Weekly Briefs: Federal Reserve Launches FedNow, Loan Rejections Surge

Key News For The Week Ending July 21st, 2023

Numbers:

According to the latest survey published by the Federal Reserve, the tightening of lending standards is resulting in a significant number of loan applicants being rejected:

The rejection rate for U.S. loan applicants jumped to the highest level since 2018.

The average reported probability that a loan application will be rejected increased sharply for all loan types. It rose to 46% and 42% for mortgage and credit card applicants, respectively.

Mortgage rates fell as inflation is showing signs of slowing:

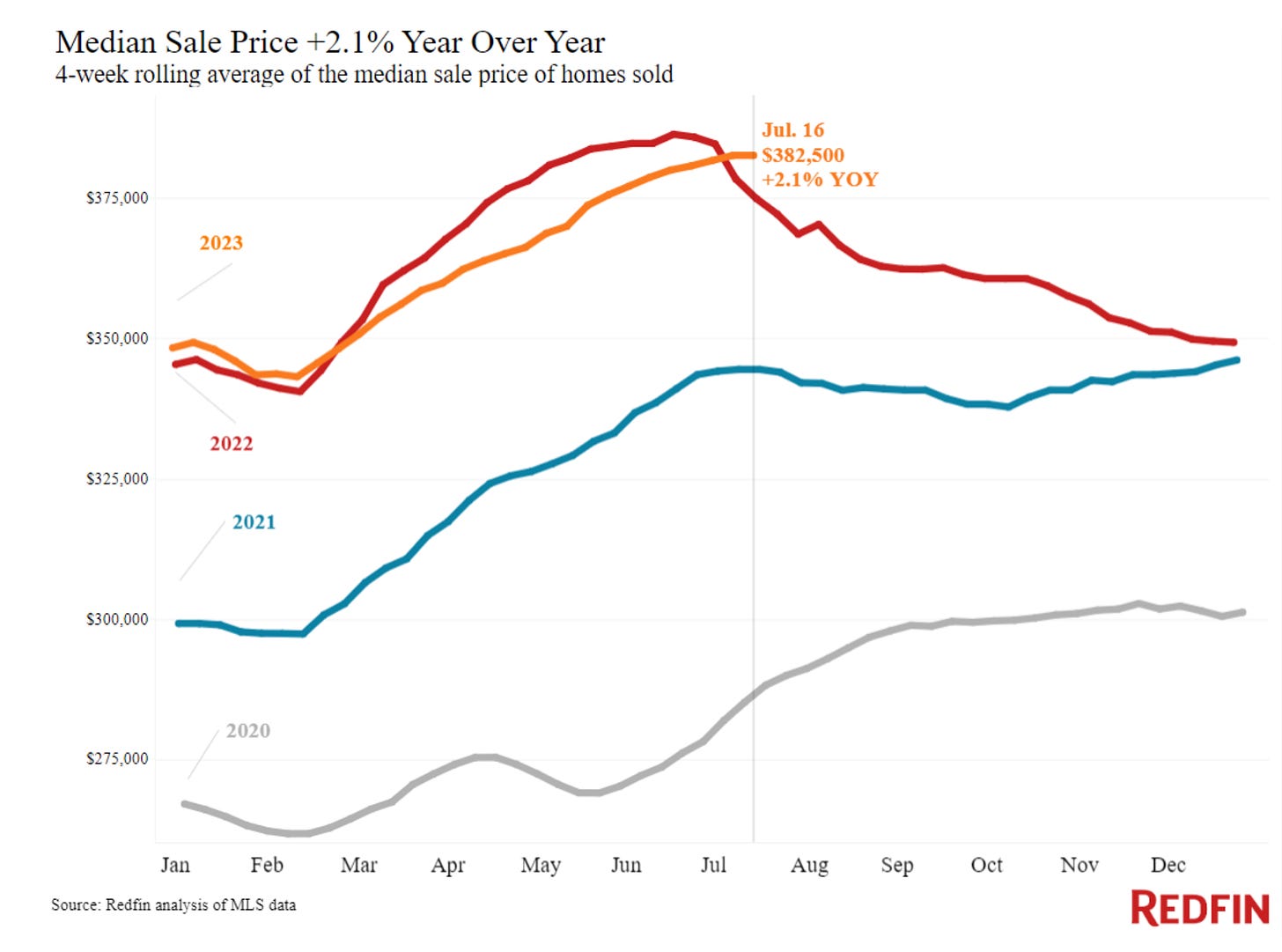

According to Redfin, home prices posted their biggest year-over-year increase in over seven months. The main driver of the increase is low inventory of homes available for sale. There is more demand than supply. If mortgage interest rates decline, we are likely to see home prices increase as buyers become more competitive.

As home prices posted a gain, existing home sales declined 3.3% in June. Year over year, sales dropped 18.9%. According to NAR, the Northeast is experiencing gains, the Midwest is holding steady, and the South and West are posting decreases. All four regions recorded year-over-year sales declines.

As of this week, initial jobless claims fell more than previously forecasted: 228K vs. 242K consensus. This indicates that labor market remains strong even though the economy has been slowing.

Events:

The Federal Reserve officially launched FedNow, its new payment system that enables allows consumers and businesses to send and receive money in seconds. FedNow has been viewed as a pre-cursor to Central Bank Digital Currencies, as I discuss in detail in this video recently:

According to Fed Chair Jerome Powell, “The Federal Reserve built the FedNow Service to help make everyday payments over the coming years faster and more convenient”.

The new system facilitates instant payments by linking participating (all U.S. based) banks. There is a transaction limit - $500,000.

Michelle Bowman, Federal Reserve Governor, said that FedNow could offer some of the same benefits as a central bank digital currency.

China, the world's second-largest economy, is slowing down as it is struggling with a significant drop in its exports as global demand weakens. Treasury Secretary Yellen commented “Slowing economic growth in China could have some negative spillovers for the rest of the global economy”.

As the Black Sea grain initiative, originally negotiated in July 2022 between Turkey, the United Nations and Russia, was not renewed, wheat prices soared to $696.50 per bushel. However, they are still nowhere close to May 2022 levels.

During the past year, approximately 33 millions tons of wheat were exported from Ukraine via the Black Sea ports. 70% of the export was shipped to the EU. After refusing to extend the grain deal, it has been reported that Russia pledged to replace the supply of Ukrainian grain to countries in need free of charge (mainly African developing nations).

Enjoy your weekend! I’ll see you later on Rumble or YouTube!

Good information. Just wish this newsletter came out more frequently/regularly.