These Three Red Flags May Cause a Massive Economic Crisis In 6 to 12 Months

The Federal Reserve is expecting a “soft landing”; however, the available data points to a different scenario.

Let’s take a look at three economic data sets that would help us understand where the economy stands today, and where it may be heading in the near future.

Total household debt in the United States just hit a record $17.1 trillion and credit card debt crossed $1 trillion for the first time in history. Consumers are borrowing at record high levels while saving at historically low levels. In other words, we are "fighting" inflation with debt we cannot afford.

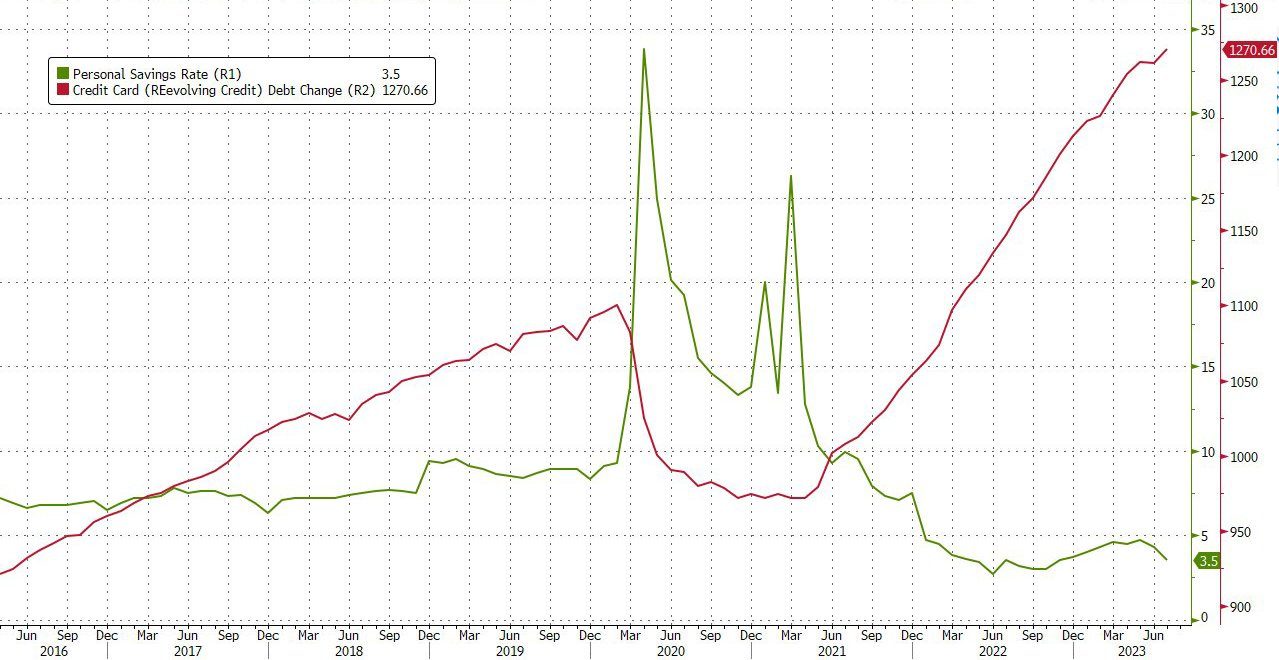

Below is the chart of personal savings rate vs. personal debt. Revolving credit in the U.S. increased $10 billion in August 2023 to a record $1.27 trillion. The personal savings rate decreased to 3.5%, its lowest reading since November 2022:

People are maxing out their credit cards while their income is being demolished by rising inflation.

Recent research found that Americans will run out of their savings by the end of October 2023. Excess savings have declined by an average of $100 billion per month since January 2022:

“Should the recent pace of drawdowns persist – for example, at average rates from the past three, six, or 12 months – aggregate excess savings would likely be depleted in the third quarter of 2023.”

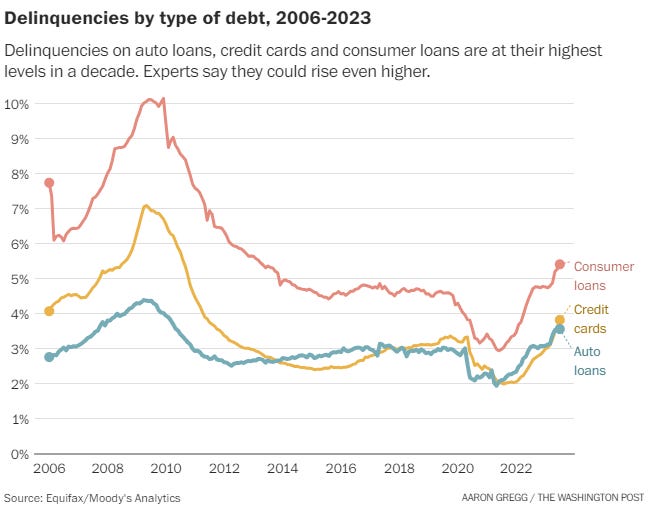

As household debt is surging, delinquencies are rising. This unfortunate scenario is not likely to change in the near term. In just one month, student loan payments on $1.6 trillion of debt will resume, creating an even less bearable burden for those who are already struggling with monthly debt repayments:

Delinquencies on auto loans, credit cards and consumer loans just hit their highest levels since 2012. As the labor market continues to cool, an increasing number of people will find themselves either unemployed or with a very limited income, and likely no opportunities to supplement it.

