Yellen Victoriously Claims "Soft Landing" As The U.S. Federal Debt Hits $34 Trillion

EU Inflation Reading Rises and the BRICS bloc Expansion

Domestic Key Events:

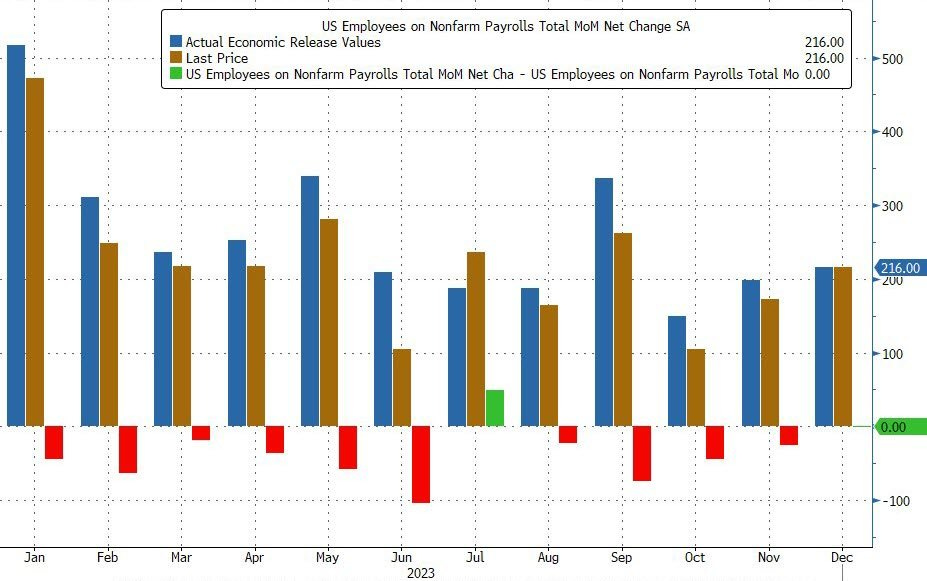

December jobs growth climbed unexpectedly.

According to the BLS, U.S. economy added 216,000 jobs in December, beating expectations of 170,000.

The unemployment rate was unchanged at 3.7 percent:

The jobs data is one of the key indicators of the economy’s performance used by the Federal Reserve to adjust the course of its fiscal policy.

As it turns out, 10 of the last 11 months have seen downward revisions in jobs data.

As you can notice in the chart below, the November 2023 jobs number was revised from 199,000 to 173,000 vs. 180,000 forecasted.

The October jobs report was revised lower from 150,000 to 105,000. This means that the October jobs report was an even bigger miss than forecasted.

The September 2023 jobs number was revised downward by 74,000 jobs.

Thus, the jobs number consistently missed expectations.

This ongoing trend should be a major concern as it raises the question of why the Bureau of Labor Statistics provides monthly data with such a considerable margin of error or clear inaccuracies.

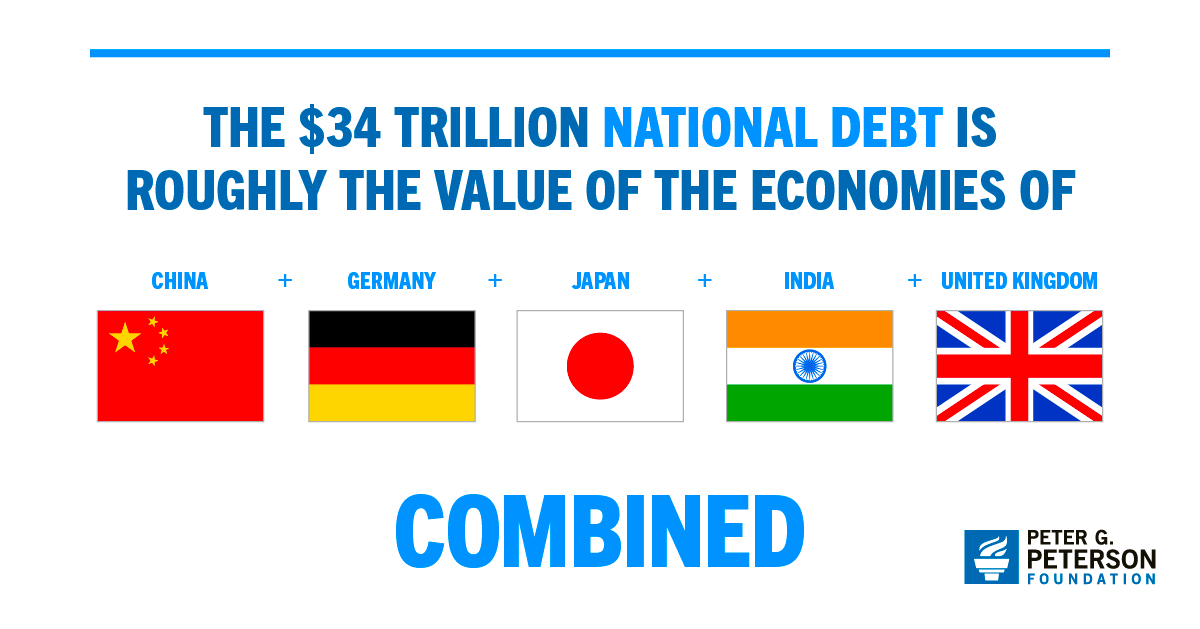

Total US debt hit $34 trillion for the first time in history. This is an increase of 100% in 9 years, since 2014.

As I discussed in detail this week, $34 trillion in debt is more than the value of the combined economies of China, Germany, Japan, India and the United Kingdom.

You are welcome to watch the video to learn more about what the new record debt balance means on YouTube or Rumble.

The probability of a rate cut as early as March dropped to 63.9% this week.

Nevertheless, 6 rate cuts for a total of 150 basis points in 2024 are still expected.

