Week In Review: Personal Spending Rose More Than Income. Gas Prices Reached 8-Months High.

Key News And Numbers For The Week Ending July 28

Numbers:

The U.S. Bureau of labor Statistics reported a slower growth in wages and salaries for civilian workers: employment income rose 4.5% for the year ended June 2023, vs. 5.1% in June 2022.

Consumer personal spending is not slowing down: personal spending rose more than income growth in June, according to the U.S. Department of Commerce.

Mortgage rates increased for the week ended July 28th, after a significant decline last week.

New construction home prices drop below resale inventory prices for the first time since 2005. The median price of new single-family houses sold dipped to $415,400, down 16% from the peak in October 2022, and down 5% year-over-year.

The labor market is showing virtually no signs of slowing down. According to the U.S. Department of Labor, initial jobless claims for the week ended July 22 fell by 7K to 221K vs. 228K consensus.

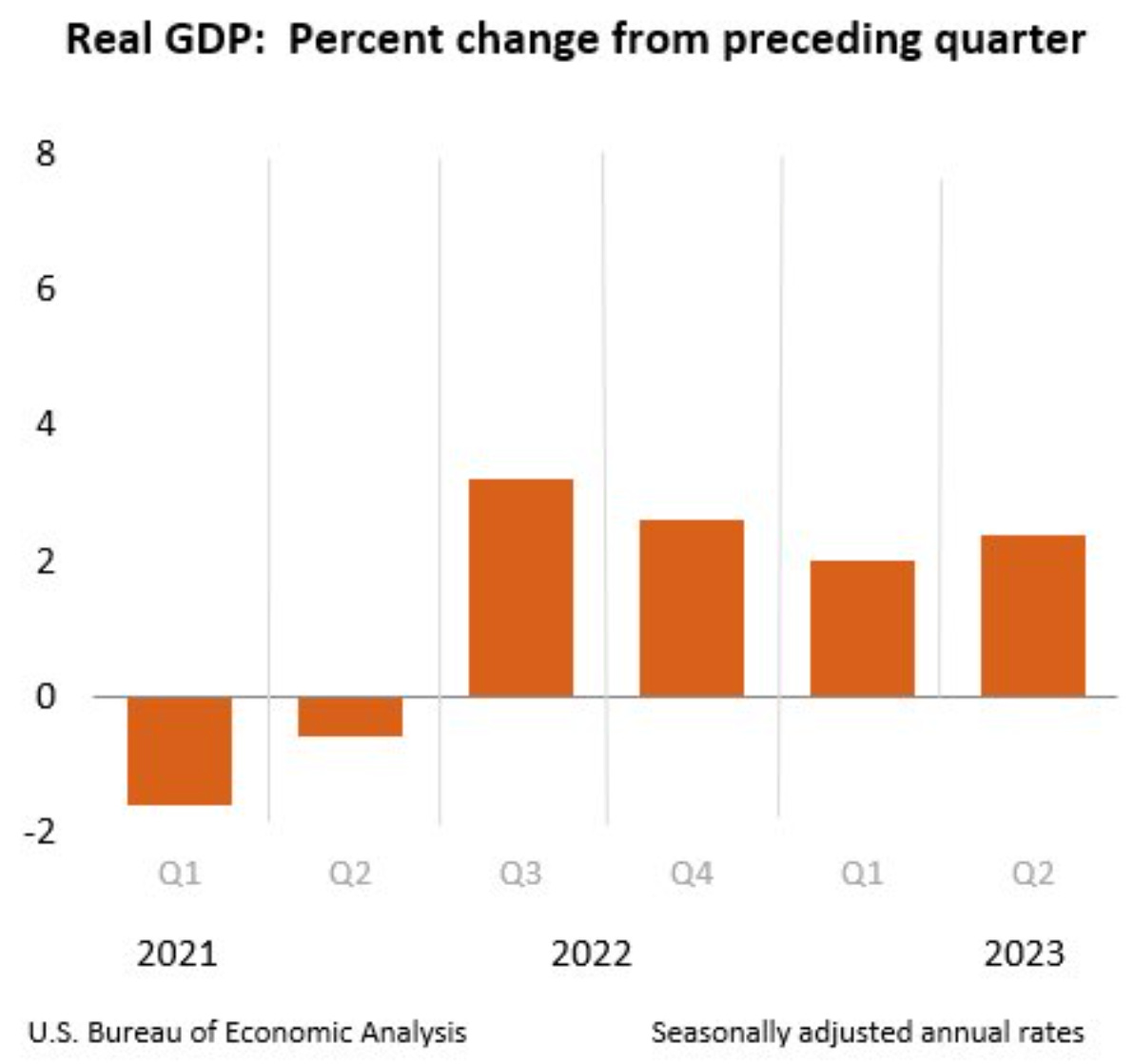

According to the Bureau of Economic Analysis, U.S. GDP increased to 2.4% in Q2 2023. This is up from 2% in Q1:

Gas prices are climbing to an 8-months high. This is the result of a stronger demand for oil/ gas amid a heat wave, and lower refinery outputs:

Events:

The most significant event of the week was the rate hike of 25 bps by the Fed. The increase brought the rate to 5.25%-5.50%. Fed Chair Jerome Powell indicated that it’s unclear whether the rate will increase in September; yet, he once again repeated the intention to achieve the targeted rate, “The process of getting inflation down to 2% has a long way to go”. He said they will do as they see fit based on the data available at the time. Powell did not rule out another hike in September if the labor market remains strong.

Additionally, Powell stated that he does not believe the U.S. economy will enter a recession:

“The staff [economists from the central bank] now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession…”

Amid the commercial real estate crisis, office space is shrinking for the first time since 2000:

Builders are using the opportunity to convert unoccupied office spaces into residential apartments. About 45,000 apartments are currently being converted from former office space, according to a report this week by RentCafe.

Enjoy your weekend!

Nice summary of important economic data. Thank you.

This dates me a little and understand times have changed. That said, in the 70s/80s, interest rates were at this level and sometimes more. It was nothing to purchase a home at that time with 6-7%+ interest rates. While it’s likely banks will see many defaults/foreclosures, I’d be surprised if in many instances they didn’t find a way to collect their fees and roll the debt. Interesting that JP says there might not be a recession. Thanks Lena.