Week In Review: Mortgage Rates Surge To The Highest Levels Since 2001. Corporate Bankruptcies Rise As The Fed Promises More Rate Hikes to Hit 2% Target

Key Events For The Week Ended August 25, 2023

Numbers:

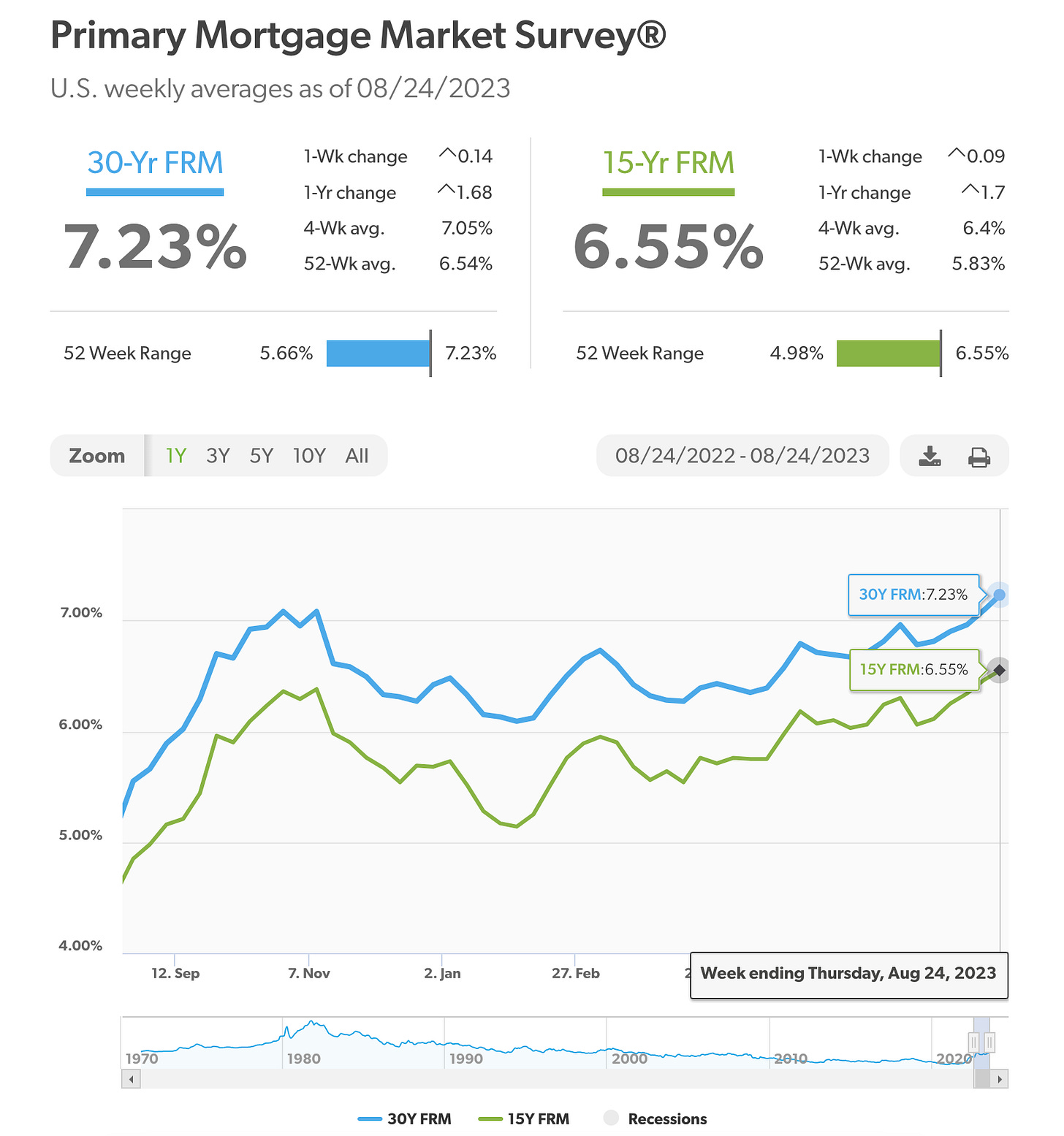

U. S. mortgage rates jumped to 7.23%, the highest level since May 2001. Rates are expected to continue rising due to two main factors: inflation and government deficit spending:

Employment data indicates the labor market remains resilient. Initial jobless claims for the week ended August 19 fell 10K to 230K, vs. 241K expected.

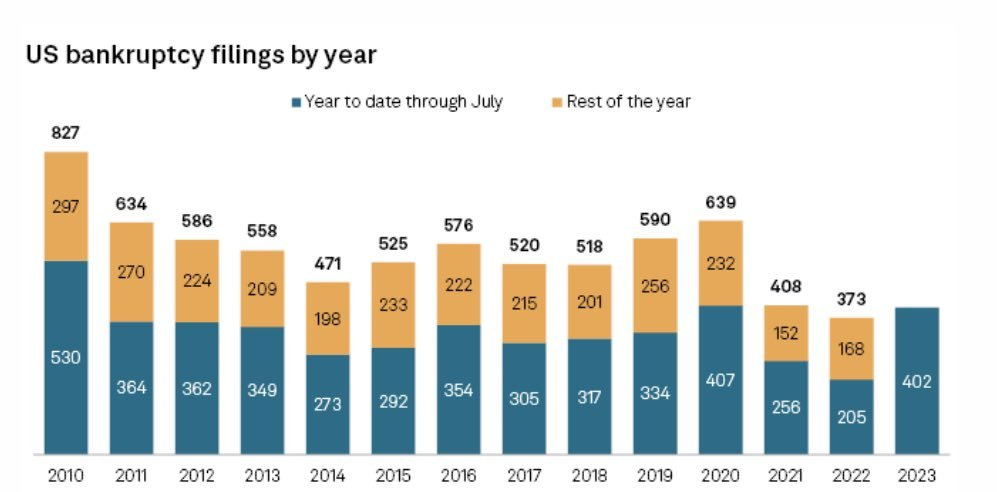

Bankruptcies January through July 2023 are above 2022 levels; and are on track to pass 2021 levels.

Interest payments to service government debt hit a new record high. The expense is now 19.5% of U.S. government revenue and will increase exponentially if the debt continues to grow:

Domestic Events:

The Jackson Hole symposium hosted by the Kansas City Fed is underway. On Friday, August 25th, Fed Chair Jerome Powell said that he is "prepared to raise rates further if appropriate," as well as to keep rates restrictive for as long as it takes to reach the goal of 2% rate. Powell concluded that “It is the Fed's job to bring inflation to the 2% goal and we will do so”.

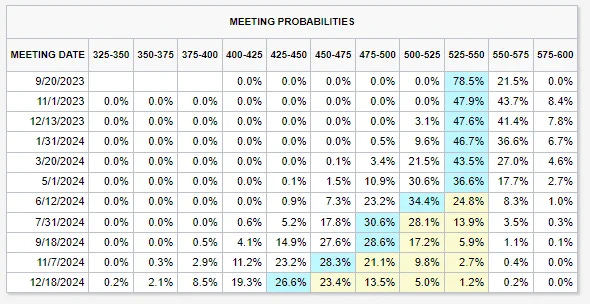

Following Powell’s speech, the odds of a 25 basis point rate hike in September more than double, to 21.5%. Further, the statement indicates a rate hike in November may be a possibility as well. Fed futures are pricing in a 25 basis point rate hike:

Global Events:

On Friday, August 25th, European Central Bank President Christine Lagarde echoed the U.S. Federal Reserve, making it clear that she is willing to keep interest rates high as long as necessary to achieve the target 2% rate. According to Lagarde, the European Central Bank is ready to keep rates “at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our 2% medium-term target."

BRICS Summit took place in Johannesburg, South Africa from August 22 - 24, 2023. The leaders of Brazil, Russia, India, China and South Africa announced that six new member countries had been invited to join the bloc. The new membership for the UAE, Saudi Arabia, Ethiopia, Iran, Egypt and Argentina is effective January 1, 2024. More details area available in this video:

Enjoy your weekend! Thank you for stopping by!

Thanks Lena. Like to see impact of de-dollarization would have on USA and individuals and a possible time line of incremental events that would occur. Lena, going to be a little more harsh then my prior comments on BRICS. I do NOT buy this warm fuzzy feeling. Looking no further then Russia and China, peace is not their objective, global influence/dominance however it comes to be, and strangling the West in the process. Going to be very difficult for the average citizen to navigate through the challenges that we’ll face as time progresses.