Weekly Recap: Mortgage Rates Decline, Fed's Promises Don't Appear To Work As Growth Expectations Are Edging Lower

Key Events For The Week Ending December 1st, 2023

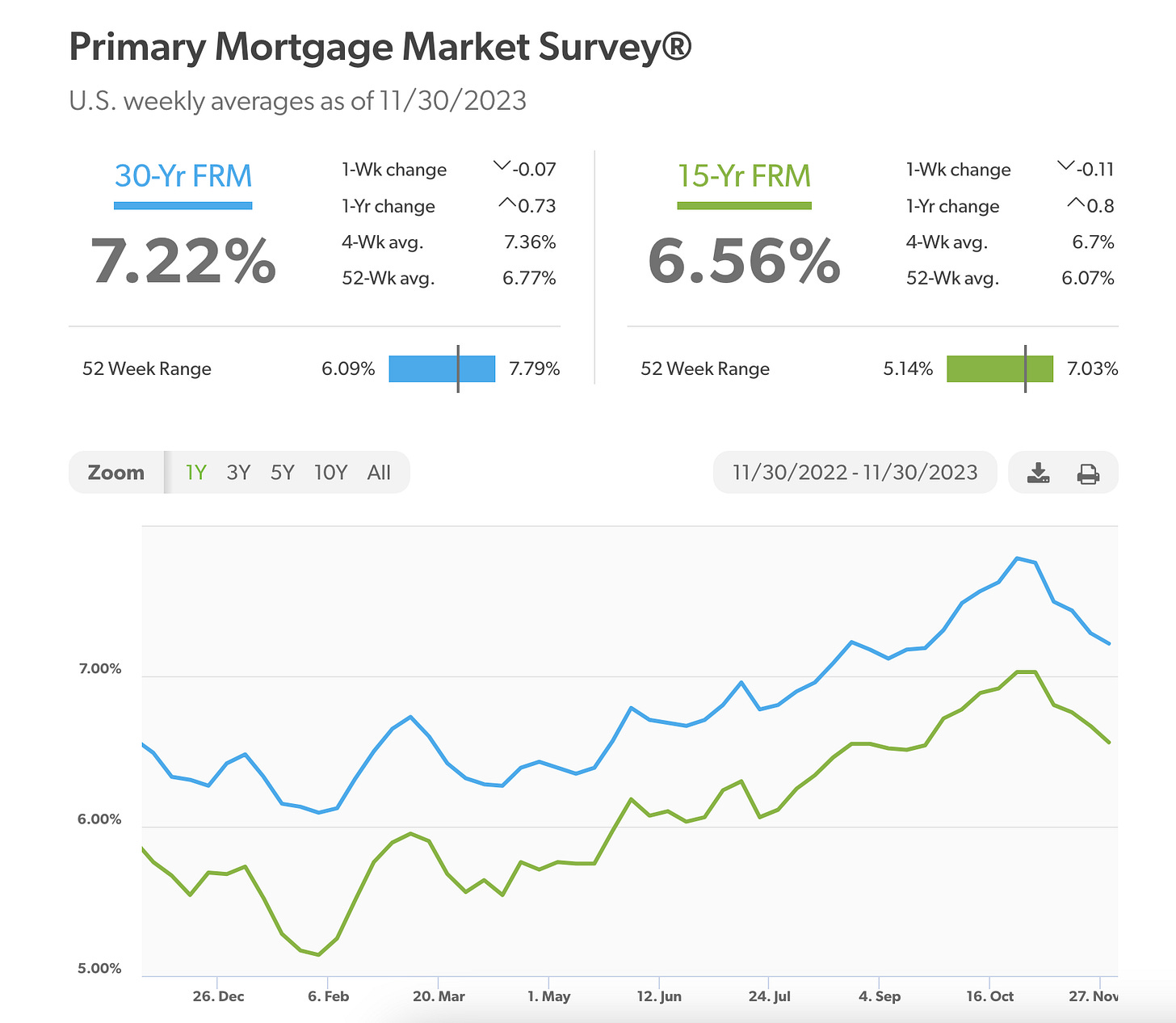

Mortgage rates declined for the fifth consecutive week. According to Freddie Mac, 30-year fixed-rate mortgages averaged 7.22% as of November 30th vs. 7.29% last week vs. 6.49% during the same period last year:

Home sales have been posting consistent declines. According to National Association of Realtors, the latest data shows that pending home sales continue to decline but at a slower pace than expected. On a year over year basis, pending transactions in October fell 8.5% vs. 11% decline in September.

Based on the data released by the U.S. Department of Commerce, the Fed’s preferred inflation reading, core PCE, increased 3.5% as of October, indicating a decline of 0.2% since September reading of 3.7%.

The Federal Reserve believes that this signals the inflation has been slowing, despite being well above its 2% target rate of inflation.

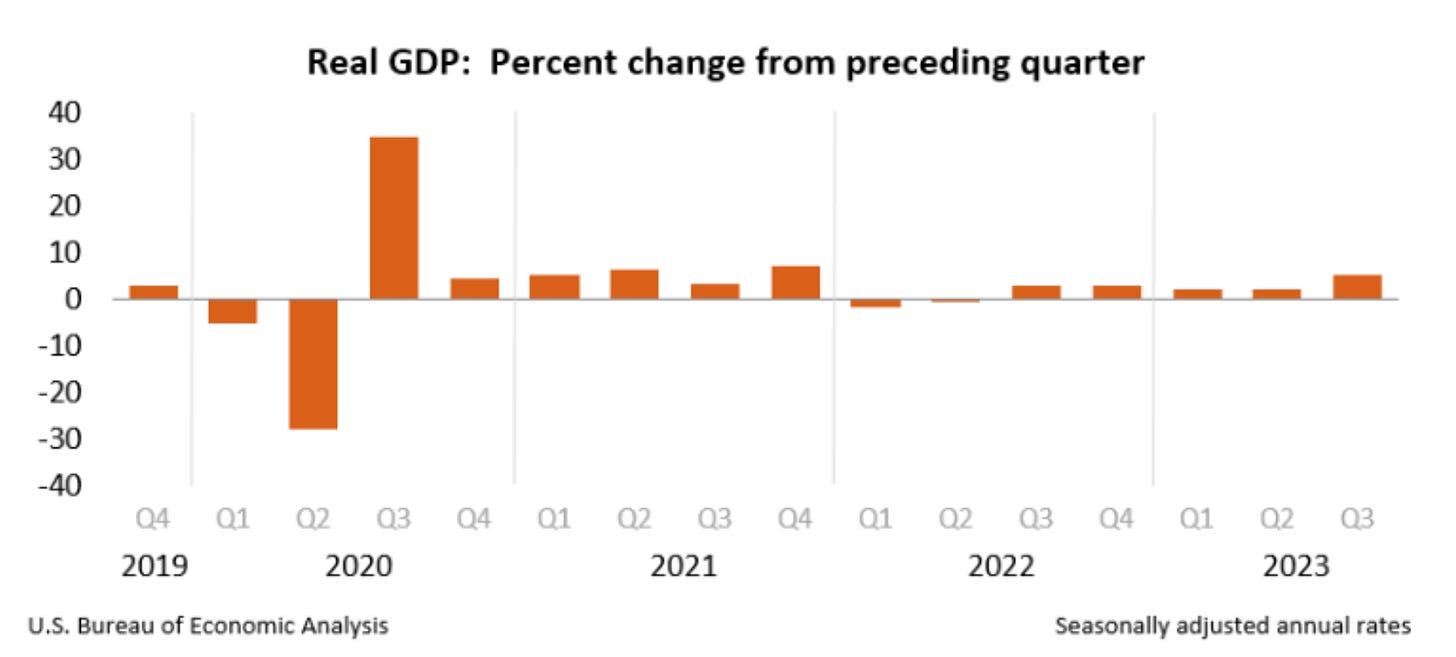

According to the Bureau of Economic Analysis, the U.S. GDP growth as of Q3 2023, exceeded expectations at 5.2% vs. 4.9% forecasted.

Once again, an increase in consumer (ie. consumers are taking on more debt), state and local government spending was quoted as the primary drivers for the positive GDP reading.

Interestingly enough, the BEA says that the personal savings rate rose to 4.0% vs. 3.8% estimate.

