Home Sales Fall To 1995 Levels, Office Vacancies Hit 19.6%, Biden Cancels $5B In Student Debt & The Sick Man Of Europe

Weekly Recap of Key Events

Long term mortgage rates declined: 30-year fixed-rate mortgages averaged 6.60%; while 15-year mortgage rate is 5.76%:

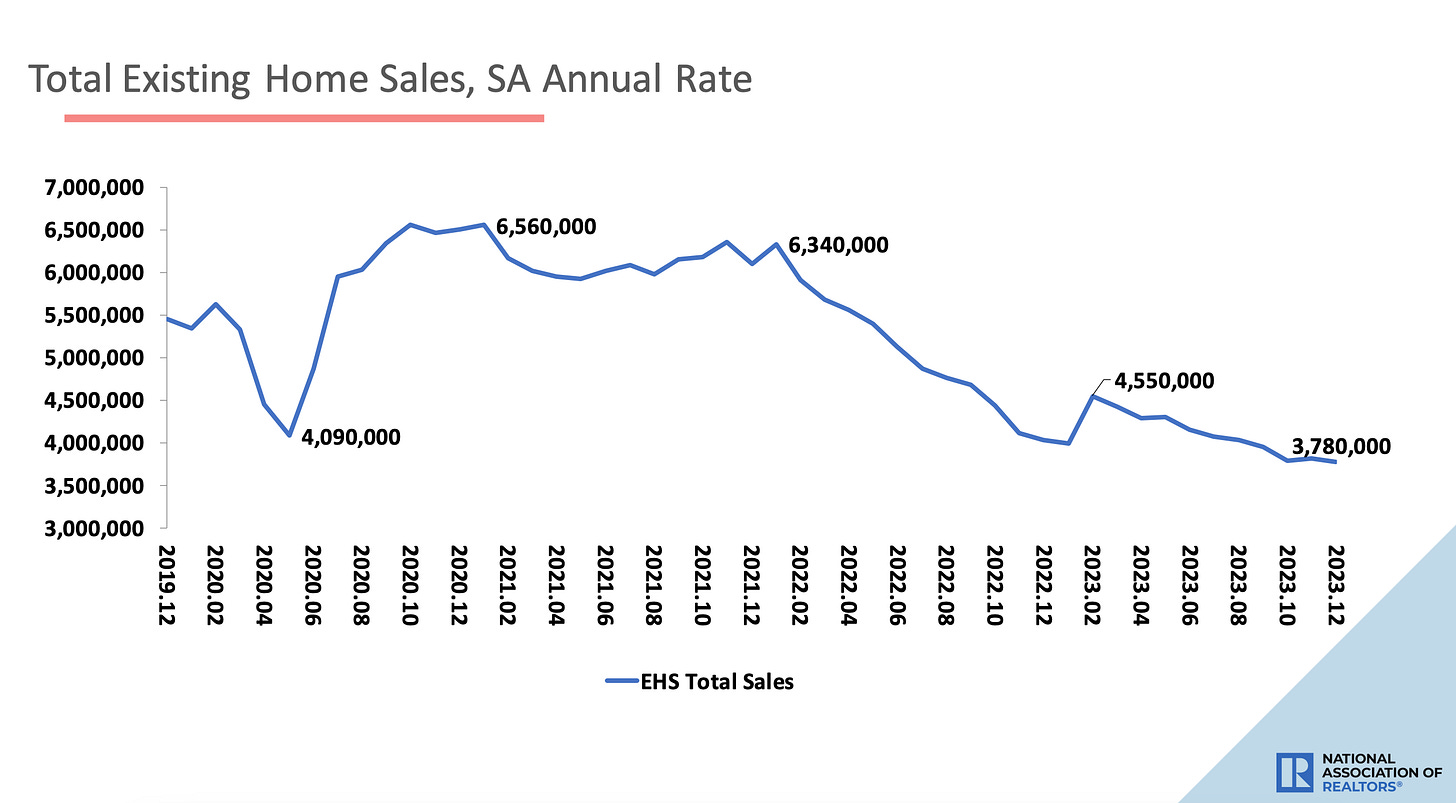

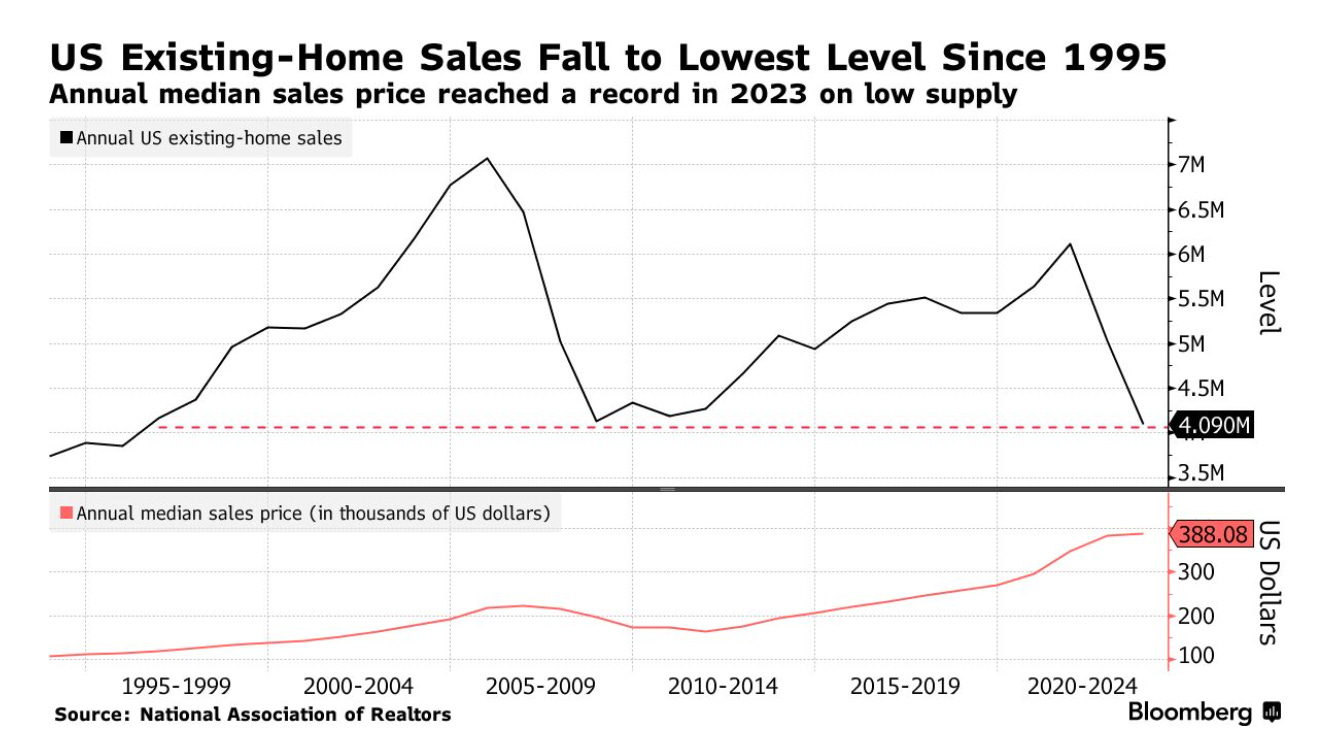

Existing homes sales in the U.S. dropped 1.0% in December to 3.78 million vs. the forecast of 3.82 million, signaling a 6.2% decline in sales year over year.

While the annual median sales price in 2023 reached a record high as the result of low inventories, the existing home sales hit the lowest level in 28 years:

In December 2023, the median home sales price was $382,600, a 4.4% increase year over year:

According to the latest (January 2024) Consumer Sentiment Index published by the University of Michigan, consumer sentiment exceeded expectations: 78.8 vs. 70.0 consensus.

Consumer sentiment is now the highest it has been since mid 2021, reportedly due to “easing inflation expectations”.

Surprisingly, the University of Michigan concludes that consumers’ personal finances have been improving:

“For the second straight month, all five index components rose, with a 27% surge in the short-run outlook for business conditions and a 14% gain in current personal finances.”

Additional details on the median wage, occupation and location of the surveyed individuals would have provided meaningful context.

The reported “improvement” in consumer sentiment contradicts the latest (December 2023) CPI data that indicated an increase in inflation.

Additionally, the University of Michigan’s report appears to contradict the fact that the level of financial distress in the United States has surpassed that of the Great Recession.

I discussed the details of the surging household debt in a video, available on YouTube and Rumble.

Analysts forecast commercial defaults to rise in the first quarter of 2024, peaking at 4.9%. These defaults are expected to be driven by companies with lower credit ratings.

Regardless of credit ratings, the number of defaults in 2023 was the highest since the pandemic and this trend is likely to continue as tighter lending standards and higher borrowing costs continue to be challenging for businesses.

U.S. office vacancy rate jumped to a record 19.6% as of December 31, 2023.

The increase in commercial real estate vacancies is very bad news for the U.S. lenders since they hold $117 billion in real estate debt that is due in 2024.

The top five cities with the highest office vacancies are:

Detroit, MI: 25.7%

Houston, TX: 25.4%

San Francisco, CA: 24.2%

Seattle, WA: 22.3%

Austin, TX: 21.2%

To learn more about how commercial real estate bubble will likely impact the U.S. banking system, watch this recent video: YouTube | Rumble.

President Biden canceled additional $5 billion in student loans. Total student loans forgiven under the Biden administration total $136 billion. According to Bloomberg:

“Polls show Biden’s support has weakened among Black, Hispanic and young voters who will be crucial to helping him secure a second term.”

U.S. Congress voted in favor of a third, since October 1st, temporary spending bill to fund the government until March 1st.

Sen. Chip Roy (R - Texas), said the quiet part out loud:

“It's Groundhog Day in the House chamber all the time, every day, yet again spending money we don't have.”

The Red Sea crisis is causing major delays in shipments (up to two weeks) and increased fears that it may impact global food supply and crude oil flows.

I discussed the details in a recent video, available on YouTube and Rumble.

In Davos, Germany’s finance minister Christian Lindner, referred to Germany as “the tired man of Europe”, apparently taking offense to the public now referring to Germany as “the sick man of Europe” as the country’s economic downward spiral continues and recovery is nowhere in sight.

German farmers, who have been protesting against the government’s cuts of agricultural subsidies, did not appreciate the latest calls made by the Davos elite to raise taxes in order to fund the green energy transition amid forecasted economic contraction.

Financial Times reports:

“Economists at Deutsche Bank this week forecast Germany’s economy would decline again in the first three months of this year from the previous quarter, “followed by lacklustre positive quarterly growth rates from the second quarter onwards”. But they forecast Europe’s largest economy would still suffer an annual contraction of 0.2 per cent this year, compared to growth of 0.2 per cent in the eurozone overall.”

Thanks for stopping by and for your continuous support of my work.

Have a wonderful weekend!

Lena, what ever happened to price disscovery and mark to market? Only found now in the Smithsonian? :)

Thanks again for another report.

I am wondering if you could do a report on your opinion with where residential housing is going. I see two schools of thought going on: one are the daily crash callers, pumping courses and enthusiastic reports that assures people of a massive dump-off and therefore a great buying opportunity; and the other crowd acknowledges that the lockdown on housing will stay the way that it is, and even get worse as mortgage rates go down and rate cuts are on the horizon, which will increase demand and forces prices back up as supply cannot keep up. I tend to go with the latter, but I would genuinely love to hear your take on things in a video or article. Thanks.