Week In Review: U.S. Runs Out Of Crude Oil Reserves As Gas Prices Increase Nationwide

Mortgage Rates Hit 20-Year High While Home Inventory Remains Low

Numbers:

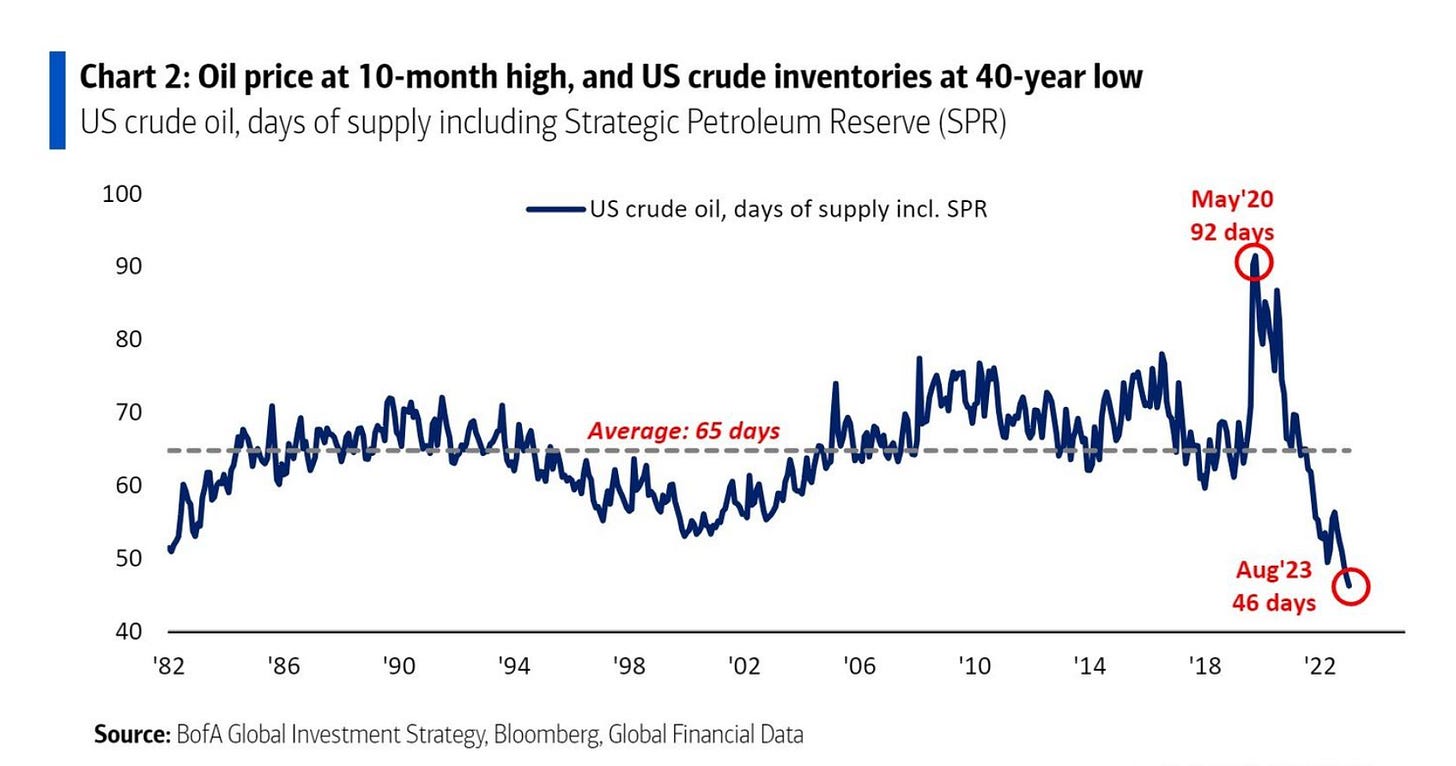

U.S. oil inventories hit a record low; while oil prices keep rising aggressively:

Typically, the U.S. has more than two months’ supply of crude oil. We’re down to 46 days:

I discussed the state of the U.S. National Petroleum Reserve in greater detail in two separate videos this week as well as in this article.

Oil prices are surging. As the result, the national average gas price is $3.80, nearly a 362% increase in just 3 years. As global oil demand is expected to remain strong, gasoline prices are not expected to decline.

Mortgage applications declined to lowest level since 1996, despite a relative drop in mortgage rates.

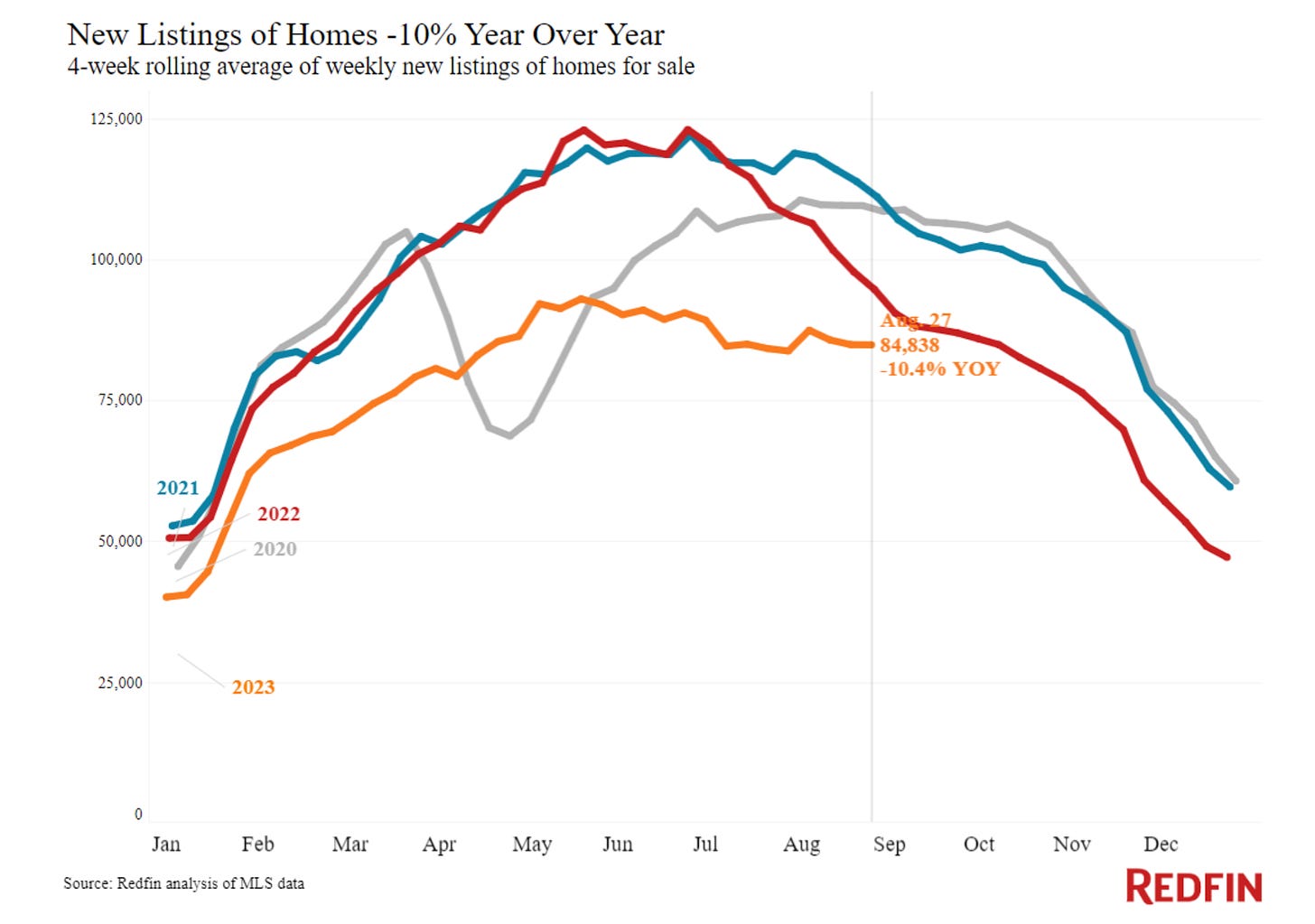

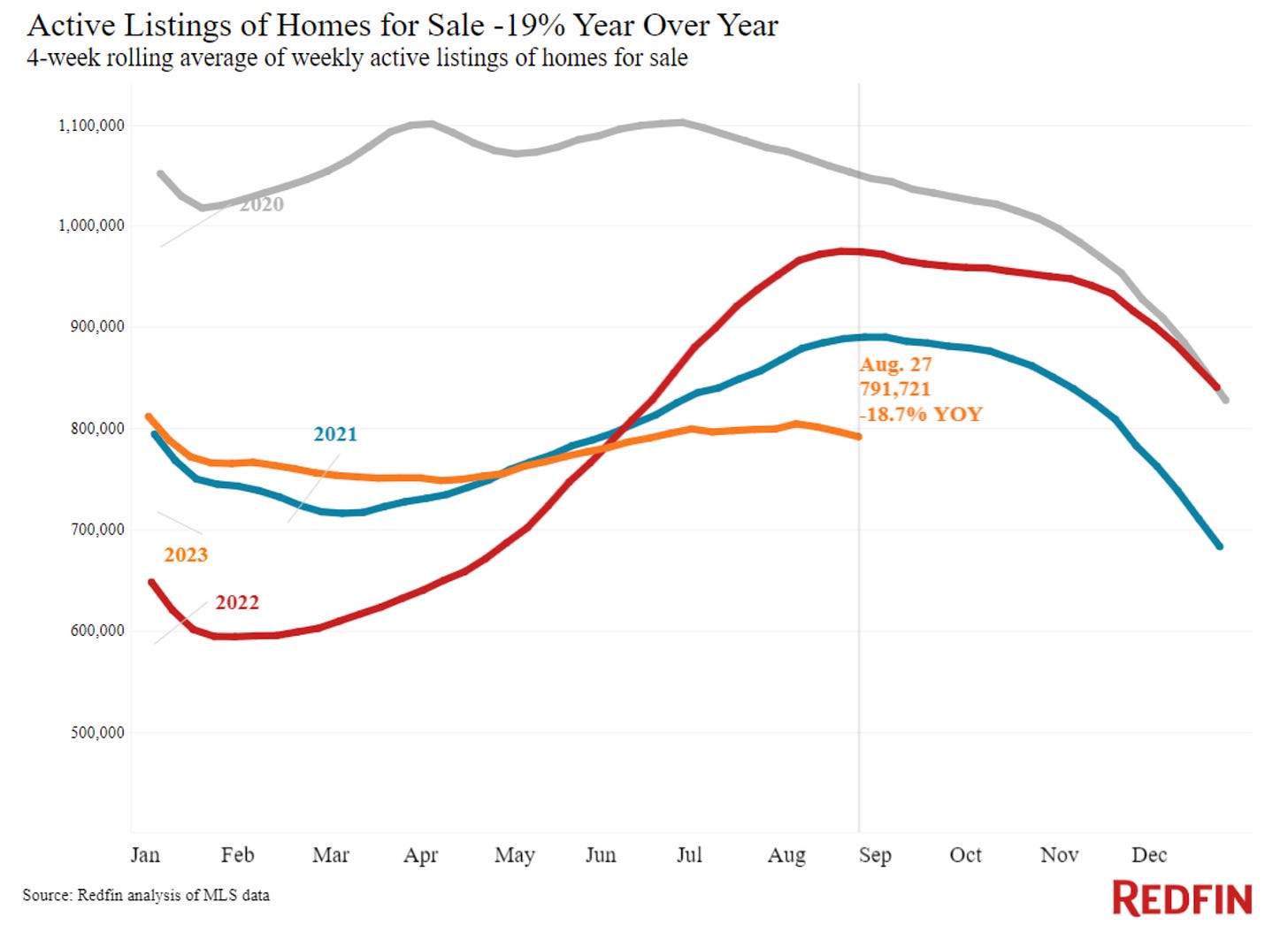

U.S. home prices rise by most in 10 months amid inventory shortages. The total number of homes for sale dropped 19%, the biggest annual drop since February 2022, and new listings are down 10%:

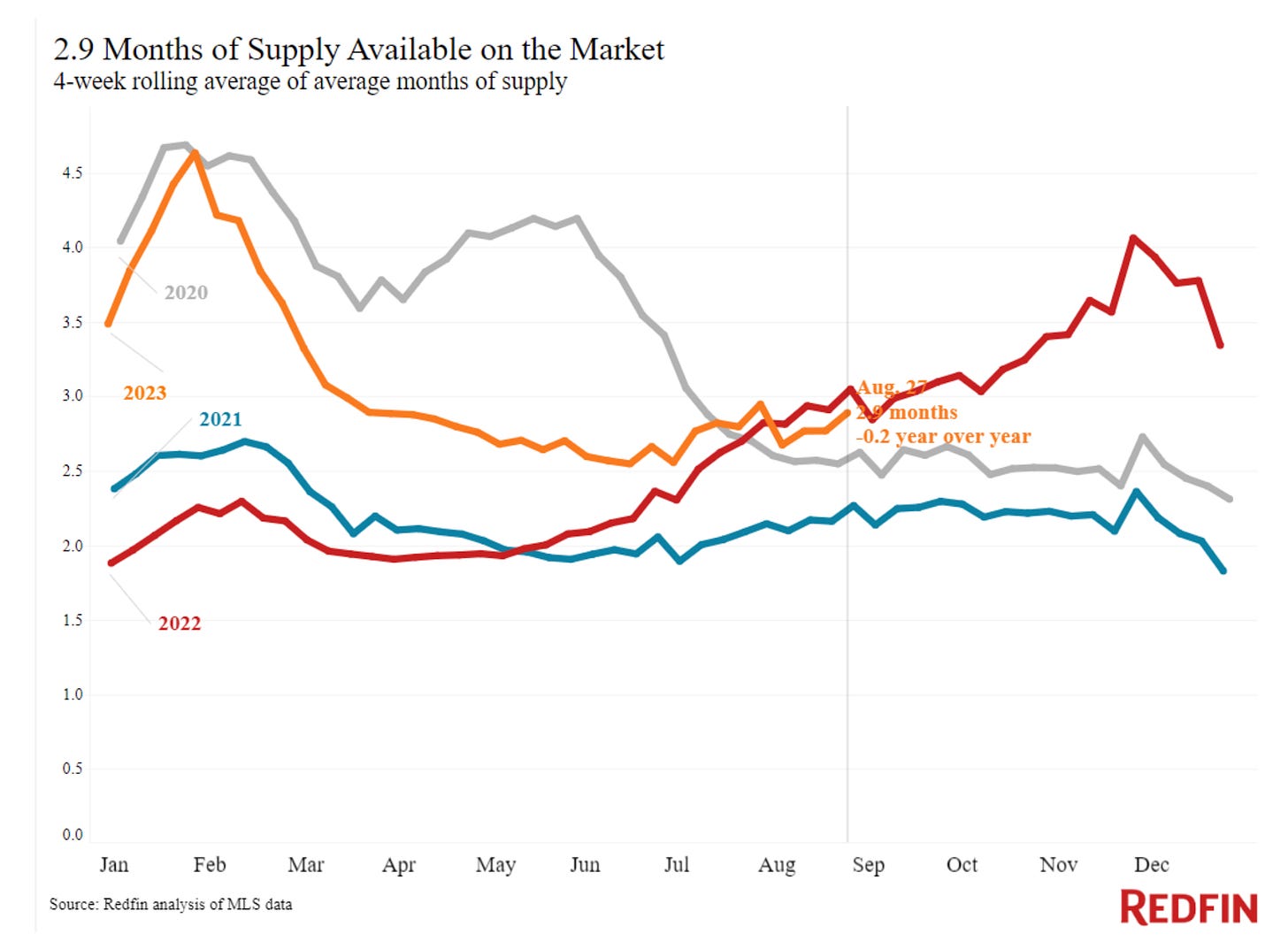

Additionally, the market has 2.9 months supply available currently available for sale:

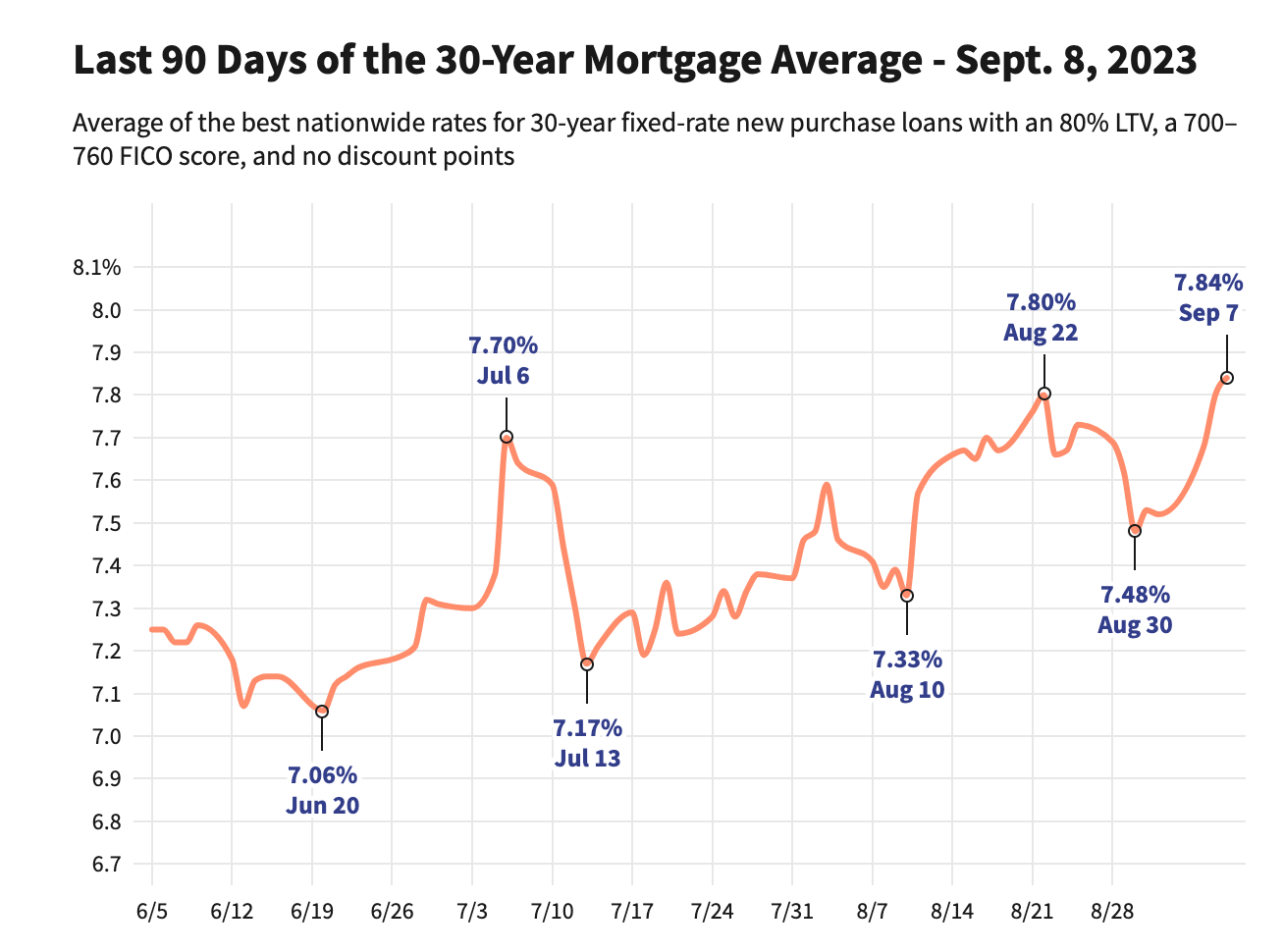

Average interest rate on a 30-year mortgage rises to 7.84%, the highest since 2000:

Domestic Events:

Goldman Sachs reduced its probability of a U.S. recession in the next 12 months as the result of the most recent inflation and the labor market data. According to their expectations, the probability of a recession now stands at 15%, down from 20%.

Apartment rent is expected to decline due to a substantial increase in supply. The number of new apartment units being built hit a 50-year high. More than 460,000 will be completed by the end of the year.

On Friday, September 8th, the IRS announced that it plans to crack down on millionaires and companies with history of tax evasion. The IRS Commissioner Daniel Werfel said the agency will utilize AI and additional funding to increase the number of audits.

Foreign Events:

G20 summit is scheduled to take place on September 9-10 in New Delhi, India. China's Xi Jinping and Russia's Vladimir Putin are not in attendance. Prior to the summit, U.S. Congress lent $21B to IMF trust funds: the main agenda of the U.S. is to increase lending to developing nations, particularly those entertaining the idea of joining BRICS. Such strategy is unlikely to succeed due to the heavy debt burden to the IMF and World Bank carried by the Global South and their fractional say in their own matters on the global arena.

G20 is expected to become a milestone in the dialogue between the West and the developing nations, signaling that the balance of power is shifting.

Thank you for reading. Enjoy your weekend!

In re reserves, is this a situation that the govt is purposely creating a “problem”? I assume that oil companies carry inventory, which they own, and can easily sell were there a buyer (ie USA). On the books, oil companies just change ownership of the inventory. Soooo, for whatever reason, the govt has chosen not to purchase oil to replenish their inventory creating a problem. This is playing with the American people and creating a crisis when there shouldn’t be one.

There is a reason why oil production is being cut, why refineries are closing, why new oil drilling licenses are being stalled. Why nuclear has been shut down with excuses of maintenance issues or green policies

https://www.brighteon.com/e516c414-62a3-419e-b49a-0d79ff51089f

The planet is going through changes. Look to the floods in China, India, Greece, Saudi Arabia, Yemen, UAE the Nevada desert. Earthquakes in Morocco, California, Turkey.

We go through these every couple of thousand years. Ever wonder what happened to prior civilisations?

Thx Lena, love your channel