Weekly Recap: Rate Cuts In May 2024, Another Strong Jobs Report and the Drowning E.U.

Key events for the week ending December 8th, 2023

As retail sales declined for the first time since March 2023, consumer spending growth slowed to 0.2% in October, the lowest reading in 6 months.

This is primarily driven by student loans repayments (the average monthly payment is approximately $500) that resumed in October. Since pandemic savings are mostly gone and consumers increased spending due to inflated prices, the level of consumer spending will continue to decline as their debt levels increase.

According to the data released by the Federal Reserve, consumer credit rose by $5.13 billion in October vs. $9.00 billion consensus and $12.22 billion prior month, September.

Total outstanding consumer credit of $4.99 trillion climbed from $4.98 trillion in September. Revolving credit (mostly credit card debt) increased to $1.3 trillion at an annual rate of 2.7%. Non-revolving credit (auto and student debt) moved up at an annual rate of 0.7% to $3.69 trillion.

Latest Bank of America and Fidelity reports indicate that 401(k) balances are down, while retirement hardship withdrawals have been increasing. As of the end of the third quarter (the latest report published by Fidelity), the average 401(k) balance fell 4%, while loans and withdrawals increased.

In Q3, 2.3% of workers took hardship withdrawal, up from 1.8% in Q3

2022. The top two reasons behind this uptick were avoiding foreclosure/eviction and medical expenses.

I discussed this news in detail in this video.

Yet another strong jobs report is in - the U.S. economy added 199,000 jobs in November, exceeding expectations of 180,000, per the U.S. Department of Labor report.

The unemployment rate fell to 3.7%, below expectations of 3.9%.

With this information, the Fed is likely to believe that the labor market is too strong and its job is far from being done.

According to a report released by Challenger, Gray & Christmas, U.S. employers announced 45,510 job cuts in November, an increase of 24% from 36,836 in October. On a year over year basis, companies planned 686,860 cuts, an increase of 115% from the first 11 months of 2022.

Inflation expectations reportedly fall as consumer sentiment increases. The University of Michigan Consumer Sentiment Index, released on Friday, came in at 69.4 in December vs. 62.0 consensus, indicates that sentiment is 39% above the all-time low measured in June of 2022 but still well below pre-pandemic levels.

Inflation expectations dropped to 3.1% vs. 4.3% consensus, from 4.5% in November.

Long term mortgage rates dropped to nearly 7%. However, demand has not increased.

According to Freddie Mac, 30-year fixed-rate mortgages averaged 7.03%, while 15-year fixed-rate mortgages averaged 6.29%.

