Failed Coup, US Dollar Rises Following Presidential Debate, Cost of Living Crisis Worsens

Weekly Reap: June 29, 2024

Core PCE inflation eased in May, indicating a rate cut may be a possibility.

May's personal consumption expenditures price index fell to 2.6% on a year over year basis, in line with expectations.

As U.S. consumers deplete their savings, their household debt reaches new records.

Since the second half of 2021, Americans depleted $2.3 trillion of accumulated savings, while their credit card debt surged by nearly 40%, or $290 billion, during the same time period.

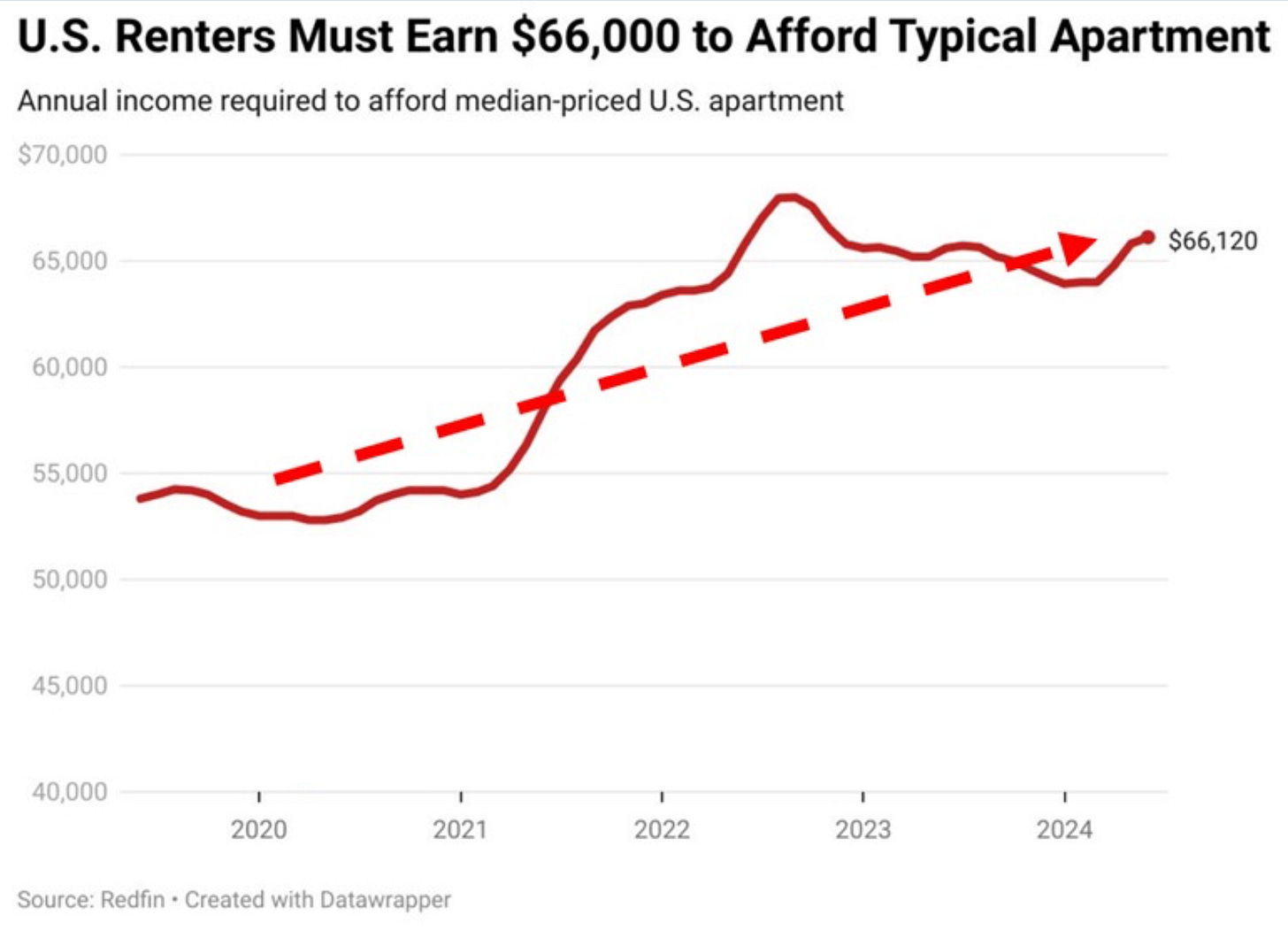

Shelter costs in the U.S. have reached new records. Renting and buying are both unaffordable.

Median income needed to afford renting is up 24% since the 2020, according to Redfin. US renters now must earn at least $66,000 annually to afford an apartment, while an average renter household earns $54,712 annually. As a result, only 39% of renters earn enough to pay for the median-priced apartment.

President Biden’s poor performance during the first Presidential debates send the US dollar surging.

In case you happened to skip the debate, here’s a clip to give you an idea of what you missed:

Joe Biden’s disaster of a performance indicated that if Trump is elected, lower corporate taxes would contribute to higher stock price and bond yields.

The European Union and the United States are preparing to impose sanctions on Russian fertilizer, which has been in high demand in Europe as well as the US.

In 2023 alone, the US purchased nearly $1.5 billion worth of fertilizer from Russia. Russia accounts for around a third of the EU’s total imports, while France imports 80% of its fertilizer needs from Russia.

Not only is Europe unable to function without cost effective natural resources (ie Russian natural gas, LNG and crude oil), but also it will find it nearly impossible to revive its domestic production of fertilizer without access to cost-effective natural resources.

You are welcome to watch one of my recent videos for more context:

Larry Fink, the chair and CEO of BlackRock, issued a warning to the G7.