Fragmenting Economies, Gold Is Less Volatile Than Treasuries and Xi's European Trip

Weekly Recap: Week Ending May 12 2024

Hello All!

I hope you are having a wonderful weekend. Before the new week starts, here’s a quick recap of the key events you may have missed.

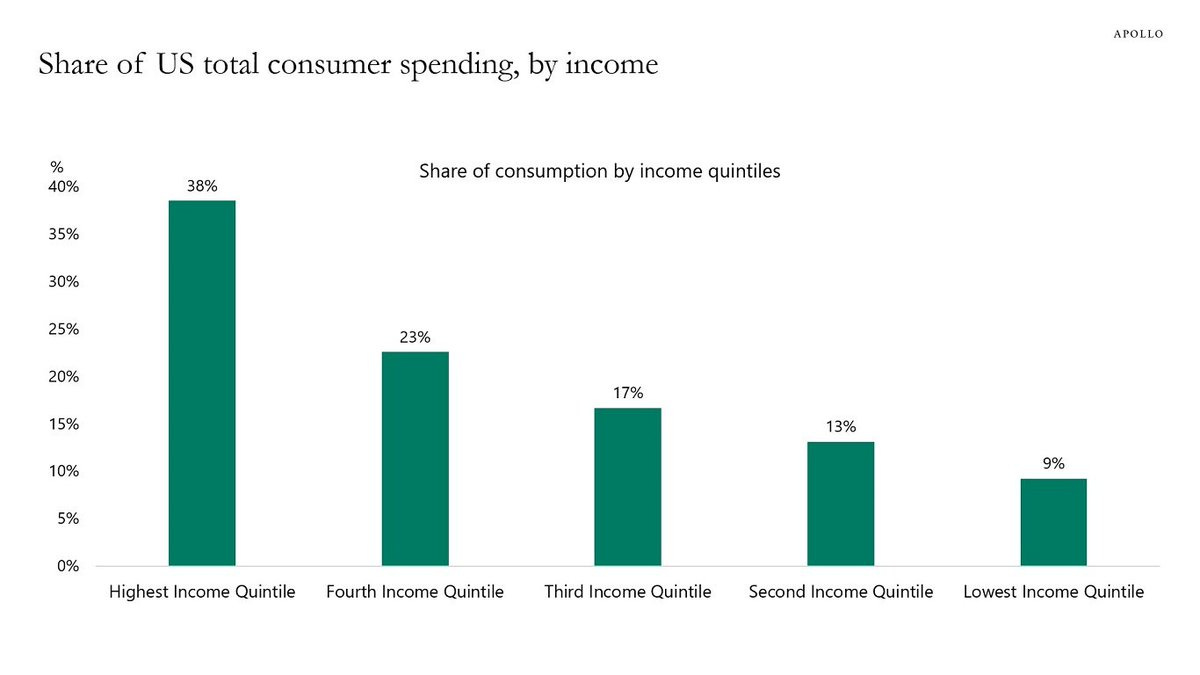

“Bidenomics” at work: in the United States, the top 20% of incomes account for 40% of consumer spending in the US. At the same time, the bottom 20% of consumers now account for just 9% of consumer spending.

Delinquencies on commercial real estate loans are on the rise, according to the Fed’s recent semi-annual report published in May 2024.

The delinquency rate for consumer loans increased for the first time since early 2020, while the delinquency rate for commercial real estate loans rose to a five-year high. Commercial property tied to these loans are primarily offices, hotels, warehouse facilities, and retail stores.

Consumer delinquencies are driven by credit card and auto loan debt. The delinquency rate for auto loans exceeds its pre-pandemic level.

The University of Michigan May consumer sentiment is far from promising: May reading declined to 67.4 vs. 76.0 forecasted vs. 77.2 in April. The drop is extremely significant and highlights a broader deterioration in consumers’ finances fueled by rising inflation and tight credit conditions.

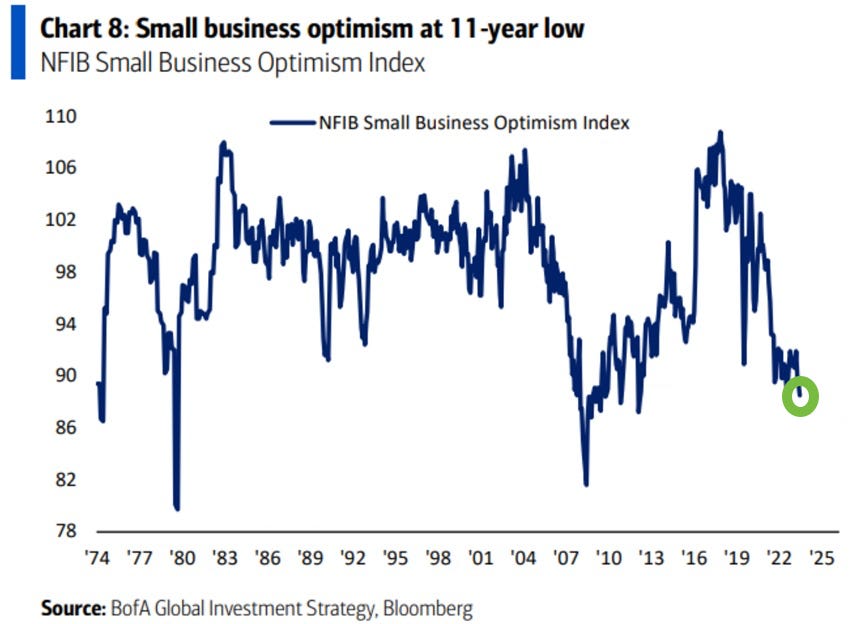

In addition to consumers, small business sentiment declined to an 11-year low. It is now worse than during the 1990s recession:

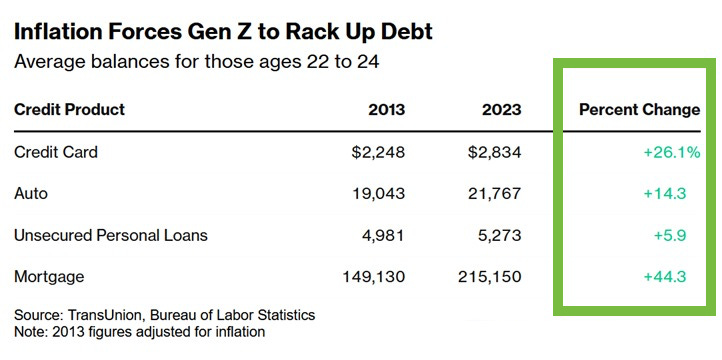

Generation Z have more debt than ever: they now hold 44% more mortgage debt, 26% more credit card debt and 14% more in auto loan than their age group (ie Millennials) in 2013.

Meanwhile, Gen Z make an average of $45,493 per year vs. $51,852 annually earned by Millennials earned in 2013.

As delinquencies continue to rise and consumer sentiment dips, consumer borrowing rose less than expected. Overall, it’s indicative of the economic slowdown and consumers are struggling with high debt (recurring monthly payments mostly driven by high-interest credit cards) and rising inflation.

Total outstanding consumer borrowing reached $5.06 trillion. Revolving credit (which includes credit cards) increased at an annual rate of 5.7% vs. $10.2% in the prior month.

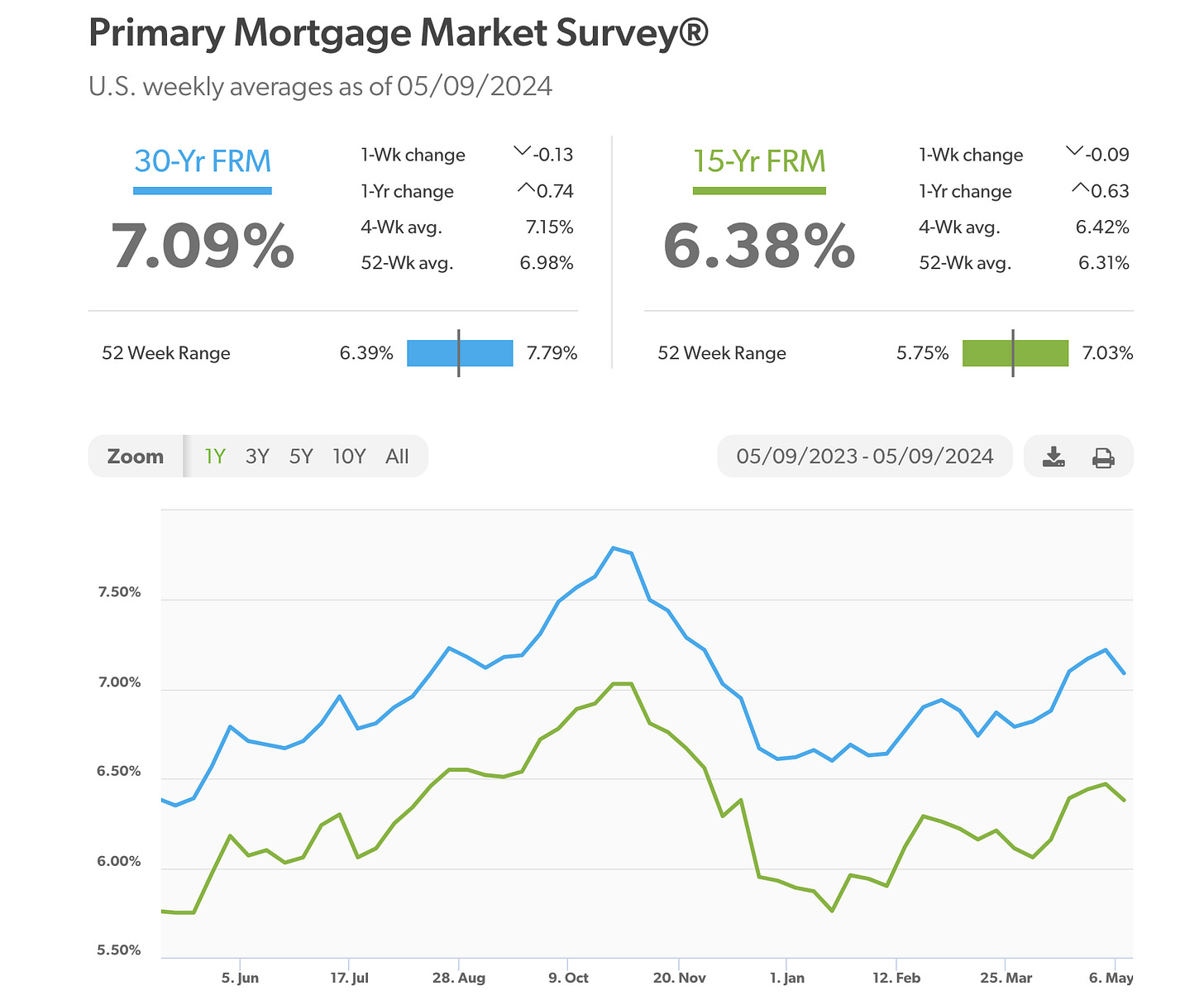

Following the release of the jobs report, U.S. mortgage rates declined after nearly 5 straight weeks of increases.

30-year fixed rate averaged 7.09% vs. 7.22% a week prior;

15-year fixed rate averaged 6.38% vs. 6.47% last week

Gold has become less volatile than US Treasuries for the first time in decades. It is no wonder that US debt is less attractive to foreign investors who have been stockpiling gold and dumping Treasuries for months.