Weekly Recap: Biden Issues New Sanctions Against Foreign Banks, PCE Trends Down, U.S. Bankruptcies Surge

Key Events For The Week Ending Friday, December 22.

The Fed’s preferred measure of inflation, the core PCE index, continues to trend down. It rose 3.2% n November vs. 3.4% expected and 3.4% in October.

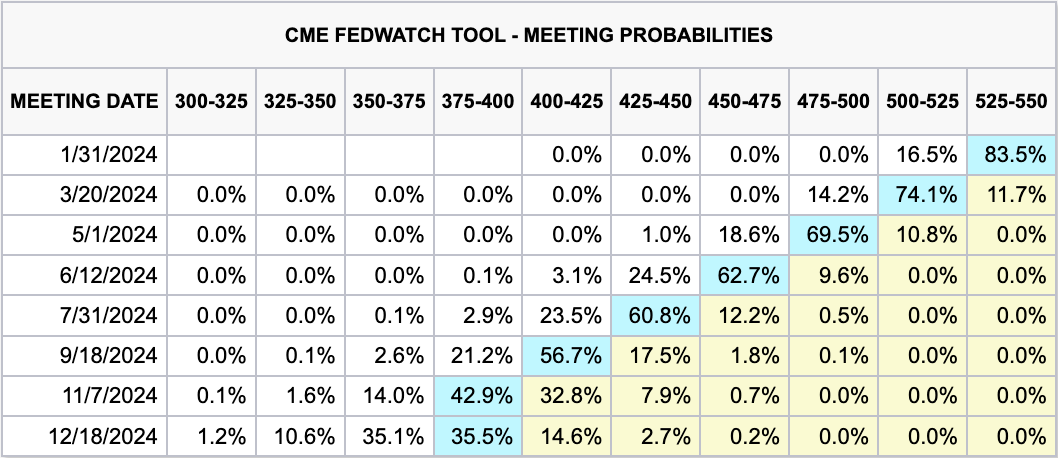

The probability of the Fed cutting its policy rate by 25 basis points at its March meeting has increased to 74.1%:

Despite the core PCE index trending down and the Federal Reserve hinting at at least three rate cuts in 2024, Morgan Stanley, in the U.S. Economics report, published on Tuesday, expects a rise in inflation in the next two months because of “sticky services inflation.”

Additionally, Morgan Stanley believes that we should expect QE to begin in June, not in March as the market projects.

Official data shows that consumer confidence in the U.S. increased to 69.70 points in December from 61.30 points in November of 2023, above expectations.

According to the official source, the unexpected improvement is due to U.S. consumers expecting inflation to ease.

The labor market remains relatively strong.

For the week ended December 16th, initial jobless claims jumped 2K to 205K, less than the 210K expected and compared with 203K a week prior.

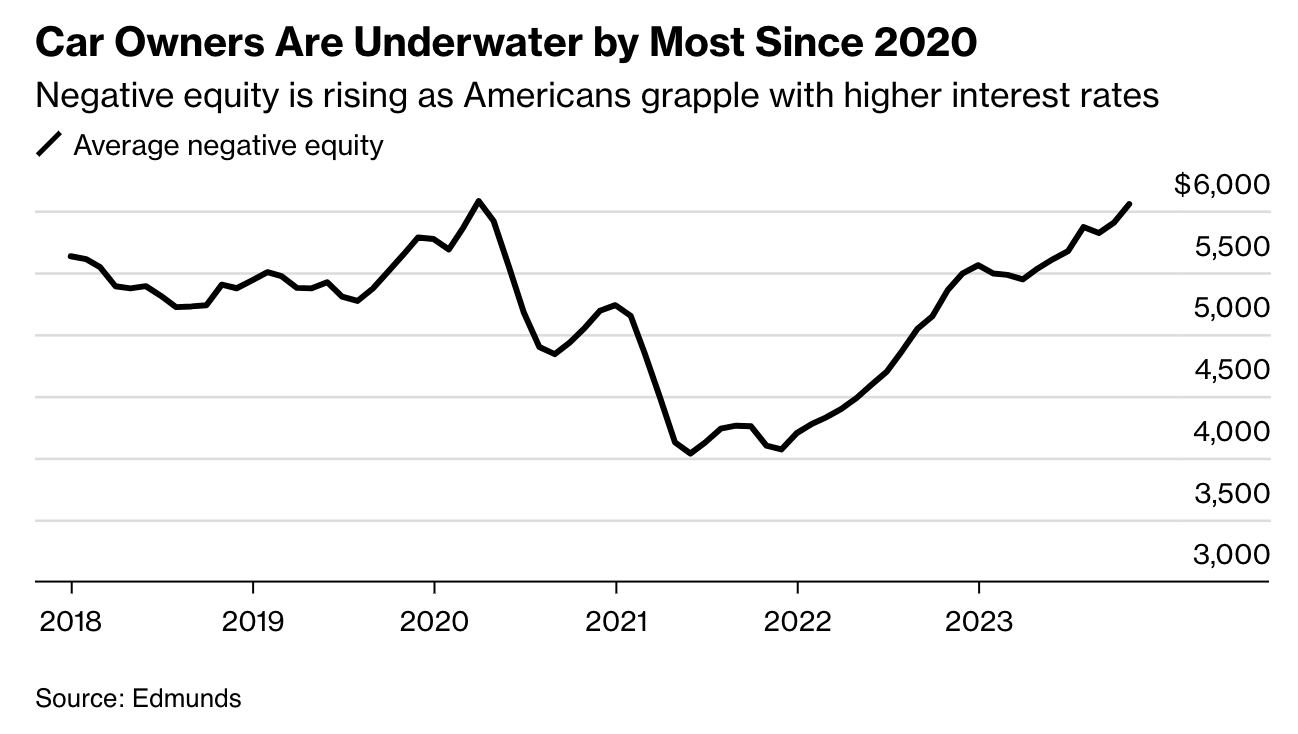

A record number of American consumers are struggling with vehicle loans. According to Edmunds, in November, borrowers with negative equity were underwater by an average of $6,054, the most since April 2020 and well above pre-pandemic averages. Additionally, repossessions have increased, with car owners being delinquent on loan payments at highest rate in three decades.

I further discussed this news in a recent video.

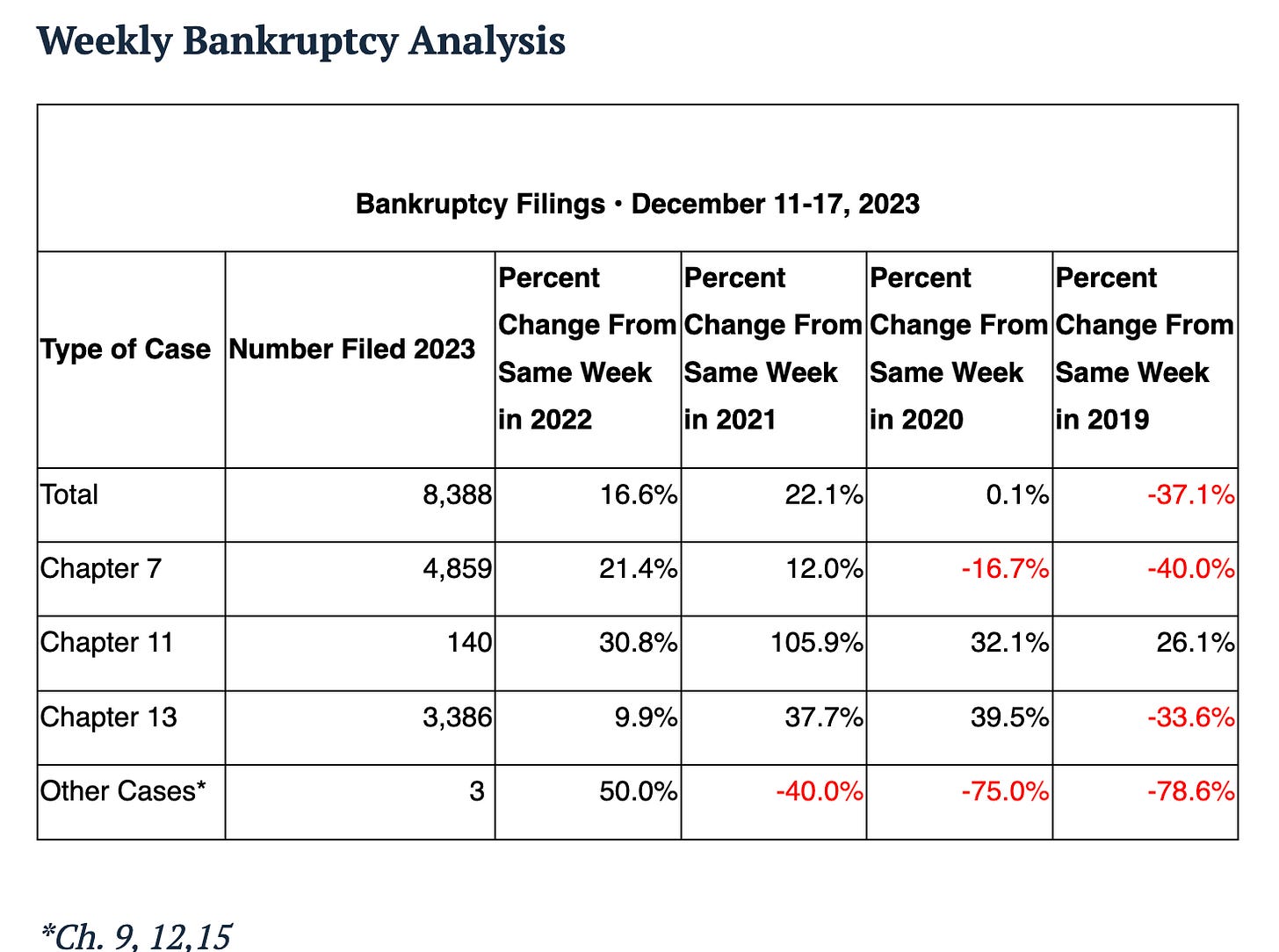

The economy is experiencing a shocking surge in commercial and consumer bankruptcy filings.

On a year over year basis, there is a 21% increase in total corporate filings: 2, 252 vs 1,864 last year.

Consumer bankruptcies have increased substantially. There have been 35,500 individuals who filed for bankruptcy protection in November alone.

Even though December data is available through the second week of the month, it is not promising. Bankruptcy filings show considerable increases across categories.

I covered bankruptcy filings in detail here.

On Friday, President Biden signed an executive order imposing sanctions on foreign financial institutions that transact with Russia. He stated that the latest sanctions would force “misbehaving” banks to “lose access to the U.S. financial system.”

Despite the fact that previous rounds of sanctions have proven to be rather futile, the current fiscal policy will undeniably backfire as the global majority has already shown initiative to seek alternatives to the carrot and stick approach.

The Red Sea crisis continues to deteriorate as major carriers are rerouted through the Cape of Good Hope, a longer route that adds two to three weeks of travel.

The Houthis continue to demand immediate cease fire in Gaza after more than 20,000 civilians have been killed.

As the result, crude oil prices increased as much as 1% on Friday, and further supply chain disruptions are expected. Brent crude is trading at $80.10/ barrel and WTI crude has reached $74.70/ barrel.

The IRS announced that it will send a “special reminder letter” to all taxpayers with an unpaid balance. This practice has been put on pause for two years. The new reminders will provide details of taxpayers’ liability and options to pay off the balance.

The IRS imposes tax penalties on past due balances, which is why it is advisable to set up a plan or to make a payment in full. You are welcome to learn more about the different types of IRS tax penalties and what to expect in this video.

A 122- year old American company, U.S. Steel, has been sold to Japan’s Nippon Steel for $14.9 billion. Nippon is the world’s fourth largest steel producer. Besides Nippon, Cleveland-Cliffs, Nucor and ArcelorMittal, a Luxemburg steel company, participated in the bidding process.

The U.S. Committee on Foreign Investments, chaired by Treasury Secretary Janet Yellen, is reviewing the deal for anti-trust violations as well as national security concerns.

I discussed the details of the U.S. Steel sale in this video.

Thank you for becoming a subscriber here on Substack and for your continued support!

Have a wonderful weekend!

Consumer confidence went up? I mean, seriously, how is this calculated and who's even being polled for this LOL?

Thanks for your reports, Lena. Have a very merry Christmas!

The Bankruptcies tell me that the unemployment figures are a Fabricated Lie, and are actually much higher.

I personally can't see inflation trending downward when the price of goods being shipped, as well as the crude oil price, are both destined to rise, based on the conflict in the Middle East, and if the US uses ots current series of excuses to start a conflict with Iran, you can be assured that inflation is going to escalate.

Loan defaults cause a loss of value, and thus also contribute to rising inflation.

It appears that those running the speculative prediction probability of interest rate decreases, as well as the Subjective consumer confidence index, are more likely a bunch of bookies running a betting shop, and believing or betting on their odds, is a sure fire way to lose your money.