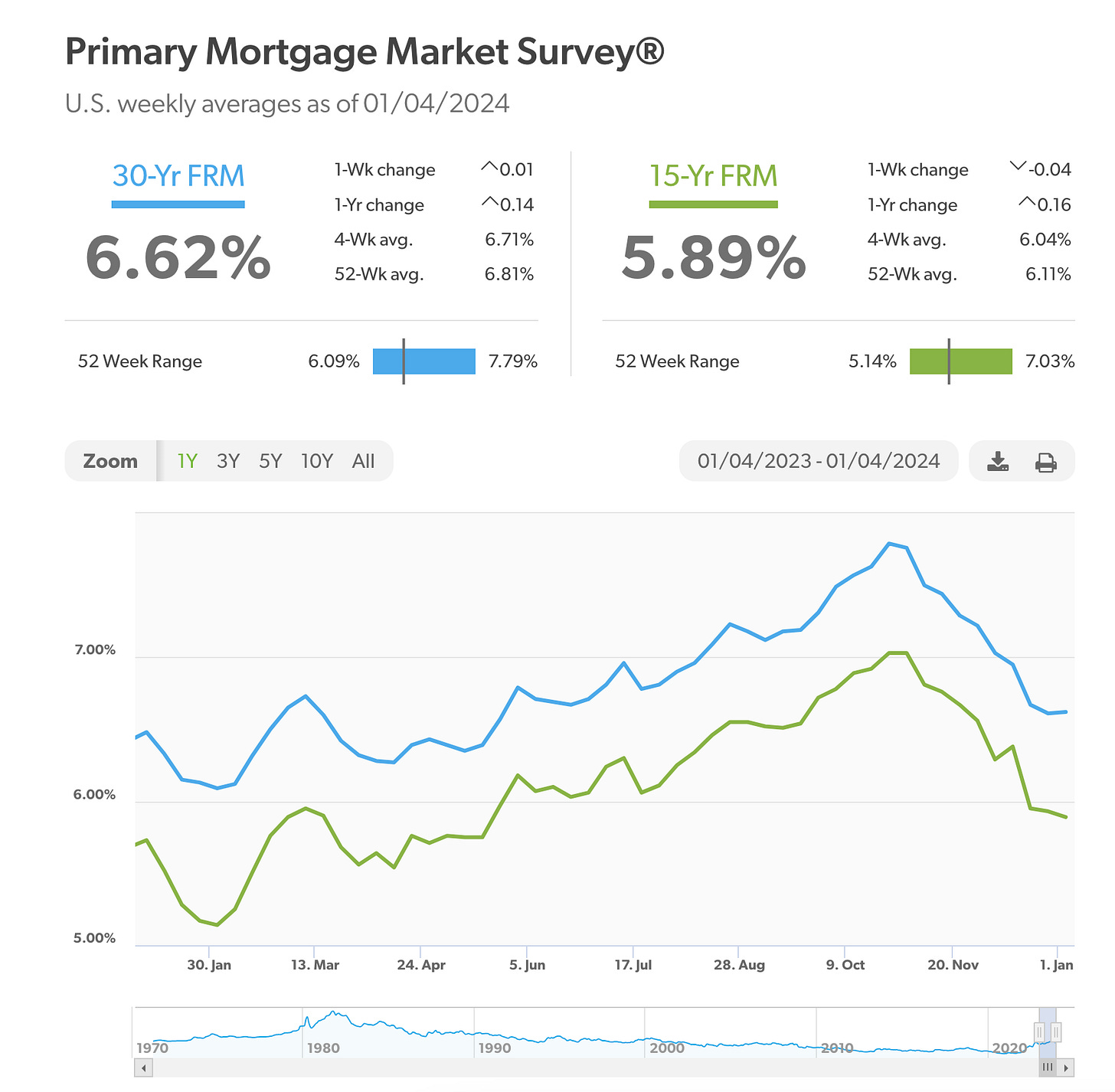

Long-term mortgage rates slightly increased this week:

30-year fixed-rate mortgages averaged 6.62%

15-year fixed-rate mortgages averaged 5.89%

The latest release (as of Jan.3, 2024) of the FOMC meeting minutes, indicates the following:

Despite expectations of multiple rate cuts, the Federal Reserve aims to keep rates restrictive

Fed officials appear to agree on rate cuts by end of 2024

2% inflation target rate remains the ultimate goal (although arguably unachievable in the short term)

Fed officials confirm that current rates are “at or new their peak”

Treasury Secretary Janet Yellen claimed victory, stating that the United States has achieved a long-sought “soft landing”.

In an interview with CNN on Friday, Yellen commented:

“What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue”

Does this latest statement beat her previous commentary on the “U.S. being in a position to fund two wars”?

International Key Events:

Effective January 1st, 2024 the BRICS bloc doubled - the UAE, Saudi Arabia, Ethiopia, Iran and Egypt became full members.

You are welcome to watch the video to learn more about the bloc’s 2024 goals and plans on YouTube or Rumble.

The US is in talks with its EU allies to seize $300 billion in Russian sovereign “frozen” assets.

Watch one of the latest videos to learn more about the bloc’s 2024 goals and plans on YouTube or Rumble.

