Week In Review: U.S. Deposits Drop $11 Billion, Americans To Deplete Savings In A Month As Loan Delinquencies Increase

Key Events For The Week Ending Friday, August 18, 2023

Numbers:

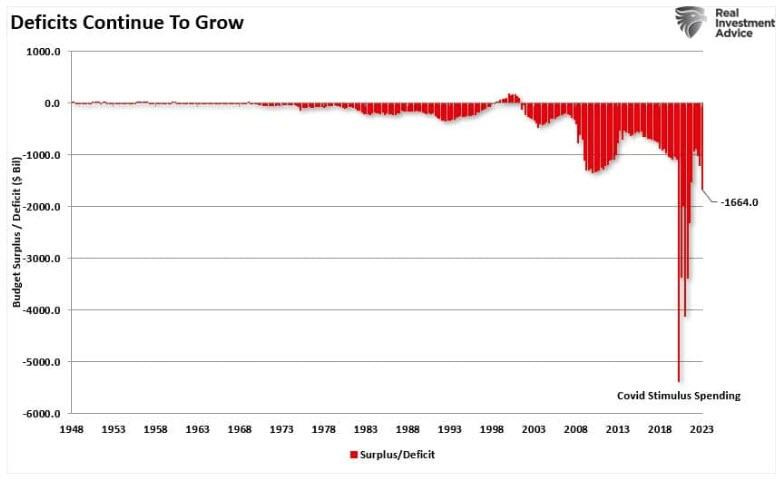

The U.S. deficit continues its exponential surge. The cumulative 2023 deficit is now $1.6 trillion, compared to $700 billion as of a year ago, July 31 2022:

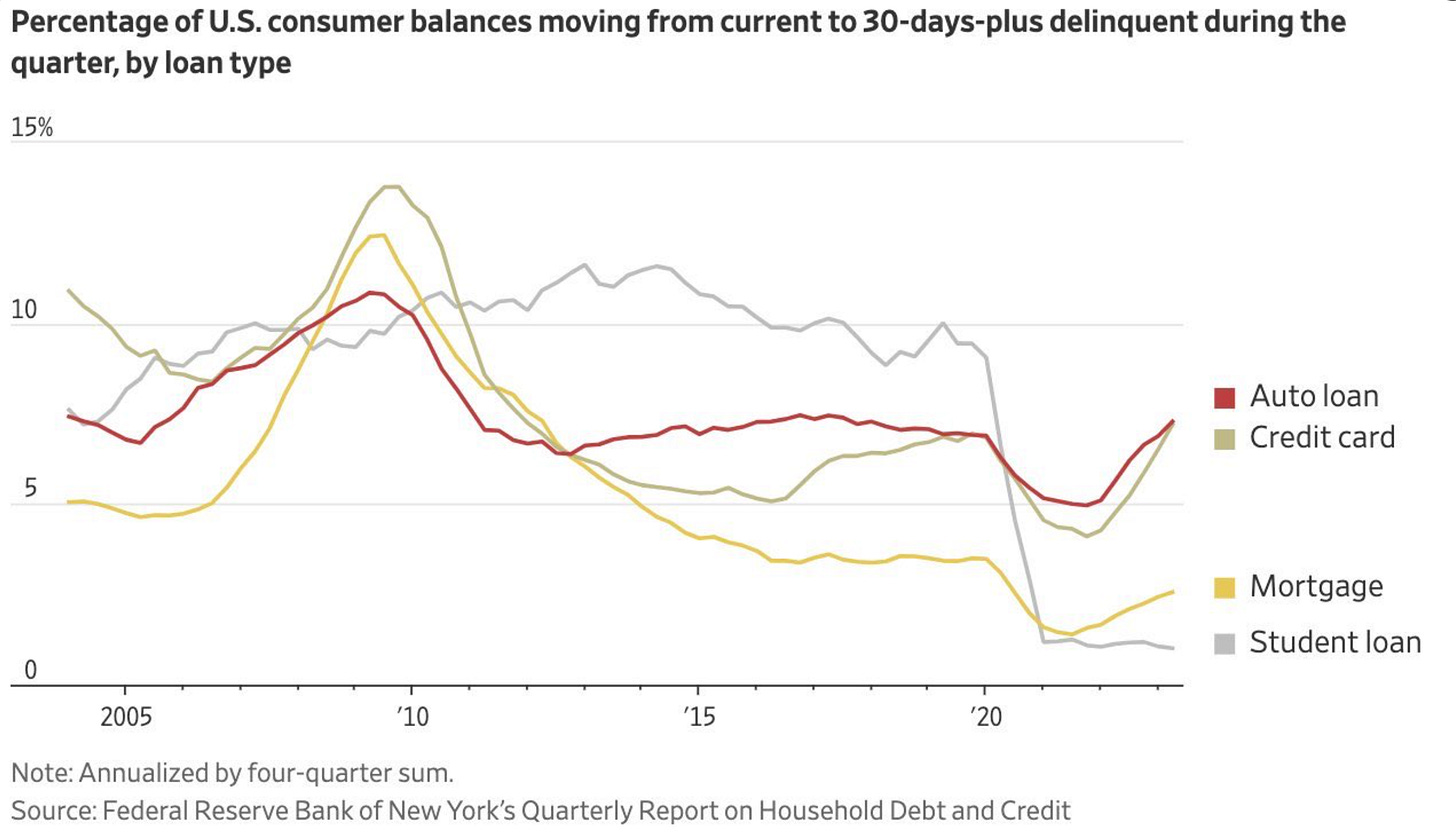

Vehicle loan and credit card delinquencies are above pre-pandemic levels. Mortgage loan delinquencies show a slight increase:

