Weekly Briefs: More Policy Tightening From ECB, Fed and BOE

Key Numbers And Events For The Week Ending June 30th

Numbers:

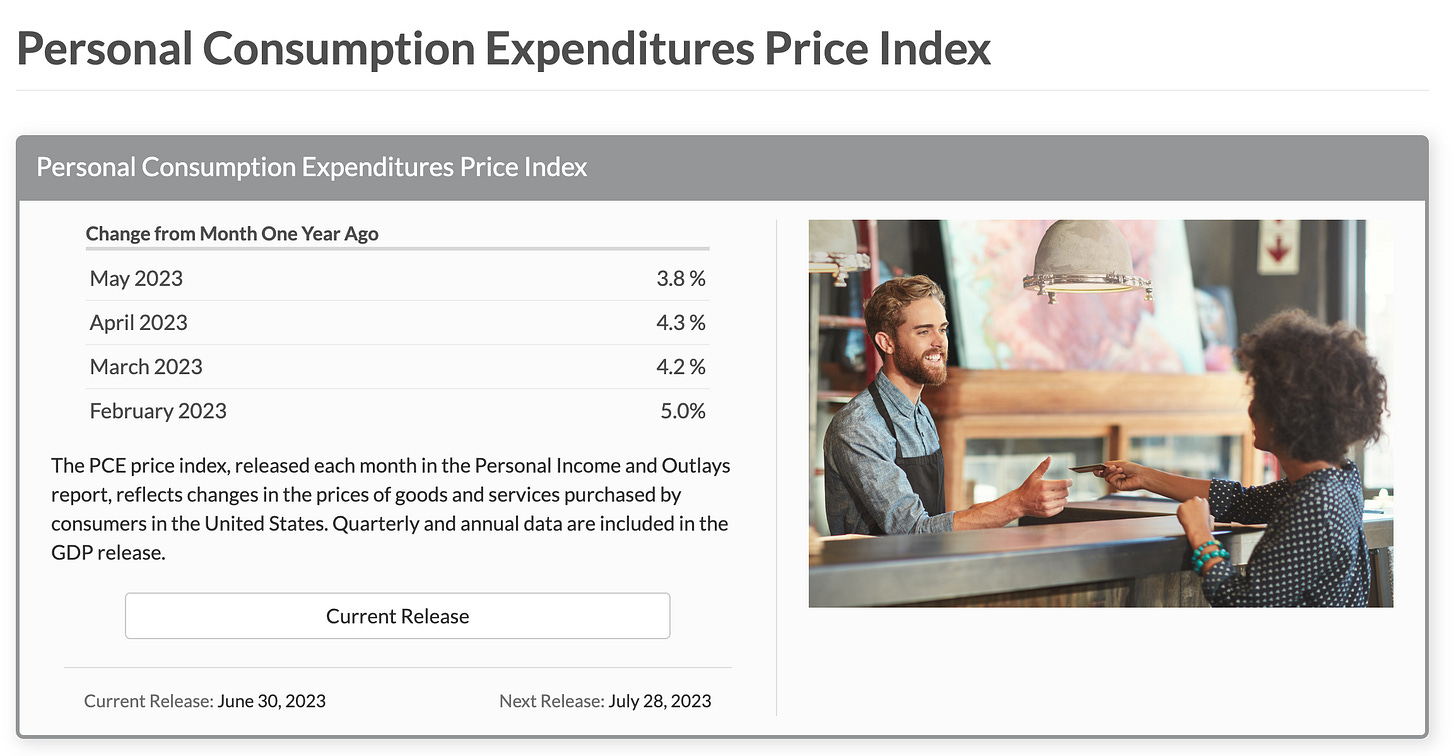

PCE inflation, the Fed’s preferred inflation metric that captures inflation (or deflation) across a wide range of consumer expenses and reflects changes in consumer behavior, fell to 3.8% (ie. below expectations of 4.6%):

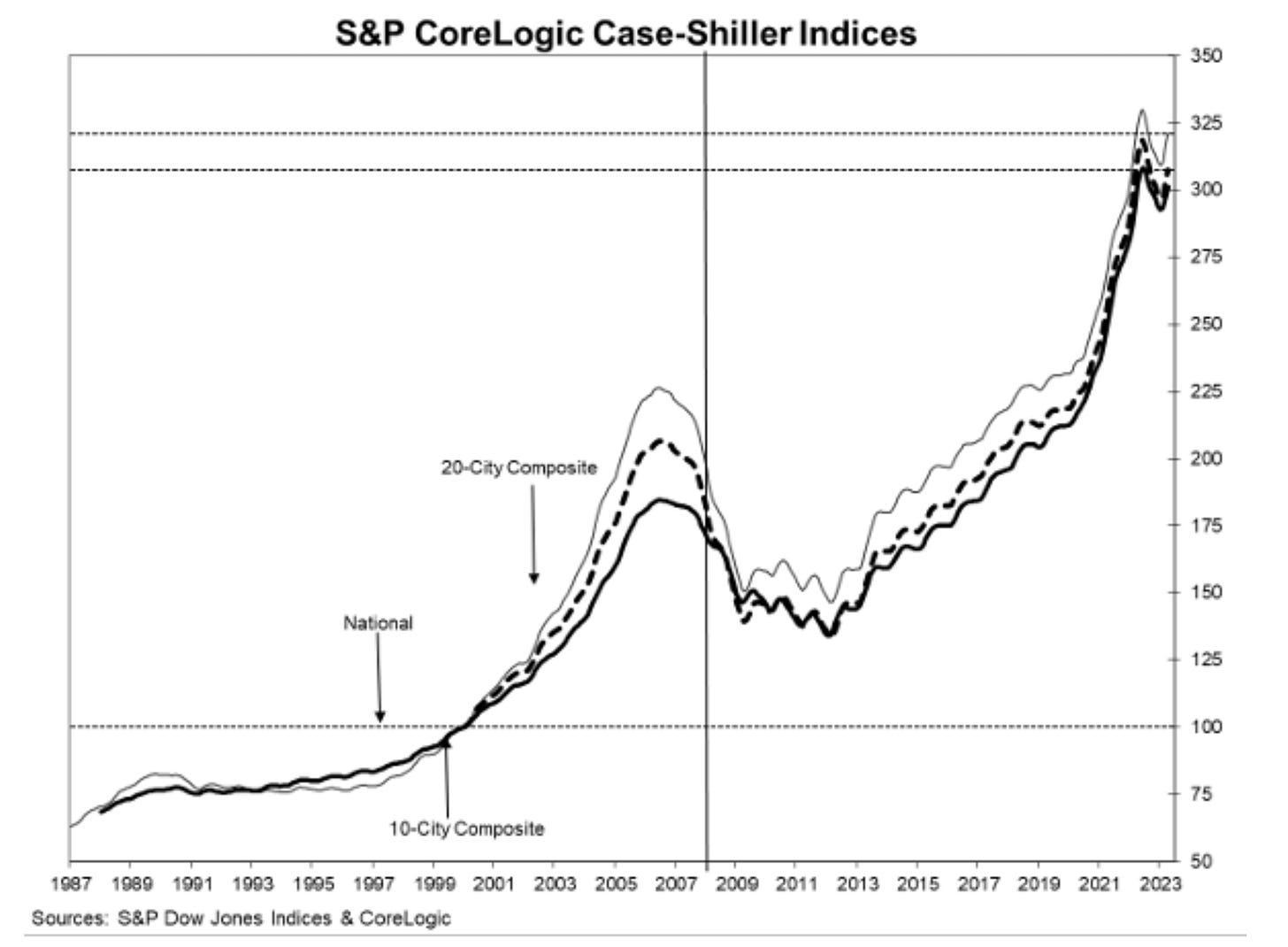

Home prices rose more than expected, even as mortgage rates remained elevated. Miami (+5.2%), Chicago (+4.1%), and Atlanta (+3.5%) posted the biggest year over year gains.

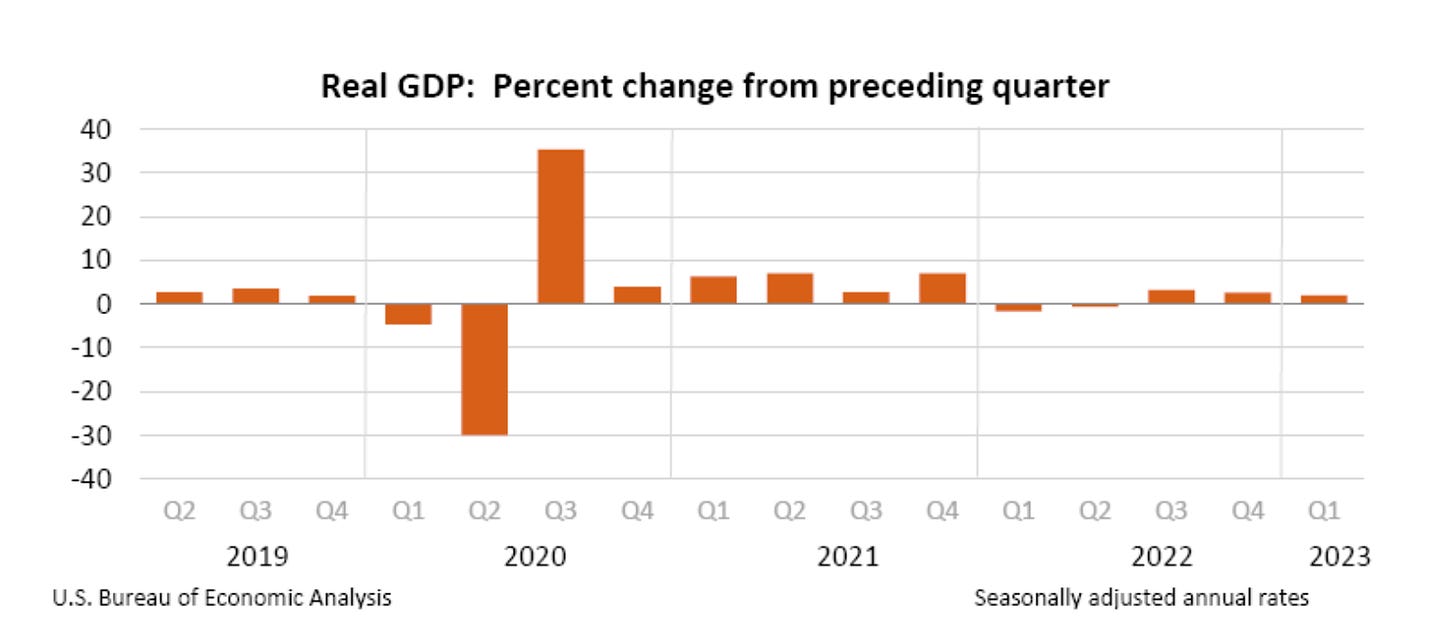

Final (revised) reading of the US Q1 GDP came in at 2.0%, above expectations of 1.4%. The change was driven by the upward revisions to exports and consumer spending that were offset by downward revisions to nonresidential fixed investment and federal government spending:

Mortgage rates rose slightly during the week:

Pending home sales dropped more than expected: -2.7% month over month to 76.5% vs. the expected decline of -0.6%.

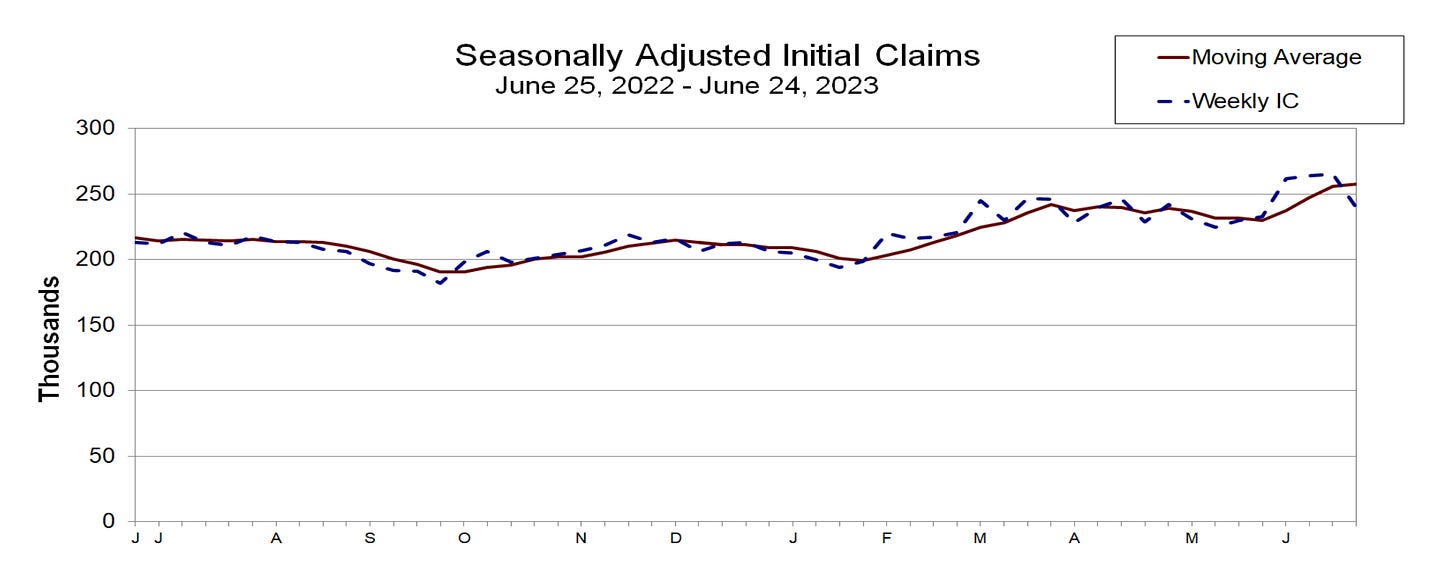

Initial jobless claims for the week ended June 24 decreased by 26K to 239K vs. the expected 266K:

News:

During the European Central Bank (ECB) forum on central banking in Portugal, Jerome Powell commented that more “restriction” is coming and 0.25% rate hikes are likely at the next 2 meetings due to a very strong labor market.

Federal Reserve Chair Jerome Powell was joined by Christine Lagarde, President of the European Central Bank; Andrew Bailey, Bank of England Governor; and Bank of Japan Governor Kazuo Ueda in a panel discussion. According to Powell:

"We feel there's more tightening power to do... we believe there's more restriction coming. A good part of the reason is due to the strong labor market. Though policy is restrictive, it may not be restrictive enough and it hasn't been restrictive for very long.”

The U.S. Supreme Court rejected the plan to cancel $430 billion in student loan debt. It ruled that the U.S. Education Department doesn't have the right to forgive student debt.

Borrowers will have to pay back the $400 billion that the White House wanted to forgive.

The Biden administration is creating a "safety net period" for millions of Americans who are set to resume making student loan payments later this year.

The Education Department finalized a plan for a three-month grace period for missed payments once the student loans come due in October. Under the so-called "safety net period," borrowers who miss payments wouldn't see their credit ratings hurt until well into 2024. And severely delinquent borrowers wouldn't see their loans enter default until 2025 at the earliest, according to Politico.

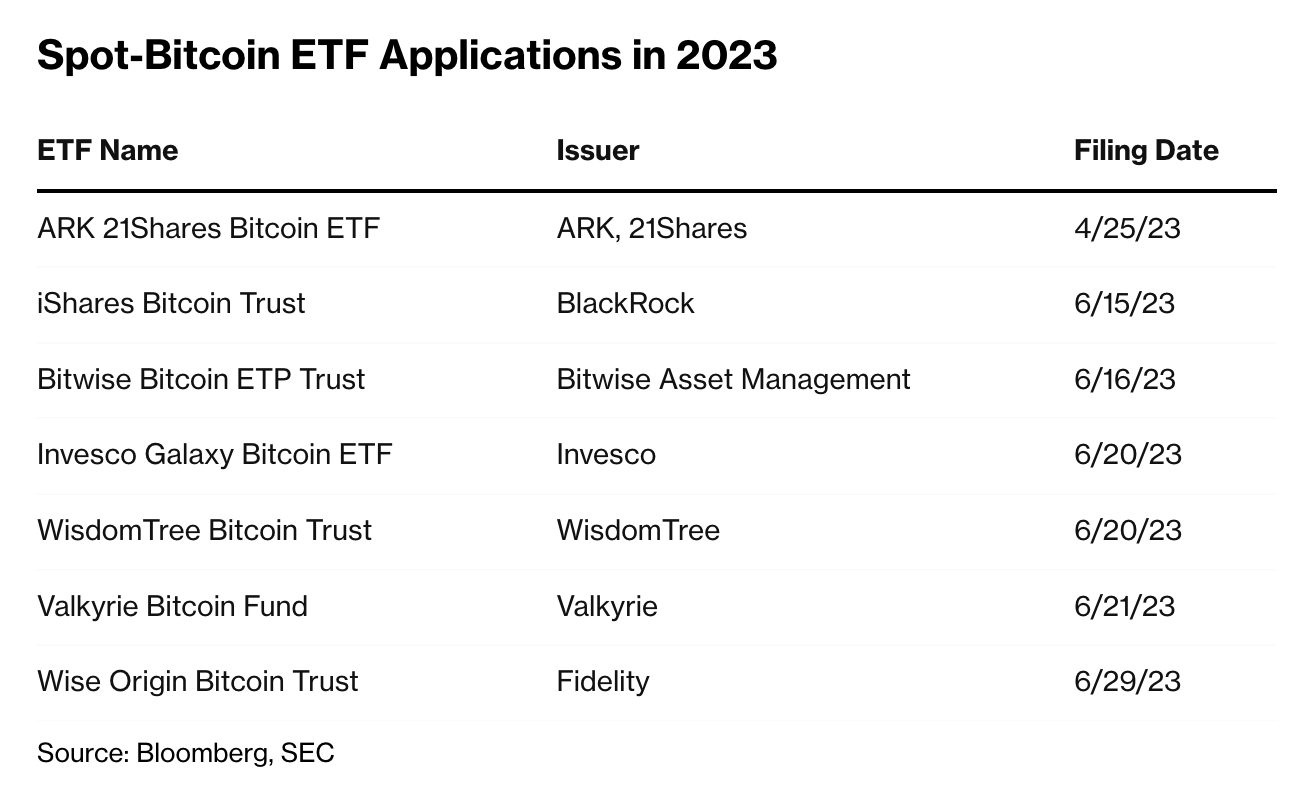

Fidelity is preparing a Bitcoin ETF application. This is the 6th application in 2 weeks, after Blackrock’s filing for a spot ETF on June 15th. Cathy Woods says that ARK application has the best odds of getting an approval from the SEC:

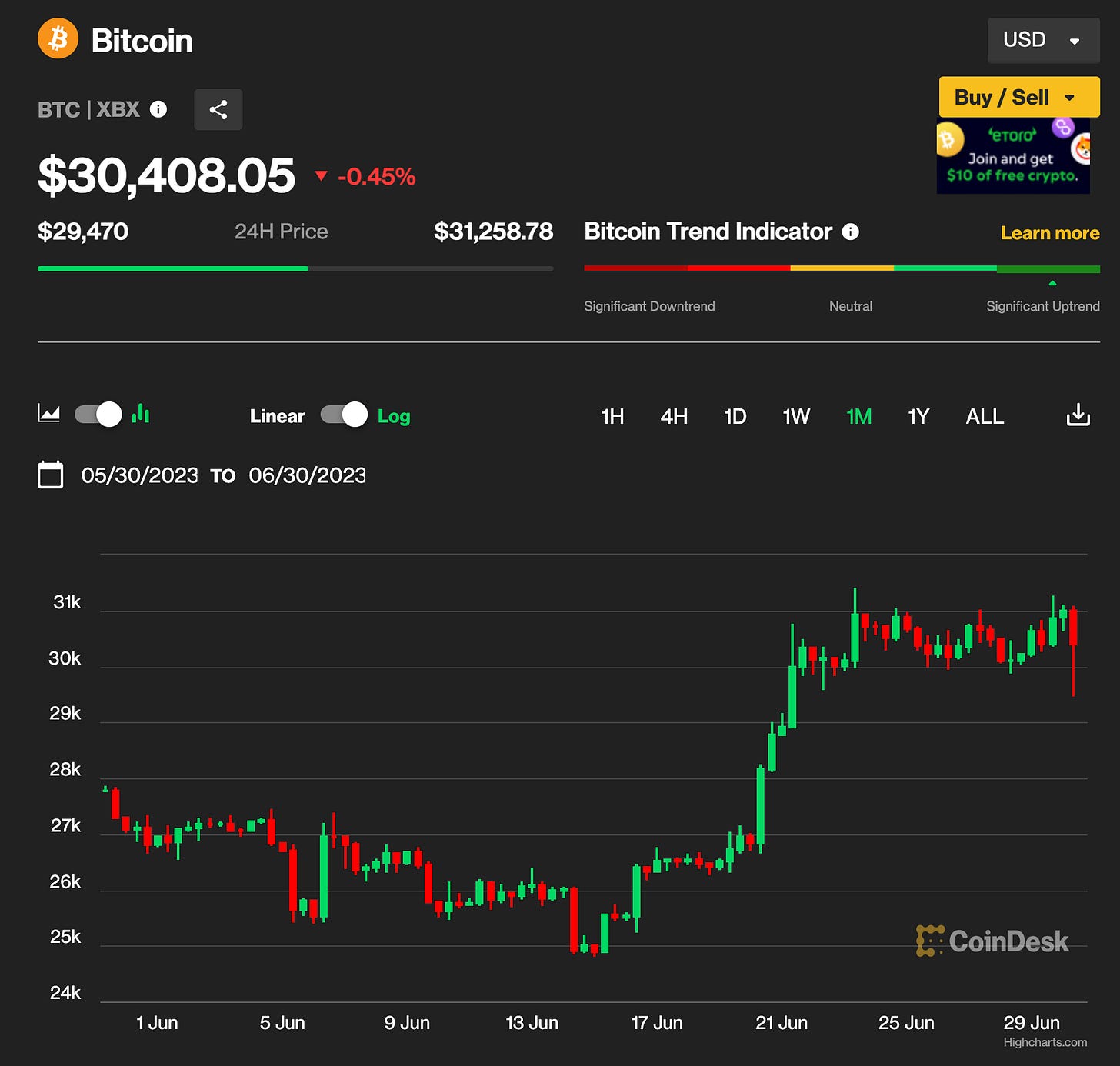

Meanwhile, Bitcoin ETF race has pushed the price of Bitcoin up:

Thank you for stopping by! Have a wonderful weekend and Happy 4th of July!

Excellent details, very concise, very clear, and super pertinent and useful. Thank you Lena, for pulling this all together and keeping it real.