Global Market Instability, Central Bankers' Meeting, Rate Hikes and China-Saudi Yuan Deals

Weekly Recap as of August 24, 2024

Hello, All!

This week I’m resuming weekly recap posts. They will go live on Saturdays and include key events of the week in a condensed format. Let’s begin!

▪️ As US personal savings rate declines, household debt (primarily driven by surging credit card balances carrying an average of 21.5%), has spiked.

The trend is indicative of a decline in consumers’ purchasing power and subsequent slowdown in economic activity.

▪️ The annual economic symposium in Jackson Hole, Wyoming, concluded this week.

At the conclusion of the Fed’s Jackson Hole Symposium, Jerome Powell commented:

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Powell indirectly acknowledged the troubling trends in the U.S. labor market (although without appropriately addressing the issue, as one would expect, following the massive downward revision of 818,000 in jobs numbers).

I discussed the four key takeaways from the bankers’ meeting in Jackson Hole in a recent video:

Also, the video is available on Rumble here.

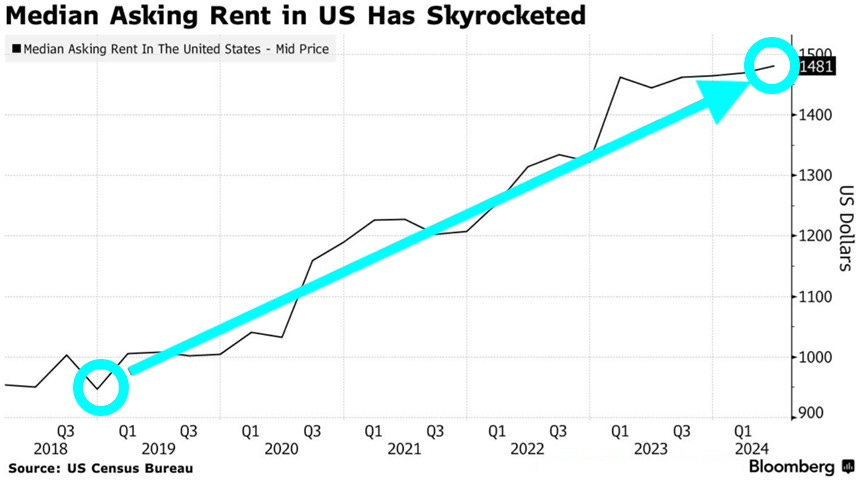

▪️ US rent prices are skyrocketing as housing affordability worsens: median rent prices in the U.S. reached $1,481 per month, an all-time high, as of June 30, 2024.

According to the US Census Bureau, median rent surged 56% since 2019. Median rent is now approximately 29 percent of the average monthly disposable personal income vs. 24 percent just 4 years ago.

▪️ The latest Fed survey shows a sharp increase in job seekers compared to a year ago.

The proportion of individuals who reported searching for a job in the past four weeks increased to 28.4 percent, the highest level since March 2014, from 19.4 percent in July 2023.

The average full-time offer wage received in the past four months decreased slightly to $68,905 from $69,475 in July 2023.

Satisfaction with wage compensation at the current job fell to 56.7 percent from 59.9 percent in July 2023. Satisfaction with non-wage benefits fell to 56.3 percent from 64.9 percent. And satisfaction with promotion opportunities dropped to 44.2 percent from 53.5 percent.

▪️ U.S. start-up failures rose 60 percent, increasing 254 over the past year, the highest level since at least 2019.

According to data from Carta, which provides services to private companies, start-up shutdowns are rising sharply, even as billions of dollars of venture capital flows into artificial intelligence outfits.

Carta said 254 of its venture-backed clients had gone bust in the first quarter of this year. The rate of bankruptcies today is more than seven times higher than when Carta began tracking failures in 2019. Only 9 percent of venture funds raised in 2021 have returned any capital to their ultimate investors, according to Carta. By comparison, a quarter of 2017 funds had returned capital by the same stage.

▪️ A shocking downward 818,000 revision to U.S. jobs numbers reveals data manipulation, inaccuracies.

Perhaps the most shocking news of the week was the jobs data revision as of March 31 2024, which indicated that the US economy created 818,000 fewer jobs than reported initially. According to the BLS, the actual job growth was nearly 30 percent less than reported previously. The final annual revision for 2024 is expected to be released in February of 2025.

For more details, watch the full video: YouTube or Rumble.

▪️ The BRICS+ Bloc Suspends New Memberships as More Than 40 Countries Express Interest in Joining

According to Sergey Lavrov, the Foreign Minister of Russia:

“By the overwhelming majority, the ten members decided to ‘take a pause’ with new members to ‘take in’ the members who have doubled the association. At the same time, we are working on categories of partner countries as stages ahead of a full-fledged membership.”

The move to suspend new memberships will allow member states to align and to create an ideal “partner model”. While future expansion of the bloc is unquestionable given the amount of interest and the long-term agenda, addressing members’ differences now will ensure future success. In my recent video I discuss the positive outcomes of the wise, but perhaps not very popular, decision.

▪️ A key regional actor in Central Asia, Azerbaijan, formally applied to join the BRICS+ bloc.

The announcement came a day after Vladimir Putin left Baku following a two-day state visit. The expansion of trade ties as well as border security with Armenia were discussed.

Azerbaijan's interest in joining the economic association was not a surprise. It had been previously mentioned in a joint declaration with China on establishing a strategic partnership between the two countries. The declaration was signed during a SCO, Shanghai Cooperation Organization, summit that took place in Astana, Kazahstan in early July 2024. During the SCO summit, both China and Russia welcomed Baku’s move.

▪️ China and the US agreed to set up contact group for cases of financial stress.

China’s central bank said a meeting in Shanghai produced an agreement with the US Treasury to appoint contact people to deal with any future “financial stress events,” a rare example of the world’s two biggest economies seeking common ground.

Why now? The US Treasuries are losing both value and demand, which is likely one of the main reasons for the move to boost communication. China still remains one of the top US debt holders. As the two biggest economies continue to compete and trade barriers are becoming increasingly frequent, the fragmentation of global trade appears to be imminent and consequential. As the entire world, hopefully including the US, understands that the US is on the path to a sovereign debt crisis, risks to global economy are increasing.

Full video: YouTube or Rumble.

Thank you for reading! If you enjoy my work, please consider upgrading to a paid subscription.

▪️ Bank of Japan governor Kazuo Ueda issued a warning: global markets are ‘unstable’.

Following extreme market volatility in early August partially as the result of the unwinding of the “Yen carry” trade positions, the Bank of Japan remains committed to raising interest rates.