Week In Review: U.S. Loses Top Rating, U.S. Crude Oil Inventories Drop As Delinquency Rates Soar

Key Events For The Week Ending August 4, 2023

Numbers:

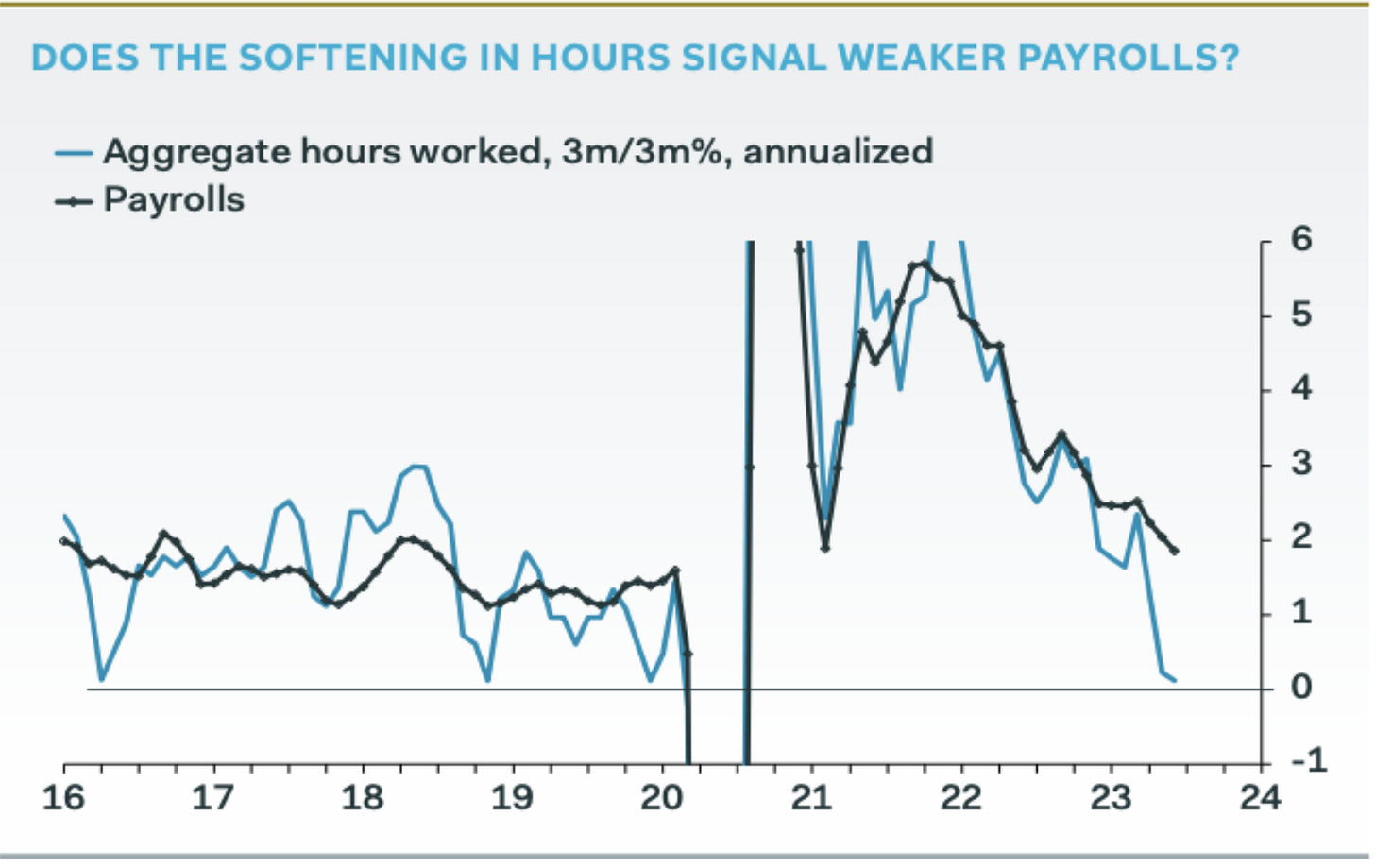

The labor market is starting to soften - payrolls in July added 187,000 jobs compared with the 2000,000 expected. For comparison purposes, U.S. labor market added more than 300,000 jobs monthly in the past 12 months.

