Weekly Recap: Mortgage Rates Close Below 7%, Fed To Cut Rates In Q1 2024 and New Bill To Force Big Investors Sell All Single Family Homes

News Summary For The Week Ending December 15, 2023

After the FOMC voted to keep the federal funds rate unchanged, the Federal Reserve officials now expect three rate cuts next year.

Lower rates should be highly beneficial for the banking industry as they will see a reduction in funding costs and lowering of billions in unrealized losses.

Goldman Sachs now sees Fed’s first rate hike in March:

“We now forecast three consecutive 25bp cuts in March, May, and June to reset the policy rate from a level that Powell has recently taken to describing as 'well into restrictive territory' rather than just “restrictive” and that most of the FOMC will likely soon see as far offside with inflation trending near 2%”

According to the Treasury’s report released this week, the U.S. federal government’s deficit surged to $314 billion in November. Interest paid on federal debt was $66.3 billion higher over the first two months of fiscal 2024 than in the same year-ago period.

Interest expense on federal debt will soon surpass defense spending.

I discussed the report in great detail in a recent video. You are welcome to view it here.

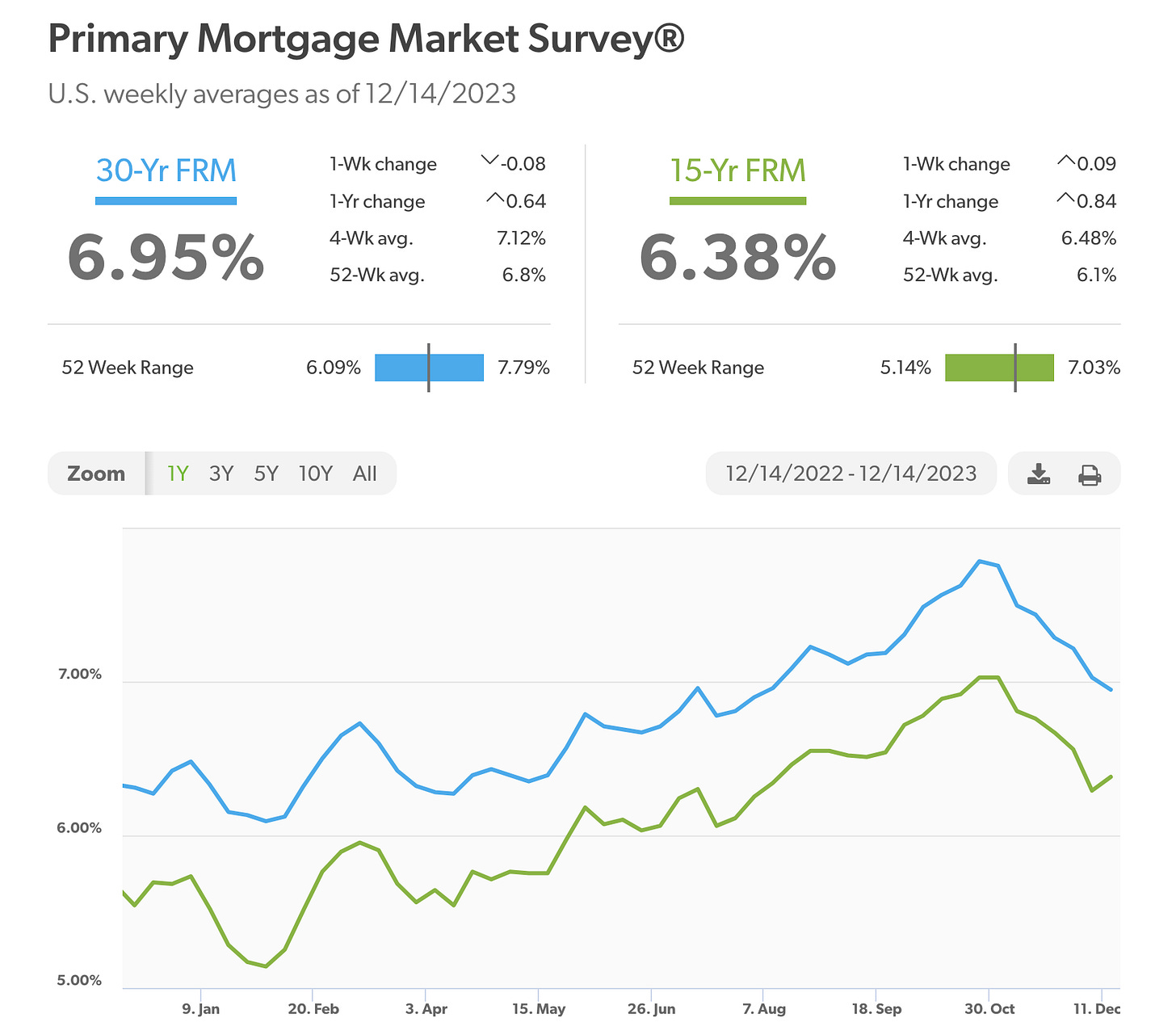

As the result of the Fed’s decision and rate cut expectations, the average 30-year mortgage is down to 6.95%, closing the week below 7% for the first time in four months.

Mortgage rates dropped over 80 basis points over the last 6 weeks.

While this is great news for homebuyers, it’s worth noting that lower rates may increase demand sending home prices even higher.

Housing affordability hit a new low in the United States. It is now cheaper to rent than to own a home. The average monthly lease payment has increased to $2,184 while the monthly mortgage payment is $3,322.

The gap between monthly rent and mortgage payments has been closing. A record high of Americans spend in excess of 50% of their income on rent.

Further details are discussed in one of my recent videos here.

A new bill titled “The End Hedge Fund Control of American Homes Act” has been introduced in the Senate that would force mandatory evictions of renters living in homes owned by large investors, and then require those homes be sold to individual buyers over a period of ten years, eventually banning hedge funds from owning any single-family homes.

Additionally, it would prohibit hedge funds from owning any single-family homes.

A new round of layoffs has been announced. Citigroup will shut down its municipal business by the end of Q1 2024 in an effort to improve earnings. Etsy is laying off 11% of its employees, pointing to a “very challenging environment”. Ernst & Young laid off a number of advisory, audit and tax staff, including partners making at least $1 million per year.

This year layoffs are ranging banking, retail and everything in between.

Higher interest rates (ie. higher borrowing costs) have made a substantial negative impact on many large businesses.

JPMorgan expects Ethereum to outperform Bitcoin and other cryptocurrencies in 2024.

“We believe that next year Ethereum will re-assert itself and recapture market share within the crypto ecosystem. The main catalyst is the EIP-4844 upgrade or Protodanksharding, which is expected to take place during the first half of 2024. We believe that this upgrade will likely prove a bigger step towards improving Ethereum network activity, thus helping Ethereum to outperform.”

Argentina's President Javier Milei announces currency devaluation by 54% and spending cuts. Milei hired a former Deutsche Bank and JP Morgan banker as his new head of the central bank. Additionally, during his inauguration address he asked the people of Argentina to prepare for “months of pain”.

Watch this video for further discussion.

China’s central bank injected a record monthly amount (policy loans) into its financial system in order to boost economic growth while keeping the interest rate unchanged. The People’s Bank of China offered commercial lenders a net 800 billion yuan ($112 billion) of one-year loans, more than twice the expectations.

Hi Lena , I have not read the "END Hedge fund control of American Homes Act of 2023 " and it has to be voted on and approved yet , But if this happiness it will put a lot of properties on the market at

same time when the America is going into server recession and shortly latter a Depression . Also if these properties have Being bundle up into securities Bonds ,it could have a more negative effect on

the real estate Market.

On President Javier Milei i have uncovered many distributing things which makes my soul feel BAD.

Unless he is playing as a double agent ,my conclusion is he is a Zionist Sheel , I could not understand

why he wrap himself up with the Israel Flag , with all the evidence and cross referenced now i understand. I really like Argentina and i was hoping for a turn around , Have a nice weekend

Thomas

As you can observe, markets determine the interest-rates (the price of money)

The rate on 10Y-US-bonds dropped significantly this week and is now below 4%. Mortgage-rates are also dropping as you show.

The FED is just following the rates that the markets dictate. The FED is NOT in charge of interest rates. The FED is not in charge of anything.