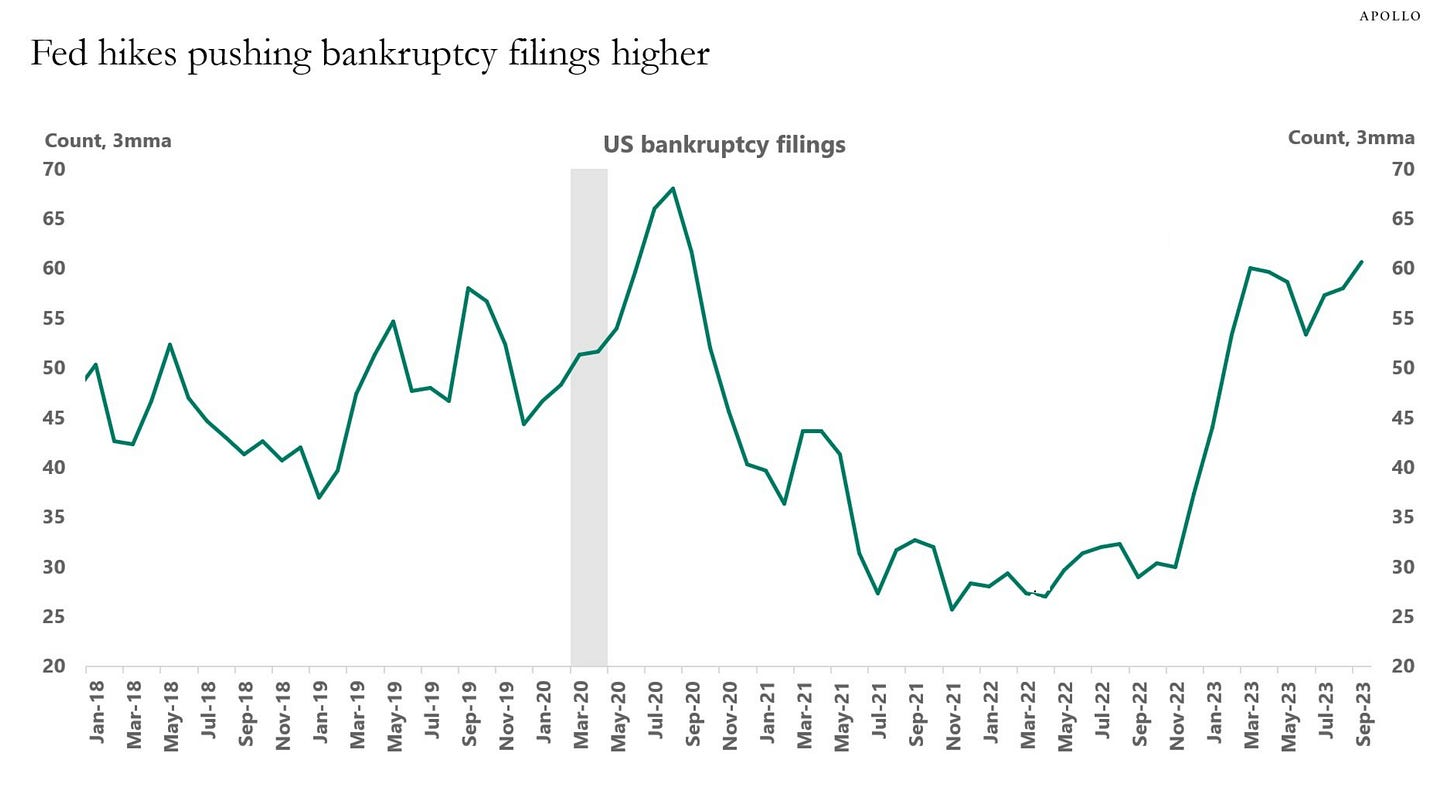

Corporate bankruptcies continue their record breaking trend in 2023. Since the beginning of 2023, there have been 516 corporate bankruptcies. In September, 62 companies went bankrupt:

Events:

US housing affordability declines to a new record low. The NAR, Mortgage Bankers Association and National Association of Home Builders, wrote a letter this week to Fed Chair Jerome Powell to refrain from raising interest rates:

The Israel-Palestine war could result in a global recession and severe shortage of energy resources. Bloomberg Economics believes oil prices could soar to $150 a barrel and global growth drop to 1.7%.