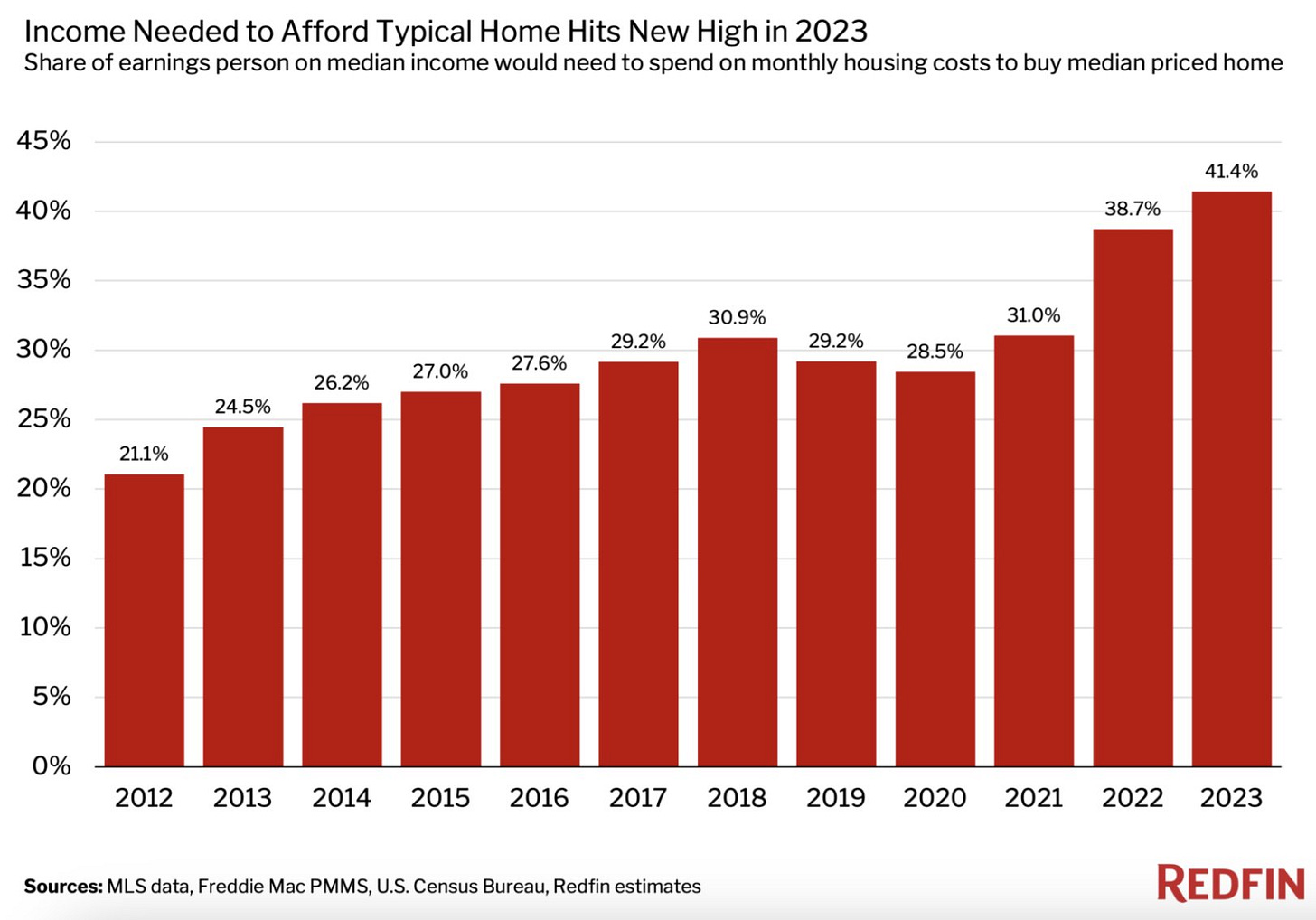

Housing affordability hits a new record low.

Per Redfin data, the income needed to purchase a home in the U.S. hit a record 41.4%, a dramatic increase from 28.5% in 2020.

The housing crisis is the result of rising interest rates, elevated home prices that have not declined and limited supply on the market.

Moody’s downgraded global banking outlook to “negative” as the result of geopolitical conflicts, billions in unrealized losses on banks’ books and the impact of rising interest rates.

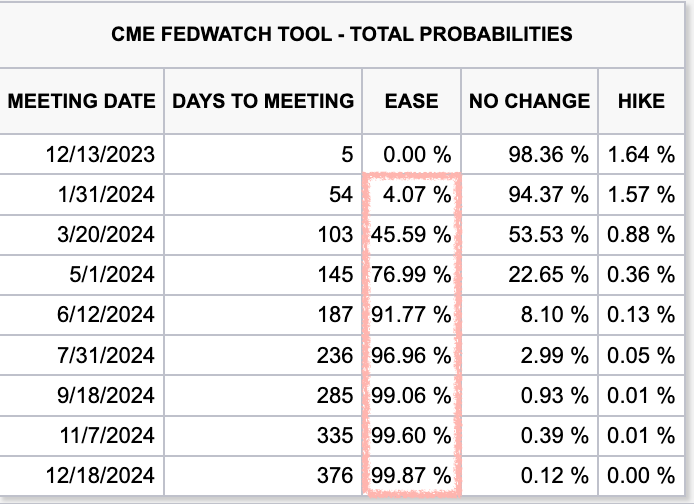

Following the latest data, there is an expectation of interest rate cuts in early 2024, possibly even as soon as January 2024.

There is an unlikely 4.07% chance of a rate cut in January 2024, a 45.59% in March 2024 and an above 77% chance of rate cuts starting in May 2024.

The World Gold Council reports that central banks’ demand for gold rose 14% year to date, a record reading. 24% of central banks state that they are planning to increase their gold reserves, with only 40-50% of the reserves to be denominated in U.S. dollars.

The biggest economy in the European Union, Germany, continues to face significant challenges as Eurozone recession signs increase.

Output in Germany fell to 0.4% in October, the lowest level since August 2020, according to Germany’s Statistics Office.

France and Italy are experiencing similar declines in GDP.

Eurozone GDP shrank by 0.1% as of the end of the third quarter.

Germany’s economy is unlikely to recover any time soon as many companies are relocating abroad or decreasing production, indicating that the country may be starting to de-industrialize.

Have a wonderful weekend and thank you very much for your continuous support!

I'm sure you heard by now, but the IMF and World Bank are calling for a "carbon tax;" "the more you pollute, the more you pay," the IMF chief said.

https://winepressnews.com/2023/12/07/imf-chief-kristalina-georgieva-urges-governments-to-implement-carbon-tax-to-punish-them-for-using-energy/

i love these reports.....thats how a person learns.....and a person can learn especially when we know these reports are the Truth.......i personally do not Trust the MSM......i don't even watch it......lol.......