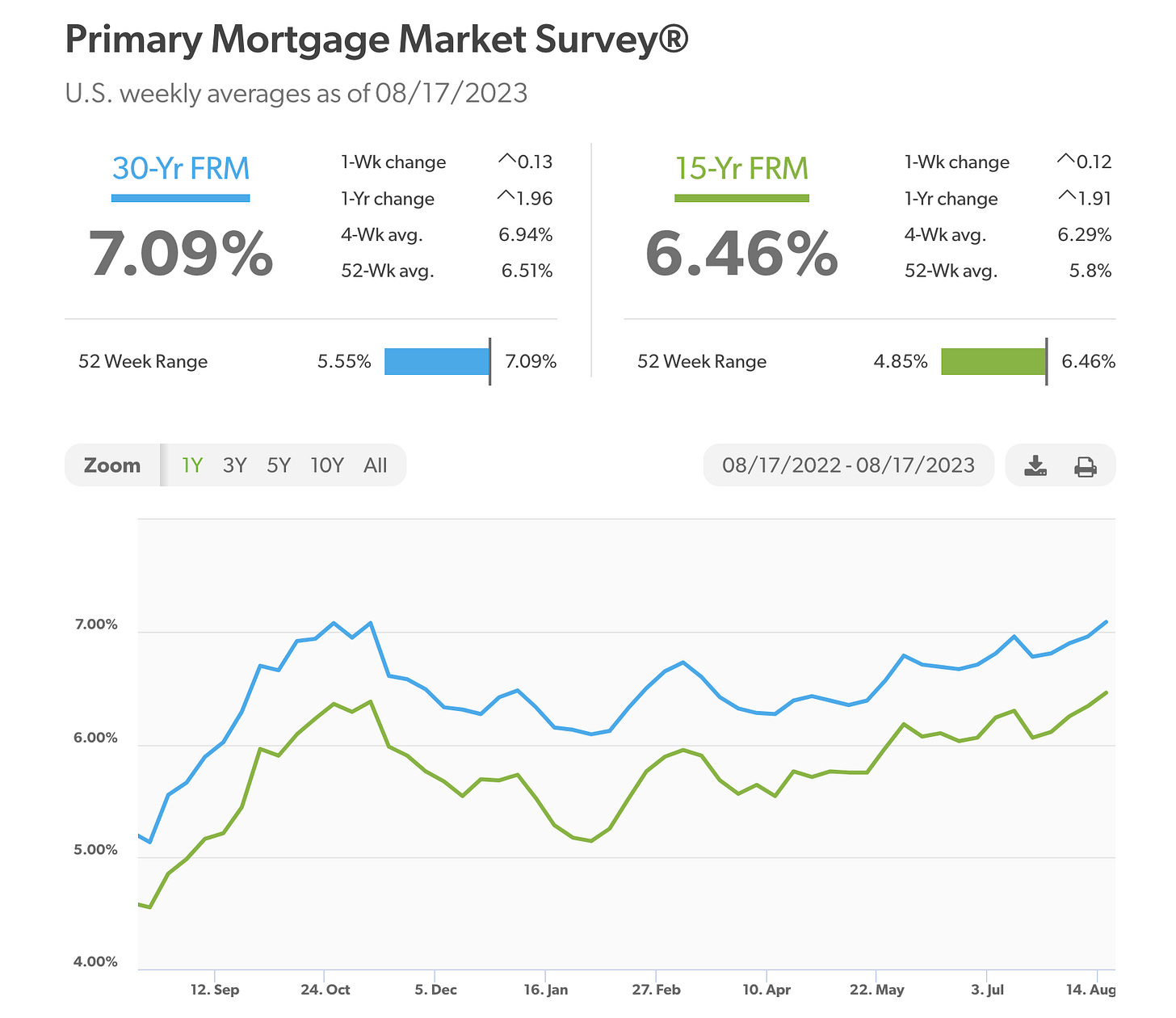

Mortgage rates continue to increase. 30-year fixed-rate mortgages averaged 7.09%, up from last week of 6.96%:

The increase in mortgage rates is simultaneous with the increase in the supply of homes and a decrease in home sales and mortgage applications. According to the latest report by RE/MAX:

“July home sales declined 14.7% from June and 16.1% compared to a year ago. The decline was tied to a 9.0% drop in new listings month over month and represented 26.7% fewer new listings year over year across the 50 metro areas surveyed. July inventory was up 3.1% from June, even though it still lagged 20.8% from July 2022. Tight inventory amid consistent demand continued to prop up the median sales price of $425,000.”

Economists believe that mortgage rates could hit 8% by the end of the year. According to MarketWatch, if the economy does not contract, and the Federal Reserve hikes its interest rate once again, rates could go up to 8%. What does this mean for the housing market? Lawrence Yun, the chief economist at the National Association of Realtors, said:

“As long as the job market doesn’t turn negative, then home prices will be stable — though home sales will take another step downward. If there is a job-cutting recession, then home prices will fall as some will be forced to sell while there are few buyers.”

The Fed says that total deposits dropped $11 billion last week, indicating an increase in deposit decline compared to the previous 4 weeks:

Events:

This week the Federal Reserve warned that Americans will run out of pandemic savings by the end of September. The head of economics at Legal and General Investment Management, Tim Drayson, said the “unsustainable drawdown of savings” had put the world’s biggest economy “at a potential turning point”. The drop in savings is taking place at the same time as payroll and income growth is slowing and student loan payments are about to resume. Consumers’ savings are expected to be depleted soon as their disposable income drops.

Evergrande, China’s largest real estate developer, filed for U.S. bankruptcy protection. The move is part of the company’s global year-and-a-half long debt restructuring process. China’s economy is experiencing a considerable slowdown. Real estate industry accounts for approximately 1/4 of the Chinese economy; with Evergrande’s continuous troubles potentially having a long lasting effect.

Have a wonderful weekend! Check back soon for more content.

Does it mean the prices in real estate will go down very soon?

You may have seen this. Gabriella focuses on the troubling credit issues that most of her colleagues in the MSM financial press prefer to ignore. Personal loans are masking Americans’ credit card problems https://finance.yahoo.com/news/personal-loans-are-masking-americans-credit-card-problems-140032349.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance