Weekly Briefs: USD Is Losing Value, July Rate Hike Is Guaranteed and Europe's Energy Crisis

Weekly Summary Of Key Economic & Financial News

Numbers:

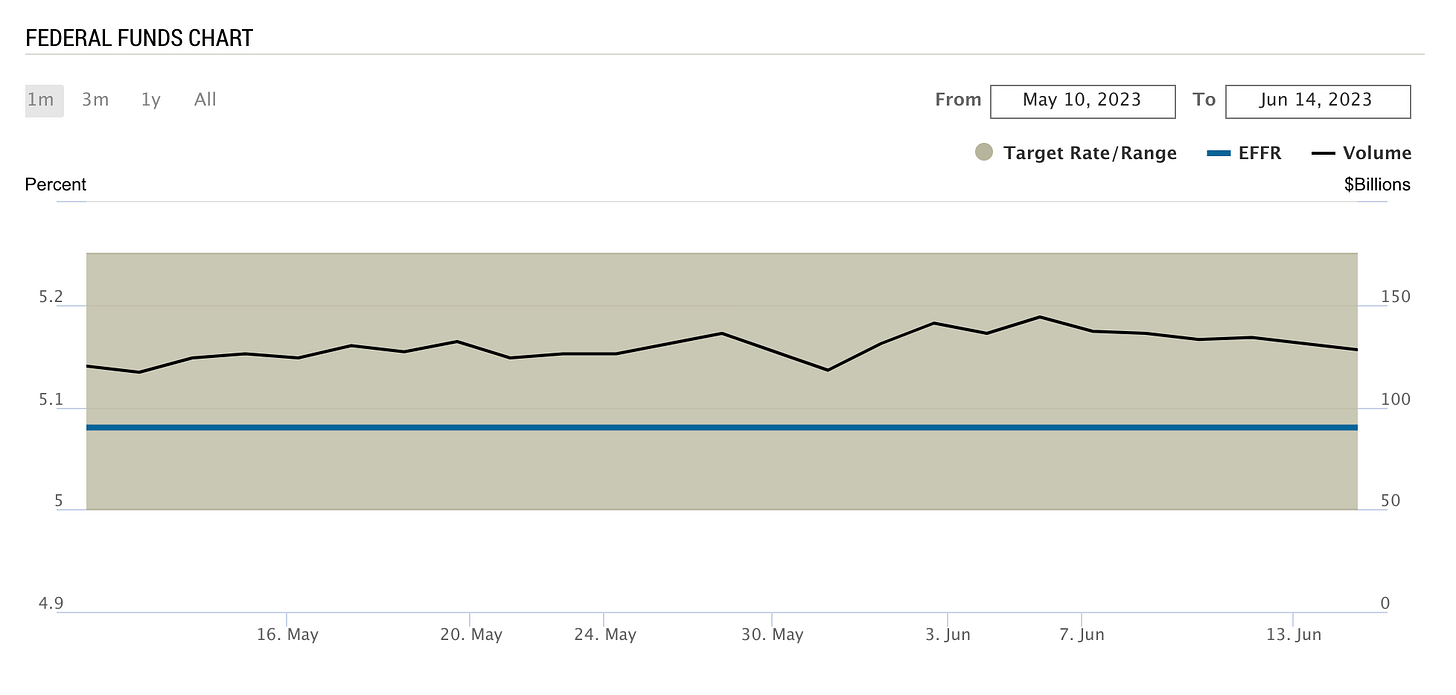

Fed’s decision to pause interest rates was a unanimous 11-0 vote. The rate remains at 5.25% - 5.00%:

A rate hike in July is guaranteed; here’s why.

The Fed now expects 4.1% unemployment rate at the end of 2023, down from 4.5%. Additionally, it sees 1.0% GDP, up from 0.4%.

According to Powell, inflation is forecasted to be at 2.5% by the end of 2024.

Long-term mortgage rates decreased as the result of the Fed’s pause. 30-year fixed-rate mortgages averaged 6.69% as of June 15, down from 6.71% last week and up from 5.78% a year ago:

In The News:

The Fed no longer expects the US to enter recession in 2023.

Treasury Secretary Yellen said to “expect a gradual decline in the dollar's share of global reserves” as foreign central banks drive de-dollarization. Yellen pointed out that she still believes the USD will remain the dominant currency as “many foreign countries do not have an alternative”. Markets Insider reports:

“Asked by Rep. Warren Davidson, R-Ohio, on whether US sanctions could impact dollar transactions, Yellen acknowledged that their use has motivated some countries to look for currency alternatives.”

However, if we look at the following graph, the decline is anything but “gradual”:

Prepare for higher food prices ahead: prices for U.S. wheat, soybeans and corn surged as the result of drought conditions in the Midwest. Drought is forecasted to persist and threatens this year’s harvest and thus, prices on the main staples.

Prices for corn and wheat are rising in the European Union as the result of hotter than normal weather and growing uncertainty of grain imports from Ukraine, that were originally meant for the developing African countries that face considerable food scarcity.

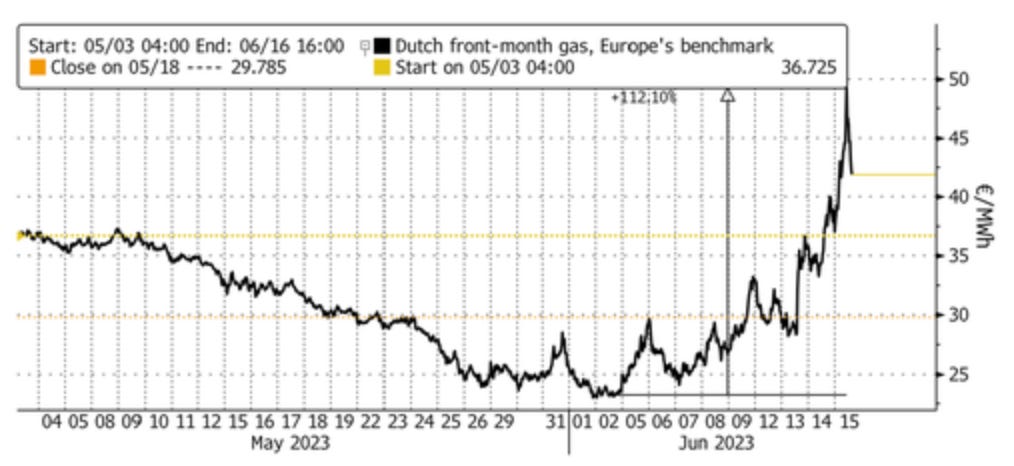

Europe’s energy struggle worsens as European natural gas prices jump more than 100%. Outages in Norway are causing supply concerns:

BlackRock filed an application with the U.S. Securities and Exchange Commission to launch the iShares Bitcoin Trust. Coinbase is listed as the bitcoin custodian. On Friday, June 16th, SEC declined the application.

Thank you for reading! Enjoy your weekend!

I recommend people go to C-SPAN and watch what Yellen actually said and the actual questions with context. The Yahoo Finance article I think this is coming from is cherry picking to push a narrative that lacks understanding at best, and is pushing Chinese propaganda at worst.

Bottom line, countries that are scared they will be sanctioned the same as Russia when they invade Taiwan, are trying to make that impossible. The lines are going to get real clear, real quick. The BS we have been engaged in where we tolerate each other, specifically Saudi Arabia, is going to end. I for one will be glad for it because despite our flaws, as long as we continue to keep autocrats out of power, freedom is superior to tyranny.