Week In Review: Mortgage Rates Are Expected To Hit 8%, As Bond Yields Climb Hire. JP Morgan Predicts Severe Energy Crisis

Key Numbers and Events For The Week Ending Friday, September 22nd.

Numbers:

The Federal Reserve left the rates unchanged. The move allows the Fed to collect more economic data in order to determine if another rate hike this year is necessary. Boston Fed President Susan Collins commented in favor of keeping rates elevated for an extended period of time, adding that future rate hikes are not “off the table”.

Fed fund futures are pricing-in rate cuts beginning in July 2024:

Average interest rate on a 30-year mortgage rose to 7.19%:

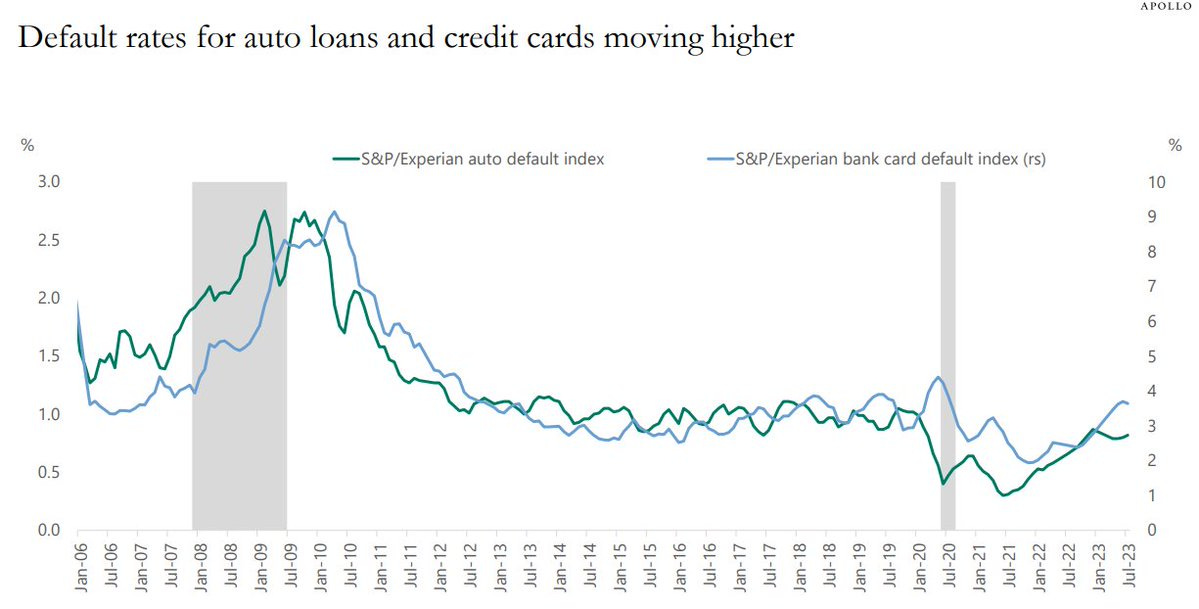

Default rates for auto loans and credit cards are moving higher:

Existing home sales continue to decline. Compared to the same period last year, home sales fell 15.3%. With the recent increases in mortgage rates, mortgage demand is at its lowest since 1995. Yet, home prices continue to increase despite lower home sales.

10-Year Note yield officially hits 4.50%; the highest reading since October 2007. At the same time, mortgage rates increased and are expected to hit 8% soon.

Events:

United Auto Workers expends strike to 38 additional facilities run by General Motors and Stellantis. UAW says it was able to achieve concessions from Ford.

JP Morgan expects crude oil price per barrel to exceed $150 as “multiple energy crisis” this decade are likely:

"Without increasing oil and gas capex, we risk energy deficits and acute inflation across the commodities complex. This may lead to multiple oil-led energy crises in this decade, potentially much more severe than the gas crisis seen in Europe in 2022.”

If you are interested to get a bit more context, I discuss the details in one of my recent videos:

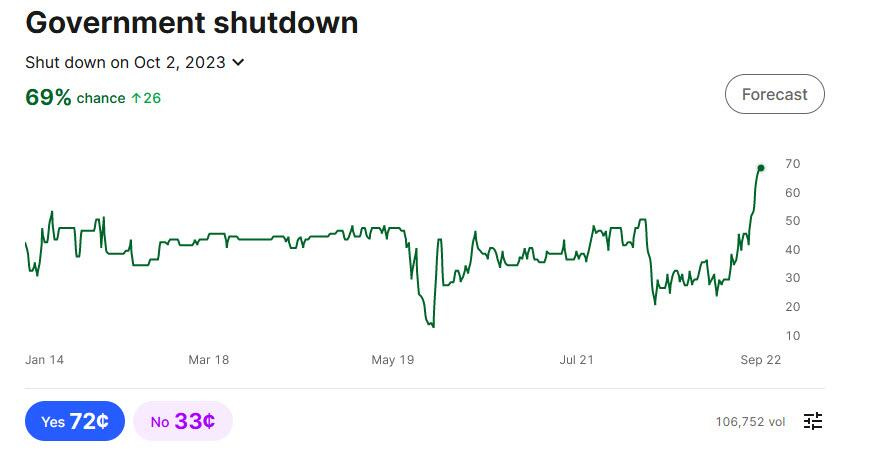

The odds of a government shutdown, starting October 1st, are getting higher. Although it has become relatively “usual”; Bloomberg believes there is a chance that it might push unemployment higher as a result of a decrease in the country’s GDP. The longer the shutdown lasts, the more it would lower the GDP. For example, Bloomberg speculates that if a shutdown lasts all fourth quarter, it would push the GDP into negative territory, which, in turn, would trigger a technical recession:

Have a great weekend!