According to the Federal Reserve, banks’ willingness to lend to consumers, i.e. banks’ perception of inherent risk, leads delinquency rates by 9 months. A rise in consumer delinquencies is associated with tighter lending standards.

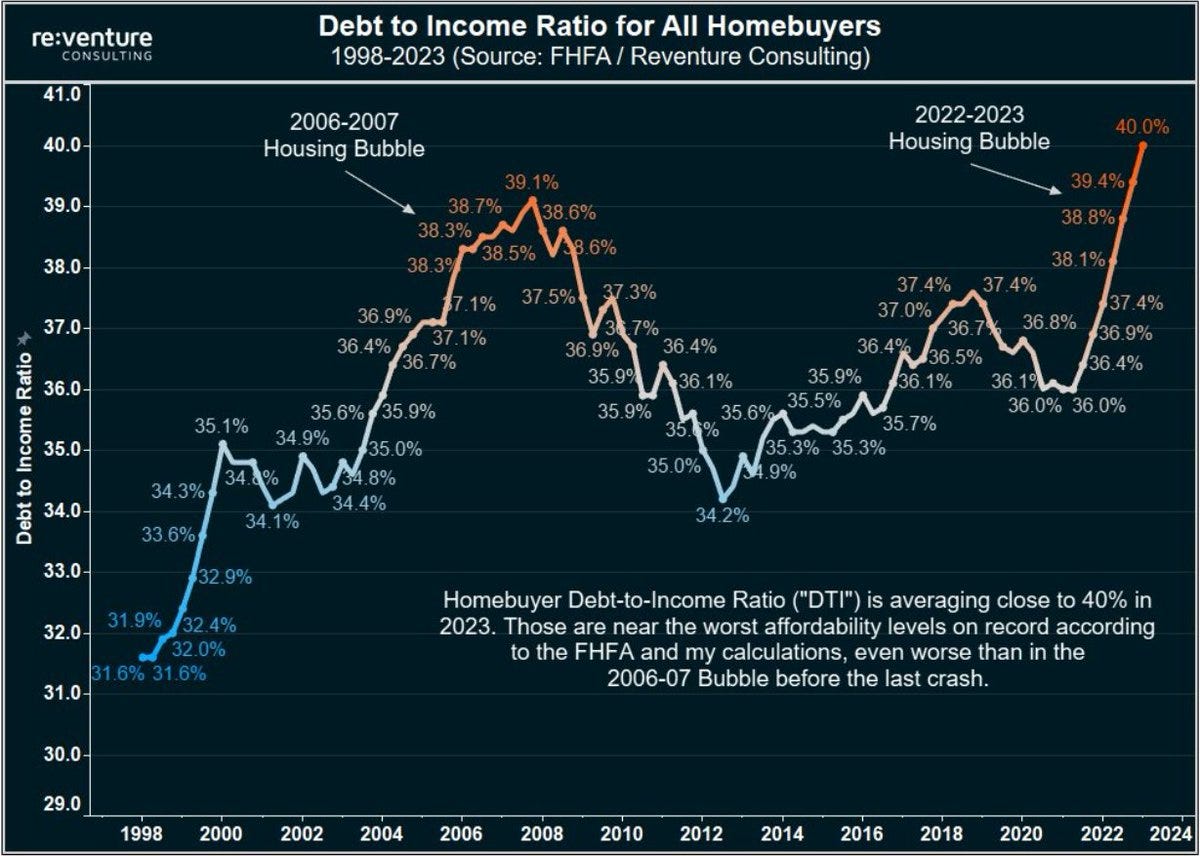

The third data point I’d like to discuss is the debt-to-income ratio. For the first time in history, the debt-to-income ratio for American homebuyers hit 40%. As a general rule, 43% is the highest debt-to-income ratio a borrower can have to get qualified for a mortgage. The ratio has never surpassed 39%.

Marco Kolonovic, a J.P. Morgan analyst, is predicting a higher likelihood of crisis within the next 6 to 12 months. He writes:

“As both premises for our cautious outlook (rates and geopolitics) turned more negative over the past few months, while positioning and valuations increased, we think there is now a higher likelihood of a crisis over the next 6 to 12 months, the severity of which could be higher than market participants anticipate. Risks of an interest rate shock and monetary tightening are clear: consumer credit (auto loans, credit cards, student loans, etc.), real estate globally (commercial and residential in both DM and EM), funding of startups and small businesses, increase of market volatility that comes with tighter monetary policy, and, eventually, impact on employment (construction, small businesses, etc.).”

With the three core indicators sounding alarm, it would take a significant amount of positive change for a “soft landing” to occur. If the Federal Reserve raises rates this fall, we are likely to see regional banks struggle as their unrealized losses increase and consumers rush to withdraw their money, causing significant deposit outflows.

Watch the video for further details on the topic:

Stay connected:

https://rumble.com/c/LenaPetrova

https://www.youtube.com/@lenapetrova

https://twitter.com/_lenapetrova

Thank you for all you do!

Excellent analysis. Thanks.