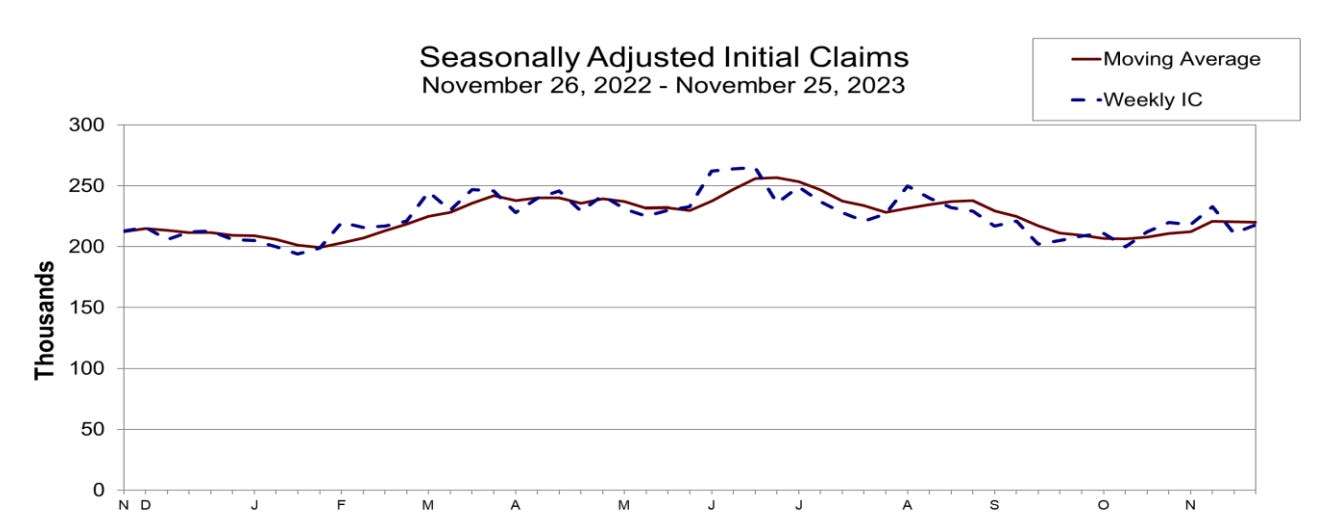

According to the Department of Labor, for the week ended November 25th, initial jobless claims rose to 218K vs. 219K expected vs. 211K prior week. The three-week moving average remains consistent:

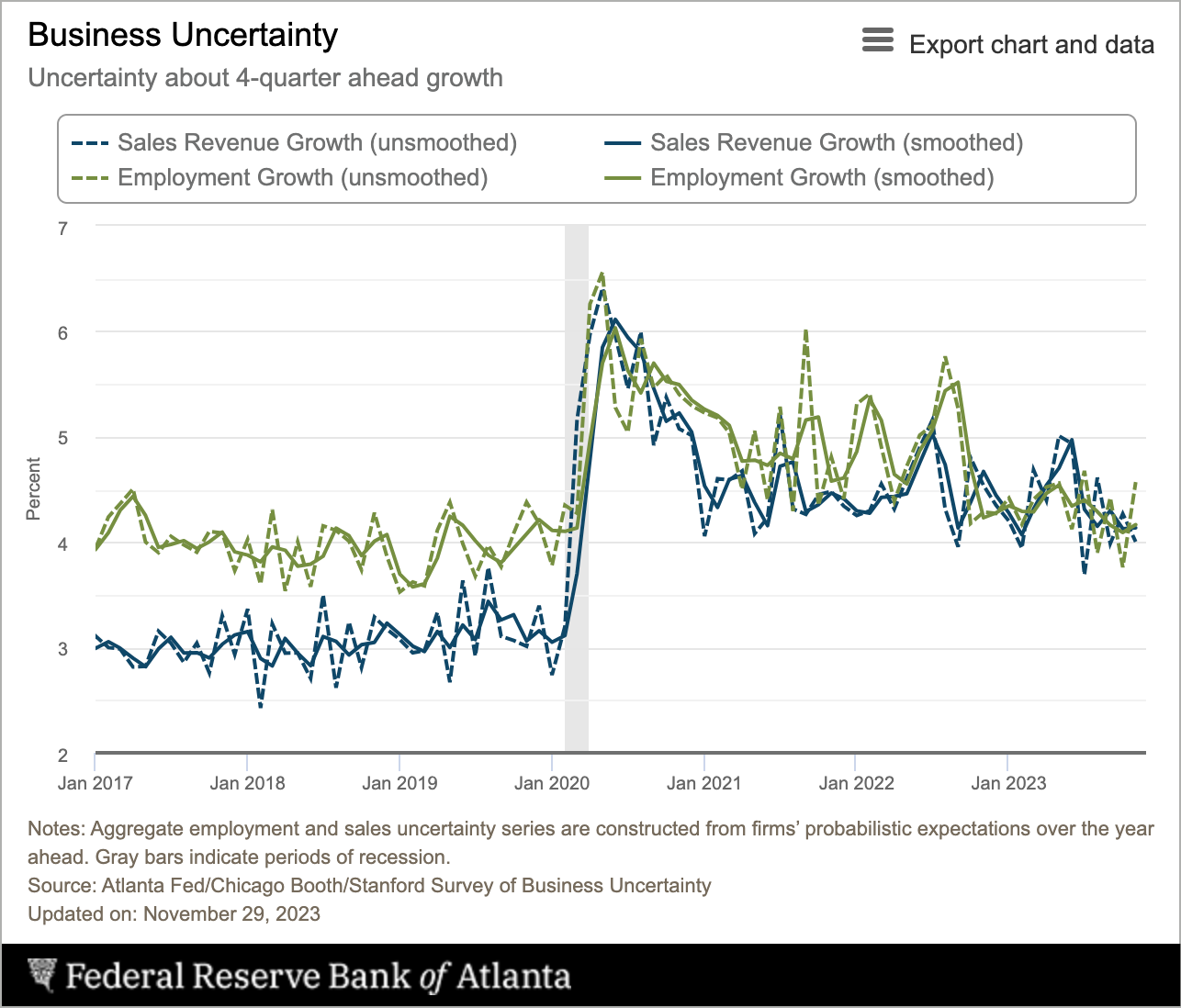

Despite the Federal Reserve announcing that the inflation has been slowing and a soft landing might still be in sight, the Federal Reserve of Atlanta reported that sales and employment growth expectations continued to edge lower.

The uncertainty remains higher than it was even prior to the pandemic. According to the Fed’s survey, interest rates are the biggest concern.

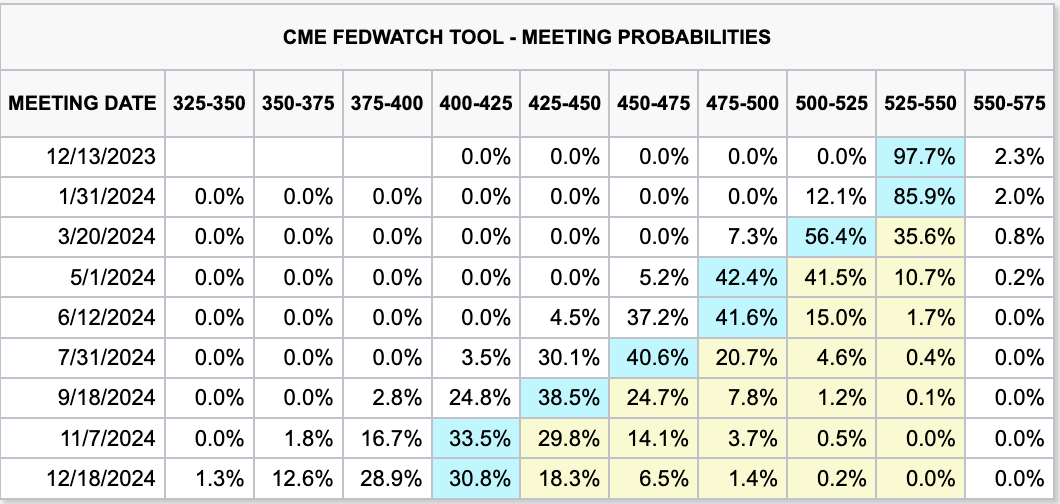

On Friday, December 1st, Fed Chair Jerome Powell said that talks of cutting interest rates are "premature” even though the market has been pricing in rate cuts as early as spring of 2024.

Similarly to other statements made over the course of the year, Powell repeated that the Federal Reserve plans on “keeping policy restrictive” until they are convinced inflation is heading back to 2%.

A long pause or increasing interest rates will continue to create pressure on the US budget deficit by fueling already soaring interest expense.

The United Arab Emirates announced that the U.S. dollar will no longer be used for oil transactions. The news is covered in detail in this video on Rumble as well as on YouTube:

The United States surpassed $33.8 trillion in national debt. The interest expense on the debt is expected to surpass federal expenditures on the U.S. defense spending. I discussed the details in this video on Rumble, also available on YouTube:

Have a wonderful weekend! Thank you for supporting my work!

Lena

Hi Lena ,thank you for your very well done articles .Russia will be taking the lead for the BRICS starting

Jan 1 2024 ,and sets the agenda Russia wants to push for Gold backing, China and India wants to hold

off at this time ,the difference is that both China and India are major energy importers so they are satisfied exchanging their currencies rather than gold ,Russia on the other hand is a net exporter does

not require all the varies currencies from other countries ie ( India ) because they intend to be self sufficient and they will have a trade in balance in their favor , much less so for China ,their trade

will go exponentially as China will want Russia to supply all the energy to China mins the long term contracts that China has to evert the mid-East, travel by sea ,insurance cost, time delays , security ,

and most pipe lines for gas and oil over land rather that sea except for the Russian Artic sea route .

If the BRICS + goes toward Gold ,the Dollar will slide very fast ,we shall see.

Have a nice weekend

Thomas

that China has

Love that I get this via email. Keep up the great work Lena!!