Stay connected:

https://rumble.com/c/LenaPetrova

https://www.youtube.com/@lenapetrova

https://twitter.com/_lenapetrova

Lena,

On the topic of "You Will Own Nothing" from the WEF, have you heard about the book, The Great Taking, recently written by former hedge fund manager, David Webb, who warns that the central bankers have legislation in place world wide that will allow them to LEGALLY take all bank deposits and securities as collateral on the $2+ quadrillion derivatives bomb?

THE GREAT TAKING: Who Really Owns YOUR Assets??? (interview with the author)

https://www.youtube.com/watch?v=QeP71CKRZNs&t=11s

https://thegreattaking.com/

What is this book about?

It is about the taking of collateral (all of it), the end game of the current globally synchronous debt accumulation super cycle. This scheme is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets and bank deposits, all stocks and bonds; and hence, all underlying property of all public corporations, including all inventories, plant and equipment; land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will likewise be taken, as will the assets of privately owned businesses which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history. Private, closely held control of ALL central banks, and hence of all money creation, has allowed a very few people to control all political parties and governments; the intelligence agencies and their myriad front organizations; the armed forces and the police; the major corporations and, of course, the media. These very few people are the prime movers. Their plans are executed over decades. Their control is opaque. To be clear, it is these very few people, who are hidden from you, who are behind this scheme to confiscate all assets, who are waging a hybrid war against humanity.

David has deep experience with investigation and analysis within challenging and deceptive environments, including the mergers and acquisitions boom of the 80’s, venture investing, and the public financial markets. He managed hedge funds through the period spanning the extremes of the dot-com bubble and bust, producing a gross return of more than 320% while the S&P 500 and the NASDAQ indices had losses. His clients included some of the largest international institutional investors.

I first learned about this from Bill Holter’s website- here's what he says about The Great Taking book: "I have spent half of Labor Day reading this article. I found it to be very well researched and footnoted. I highly recommend you read this in its entirety as it discusses the “how” you will own nothing (but not how you will be happy). What hooked me on reading the entirety is the discussion of “securities” and that book entry securities will be confiscated LEGALLY in the great margin call to come. This harkens back to my JSMineset days where Jim urged everyone to get their certificates issued in paper form. The rest of the article is bone chilling, but I cannot disagree with the author’s how or where it all leads to. May God help us all! Please do not e-mail me with questions regarding certificate issuance. Please contact your individual companies and query who their transfer agent is and how to have your certificate issued. As for any questions on the overall article, please contact the author directly."

The Great Taking...The Plan To Hand Over YOUR Assets To The Banksters (very thorough explanation) Mike, Parallel Systems

https://www.youtube.com/watch?v=IIoGu692a64

Mario Innecco/Maneco64, a finance expert who used to work in the City of London, read the book and think the author and his warnings are legit:

How the Central Bankers Plan to Come After Your Assets.

https://www.youtube.com/watch?v=r4I6uqLuJfA

Get Ready for "The Great Taking" Doug Casey's Take [ep.#275] https://www.youtube.com/watch?v=M5-qvST4_iE

Ellen Brown, lawyer and author of Web of Debt, has read the book and also believes the warnings are legit. Here's what she sent to another attorney: “Every form of collateral from deposits to stocks to bonds, is being pooled; and those players with super priority status in bankruptcy can take from the pool before the bankruptcy proceedings even start. I knew that about deposits-derivatives have super priority status in bankruptcy- but didn’t realize it about stocks and bonds. The derivatives bubble will inevitably pop, and it is larger than all the assets in the world, which have been pooled by international agreement as the author shows”

Also, Mike from the Parallel Systems youtube channel above is a Brit and he mentions that they don't actually own their own property (I think it is in a trust, from when the bankers burned down London in 1666) and it can be taken from them at any time. I'm wondering if the same might apply to us here in the US because of legal trickery mentioned in this book (I've also heard finance expert, Greg Mannarino warn about this too):

They Own It All (Including You!) By Means of Toxic Currency https://archive.org/details/TheyOwnEverythingIncludingYou/mode/2up

Here's more info on the book here http://newpeopleorder.com/

Hi Lena , I think J P Morgan is over estimating the $ 150 crude oil price per gallon ,that would mean

that a barrel of oil ( 42 gallons ) would have to go up to $ 6300.00 U S Dollars ,and this is possible

If we go in to Hyper-Inflation ,it seams funny now but it could happen . Ha Ha .

Crude oil is calculated in Barrels not gallons ,I 'am just having fun with you !

Thomas