Weekly Briefs: 72% of Americans Hemorrhaging Money, Feel Financially Insecure.

Biden Administration Forgives $39 Billion In Student Debt As The Fed Wants More Tightening And Interest Costs On National Debt Reach $1 Trillion

Numbers:

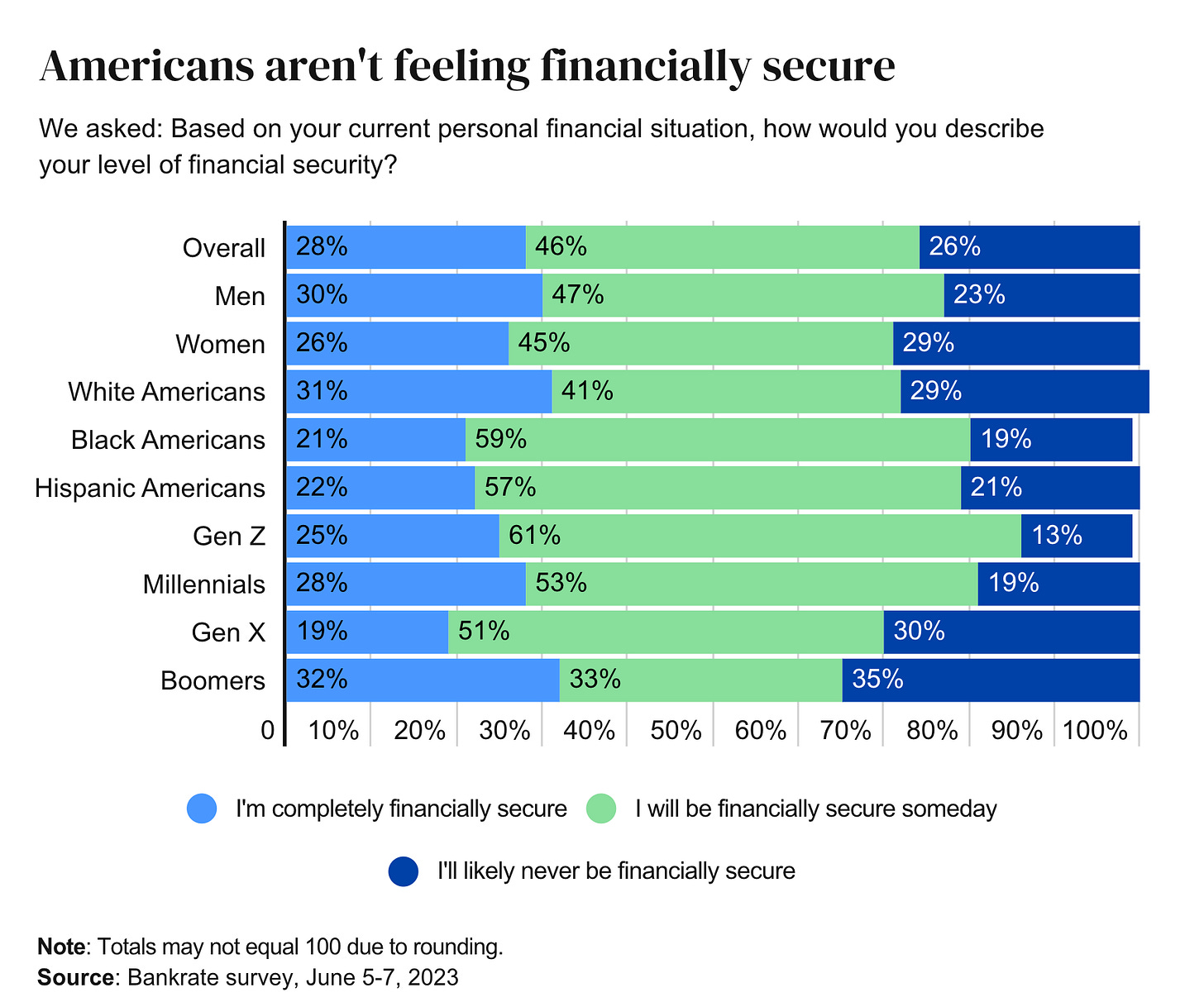

According to the Bankrate survey, 72% of Americans do not feel financially sound. Their primary concerns are inflation, primarily concerned with food costs as well as growing economic uncertainty. A quarter of the surveyed Americans feel that they will never be financially secure. A Bankrate survey published a month earlier, in May, found that financial insecurity is the number one reason why 52% of Americans claim to have mental health issues.

Further, the most challenging factors mentioned during the survey were:

Insufficient emergency savings (42 percent)

Insufficient retirement funds (41 percent)

Low pay/not enough career mobility (33 percent)

High or revolving debt (26 percent)

Renting instead of owning/housing affordability (25 percent)

Other (9 percent)

Even though more people are starting to feel financially insecure, they are desperate to keep up with their spending habits by taking on more debt. Consumer debt is a ticking time bomb, as discussed in detail in this video.

Consumer Sentiment Index reached the highest level since September 2021. It jumped to 72.6 in July. It surpassed the expectation of 65.5 and increased 13% from 64.4 from a prior month.

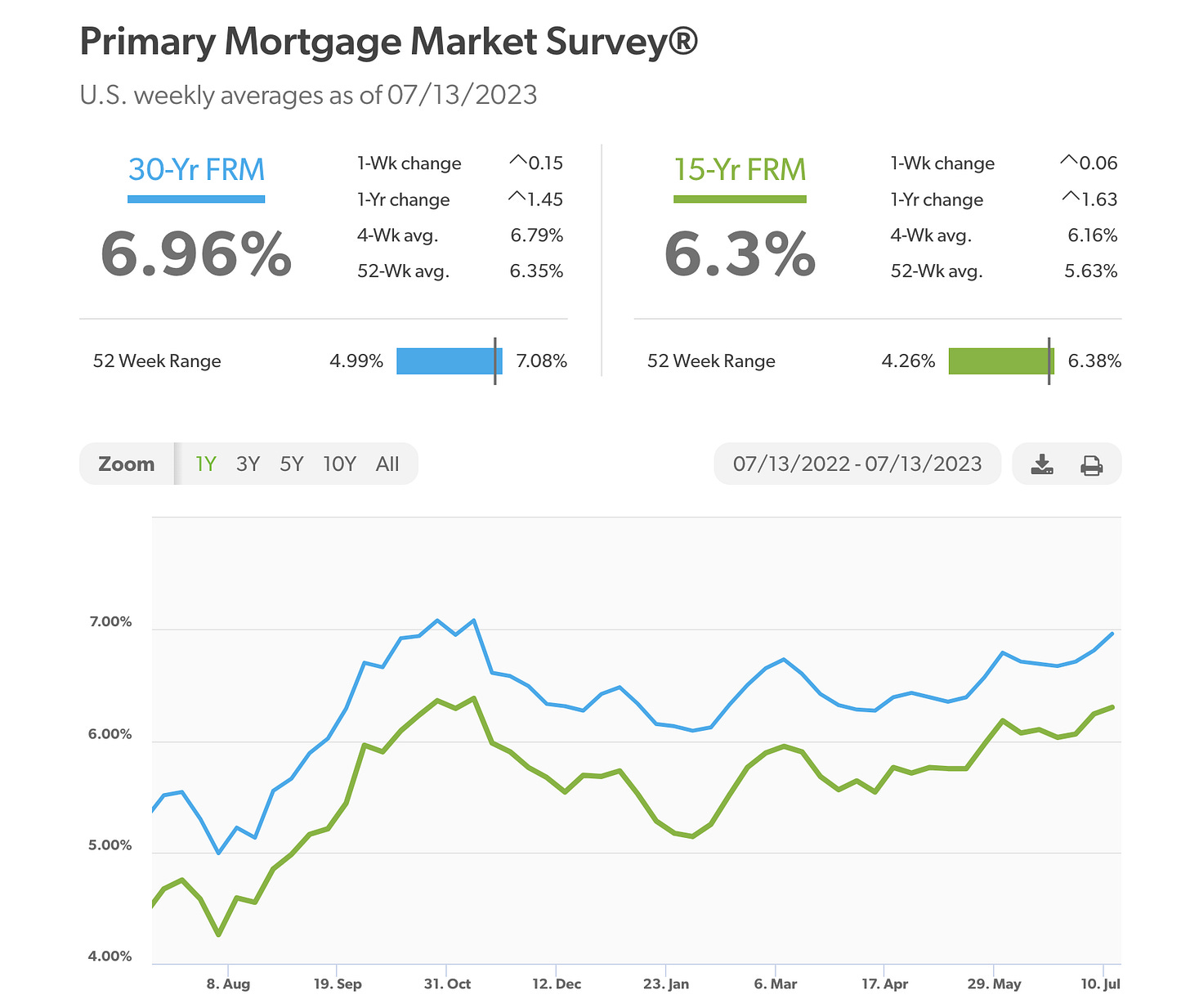

Mortgage rates increased this week, nearing 7%. Housing prices remain high despite the increase in long term borrowing cost:

There was a 0.9% increase in mortgage applications in June. Still, applications remained 26% lower than the same week last year.

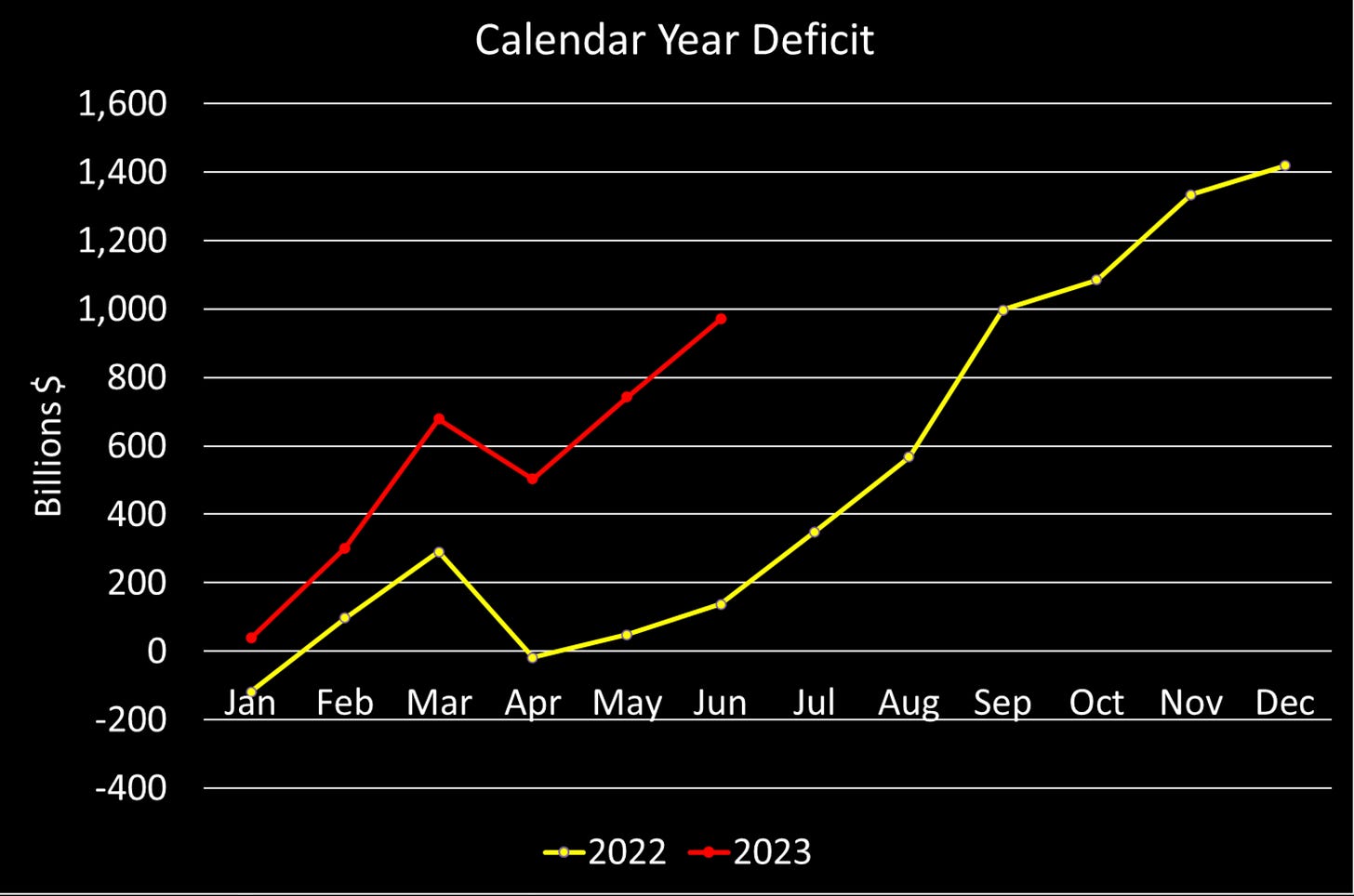

The U.S. government spent $228 billion more in June than it collected in revenue, further hiking its deficit and piling on debt. The deficit is up 607 per cent year over year, a shocking reading:

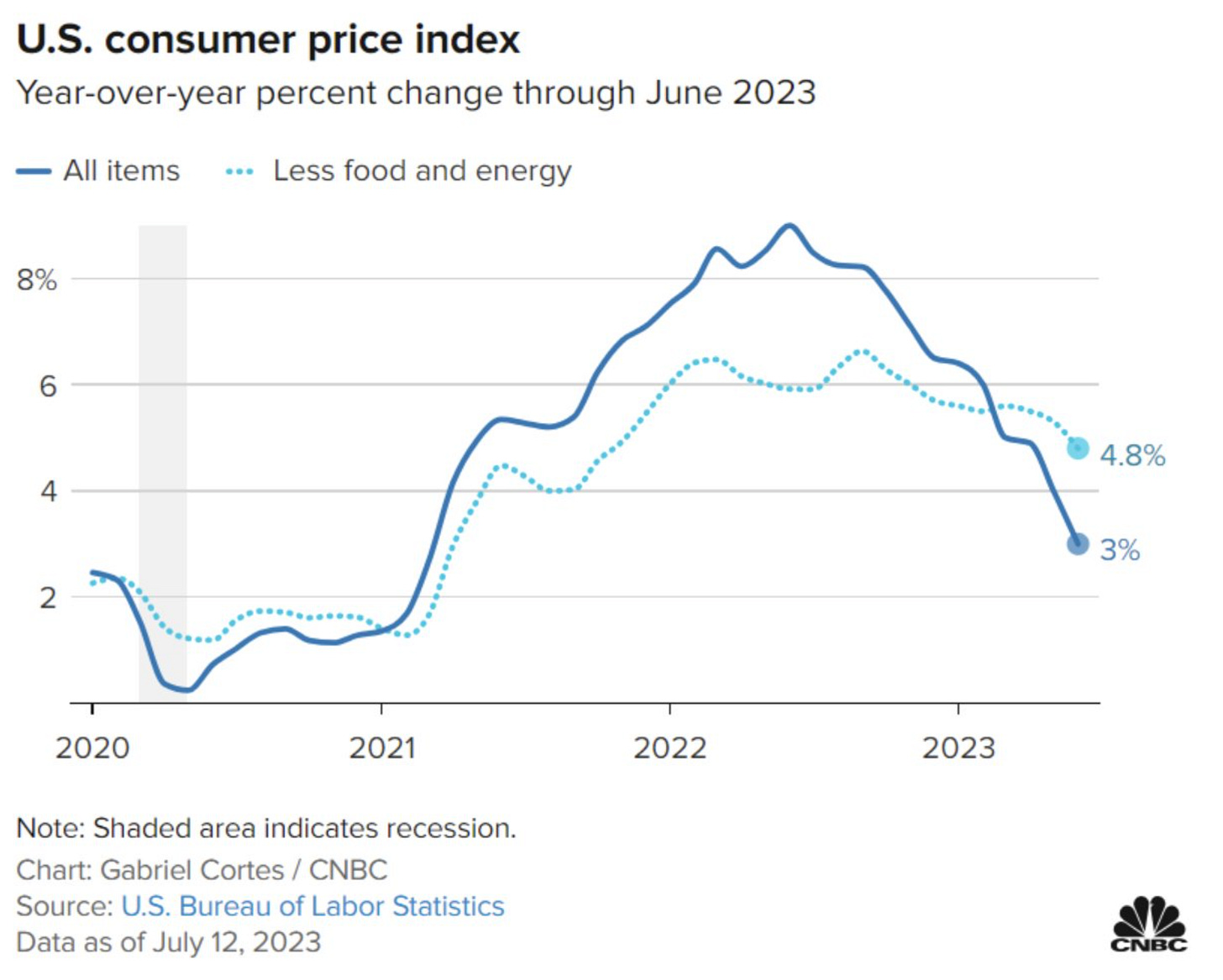

According to the U.S. Bureau of Labor Statistics, the inflation curve is flattening. This may be an indication that the Fed will continue moderate rate hikes in the near future as inflation slows:

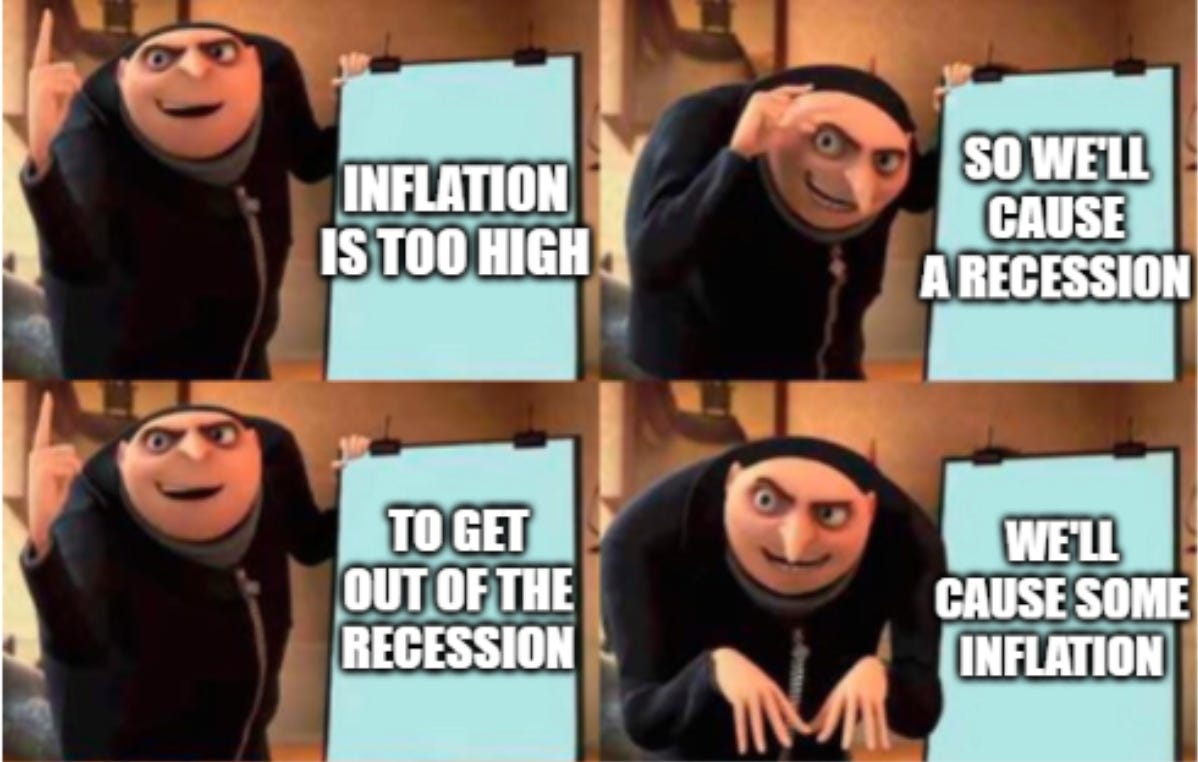

Meme of the Week:

Events:

On Friday, the Biden administration announced that it would go against the Supreme Court ruling. It will forgive $39 billion in student debt for 804,000 borrowers. According to their plan, borrowers will pay a fixed percentage of their income for 20-25 years. Any remaining debt left after that period will be automatically forgiven. Eligible borrowers will be notified by the Education Department.

Assets under the world’s largest money manager, BlackRock, climbed to $9.4 trillion. For comparison purposes, the U.S. GDP was $26.5 trillion in the first quarter of 2023, the latest data available. BlackRock reported $1.4 billion in net income in the second quarter, a rise of 27 per cent over the same period last year. According to Financial Times:

“Most asset managers are shrinking and BlackRock has been growing.”

Fed’s Waller (not surprisingly) is pushing for two more rate hikes this year. Governor Waller warns “more policy tightening” needed to bring inflation under control. He commented:

“If inflation does not continue to show progress and there are no suggestions of a significant slowdown in economic activity, then a second 25-basis-point hike should come sooner rather than later, but that decision is for the future.”

To sum it up, despite somewhat “promising” CPI data, consumers are not truly feeling hopeful. Monthly payments on vehicle loans reach $1,000. Homeownership is becoming more expensive as rates rise, banks tighten lending standards and home prices remain relatively stable. Fewer people are able to afford emergency expenses. Additionally, consider growing geopolitical tensions as conflicts in Ukraine, Syria and Palestine feed into the global instability and power shifts.

Lastly, here’s the quote of the week to add perspective:

“The political machine triumphs because it is a united minority

acting against a divided majority”

- Will Durant

Enjoy your weekend! I’ll see you later on Rumble or YouTube!

One suggestion; would be helpful if you post videos on youtube instead of rumble as we manage all our playlists and subscriptions on youtube.