Yellen's China Trip, Bank Liquidity Tensions Rise, Safe Haven Assets Continue to Rise

Key Events for the Week Ending April 7, 2024

U.S. job growth surged past expectations, adding 303,000 jobs in March vs. 212,000 consensus, vs. 270,000 jobs added in February. However, the actual data tells a completely different story and points to several extremely concerning trends in the labor market. One of these trends is all net job gains are driven by illegal immigrants:

A recent video explains the latest jobs report in detail: Rumble | YouTube | Locals.

Following the labor market report, the Federal Reserve may not cut rates later this year. Federal Reserve Governor Michelle Bowman commented:

“While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse. Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2 percent over the longer run.”

Dallas Fed President Lorie Logan said it is too soon to think about rate cuts. Additionally, Minneapolis Fed President Neel Kashkari commented that there may not be rate cuts this year at all, adding that rate hikes are not off the table.

Treasury Secretary Janet Yellen is on a trip to China until April 9th. She’s expected to address China’s manufacturing “excess capacity” (although nobody knows who actually sets the rules of what “over-capacity” is in the context of foreign production):

Yellen said she would “not rule out” raising trade barriers to protect US green tech businesses from Chinese competition.

Yellen’s visit comes a week after a group of 20 U.S. top CEOs met Xi Jinping in Beijing to discuss future investment opportunities and partnerships.

While Yellen says she is in China to protect “American workers”; it’s likely that her visit will be as successful as her trip in July 2023.

Here’s a recent video for further details: Rumble | YouTube.

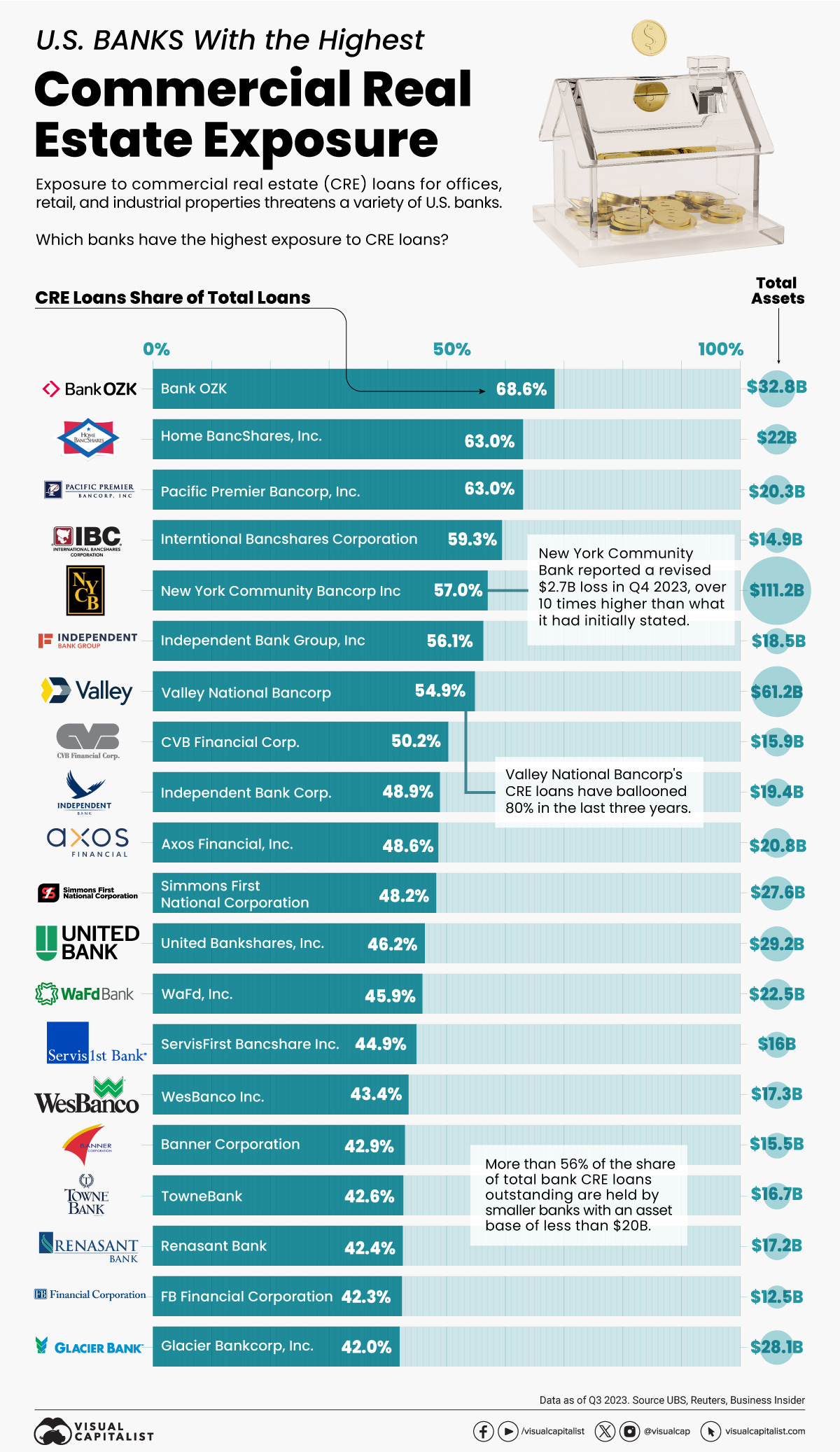

The Federal Reserve is assessing the banks’ exposure to commercial real estate.

There is approximately $5.7 trillion in commercial real estate debt outstanding. If the rates stay higher for longer, it’s likely the Fed anticipates small and mid-size banks are facing major liquidity threats.

Here’s a list of top banks with the highest exposure:

This is especially concerning given that banks are exposed to a record high in consumer loans, nearly $2 trillion and counting.