Additionally, the trend coincides with the sharp slowdown in hours worked:

As labor market is starting to become weaker, jobless claims for the week ended July 29, 2023 (there is a lag in reporting) rose more than expected, adding 6K claims: : 227K vs. 225K expectation and 221K prior reading.

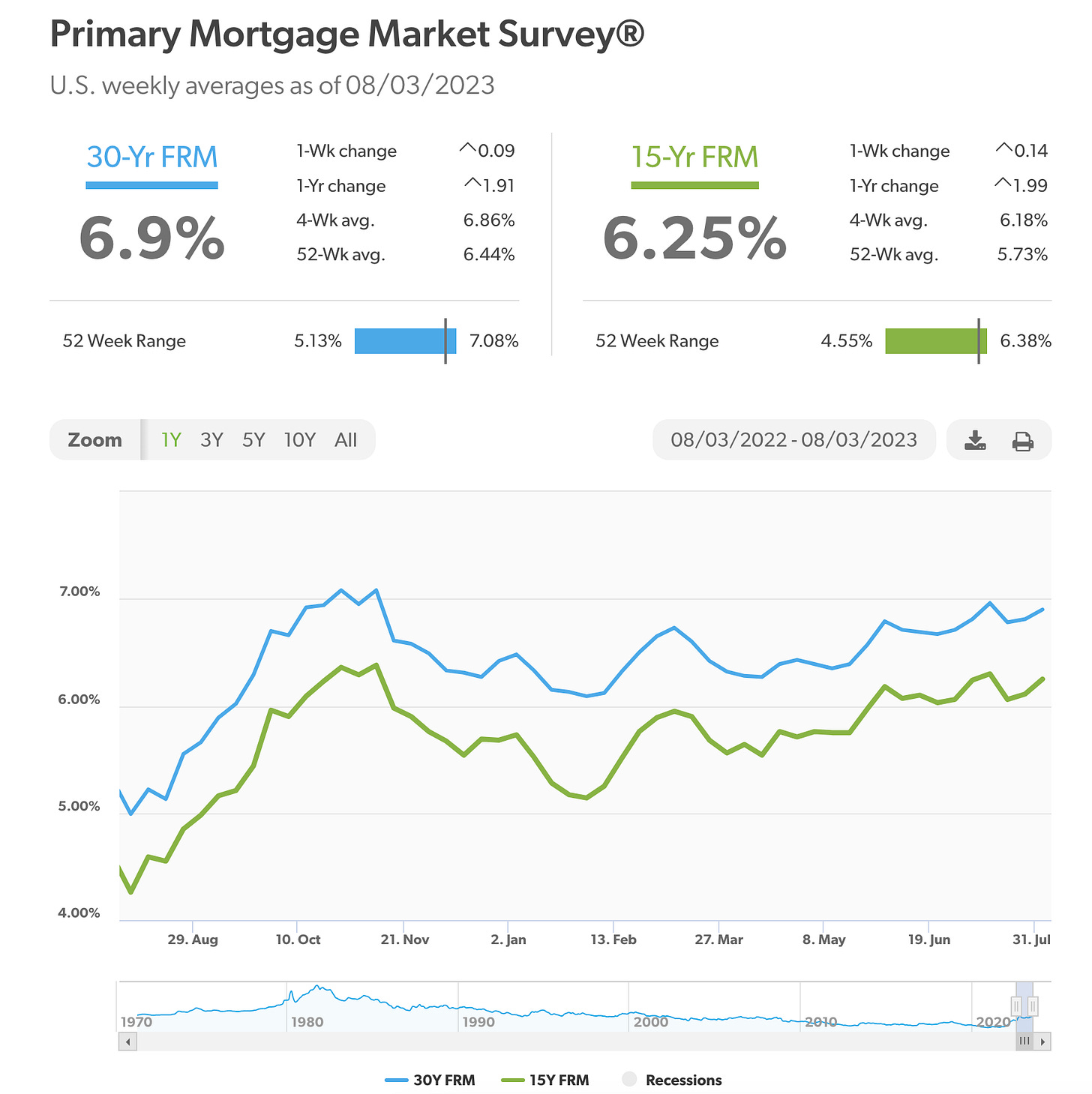

As the result of the U.S. government rating downgrade, 30-year fixed-rate mortgages averaged 6.90% and 5-year fixed-rate mortgages averaged 6.25%:

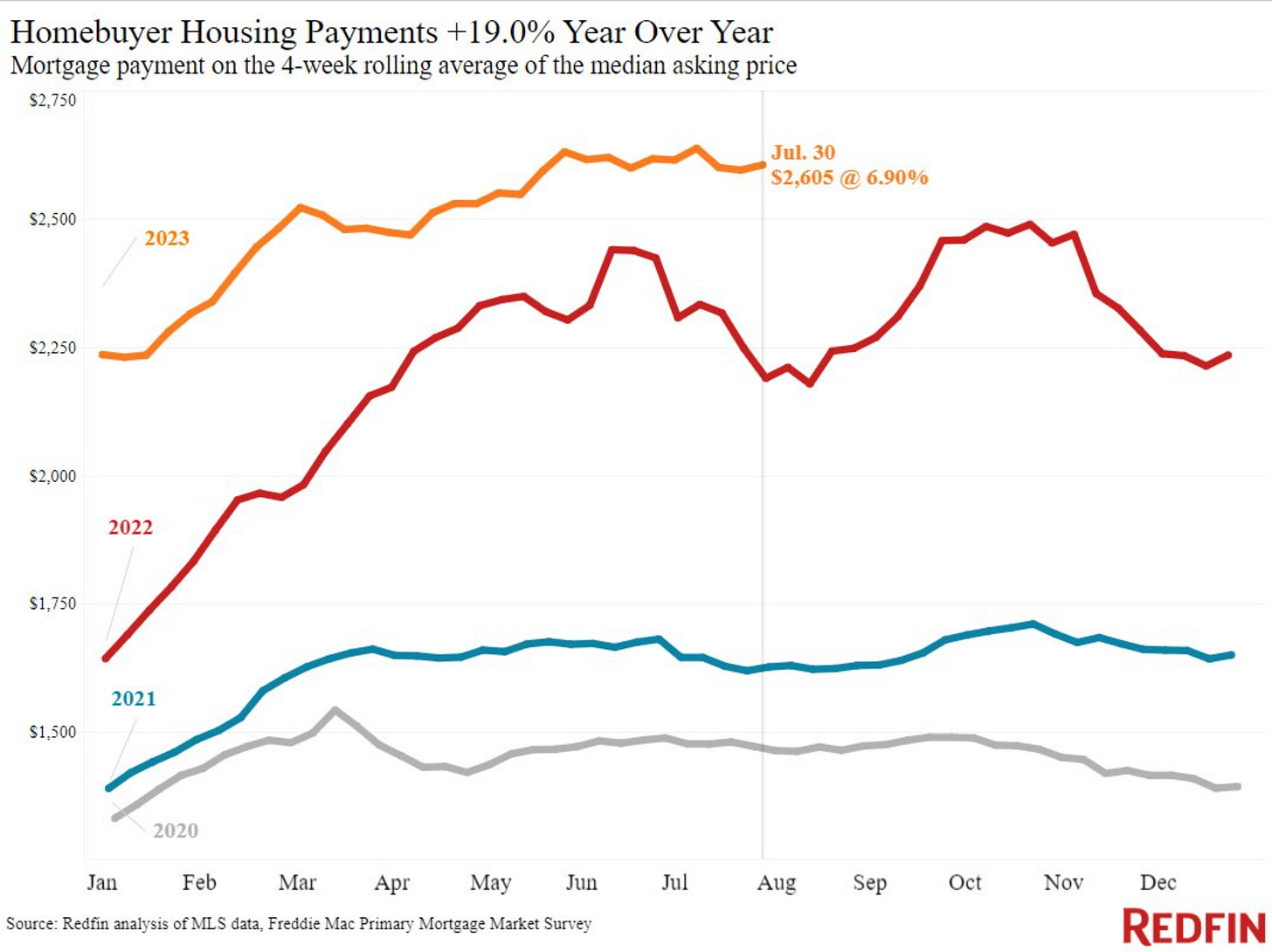

The median house payment in the US is now at $2,605 per month, up +19% compared to 2022; +67% from 2021 and +79% from 2020:

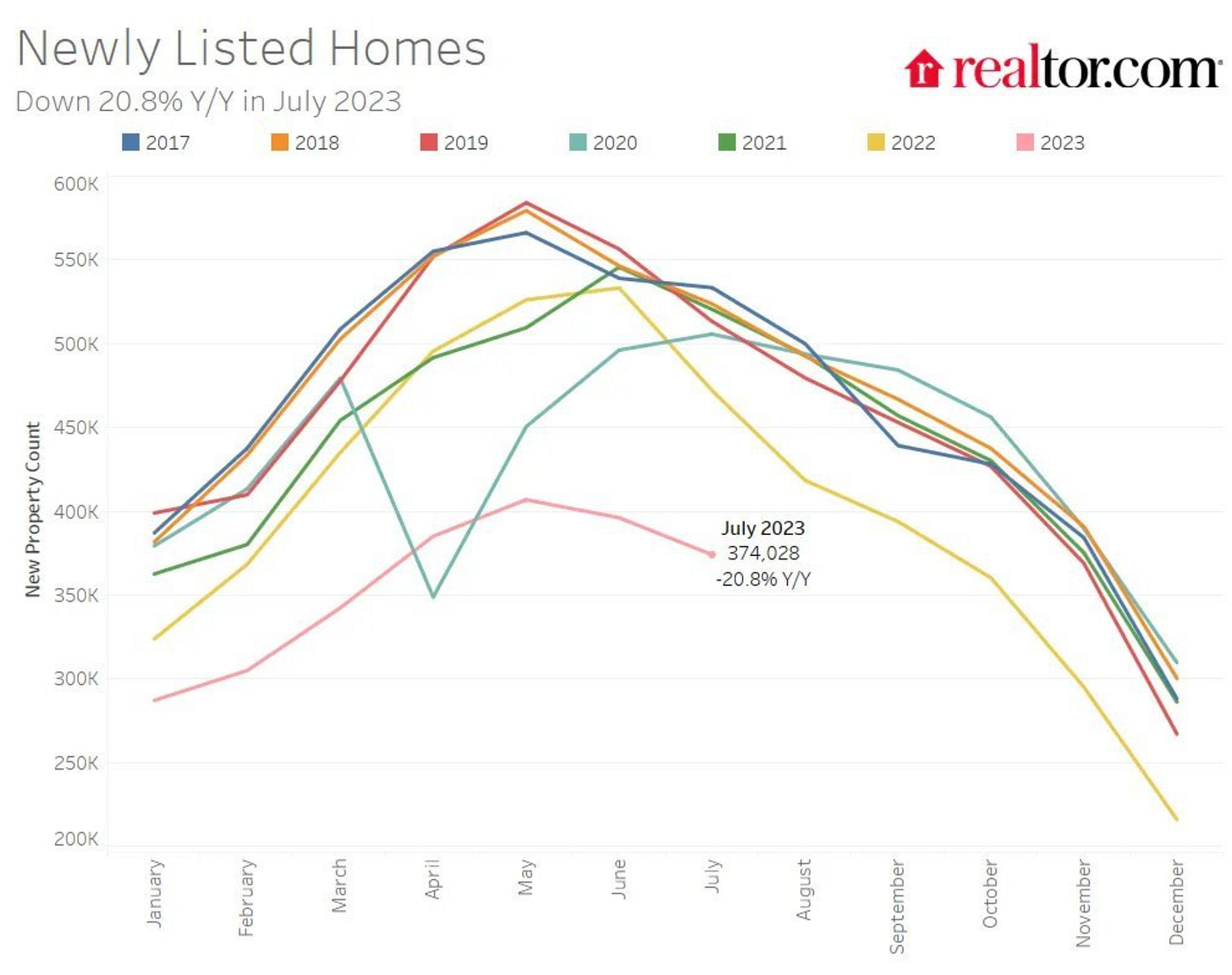

The number of newly listed homes on the market dropped to 21% compared to last July. Supply is limited; it maintains the home prices at the level they are today:

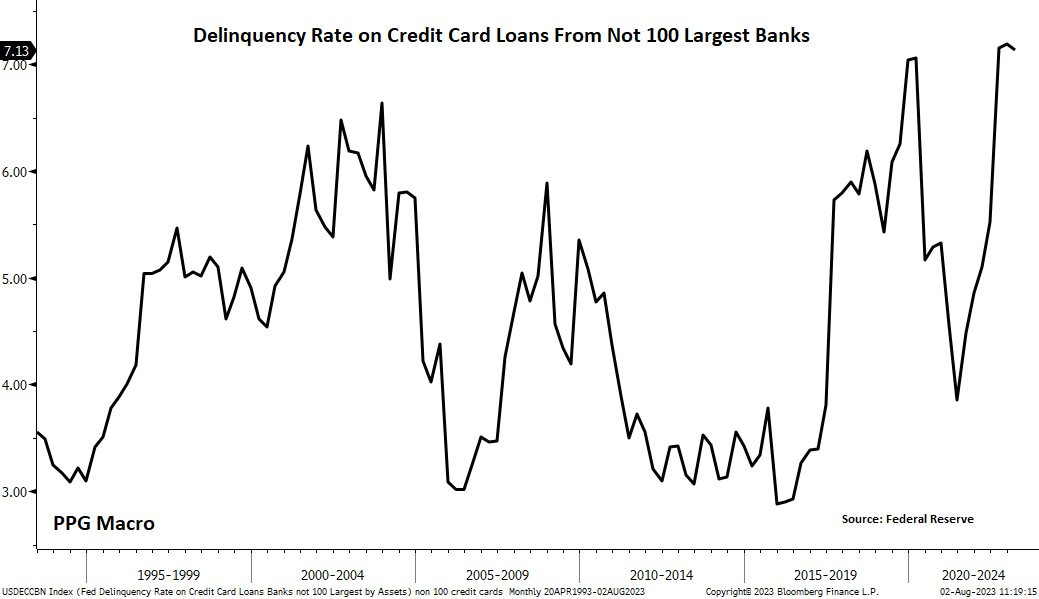

Delinquency rates on credit card loans from small lenders are now at an all time high of 7.1%:

Events:

The most significant event was Fitch U.S. ratings downgrade from AAA to AA+. The rating indicates that the U.S. government securities and the U.S. dollar are believed to be less safe investments. The timing of the downgrade has been questioned by many, who indicated that the reasons for the downgrade have been true for a long time. As you may recall, Fitch placed the rating on “watch negative” in May.

The loss of the top rating by the United States is based on the overall fiscal deterioration and a growing, completely unsustainable debt burden. Fitch pointed to the now “normal” debt standoff as being the cherry on top that drove the decision:

"The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. The government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process. These factors, along with several economic shocks as well as tax cuts and new spending initiatives, have contributed to successive debt increases over the last decade”.

In contrast, Treasury Secretary Yellen voiced her disagreement with the downgrade, stating that her team and she are “focused on making critical investments in our country’s core economic strength and productive capacity”.

Saudi Arabia and Russia will voluntary extend production cuts of 1 million barrels per day through September. Commodities analysts expect oil prices to continue increasing, in line with the past several weeks.

The extension of production cuts coincided with U.S. Crude inventories falling by a record 17 million barrels. This is the largest drop in U.S. crude stockpiles since 1982.

Thank you for reading! Enjoy your weekend!

Good info on housing.