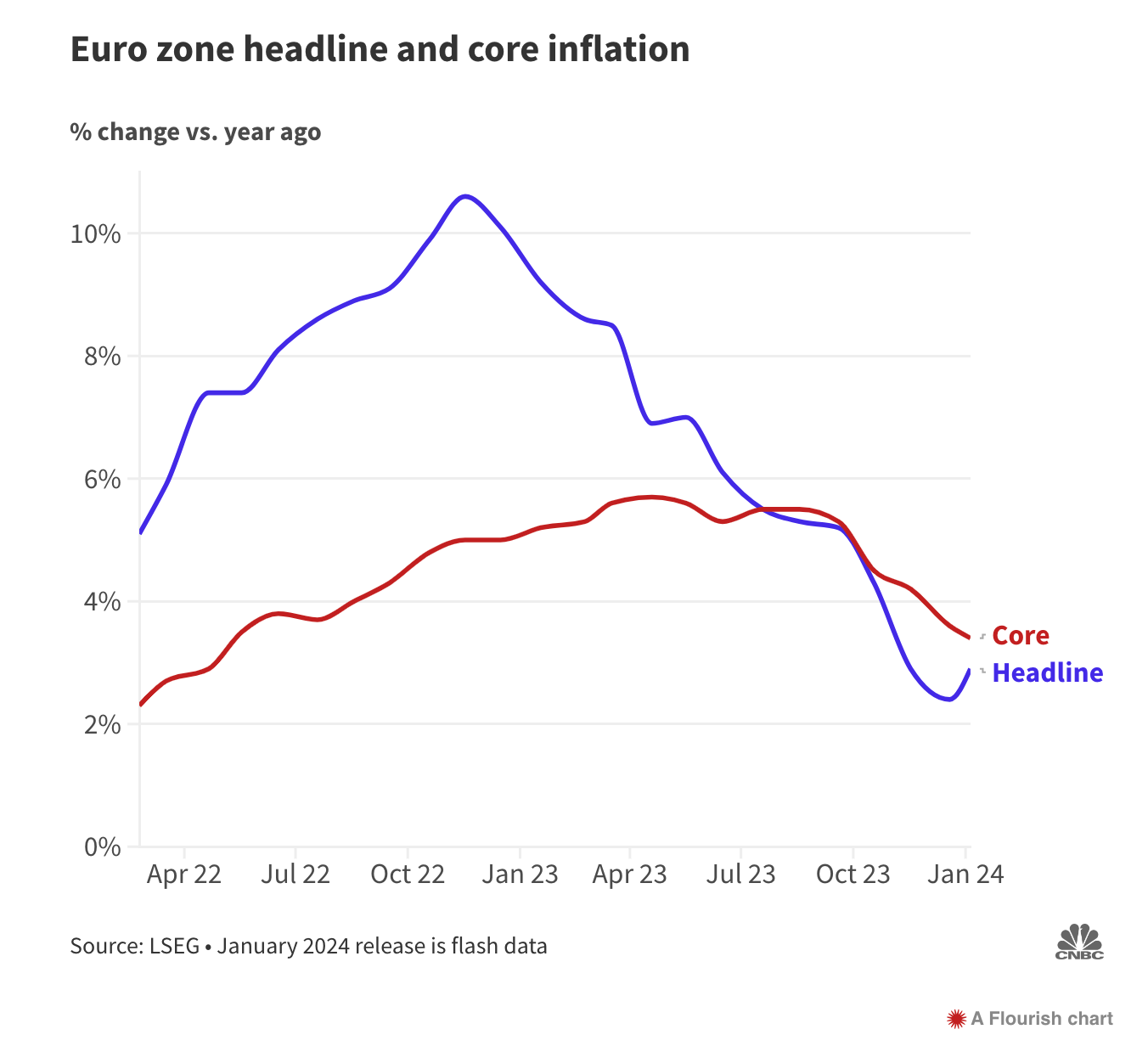

The EU is seeing inflation spike again despite its central bank aiming to start cutting interest rates. Inflation in the euro zone climbed to 2.9% in December, an increase from 2.4% in November.

Hey Lena, have you seen what Blackrock has said surrounding the launch of Bitcoin ETFs? Fink came out last week and praised the move, comparing it to gold and claimed that it is a precursor to tokenization.

https://winepressnews.com/2024/01/12/sec-approves-bitcoin-etfs-in-historic-move-blackrocks-larry-fink-says-its-an-asset-class-that-protects-you-says-is-next-step-to-tokenization/

https://www.youtube.com/watch?v=HTveRlW7QPo

Moreover, not sure if you have heard of this, but in 2019 Blackrock put out a document called, "Dealing with the next downturn: From unconventional monetary policy to unprecedented policy coordination.” In it, they explicitly say that they wanted massive inflation and helicopter money to occur as a way to then justify tokenization, CBDCs, and digital IDs.

Since you have been warning about tokenization I figured you might this interesting.

https://www.reddit.com/r/conspiracy/comments/ov60f6/blackrock_presented_their_going_direct_reset_plan/

https://winepressnews.com/2023/07/20/must-read-top-economist-and-professor-reveals-that-central-banks-want-to-microchip-people-so-they-can-administer-cbdcs/

Here's further confirmation of the FED Bureau of labor statistics, having lied about jobs being created.

https://www.westernjournal.com/us-employment-reports-greatly-exaggerated-400000-jobs-mistakenly-added-total/