Job Cuts Spike 136% In January, Surprising Job Growth Numbers, Extended BRICS+ Bloc Meets in Moscow To Discuss Strategy

Weekly Recap For The Week Ending February 2, 2024

Domestic Events:

The Federal Reserve kept fed funds rate unchanged and indicated that rate cuts as soon as March are unlikely. Fed Chair Jerome Powell indicated that the Federal Reserve needs confidence that inflation declines before it makes the decision to cut rates.

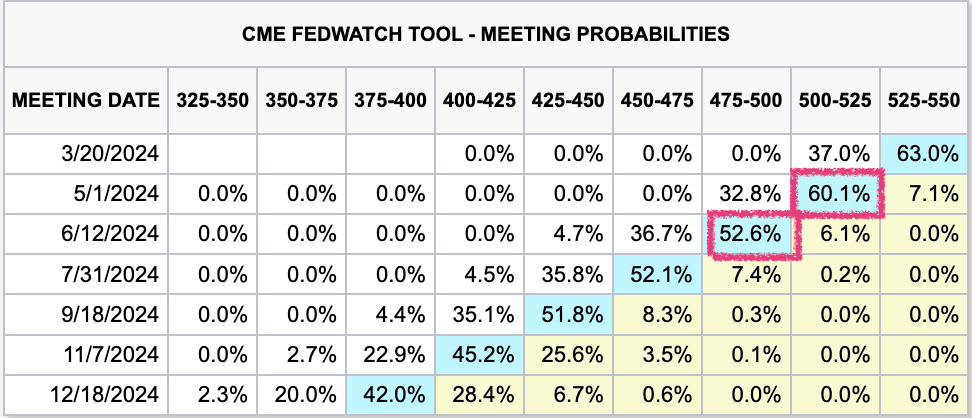

Following Jerome Powell’s press event, the probability of a rate cut increased to 60% and 52.6% in May and in June, respectively:

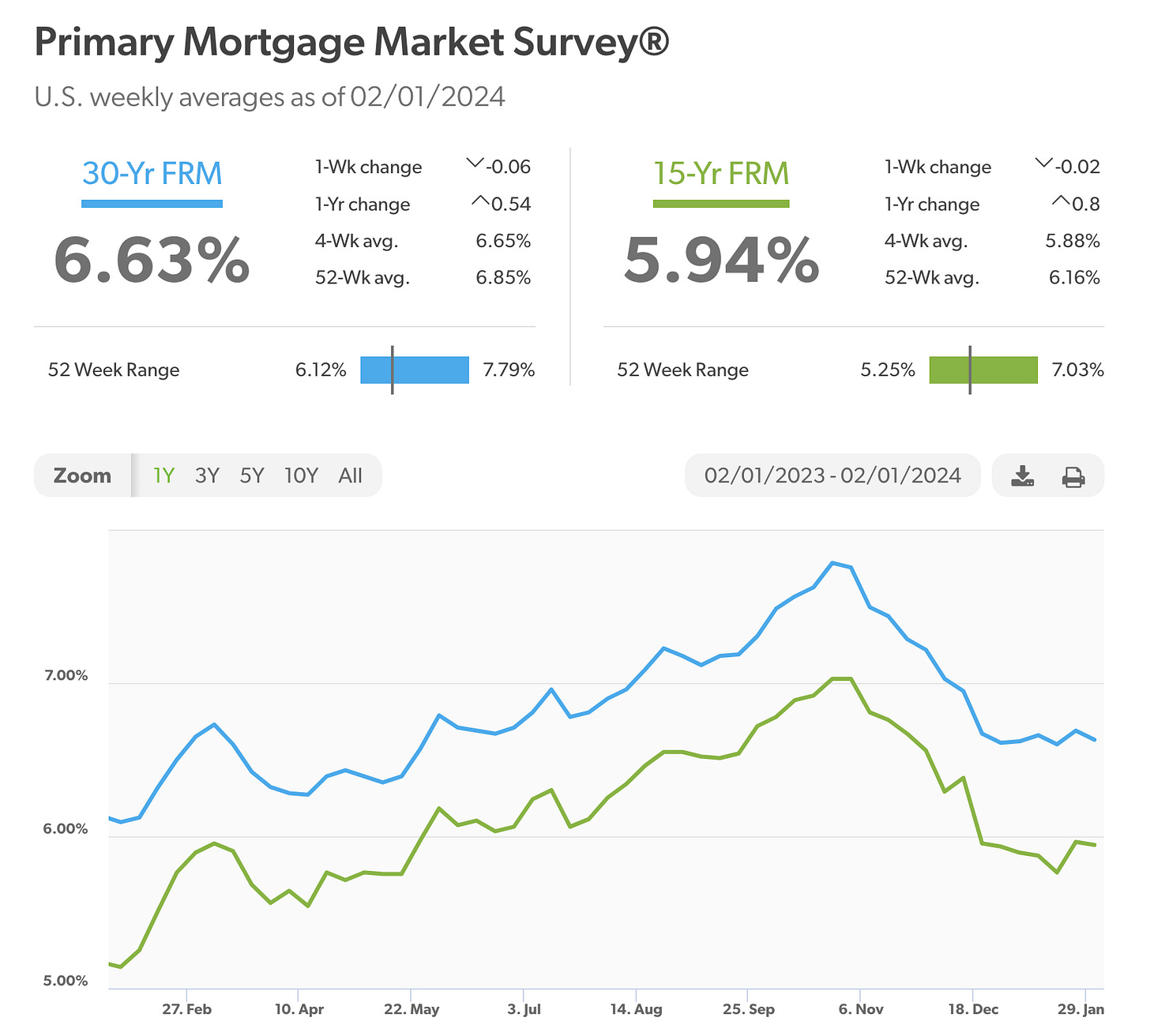

Mortgage rates declined amid the Federal Reserve keeping rates unchanged.

According to Freddie Mac, 30-year fixed-rate mortgages averaged 6.63% as of February 1st, while 15-year fixed-rate mortgage averaged 5.94%.

According to the Department of Labor, initial jobless claims rose more than expected: 224K vs. 213K expectation. This is due to a sharp increase in job cuts and layoffs, discussed below.

Additionally, private sector employment rose less than expected: 107K actual vs. 145K consensus. This indicates the economy is cooling more than expected.

In January, U.S. employers announced 83,307 job cuts, the most in 10 months, a sharp increase of 136% from 34,817 job cuts a month prior. The job cuts are due to increased input and material costs, as well as an expected decrease in consumer and business activity. Companies that announced layoffs are largely driven by the need to cut costs in an increasingly uncertain environment. Among the companies that announced layoffs are:

PayPal - 9%

Twitch - 35%

Unity Software - 25%

Discord - 17%

Wayfair - 13%

Brex - 20%

Riot Games - 11%

Duolingo - 10%

Blackrock - 3%

Plus, Citi Group, eBay, Google, Amazon and many more companies.

Job growth report released on Friday, February 2nd, effectively cemented the fact that the Federal Reserve will not cut rates until after the first quarter.

The U.S. economy added 355K jobs to nonfarm payrolls vs. +170K expected, according to the Department of Labor. The unemployment rate remained at 3.7 percent. Further, the labor force participation rate is 62.5%, unchanged from December. The official report shows job gains were the strongest in:

professional and business services - 74K

health care - 70K

retail trade - 45K

social assistance - 30K

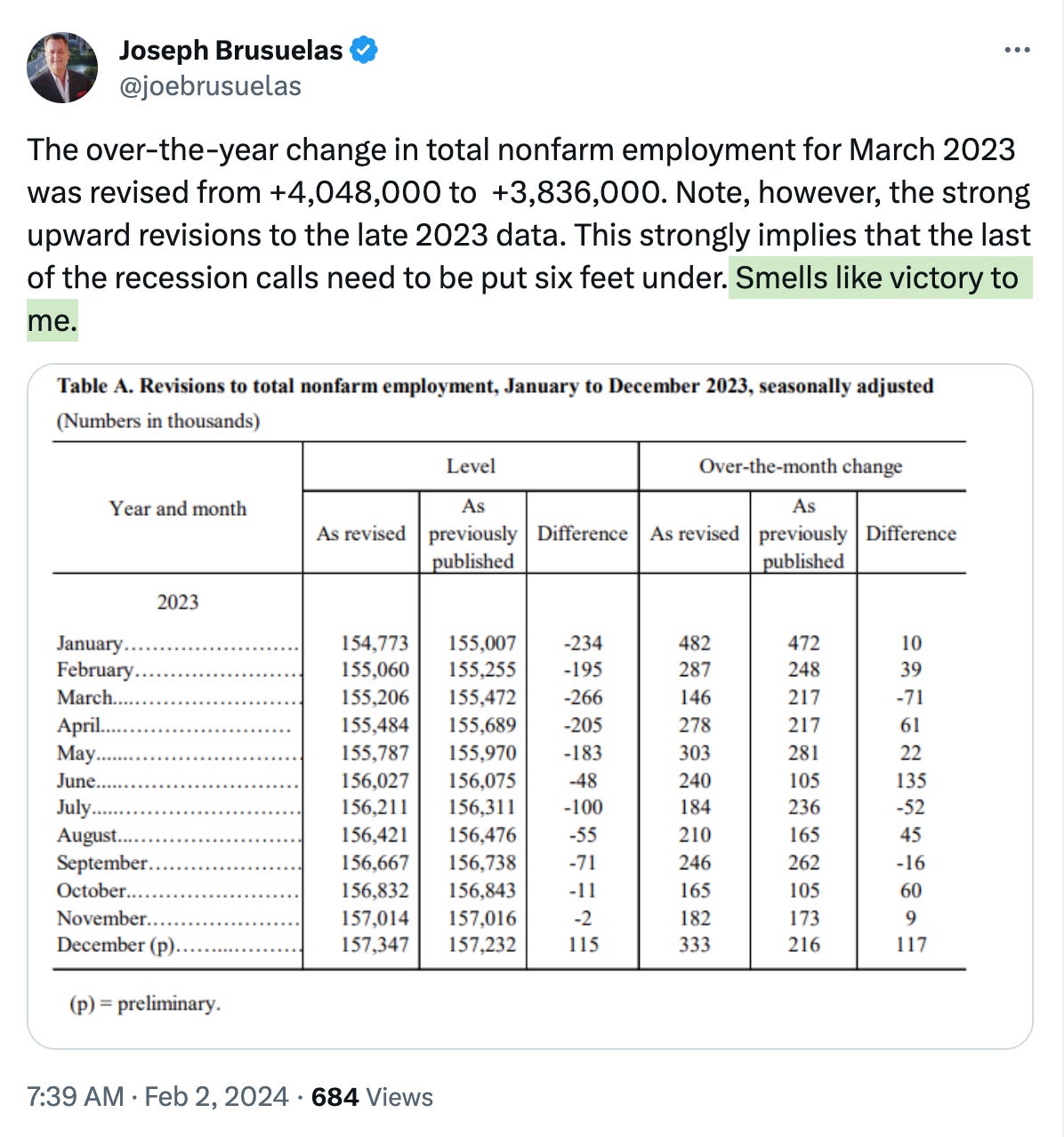

Immediately after the release of the surprising data, claims of “victory” followed from Joseph Brusuelas, RSM US Chief Economist:

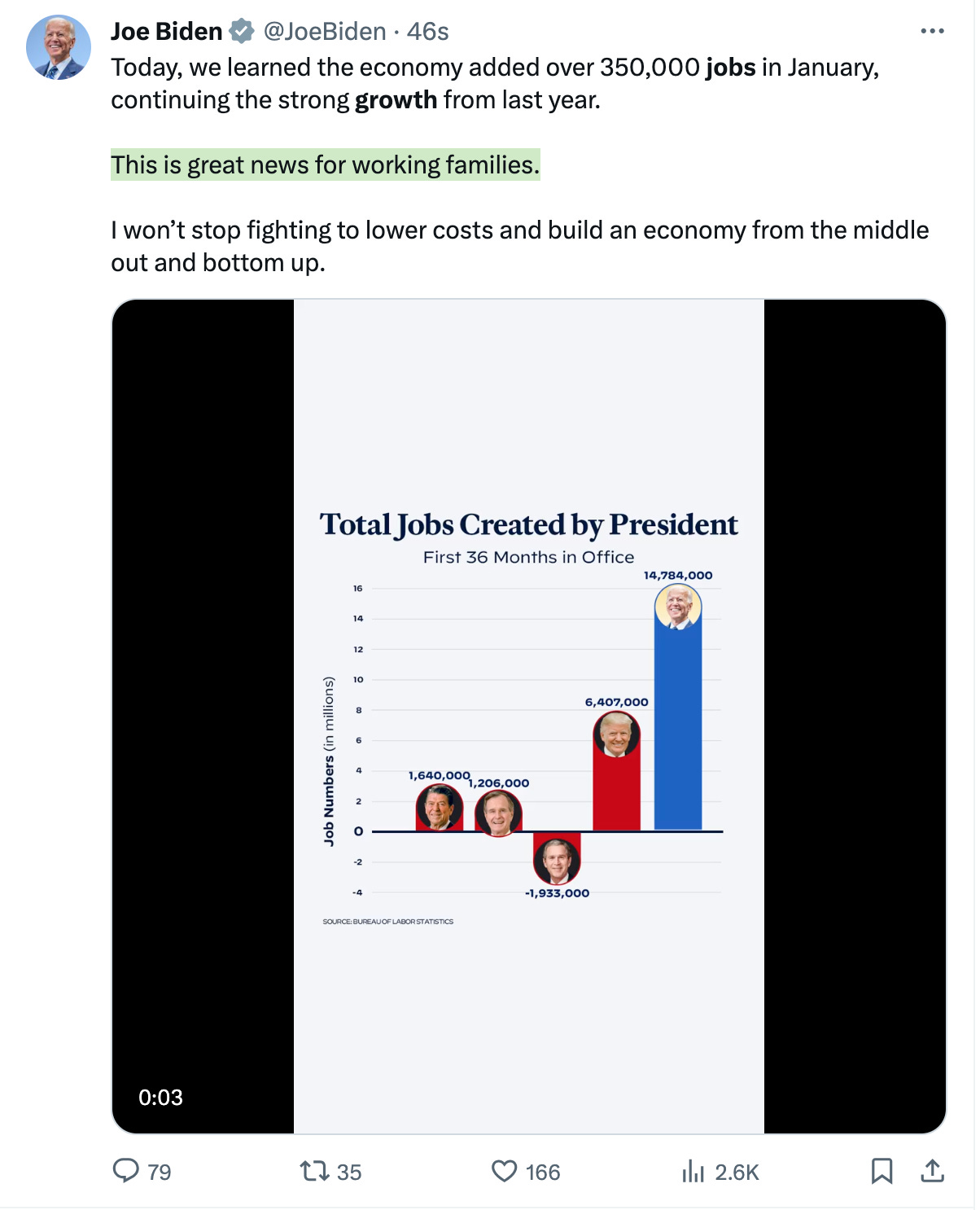

and even President Biden himself used fancy infographic to illustrate the achievement:

However, you don’t need to be an economist to see that the job growth data neither aligns with the surge in layoffs in January, nor does it make sense in the context of broader economic indicators. In fact, it makes zero sense and should be a true concern because it shows just how much real data is being manipulated. First, monthly jobs reports are always revised down later. Second, quarterly census program shows nearly 50% job growth downward revisions for the period of April through June 2023. This means the real job gains would be half the announced number at best.

President Biden halted exports of new LNG to Asian and European allies due to concerns over climate change. The impacted projects are located in Texas and Louisiana.

The timing of the ban coincided with Governor Greg Abbot refusing to comply with the Supreme Court ruling. Texas, joined by 25 U.S. states, moved forward with protecting its border against the waves of illegal immigration.

I discussed the details of the move imposed by the Biden administration as well as its impact on Europe and top LNG exporters in a recent video. Watch it on Rumble or YouTube: